Nikolai Pandev/E+ via Getty Images

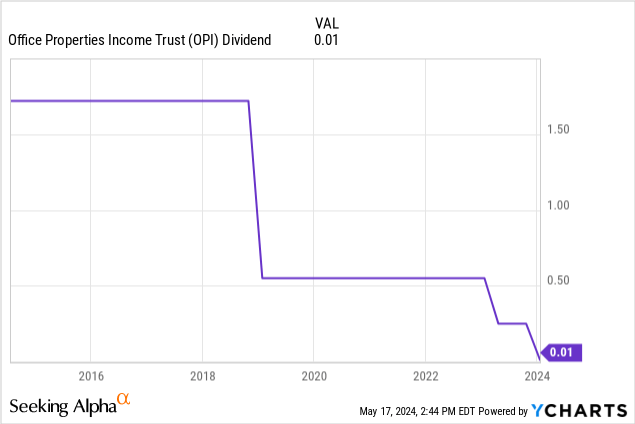

Purchased Office Property Income Trust (Nasdaq:OPI) 6.375% Senior Notes Deadline: June 23, 2050 (Nasdaq:opinle) in November, against the backdrop of an approximately 40% discount on the liquidation value of $25 per note at the time.This security continues With consumer inflation still above the target interest rate of 2%, the Fed’s announcement to raise long-term interest rates heightened market concerns about office real estate, leading to a decline. OPINL is currently trading at $10.40 per share, a nearly 60% discount to its liquidation value. The bond pays an annual coupon of $1.59,375 and has a cost yield of 15.2%. The last Peppercorn cash dividend announced by OPI was $0.01 per share Dividends to common shareholders are unchanged from the prior quarter at an annualized rate of $0.04 per share, representing a dividend yield of 1.8%.

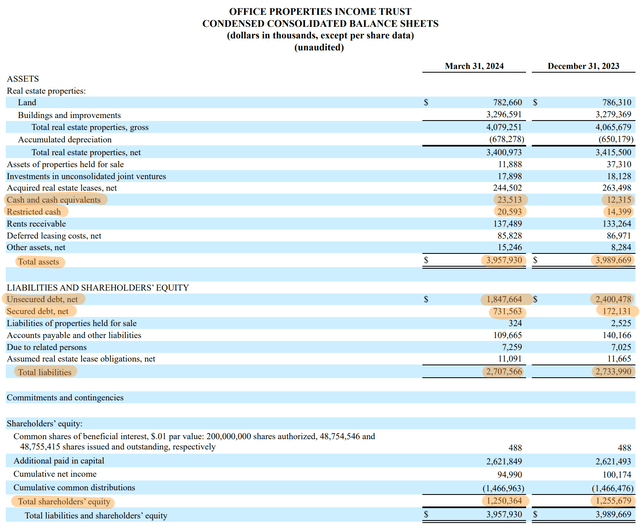

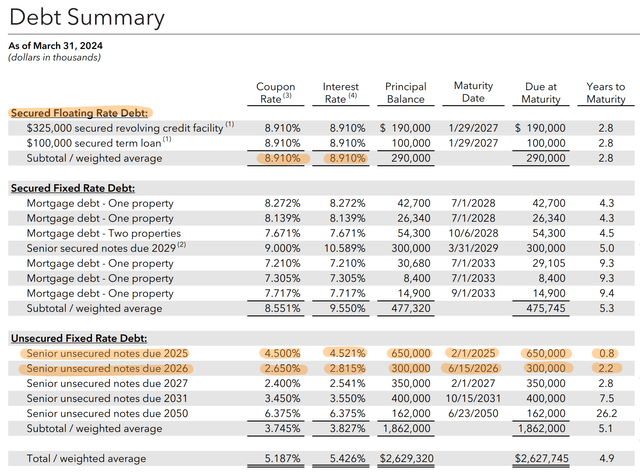

This is a very risky security and we recommend that most investors stay away from it.I’m chasing a rising possibility Solvency expectations have been reset and the Fed has cut rates, but OPI faces Sisyphean-like challenges managing declining occupancy, looming lease expirations, and a fully accelerated debt maturity schedule. There is. The office REIT has a market capitalization of $112 million and is down 70% since the beginning of the year, with common stock trading at $2.20 per share. OPI’s total debt balance is $2.6 billionAt the end of the first quarter, the weighted average maturity was 4.9 years and the weighted average interest rate was 5.4%. The REIT held cash and cash equivalents, including restricted cash. $44.11 million. An additional $135 million of liquidity is available through the credit facility.

Office Real Estate Income Trust 2024 First Quarter Form 10-Q

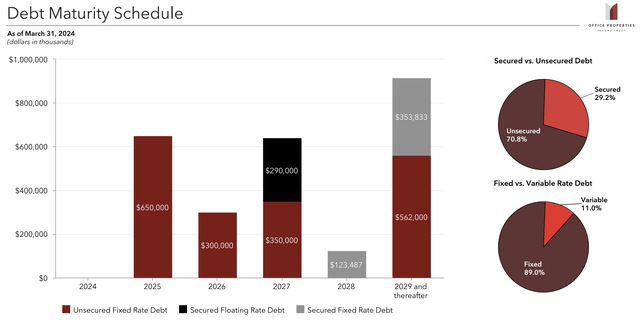

Debt, maturity and liquidity

OPI currently does not have the liquidity to meet future maturities of its unsecured fixed rate debt. The most immediate future is expected to be $650 million in February 2025. This is the central headwind facing Commons, and the strong solvency risk if OPI is unable to refinance its maturing debt. Additionally, short-term bonds were initially issued at significantly lower interest rates, meaning that REITs’ FFO is expected to shrink significantly.

