Onuldonger

Magnite (Nasdaq:MGNI) stock prices rose significantly on Thursday news That Netflix (NFLX) plans to launch its own advertising platform with Magnite as a partner.This can be an additional important source Over time, your revenue will increase and have a significant impact on your company’s bottom line. However, I don’t think this will change Magnite’s outlook much. The company has appeared to be highly undervalued for some time based on its ability to generate free cash flow, but an uncertain macro environment and evolving ad tech landscape are holding back the stock’s upside.

previously suggested Magnite’s stock price should continue to rise as the company moves from net deleveraging to returning cash to shareholders, he said. I still think it will, but it will take time and depends on whether the macro environment remains supportive.

market conditions

Although the macro environment remains challenging, Magnite suggested that conditions are improving. It is said that March was a good month. This sentiment appears to broadly reflect the performance and outlook of companies exposed to digital advertising. In particular, growth has accelerated markedly in recent quarters, even among listed companies that have struggled in recent years.

Given Magnite’s relatively high CTV exposure, the impact of rapid growth and supply of ad-supported streaming services on pricing remains a concern. Magnite recently indicated that his CPM has been showing a low single-digit decline. More stable pricing should help Magnite’s CTV business going forward.

Magnite Business Latest Information

Magnite’s CTV business was strong in the first quarter. Live sports is a tailwind at the moment, with March Madness contributing to a strong first quarter performance and the Olympics likely providing a boost later this year.

At the moment, advertising distribution is also our specialty. FreeWheel has a strong position among broadcasters, while SpringServe is reportedly doing well among his OEMs and ad-supported streaming services. Magnite believes that by integrating SpringServe with a streaming SSP, publishers can maximize revenue while protecting the user experience. Magnite plans to make SpringServe and its SSP available through unified login to help facilitate cross-selling.

Supply chain optimization remains a key trend right now, and Magnite’s ClearLine self-service direct purchasing platform is gaining traction. This should be supported by Magnite’s growing partnership with Mediaocean, including an exclusive deal for his CTV purchases through ClearLine. The partnership will allow linear TV buyers to use his Mediaocean planning tools to purchase inventory through ClearLine. This is potentially important because Mediaocean’s total spend is $200 billion and its products are deeply integrated into existing purchasing workflows.

However, SPO may be one of the factors hindering Magnite’s valuation, and the company may face disintermediation from the demand side. trade desk (TTD) introduced Open Path a few years ago, and Magnite’s DV+ business has been performing reasonably well ever since. Magnite believes protection will be provided by providing comprehensive revenue management using data and AI and a more secure publisher trading environment, but this remains to be seen.

Magnite also believes its existing partnerships will help it play an important role in CTV over the long term. However, this is not necessarily a strong argument in Magnite’s favor, as consolidation could undermine Magnite’s competitive position. This can be seen from Disney’s DRAX Direct service integrated with his DSP, the largest in the industry.

Magnite works with Disney through its Managed Services team and is Disney’s only SSP partner. Disney has its own ad server, but provides the technical capabilities to connect with DSPs. However, the Trade Desk merger is not expected to occur until 2025.

Netflix advertising platform

Netflix plans to launch service Leverage the power of The Trade Desk, Magnite, and Google to build an in-house advertising platform by the end of 2025. Netflix previously partnered with Microsoft, but this change could signal dissatisfaction with the current arrangement. This should ultimately become a significant source of additional revenue for his Magnite, as Netflix recently revealed that it has 40 million users on its ad-supported plans. It also provides validation of Magnite’s services. However, this arrangement will do little to allay investor concerns about the role of SPOs and SSPs in the long term.

financial analysis

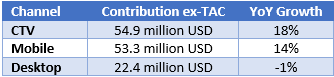

Magnite had revenue of $149 million in the first quarter, up 15% year-over-year, with contribution excluding TAC up 12%. Growth was driven by his CTV contribution excluding his TAC, which was up 18% year over year. CTV strength was a result of Magnite’s programmatic services, with managed services revenue down slightly year-over-year. DV+ contribution excluding TAC increased 9% year over year, with mobile strength somewhat offset by desktop weakness.

Table 1: Magnite contribution excluding TAC per channel (Source: Created by author using data from Magnite)

Magnite expects its second-quarter contribution, net of TAC, to be between $142 million and $146 million, representing approximately 7% year-over-year growth at the midpoint. Contribution to CTV (after tax) is expected to increase approximately 7% to $59-61 million, with programmatic continuing to drive growth. His contribution from DV+, net of TAC, is expected to be $83 million to $85 million, up 7% year over year at the midpoint. For the full year, Magnite expects his contribution excluding TAC to increase by at least 10% and his CTV to exceed his DV+.

