nemke

Main papers/background

The purpose of this article is to discuss the broader European stock market, focusing on recent performance and my outlook for the second half of 2024. This is my supplementary article. Recent review So I talked about my preference for large-cap US stocks. This remains true, but with domestic indexes hitting record highs, readers will want to maintain diversification. So I remain a US bull, but that doesn’t mean there isn’t value to be found elsewhere.

Let’s take a look at European stocks. This is because I have gotten out of my emerging market exposure (both bonds and stocks) but still want to hold onto it. something Outside of America. Therefore, I want to manage risk as much as possible, and that means developing markets overseas (rather, than in more unstable areas). To me, this suggests that Europe (and Canada, but that’s another review) is a wise place to store cash. In this article, I explain why I view this region favorably and how investors can benefit from this outlook in the coming months.

**I own the SPDR Euro Stoxx 50 ETF (Fes) and Schwab International Stock ETF (SCHF). We recommend both for exposure to developed markets outside the US (and Europe), but there are many options.

Evaluation discount across ponds

First, I want to manage expectations here. I continue to believe there is a path for stocks to go higher, but we need to be aware of where we are in terms of relative valuations. Stock prices are not cheap in absolute terms. The US market is a clear example of this (just a few percentage points away from all-time highs). Similarly, European stocks (and other developed markets) continue their bull run.

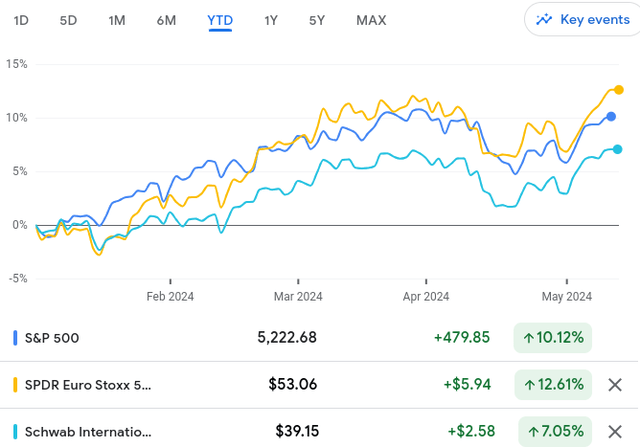

Year-to-date results (Google Finance)

As you can see, FEZ is outperforming the S&P 500 and SCHF (which has significant exposure to Japan and the UK). Therefore, I would like to emphasize that this is not a “cheap” play, even if other metrics suggest it is. These stocks have performed well in the short term, and even if you’re bullish (like I am), your upside expectations going forward should be limited.

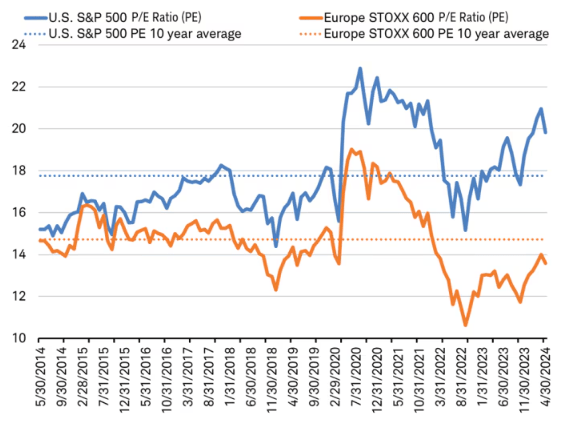

That said, it’s worth noting that even though European stocks have performed so well, they do have the following advantages: Relative Discount rate compared to the US (as measured by the S&P 500). European stocks are lower than U.S. stocks in terms of P/E ratio, and their long-term average P/E ratio is also lower. This could encourage value-oriented investors to continue buying.

European stock trading below long-term average (Charles Schwab)

My conclusion here is that European stocks are not that expensive compared to the US and its history. Although I hesitate to call the stock cheap, there is no need to rush to take profits or cause reluctance to buy at the current valuation. In fact, I think that’s a reason to remain bullish, even if my expectations have come down a bit.

Electricity prices continue to fall

The second reason I continue to hold mainland European stocks for a long time has to do with the fact that the Russia-Ukraine war remains contained in Eastern Europe. This conflict is not “good” for any reason, but the initial concern (and in the months that followed) was that it would spread to a more global conflict, impacting Central and Western Europe more directly. This means that they may give it to others. This uncertainty clouded my outlook on European stocks and I remained quite negative about the region.

