AdShooter

The Voya Infrastructure Industrials and Materials Fund (NYSE:IDE) is a little-known closed-end fund, or CEF, that investors can employ as a means of generating income from the assets in their portfolio. There are many closed-end funds that can be used for this purpose, and indeed since most closed-end funds tend to have the highest yields available in the market, they tend to be very popular with income-hungry investors. This one has an advantage over many of the other closed-end funds in the market, however, as it does not require investors to sacrifice the potential upside that could be obtained from an investment in common equities. This is because this is an equity closed-end fund that invests primarily in common stocks. That is something that could prove very attractive to many investors as inflation continues to ravage the economy, due to the simple fact that common equities tend to be better than fixed-income securities at protecting wealth against a declining dollar.

The Voya Infrastructure, Industrials, and Materials Fund certainly does not sacrifice any yield despite being an equity fund. At the current share price, the fund boasts an 11.74% yield that is obviously very attractive compared to most assets in the current market environment. It also compares quite well to its peers, as can be seen here:

Fund Name | Morningstar Classification | Current Yield |

Voya Infrastructure Industrials and Materials Fund | Equity-Global Equity | 11.74% |

Allspring Global Dividend Opportunity Fund (EOD) | Equity-Global Equity | 8.98% |

Calamos L/S Equity & Dynamic Inc Trust (CPZ) | Equity-Global Equity | 10.81% |

Clough Global Equity Fund (GLQ) | Equity-Global Equity | 10.91% |

Eaton Vance Tax-Advantaged Global Dividend Income Fund (ETG) | Equity-Global Equity | 8.41% |

Lazard Global Total Return and Income Fund Inc (LGI) | Equity-Global Equity | 7.64% |

Admittedly, the Voya Infrastructure, Industrials, and Materials is more sector-specific than some other funds shown on this list. However, that would be a handicap if anything since the broad-market peer funds shown have the ability to invest in the same companies as the Voya Infrastructure, Industrials, and Materials Fund or different ones that may offer the potential for better yields or returns. The high yield of this fund could therefore be something that attracts investors of all stripes, although income-focused ones in particular could find a lot to like here. However, the fact that this fund has a higher yield than its peers could be a sign that the market doubts its ability to sustain its distribution and expects that the fund will need to cut the payout. This is something that we should investigate over the remainder of this article.

The recent performance of the Voya Infrastructure, Industrials, and Materials Fund has been rather disappointing. Over the past three years, shares of the fund have declined by 17.11%. The iShares MSCI World ETF (URTH) and the S&P 500 Index (SP500) were both up over the same period:

This poor performance mostly undoes all the goodwill that the fund obtained with its high yield. After all, nobody likes to lose money over time, and while income investors might be willing to accept a lower return than the market, there is a limit to the amount of underperformance that they are willing to accept.

However, as I stated recently:

A simple look at a closed-end fund’s price performance does not necessarily provide an accurate picture of how investors in the fund did during a given period. This is because these funds tend to pay out all of their net investment profits to the shareholders, rather than relying on the capital appreciation of their share price to provide a return. This is the reason why the yields of these funds tend to be much higher than the yield of index funds or most other market assets.

The MSCI World Index has a trailing twelve-month yield of 1.54% and the S&P 500 Index is even lower. As such, we would expect that the much higher yield of the Voya Infrastructure, Industrials, and Materials Fund would lift its performance relative to the two indices. This is the case, although it is still not sufficient to result in the fund outperforming the indices:

At least we can see that the fund delivered a positive return to its shareholders over the period. However, the fund only managed to deliver a 9.30% total return over the period. Due to inflation, prices are up about 20% over the same three-year period, so the fund unfortunately failed to provide a positive real return. This is discouraging, especially for retirees who depend on their portfolios to deliver the income and wealth preservation that they require.

However, just because a fund delivered a disappointing performance during a certain period does not mean that this will always be the case. Anyone who purchases the fund today will not be affected by events that occurred in the past, so let us take a look at the fund as it is today and try to determine if it makes any sense to purchase it.

