Jiang Jifeng

investment thesis

It is said that 2024 dragon yearIn Chinese culture, the dragon is revered as a highly auspicious symbol and is known to be a symbol of good fortune.

I have been lagging behind in the world market for many years. Taking cues from a series of measures taken by the Chinese government to revitalize China’s sluggish economy and financial markets, 2024 may be the year when China’s economic dragon awakens. At the same time, China’s economy is taking steps to quell depressed sentiment surrounding previous policies and decisions. In my view, a combination of declining sentiment and an improving outlook provides a powerful recipe for a contrarian trade.

In terms of exposure to the Chinese economy, the KraneShares CSI China Internet ETF (Knee search:KWEB) it’s the best Good for providing that exposure. Adding to my contrarian outlook for the overall economy, China’s e-commerce industry is expected to record its first year of growth. This makes KWEB a likely candidate to benefit from this deal in 2024 as he is in the Year of the Dragon.

I rate KWEB a “buy” for the reasons stated below.

About KraneShares CSI China Internet Fund

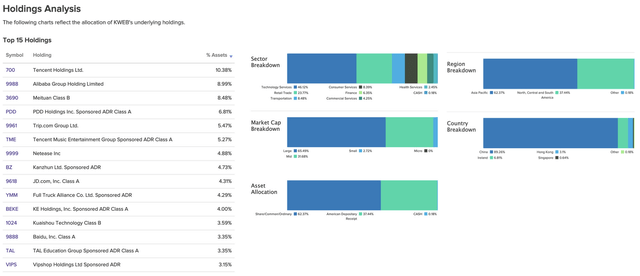

The assets of the KWEB Fund are owned and managed by KraneShares, a New York-based asset management company. The fund typically provides access to Chinese internet companies operating in the Chinese market or the global e-commerce sector. As seen in Exhibit A below, the Fund invests assets in a wide range of Chinese e-commerce and technology companies that are listed on the Chinese market or listed on the US market through American Depositary Receipts (ADRs). .

by fund prospectusKWEB achieves its objective by tracking the CSI Overseas China Internet Index. “Float market capitalization is weighted and includes securities listed on either the Hong Kong Stock Exchange, the Nasdaq Stock Market, or the New York Stock Exchange.”

Below is a graph showing the top 15 holdings and KWEB’s fund composition by category.

Exhibit A: KWEB’s top 15 holdings and holdings by sector (etfdb)

peer comparison

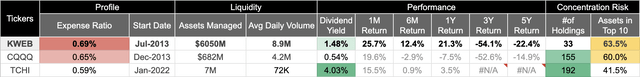

When analyzing KWEB, we also looked at some of its competitors. Since I focused only on investments in the technology and e-commerce sector, on a sector basis he only looked at peer companies that could compete with KWEB. I have added my peer analysis in Exhibit B below.

Exhibit B: Comparison of KWEB Fund Indices and Industry Peers (SA)

With over $6 billion in assets, KWEB is the largest fund with assets in China’s e-commerce and technology sector. I prefer large funds because investing in some emerging market economies involves some risk. We’ll discuss that risk in a later section, but we’ll also talk about large funds. Larger funds like KWEB offer higher levels of relative liquidity, as seen in Exhibit B, with more than 8 million shares traded each day.

KWEB offers a dividend and currently has an annual yield of 1.48%. As seen in Exhibit B, this is well below one of its peers, but I don’t plan on holding his KWEB for the long term. My horizon is short to medium-term, as past performance shows that KWEB and its peers, as well as large China-focused emerging market ETFs, have delivered marginal returns over the past few years. .

And while KWEB may not be the most diversified fund, that doesn’t prevent it from outperforming its peers on a relative basis, as seen in Exhibit B.

Outlook and assessment: policy easing, economic growth, attractive valuations among risks

risk

Given the many events that have occurred in the post-pandemic era, it is worth noting that sentiment surrounding Chinese stocks has declined. Rising trade tensions and increasingly investor-unfriendly policies around the world, combined with China’s fragile real estate market, are causing investors to leave the country.

