I’m bullish on energy in general. The lack of investment in this space is real, and I think it’s still largely underinvested as investors chase technology. If you’re on the same page, check out the Strive US Energy ETF (New York Stock Exchange:DRLL) is a fund you’ve probably seen, but unfortunately it’s not my favorite in this space.

So let’s get down to business. DRLL is a passively managed exchange-traded fund that seeks broad market exposure to the U.S. energy sector. Established on August 9, 2022, DRLL aims to provide concentrated exposure through cost-effective index products. The fund’s benchmark recently changed from the Solactive US Energy Regulated Capped Index TR to the Bloomberg US Energy Select Index, reflecting the fund’s commitment to capturing the dynamic nature of the energy market. DRLL has an expense ratio of 0.41% and a 30-day SEC yield of 2.54%, making it relatively competitive in the sector-specific segment of the ETF market.

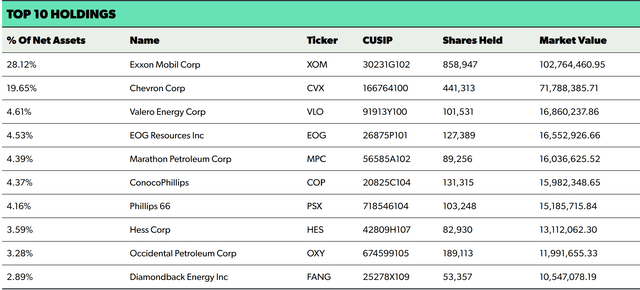

ETF Holdings

DRLL includes a variety of energy-related companies, with its top five holdings accounting for the majority of its net assets. This is a very top-heavy fund. The top two holdings, Exxon Mobil and Chevron, account for a whopping 47.77% of the fund. Yes, that’s right. Nearly half of the fund consists of just two stocks.

effortfund.com

Frankly, I’m not a fan of the very high gravity here. In exactly the same way. I wonder if this creates more risk than necessary for what the fund is trying to gain exposure to. I understand that it’s passive and index-based, but no matter how good these companies are and their growth rates are high, doing this kind of allocation makes me very nervous. I would argue that too much idiosyncratic risk in a sector fund would make the fund less sectoral and more company specific, which is exactly the case.

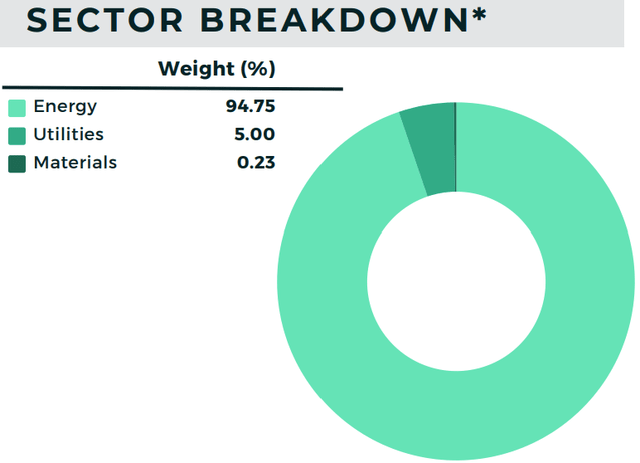

Sector configuration

DRLL The company has broad exposure to various subsectors within the U.S. energy market, including crude oil, natural gas, bituminous coal, hydroelectric power, nuclear power, solar, wind, geothermal, biomass, and related services. This diversified approach theoretically means that investors are not overly reliant on a single energy source, thereby reducing the risks associated with sector-specific volatility.But again, in my view, the concentration on ExxonMobil and Chevron is primarily I deny this.

effortfund.com

peer comparison

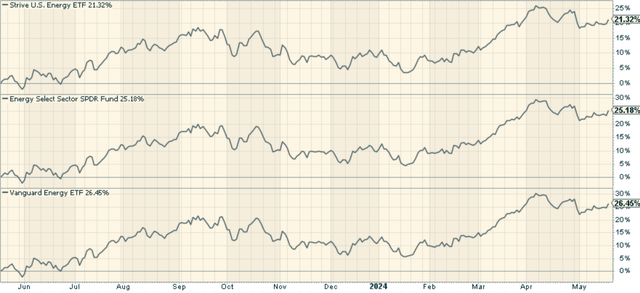

When comparing the Strive US Energy ETF to other similar ETFs, the real comparison is the Energy Select Sector SPDR Fund (XLE). XLE’s expense ratio is lower at 0.12%, but it has a slightly different structure with an emphasis on integrated oil and gas companies. Another peer, Vanguard Energy ETF (VDE), also offers broad exposure to the energy sector with an expense ratio of 0.10%.

Remember what I said about Exxon and Chevron? Now, we see that XLE and VDE also have them in their top two holdings. XLE holds 43% of these two funds, and VDE holds 36.6%. This makes a big difference. It also explains where DRLL fails. Indeed, the company has a good mix of energy company stocks, but both XLE and VDE underperformed because Exxon and Chevron were more balanced than the rest.

StockCharts.com

Advantages and disadvantages

Although the performance shown here is below average, there are other things to consider. First, the fund provides concentrated exposure to the U.S. energy sector, which remains an important component of the global economy. The inclusion of both conventional and renewable energy sources ensures a diverse approach to capturing the ongoing energy transition.

But that’s not enough. The non-diversified nature of the Fund may make it more sensitive to economic, business, political, or other changes affecting individual stocks or investments, resulting in greater fluctuations in the value of the Fund’s shares. It means that there is a possibility that Furthermore, as it is a relatively new fund with a limited track record, prospective investors have limited track records on which to base their investment decisions.

Conclusion

I don’t think there’s necessarily anything wrong with this fund, but I do question its concentration and performance compared to cheaper energy sector ETFs. Personally, I’d consider XLE or VDE over this fund for now, but my view is that momentum in the broader energy sector is returning, which is clearly a tailwind.

Predict crashes, corrections, and bear markets

Predict crashes, corrections, and bear markets

Tired of being a passive investor and ready to take control of your financial future? Check out the Leadlag Report, an award-winning research tool designed to give you a competitive edge. This is an introduction.

The Lead-Lag Report is your daily source for identifying risk triggers, uncovering high-yield ideas, and capturing valuable macro observations. Stay ahead of the game with key insights about leaders, laggards, and everything in between.

Move from risk-on to risk-off easily and confidently. Subscribe to the Lead Lag Report now.

Click here to access and try Leadlag Report for free for 14 days.