About The Fund

According to the fund’s website, the Voya Infrastructure, Industrials, and Materials Fund has the primary objective of providing its investors with a very high level of total return. The website specifically states that the fund is aiming to provide its total returns through a combination of current income, capital gains, and capital appreciation:

The fund’s objective makes a great deal of case given its strategy. The website provides three bullet points detailing the fund’s strategy:

- (The Fund) invests primarily in companies in the infrastructure, industrials and materials sectors that will potentially benefit from the building, renovation, expansion, and utilization of infrastructure.

- (The Fund) seeks to build a diversified portfolio of equity securities of companies that may potentially benefit from spending in six areas: power, construction, materials, communications, transportation and water.

- (The Fund) sells call options on exchange-traded funds. The underlying value of such calls will generally represent 15% to 50% of the total underlying value of the portfolio.

Thus, the fund is primarily an equity fund that invests in companies that it defines as infrastructure firms. However, it adds a twist to the option-writing call strategy that is similar to the one employed by some of Eaton Vance’s option-income funds. Common equities primarily deliver their investment return through capital appreciation, although many of them pay dividends as well, so that can act as current income. The call option-writing strategy primarily is an income strategy, since the goal is to receive the upfront premium and then have the option expire worthlessly. The premium itself serves as a source of income for the fund. Total return is the combination of current income and capital gains, so it works pretty well as an objective for this fund.

The strategy description provided on the website specifically states that the fund invests primarily in companies operating in the infrastructure, industrial, and materials sectors. Closed-end funds that concentrate their efforts on infrastructure companies are fairly common, and indeed there are a few very popular funds in this sector, such as the Cohen & Steers Infrastructure Fund (UTF). This is even though the infrastructure sector in general does not get much attention from the financial media unless a politician is promoting a plan to invest in upgrading the nation’s infrastructure. The sector, which includes railroads, utilities, pipelines, telecommunications networks, and highways, is vitally important for our modern way of life, however.

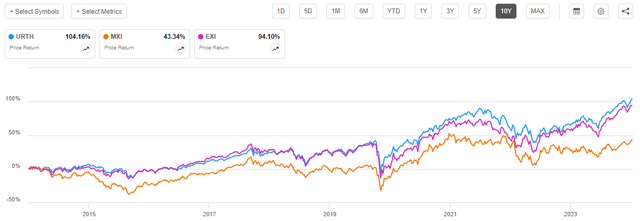

The industrial and materials sectors are rare to find as focal points in a closed-end fund. There are very few equity funds that specialize in companies operating in these two sectors. This is probably because neither sector has garnered much attention from the market over the past ten or twenty years. One reason for this is that capital gains have not been as prominent in these sectors as they have in technology, healthcare, or other long-duration areas. For example, consider the following chart that shows the MSCI World Index against the iShares Global Materials ETF (MXI) and the iShares Global Industrials ETF (EXI) over the past ten years:

As we can see, the MSCI World Index beat both global industrials and global materials by quite a lot. The materials sector in particular lagged well behind global stocks. If we look at the United States, the underperformance of industrials and materials against the broad large-cap stock indices is even more pronounced. As a result, there has probably not been enough demand for specialty funds focused on industrials or materials among investors to justify a fund house creating specialty products for the sector. This does not necessarily mean that they are bad investments, and indeed commodities did very well the last time that we had stagflation in the United States. As I have mentioned in a few previous articles, there are signs that the United States may be entering a similar era of stagflation.

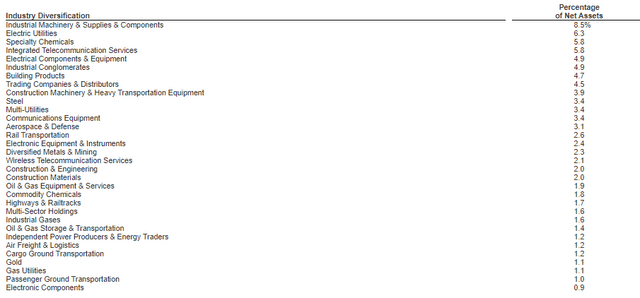

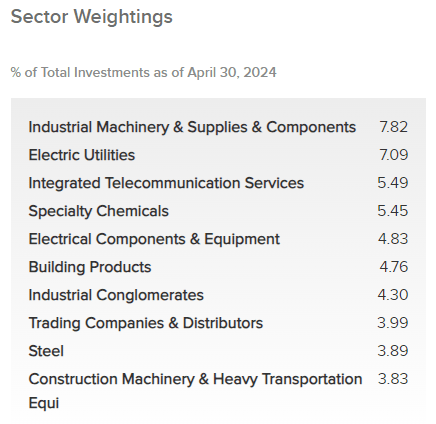

However, this fund’s definition of materials is not commodities but basic building products such as steel. Here is the fund’s sector allocation as of April 30, 2024:

