simon2579/E+ (via Getty Images)

paper

upon (New York Stock Exchange:Onon) currently meets all textbook investor aspirations and is showing outstanding profitable growth. Following Nike’s strategy (NKE) In some ways, On may be a fresher brand. Premium strategies can pose a serious threat to market leaders.

- This analysis approaches a company called On using an integrated financial plan as the basis for a simplified DCF (discounted cash flow) valuation and moves from there to a discussion of qualitative and market aspects of On.

- Notice that I’m engaging in backward engineering at several points. This is a method that seeks to match high growth with high valuations and understand market expectations.

- Regarding these market expectations and their possible limitations, On’s brand quality, competitive market, Market leader Nike.

- To summarize this discourse, from my perspective, On has a cautiously positive Hold rating and a Buy trend.

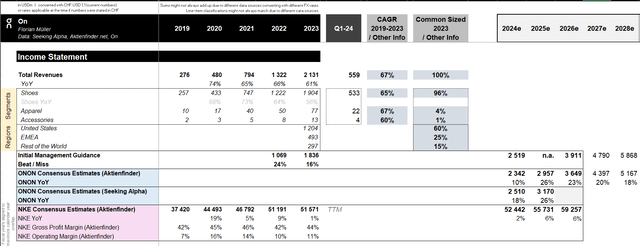

brilliant top line

On has achieved annual revenue growth of over 67% since 2019. All segments are growing at a similar pace, with footwear still accounting for by far the largest share at 96%. Swiss companies, which account for 60% of their US exposure, report in Swiss francs and are primarily affected by the exchange rate between the US dollar and the Swiss franc. The appreciation of the Swiss franc in 2023 resulted in significant foreign currency losses. However, in the first quarter of 2024, the weaker Swiss franc had the opposite effect, resulting in significant foreign currency gains.

Regarding top-line targets, management has consistently exceeded its own expectations by a significant double-digit percentage range over the past two years. Regarding the current fiscal year, Management expects Revenue is expected to be approximately $2.5 billion, consistent with Seeking Alpha analyst consensus. Analyst consensus on Aktienfinder.net, using FactSet as the underlying data source, shows a slightly conservative forecast out to 2026, which I rely on for prudent planning. Therefore, in 2026, USD 3.6 billion is expected. Management’s own expectations Approximately $3.9 billion. Management expects his annual sales to increase by 20-25% from 2026 onwards. I personally rely on more conservative assumptions, gradually approaching a still high terminal growth rate of 14-15% in 2027-2028. Alternatively, they could have extended the planning period and set a lower perpetual growth rate. The derivation of the perpetual growth rate after 2028 will be explained in detail later. Nike, its primary target competitor, naturally grows at a much slower single-digit pace due to its size. In terms of size, On will grow to about 10% of Nike over the planning period, which seems pretty realistic. Nike’s margins will also affect On’s future plans.

top line income statement (Author | Data: Seeking Alpha, Aktienfinder.net, On)

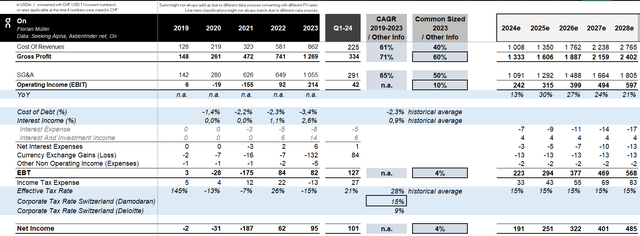

Investor’s dream: profitable growth

On boasts an impressively high gross profit margin of 60% and an EBIT margin of 10%. By contrast, Nike’s averages over the past five years were 44% and 12%, respectively. My model assumes that On will gradually approach these values over the planning period to its final value in order to approximate its established industry peers. In summary, this means gross margin growth will be slower than sales, as the marginal benefit of additional customers acquired may decrease as market penetration increases, but operating profit rates grow faster thanks to economies of scale. Determining tax rates in Switzerland is not as easy as in some other countries, but we will not discuss this in detail.We found various corporate tax rates deloitte than from DamodaranThis also differs from On’s historical effective tax burden, so we settle on the middle of the three values, 15%, for planning purposes. This may be inaccurate. Overall, my own plan for his EPS level is more conservative compared to analyst expectations through 2025 according to Seeking Alpha, and analysts have already predicted that he will exceed $1 in 2025. My prediction is that he won’t break above the $1 mark until 2026.