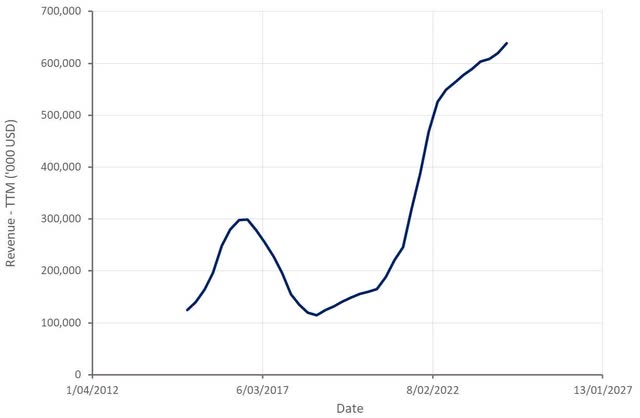

Figure 1: Magnite revenue (Source: Created by author using data from Magnite)

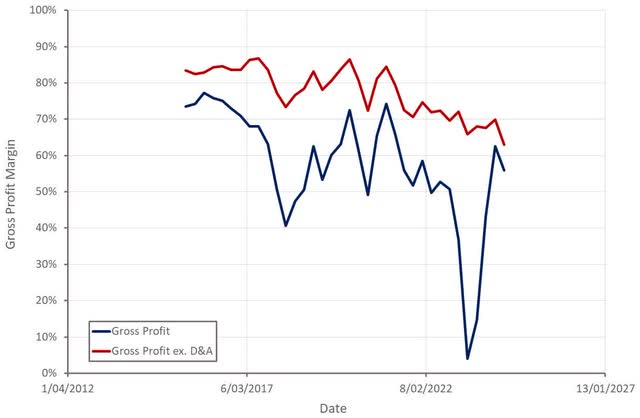

Although Magnite’s GAAP gross margin has now largely recovered from the impact of the SpotX acquisition, the company’s underlying gross margin continues to decline. Given his Magnite comments on pricing, this appears to be the result of a change in revenue mix. Magnite’s managed services business has relatively high margins, but it has struggled in recent quarters.

Figure 2: Magnite gross profit margin (Source: Created by author using data from Magnite)

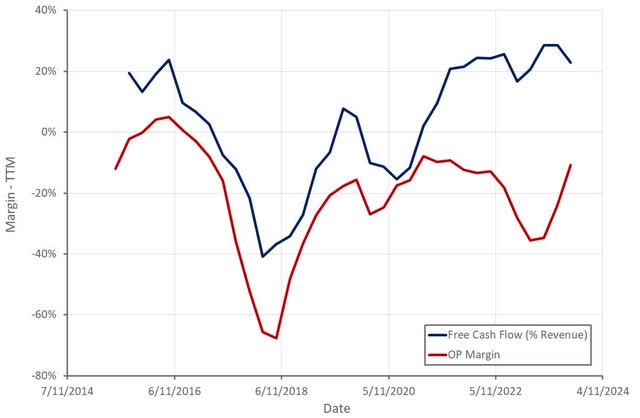

Magnite’s GAAP operating margin continues to improve due to lower operating leverage and amortization expense. Although the company’s cash flow margins have been somewhat stagnant in recent quarters, GAAP profitability should continue to be in line with cash flow margins in 2024. Cash flow margins should also increase further as the business expands, especially if gross profit margins stabilize or increase. .

Figure 3: Magnite Free Cash Flow (Source: Created by author using data from Magnite)

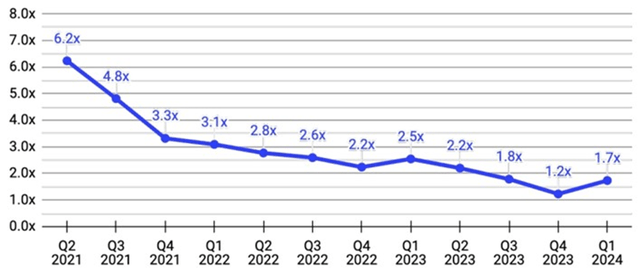

Magnite’s net leverage is trending downward across the board, and the company hopes to achieve a ratio of less than 1x by the end of the year. Net leverage was higher in the first quarter due to typical cash seasonality.

Figure 4: Magnite Net Leverage (Source: Magnite)

conclusion

While Netflix’s announcement is positive, I don’t think it will significantly change Magnite’s outlook. The company continues to generate solid growth and free cash flow, but that’s not reflected in the stock price. This is likely due to Magnite’s past failure to create shareholder value and investor skepticism about the strength of SSP’s business model.

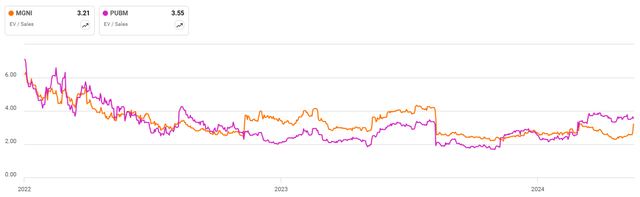

Growth and improving cash flow should support Magnite’s stock price, but valuation could limit upside in the short term. Magnite has been trading at a deep discount to PubMatic in recent months, likely due to PubMatic’s (publisher) has experienced strong growth in recent quarters. The two companies are now trading more evenly, but the gap has now largely closed.