A strong U.S. dollar and one of the sharpest interest rate hikes by the Federal Reserve in recent years have further worsened the outlook. This creates uncertainty about China’s economic outlook, as market participants believe these risks may persist. This is also pointed out in the results of a study published in a journal. This Bloomberg memo:

Research shows that shorting Chinese stocks is one of the most crowded trades, with only longing the US dollar and the Magnificent Seven of US tech stocks seen as more popular.

Outlook

However, I believe short selling in Chinese stocks could result in a crowded trade, which could create the perfect situation for a contrarian trade in Chinese stocks.

another Note from JP Morgan Although he analyzes some of the reasons for the decline in emotions on historical grounds, he also points out that: “Policy action is becoming more aggressive.”

In February of this year, With a surprising move, PBoC (People’s Bank of China) lowered the loan prime interest rate by 25bp to 3.95%.Around the same time, Bloomberg also reported that China’s so-called ‘National Team’ Companies such as China Securities Finance Corporation and Central Huijin Investment reportedly invested up to $57 billion in domestic stocks. According to the memo:

More than 75% of the inflows went into products tied to the benchmark CSI 300 index, and a further 13% went into products reflecting the CSI 500 index, according to strategists including Lei Meng. Government funding has been key to stabilizing recent stock market declines, with Central Investors announcing earlier this month that it would continue to increase its ETF holdings. Soaring volumes in many ETFs suggest authorities are actively buying both blue-chip and small-cap stocks.

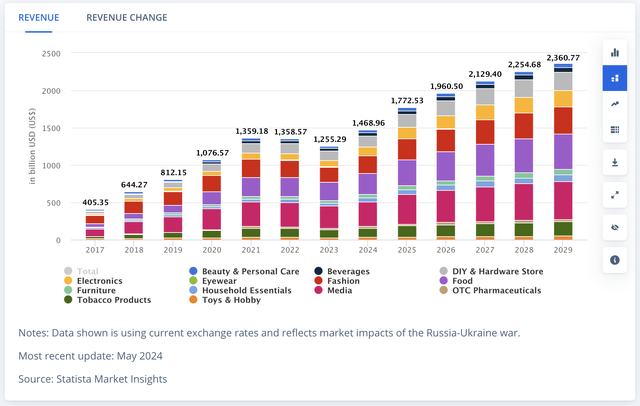

At the same time, we note that China’s e-commerce industry is expected to grow by up to 17% in FY24. Most of KWEB’s shares are tied to technology and e-commerce stocks, and KWEB stands to benefit from any restructuring in the e-commerce space. plus, I was surprised that China’s GDP numbers were on the rise. The stock rose 5.3%, well above the consensus estimate of 4.8%.

Exhibit C: China’s e-commerce market expected to grow 17% in FY24 (Statista Market Insights)

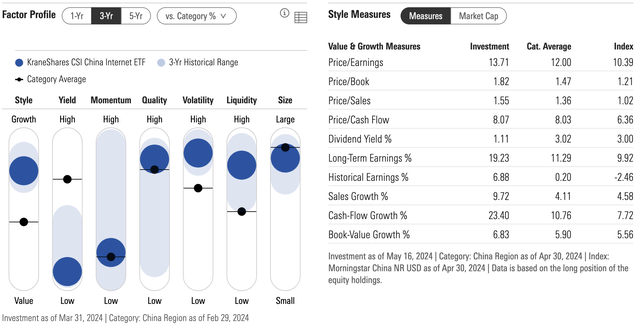

We believe that this will enable KWEB to make a profit in FY24.According to Morningstar in Exhibit D below, KWEB companies are S&P 500 long-term earnings growth rate. Its long-term growth rate is predicted to be up to 19%. In contrast, I think KWEB is trading at a fairly reasonable P/E of 13x.

Exhibit D: KWEB Revenue Growth and Valuation Multiple (Morningstar)

remove

There are certainly risks to investing in KWEB today, especially given that China’s economy appears to be waking up and government policy appears to be becoming increasingly investor-friendly again. , I think the risk and reward looks attractive to me. While the previous extreme pessimism about the Chinese economy may be understandable, the current system looks favorable to KWEB.

Rate KWEB as “Buy Here”.