About the final income statement (Author | Data: Seeking Alpha, Aktienfinder.net, On)

Prerequisites for technical evaluation

As in the previous analysis, we will omit further model planning details in the area of balance sheets and cash flows, and only briefly summarize the main methodological points.

- Cash balance as a result of total cash flow planning.

- Plan inventory, accounts receivable, and payables based on historical turnover.

- PP&E is based on future CAPEX plans and increases in parallel with EBIT on the assumption that growth is not possible without capacity expansion. From this, the historically implied depreciation rate is subtracted. On’s balance sheet primarily lists capital lease assets, which we simplified to PP&E during the planning period.

- Plan your capital by adding net income. This young company is still in its growth stage, so I don’t foresee any share buybacks or distributions. We also believe that we have reached a stage where we can grow further on our own without further diluting our shareholders.

- Total cash flow adjusts for or adds (non-)cash effects from the balance sheet delta (operating portion), subtracts capital expenditures required for growth (investment portion), and partially capitalizes for increases in capital lease liabilities. It is calculated and planned indirectly by assuming that it will be used for investment (financial part). .

For WACC, I rely on the 30-year US Treasury spot yield as the risk-free rate, as the available estimates are calculated in US dollars. Some analysts’ forecasts may have been planned in Swiss francs and then converted to US dollars, so some discrepancies may occur. I don’t like to plan for FX effects, so I think this approximation is sufficient. Of particular note is On’s high beta coefficient, averaging 2 based on Seeking Alpha’s 24-month and 60-month values. This results in a high cost of capital of almost 16%, but due to low leverage this cost only decreases to 15% of his WACC. This is slightly lower than the ROIC of about 15-25% that I expect over the planning period, and the company has already been close to reaching profitability for the past two years. As a growing company, I envision reinvesting profits almost entirely, which allows for the high terminal growth of 14-15% mentioned above.

And now I’ll be completely honest. To see what the market is assuming for this young company, especially on the technical valuation part, we did some backward engineering to arrive at the size On is currently valued at. . A consistent, integrated planning model. The reason I did this is because given this much growth, the parameter assumptions are too sensitive and I don’t want to commit to the evaluation. Because long-term growth as high as a WACC of about 15% can change the decimal places of the assumptions. It greatly affects the value. So, my conclusion is that with a WACC of about 15% and similarly high perpetual growth assumptions, On is actually quite good value. My indicative valuation result is $45, which is a one-year forward P/E of 74x based on my own more conservative plan and a one-year forward P/E of 49 based on analyst estimates. It means that. Both are acceptable multiples for at least five years of earnings growth, and there’s certainly potential for them to be near or above the 20% mark. The question remains whether we want to attribute such growth potential to On. History and success on paper certainly support this, but the path forward is unlikely to continue as easily.

Do what Nike does – no distinction or a chance for a podium?

Now, I would like to dig a little deeper into the qualitative and market aspects of On. On is one of the brands that I see as being competitive enough through quality branding to potentially be a threat to Nike in the long run (just kidding). So, in some cases, I’m very reluctant to use giant company Nike as a comparison.

On adopts the key sales strategy of its largest competitors: cutting out the middleman. Nike has adopted a strategy of selling products directly through its own stores and online channels, rather than having margins cut by intermediaries.Currently, Nike 44 percent Although the majority of its revenue comes from direct sales, a large portion of it is still handled by third-party sellers. For On, 38% of his revenue currently comes from his DTC, with the rest coming from wholesale. However, there is a positive trend towards DTC as the DTC channel significantly outperforms the wholesale segment and captures a larger share of revenue.