Office real estate income trust supplement for the first quarter of 2024

The unsecured bonds due in February are as follows: at 4.52% The 2026 bond is even lower at 2.815%. OPI’s recent secured floating rate notes were issued at approximately 9%, so the REIT’s interest expense is expected to increase significantly. To be clear, OPI’s fiscal 2024 first quarter normalized FFO was $38.3 million, or $0.79 per share. Annualizing this number means that the commons is trading at a ridiculously low multiple. However, they are aware of both solvency and refinancing risk.

Office real estate income trust supplement for the first quarter of 2024

REIT has started debt exchange offer This will result in the issuance of up to $610 million in new 9% senior secured notes to 2025 bondholders in exchange for 2025, 2026, 2027, and 2031 senior unsecured notes. It turns out. The new notes are secured by first lien liens on 19 office properties and have an adjusted total asset value of approximately $722 million. We also plan to hold second-priority liens on an additional 19 properties. The exchange offer will expire after the market closes on May 30, 2024, and uptake by holders of the 2025 Notes will determine short-term price movements for the baby notes.

Occupancy, rental, short-term interest rates

Office real estate income trust supplement for the first quarter of 2024

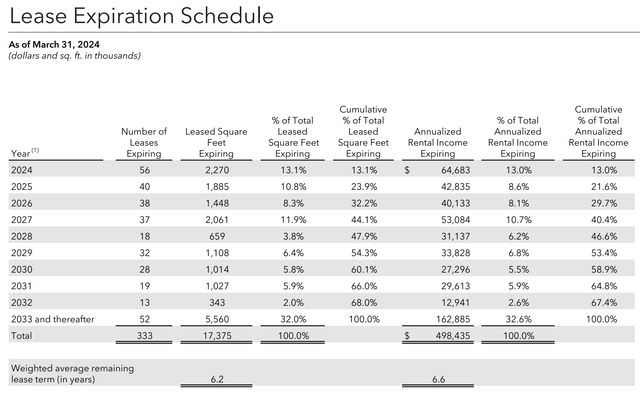

OPI recorded revenue in $139.44 millionwas up 5.3% year-over-year and beat consensus by $9.67 million. His 151 property portfolio spans 20 million square feet, with a weighted average remaining lease term of nearly seven years, and his same property occupancy was 88.2% at the end of the quarter. This was a continued decrease from his 89.5%. Occupancy was 93.3% at the end of Q3 2023. Therefore, OPI’s accelerated lease expiration schedule may result in continued declines in occupancy. 13.1% of the leases are scheduled to expire in 2024 and 10.8% of the leases are scheduled to expire in 2025. The REIT signed 488,000 square feet of new and renewal leases at 10.2% roll-up rents in the first quarter. This continued lease volume is a salvo for OPI, and the pending Fed rate cut is set to provide further benefits to his REIT.

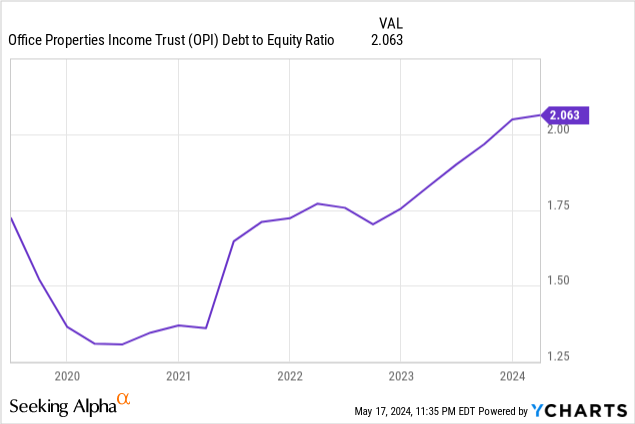

The REIT’s debt-to-equity ratio is high at 2.063, but the increase has slowed since then as OPI also earned $39 million from real estate sales in the first quarter. Therefore, the survival of REITs will depend on whether the debt exchange offer is accepted and if consumer inflation continues at a moderate pace, as the April data showed, the Fed’s current long-term high policy may become more dovish. It depends on whether it changes direction or not.

S&P Global

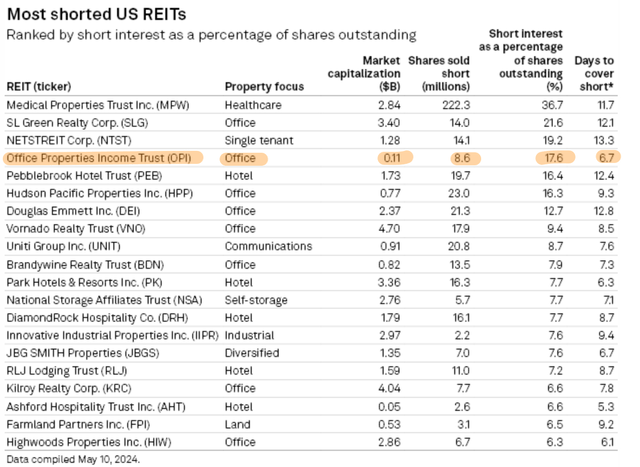

OPI is the fourth most shorted REIT in the stock market. 17.6% of the float that is currently shorted. This is understandable considering the risks that REITs face. I continue to hold the bonds as a means of continuing OPI’s solvency, and a 2025 maturity extension could trigger a partial recovery.