My fears turned out to be a bit overblown, and Europe’s initial decline due to the conflict turned into a great buying opportunity. I became cautious and fell a little behind, but since then it has continued to grow steadily, so I don’t have many regrets.More importantly, what I’m expecting is this conflict remain I am not reluctant to have equity exposure to the Eurozone in the second half of 2024, as it is contained within the borders of Russia and Ukraine.

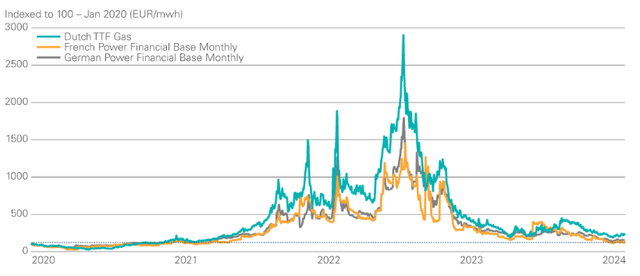

There are many reasons why this containment is good for investors. Specifically, European consumers are no longer experiencing higher energy and utility bills. Back in 2022 (and he says 2023 as well), input prices for electricity have increased significantly due to threats such as Russian supply chain challenges, tariffs, and winter cold. This had a huge impact on European households and affected the consumer environment. The pain was very real at the time, but it turned out to be relatively short-lived compared to what was expected. Fortunately, prices eased in late 2022 and remained low throughout 2023 and early 2024.

Electricity prices (EU) (S&P Global)

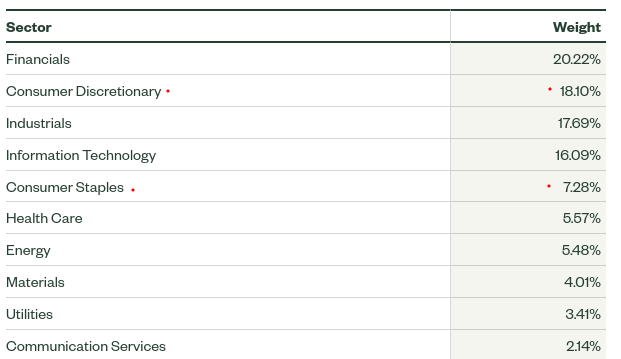

This is important both for investors in the region and to support consumer purchasing power going forward. By reducing the burden of being tied to energy and electricity bills, sentiment and confidence improve, leading to increased household spending among consumers. The importance of this cannot be ignored, as funds such as FEZ (and others with exposure to primarily European large-cap stocks) are heavily tilted towards consumer-oriented sectors.

FEZ holdings list (by sector weighting) (State Street)

What I see here is an improvement in the macro context that appears to be beneficial to both businesses and consumers and moving in a sustainable direction. Naturally, the war in Eastern Europe creates headwinds, but as time passes, the headwinds continue and the conflict continues to be contained. This is a big issue for this investment theme, as European ETFs are heavily weighted towards consumer exposure.

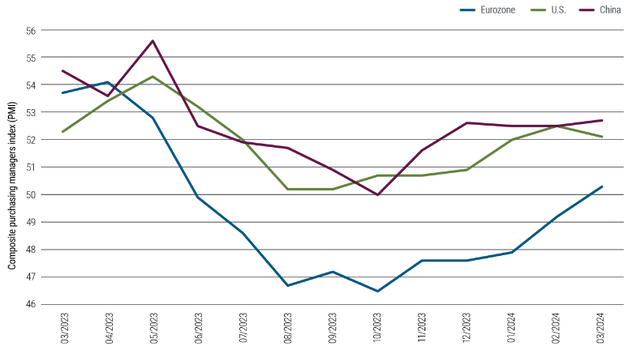

Eurozone growth accelerates

Another factor that I feel bodes well for Europe as a whole is that economic activity appears to be on a strong upswing. This is very different from the US, China, and even other parts of the world. While other countries and economies may see more positive economic indicators for the time being, activity in the euro area is picking up, with growth accelerating from late 2023 to today.

To be fair, you can look at this in two different ways. It appears that the United States may have an advantage here in that its economy will expand over a longer period of time than Europe. Meanwhile, the market is looking to the future, and the recent acceleration in economic data in Europe suggests that growth in the coming months could be stronger than here at home. This all depends on your personal outlook and perspective, but for me I see this rise as a strong signal that Europe will have a good second half of the year.