Voya Investment Management

The above weightings only total 51.45%, so obviously the sector weightings chart on the website cannot possibly show us the entire portfolio. The fund’s annual report provides a different sector allocation:

The above weights total 93.7% so it still does not account for the 98.5% common stock allocation that the fund claims to have. However, the fund’s annual report also includes the following chart on the next page:

This brings us up to 100% when the two charts are combined, but not all of these positions are common stocks. The fund’s annual report says that it has 98.5% of assets invested in common stock, 1.6% of assets invested in the MSCI World Index ETF, 0.4% of assets invested in preferred stock, and 0.4% of assets invested in the Goldman Sachs Financial Square Government Fund Inst (FGTXX). Overall, though, the overwhelming majority of the fund is invested in common stock, with the small allocation to preferred stock providing a bit of an income boost due to the higher yields available from preferred stock relative to common stock. The money market fund holdings are obviously in the fund as a place to hold cash for a very short period of time before investment or distribution. Unlike open-end mutual funds, a closed-end fund does not need to hold cash to meet shareholder redemption requests.

The fund’s holdings and sector weightings information provided in the annual report is as of February 29, 2024, so the information provided on the website is a few months newer and therefore should be considered to take precedence over the annual report whenever the two sources conflict. However, we can clearly see that the information on the website appears to be only a snapshot of the fund’s actual holdings. The portfolio itself is far more extensive and diversified than the website’s charts suggest.

One characteristic of infrastructure, industrial, and materials companies that many of us have come to appreciate over the years is that these firms have higher yields than many other things in the market. This is true of the stocks that comprise the fund’s largest positions. Here they are:

Voya Investment Management

Here are the current yields of these assets:

Fund/Company Name | Current Yield |

iShares MSCI ACWI ETF (ACWI) | 1.71% |

Cisco Systems, Inc. (CSCO) | 3.32% |

Siemens Aktiengesellschaft (OTCPK:SIEGY) | 2.69% |

The Sherwin-Williams Company (SHW) | 0.92% |

Parker-Hannifin Corporation (PH) | 1.20% |

AT&T Inc. (T) | 6.38% |

Holcim AG (OTCPK:HCMLF) | 3.56% |

AMETEK, Inc. (AME) | 0.67% |

Compagnie de Saint-Gobain S.A. (OTCPK:CODGF) | 2.37% |

Linde plc (LIN) | 1.29% |

As mentioned in the introduction, the MSCI World Index has a trailing twelve-month yield of 1.54% but the MSCI All-Countries World Index has a trailing twelve-month yield of 1.71%. As we can see above, several of the stocks that comprise the fund’s largest holdings have yields somewhat above this level. However, clearly, not all of them are because four of the nine stocks on the list have yields that are lower than the index. For the most part, though, we can see that the fund’s portfolio should deliver a level of current income that is higher than that of the overall market. This is something that income investors should be able to appreciate, as the steady income produced by these dividend-paying stocks provides the fund with some money that helps support the distribution that the fund pays out.

Distribution Analysis

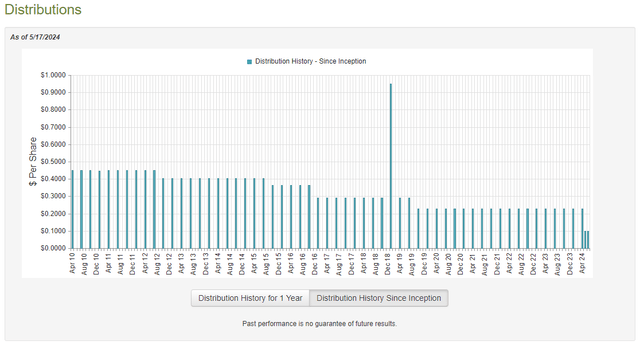

The primary objective of the Voya Infrastructure, Industrials, and Materials Fund is to provide its investors with a high level of total return. However, it primarily provides this to its investors via current distributions, just like most closed-end funds. To this end, the fund pays a monthly distribution of $0.10 per share ($1.20 per share annually), which gives it an 11.74% yield at the current price. The fund has not been especially consistent regarding its distribution, and it has generally declined over the years:

This is not what we want to see, especially since today’s high rate of inflation requires that our incomes grow over time instead of decline. Nonetheless, if the fund can sustain its current distribution, then new investors should not be negatively impacted by distribution cuts, nor will they suffer declining income.

The most recent financial report that we have available to us is the annual report for the full-year period that ended on February 29, 2024. A link to this document was provided earlier in the article. As this report is very recent, it should give us a great idea of how well the fund is covering its current distribution.

For the full-year period that ended on February 29, 2024, the Voya Infrastructure, Industrials, and Materials Fund received $5,056,456 in net dividends (dividends minus foreign withholding taxes) and $2,421 in interest from the assets in its portfolio. When we combine this with a small amount of income from other sources, we arrive at a total investment income of $5,059,947 for the full-year period. The fund paid its expenses out of this amount, which left it with $2,938,636 available for shareholders. The fund paid $14,043,290 to its shareholders during the period, so obviously it did not have sufficient net investment income to completely cover its distributions.

The fund was able to make up the difference with capital gains. For the full-year period that ended on February 29, 2024, the Voya Infrastructure, Industrials, and Materials Fund reported net realized gains of $6,843,600 and another $10,341,900 net unrealized gains. Overall, its net assets increased by $814,717 after accounting for all inflows and outflows during the period. Thus, the fund did manage to cover its distribution, although it had to rely on net unrealized gains to do so.

Some readers might notice that the fund’s net assets increased by much less than would be expected given the total gains. After all, the fund’s net realized gains and net unrealized gains together are $17,185,500, which is enough to cover the distribution and still leave a decent amount of money left over. The fund’s net investment income further increases the boost to net assets that would have been expected. The explanation for this discrepancy is that the Voya Infrastructure, Industrials, and Materials Fund bought back $5,266,129 of its own shares during the period. This is something that several Voya funds have been doing over the past few years in an attempt to reduce the discount that the share price trades at. The fact that the fund managed to cover this extra expense on top of the distribution tells us just how well it actually did during the period, and makes it quite obvious that we should not need to worry too much about the distribution right now.

With that said, the fact that this fund has a managed distribution policy means that there is no guarantee that we will never need to worry about the distribution. The annual report explains the managed distribution:

Under the managed distribution policy, the fund makes quarterly distributions of an amount equal to $0.229 per share. You should not draw any conclusions about the Fund’s investment performance from the amount of this distribution or from the terms of the Fund’s plan.

The fund switched its quarterly distribution to a monthly one in April 2024. The new amount is $0.10 per share, which actually works out to a lot more than $0.229 per share quarterly. It is still lower than some of the amounts that the fund has had in the past, though, so the long-term trend is still a declining distribution. The key thing here is that the fund pays this amount out regardless of the amount of investment profit that it actually manages to achieve. Thus, in a weak market, the fund might wind up making some destructive distributions. Investors who purchase this fund as a long-term source of income may wish to keep this in mind.

Valuation

Shares of the Voya Infrastructure, Industrials, and Materials Fund currently trade at a 13.27% discount to net asset value. This is a more attractive price than the 12.88% discount that the shares have had on average over the past month.

Conclusion

In conclusion, the Voya Infrastructure, Industrials, and Materials Fund is a unique closed-end fund that invests in market sectors that are rather unusual for closed-end funds. This certainly does not mean that it is a bad fund, though, as it enjoys a significant amount of diversification and is surprisingly performing pretty well financially.

Voya Infrastructure Industrials and Materials Fund does trade at an enormous discount, though, and this discount appears to be a perpetual problem for the fund. The large discount is only a problem for sellers of the fund, though, not for buyers. Overall, this one might be worth considering for someone who wants to increase their exposure to the infrastructure and similar sectors.