Matthiukol

investment thesis

Based on recent cross-market trends and taking into account the individual characteristics of each market, Sibanye Stillwater Limited (New York Stock Exchange:SBSW), despite the many risks associated with this stock, we believe a cyclical swing to the upside is: Still playing. In any case, SBSW now appears more likely to rise in the medium term than continue the multi-week correction that has been ongoing since February 2022.

Why do you think so?

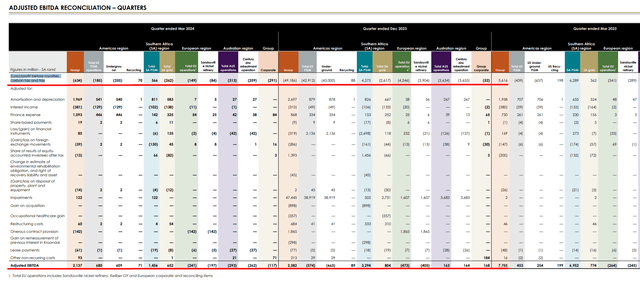

I want to say from the beginning that SBSW reported this. terrible results For the last quarter. Adjusted EBITDA for the first quarter of 2024 decreased by more than 74%, or 3.9x, in US dollar terms. Essentially all of the company’s businesses were down year over year due to lower selling prices (and in the case of gold, lower production). operation).Losses before royalties, carbon taxes and taxes amounted to -$634 million, which is Profit for the first quarter of 2023 was $5.6 billion.

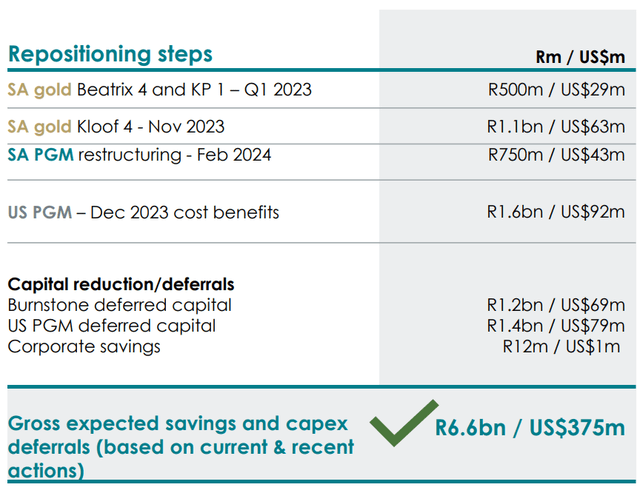

SBSW’s IR materials, author’s notes

Sibanye is actively restructuring its business, including closing unprofitable shafts. In November 2023, the company closed the Kloof 4 shaft and repositioned its PGM operations in the United States. In February 2024, they closed his Simunye shaft and properly sized the Siphumelele and Rowland shafts. In addition, the four-belt shaft will operate conditionally and will be closed from April 2024. Latest IR briefing updated. Although the company was not successful in reducing costs in the first quarter of 2023, management expects to achieve significant savings of approximately $375 million in the foreseeable future through systematic cost reductions and rescheduling of major capital projects. We expect to achieve cost reductions.

Judging from Sibanye Many other presentation files It’s clear from previous periods that the market wasn’t too impressed with management’s plans. In short, management consistently repeated similarly optimistic plans and forecasts, but the boom years never arrived. I believe this is primarily due to the large imbalance in SBSW’s business structure to his PGM Metals, further reducing adjusted EBITDA.