And it is precisely these direct customer relationships, brand building and marketing that are so important in such a competitive market. After all, it’s the shoes that matter, not some irreplaceable rocket science. Nike knows this too. According to management, a new multi-year cycle of innovation and growth begins. This means a new focus on targeted brand identity, closer customer relationships, and improved storytelling around the brand. Nike products are meant to be “must-haves,” and the process of shopping directly through Nike, whether online or in-store, should be an experience. It’s unclear whether this plan will succeed, but Nike certainly has the ability to accomplish it.

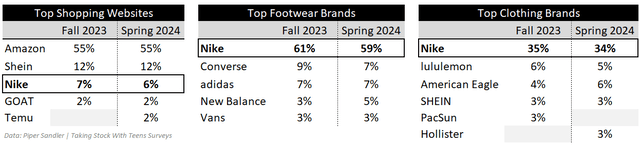

The twice-yearly survey is piper sandler It provides a snapshot of the most popular brands among the average 16-year-old in the U.S. and is important for sustainable market positioning. On the other hand, Nike is already one of the most popular shopping sites for clothing, so it shows that Nike’s DTC strategy appears to be effective. This justifies On’s strategy. At the same time, the study finds that in the U.S. market, On is up against dominant incumbent Nike, which holds a significant lead in popularity as a footwear and clothing brand among young people. has become clear. However, the slight decline in approval ratings in the short term suggests that Nike’s position is not solid and could certainly be challenged, and amidst this risk there is an opportunity for On. It is.

Piper Sandler reviews research on teens (Author | Data: Piper Sandler)

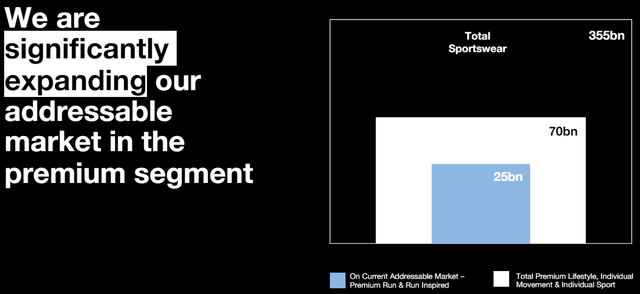

Ambitious or megalomaniacal?

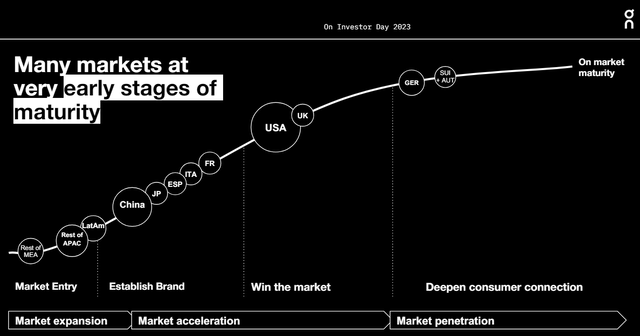

On’s goal is nothing less than to become the world’s most premium sportswear brand. The following diagram summarizes how On will grow in the future. This is partly due to expanding its application area beyond running, all within the premium segment. On currently accounts for nearly 10% of the $25 billion running-focused market, which is expected to grow to $70 billion by leveraging other apparel. On aims to significantly expand his apparel market share beyond 10% in 2026 and beyond. The second growth driver is global expansion, as shown in the second diagram below. On aims to increase its share in China to more than 10% after 2026. In the short term, the Paris Olympics may provide further momentum for On, but it’s also definitely the stage on which all other sportswear will be leveraged. Brands are eyeing this opportunity.

upon

upon

Just Another Nike – maybe better, maybe not

This hold rating is interpreted as leaning toward buy. That’s because there’s little to deny On’s current fundamental business performance and potential, and given this kind of growth, this valuation may even be reasonable. However, all of this is built on a large marketing apparatus that may not be as established as a major company like Nike. Because, although some argue that On’s products are of inferior quality, after all, any company offers high-quality sportswear, so nothing is irreplaceable. Furthermore, the size, long-standing presence, and inertia of a large company like Nike could open the door for On in this vast market and seriously threaten the market leader. But personally, in this scenario, I’d bet on Nike, an industry leader with an attractive value, albeit slow growth. However, this is a personal preference and at the same time I consider On to be one of his most likely challengers.