Are there any risks? Of course

Of course, no investment discussion is complete without considering some risks. Europe is no exception. As anywhere in the world, there is much to be concerned about. The first that comes to mind is Russia, both in terms of its current war in Ukraine and its ambitions across the continent. This remains a wild card that the rest of Europe needs to be aware of carefully, and that is not going to change.

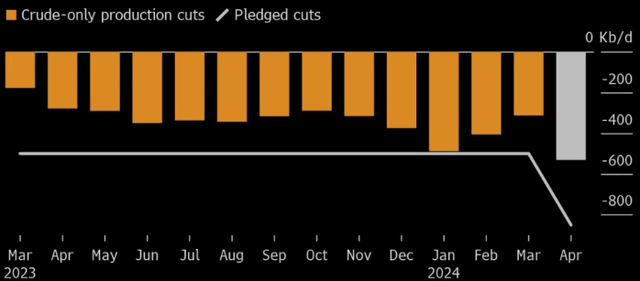

The deterioration of relations between Russia and the West is not only geopolitical in nature, but also has economic implications. Russia has promised to cut oil production to offset sanctions imposed on it (by the United States and its Western allies) and boost oil prices in the short term. This is quite consistent with OPEC+’s broader strategy and shows that Russia still has room to cut production if it wants to meet its previously announced goals. quota:

Russia’s production cuts (oil) (Bloomberg)

If Russia continues on this path alone it will not have a major impact on the market, but if it signals more oil producing countries it could have broader economic implications. The main issue is pain for consumers around the world, and the areas I have already mentioned have a huge impact on European equity funds.

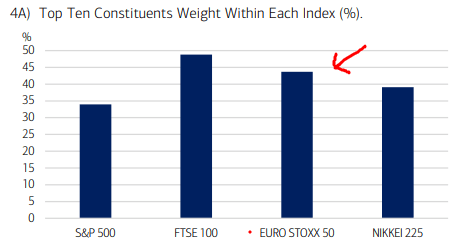

Another risk to consider is concentration risk. This is a bit ironic. Because one of the reasons I (and I’m sure many others) are looking outside the United States is because of the increased concentration risk here at home. As Mag 7 and other tech stocks continue to dominate the stock market, the S&P 500 has become heavily dependent on its performance. Therefore, while expanding branches outside of U.S. borders makes sense, readers should understand that other developed country indices are similarly affected by concentration. Let’s take Europe as an example. The Euro Stoxx 50 index that FEZ tracks actually ranks above the S&P 500.

Top Heavy Index (FactSet)

What this shows is that moving to other indexes, such as Europe, the UK, or Japan, does not reduce the risk posed by top-tier funds that track these countries. Although the European ETF will offer investors a variety of underlying stocks, overall performance will still depend on just a handful of large companies. This provides opportunities, but also challenges. Therefore, please note that this does not completely solve market concentration risk.

conclusion

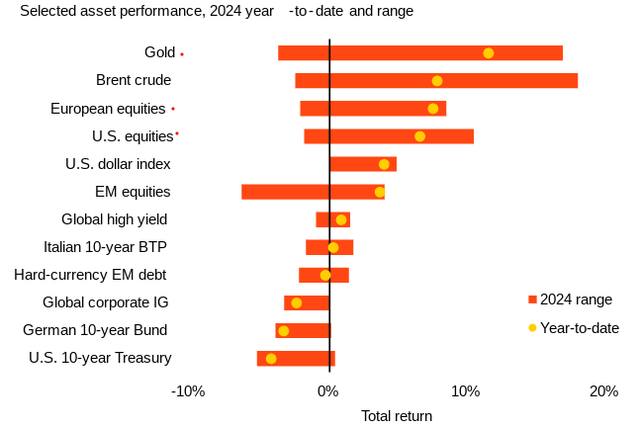

We expect the market to benefit investors in the first half of 2024, with some of the top sectors continuing to perform well in the second half. This includes US large-cap stocks, gold, and, as discussed here, European stocks. All of these themes are on track and I personally like the momentum.

Year-to-date performance (by sector) (BlackRock)

Keep in mind that nothing goes up forever, but momentum plays often last for a while. In my view, there are enough tailwinds for European stocks that the recent rally is not a reason to avoid the sector. As such, I intend to strengthen my position in FEZ and SCHF and encourage my followers to consider these funds and other ETFs linked to Europe at this time.