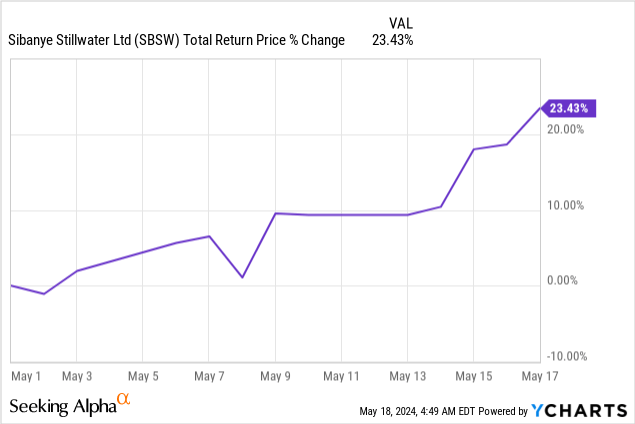

In fact, the company’s financial problems snowballed. According to news that came out a few days ago, the company is probably facing liquidity issues. As reported by Seeking Alpha“The miners said so.” talk to lender Despite this highly negative news, the company’s stock price actually rose MTD, with no significant negative reaction to recent developments.

As RBC analyst Marina Calero writes, the bank had expected a positive response to its quarterly results given the better-than-expected results and the reiteration of guidance.

And really, what will save your company are two things:

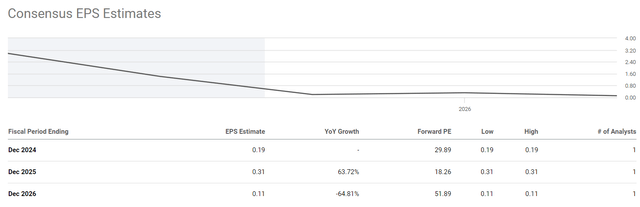

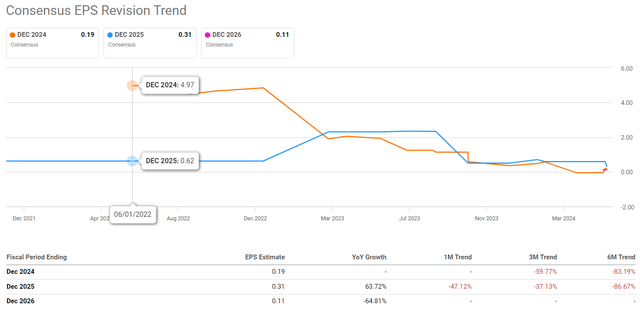

1. Negative market perception of future prospects. For example, if you look at the following: EPS revision For fiscal 2024 and beyond, we see that all EPS forecasts have decreased significantly over the past six months compared to their prior forecasts.

Seeking alpha premium data, SBSW

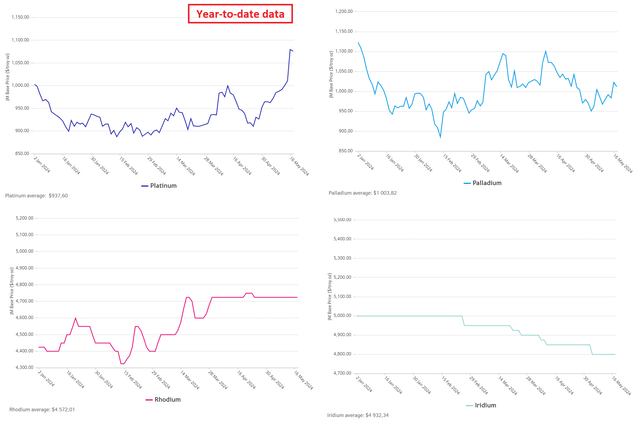

2. Major PGM metal prices began to recover rapidly (Especially platinum). Demand was expected to slow due to the shift from internal combustion engine cars to electric vehicles, which do not require catalysts made from the precious metal.

Johnson Matthey data, edited by author

BMO analysts said in an early May note (proprietary source) that they expect overall auto sales to remain relatively strong this year, including gasoline-powered vehicles (which typically have palladium catalysts). It is written. This should support the prices of all his PGM metals if demand indeed reaches the right level soon. From an economic pattern perspective, there is a good chance that demand will continue to recover. Domestic car inventory America’s population today is extremely low in long-term historical context.

I can’t cite any specific sources or reliable scientific studies, but based on my years of experience working with cyclical stocks, I can tell you that the market responds to very negative earnings results after a long period of declining stock prices. When you see a positive reaction, it’s often because it’s reached the bottom or is very close to the bottom. In my opinion, SBSW stock looks very attractive based on this pattern.

If you look at the stock chart, you’ll see a huge sharp decline that started in February 2022. In my view, this decline was too steep. Recent positive developments suggest that the downtrend has been broken and the market structure has collapsed, as traders say, and we are now headed for an upward trajectory, with the next logical price level at around It is between $8 and $8.50, indicating potential upside. That’s about a 42% discount from the current price.

TrendSpider Software, SBSW, Author’s Note

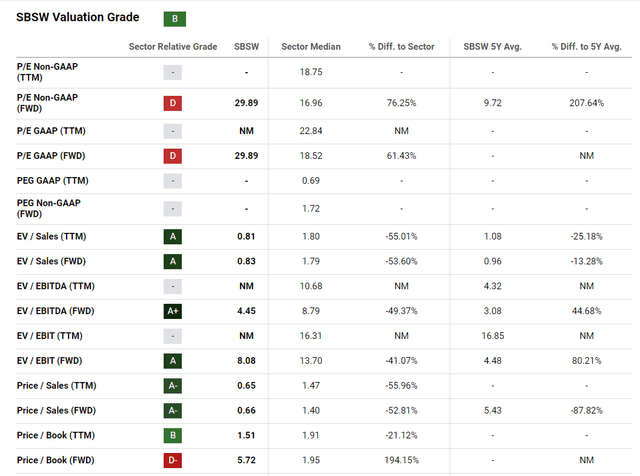

It would be great if my above findings were supported by the company’s evaluation. However, at present, Sibanye’s ratings are low If you look at the forward price-to-earnings ratio, it’s less obvious. The company trades at almost 30 times earnings, so don’t expect anything amazing this year. However, what makes the situation somewhat better is that the company’s front-wheel drive EV/sales are below the industry standard of 1x (half). Additionally, the forwarding EV/EBITDA ratio is approximately 4.5x, which is also approximately half the sector median. This is in line with the conclusion drawn from the technical analysis above and suggests significant growth potential based on these two indicators.

Evaluating SBSW in search of alpha

Therefore, despite the abundance of risks discussed below, I tend to believe that SBSW is still oversold. In my opinion, despite the somewhat depressing financials and somewhat uncertain valuation conclusions, there is still significant resilience in SBSW’s underlying end-market that is driving PGM prices higher. Therefore, we expect the stock price to rise, at least in the medium term.

What is wrong?

I’m a little surprised by that recent gold growth Despite the fact that Sibanye has quite extensive business activities related to this precious metal, it is not suppressed in any way. Moreover, it is alarming to observe trends in the automobile market. Transition from ICE to EV – indicates a decline in demand for palladium and platinum. From a long-term perspective, as soon as the current positive price appreciation for these metals stops (which I think is inevitable), further declines in SBSW could follow. This probably poses the biggest risk to my paper today.

You should also consider that, as far as I can see, the company’s valuation doesn’t reflect any significant discounts. SBSW’s valuation multiple appears less reliable at this point, as actual adjusted EBITDA and EPS forecasts have declined significantly recently, but building an accurate DCF model under these circumstances It is unclear whether these efforts are justified, given the large amount of effort required and narrow profit margins. This is due to an error, so to speak (assuming cyclical stocks is very difficult). but, the theory suggests that cyclical stocks should be purchased when their multiples to net income are very high or non-existent (indicating negative net income on a TTM basis). So who knows how likely EPS will eventually reverse. For example, The Street considers such a scenario to be a basic assumption, so SBSW states: Expected PER for FY2025 is 18x Not so scary:

Considering all of the risks listed here, we recommend that you exercise caution when purchasing SBSW stock. Avoid making it a major position in your portfolio or holding it for too long. Also, don’t ignore any obvious negative signs or red flags that may appear in the future.

conclusion

Despite the many risks involved, I believe that cyclical upward momentum is in play and that medium-term price appreciation appears more likely than a sustained correction. SBSW reported dismal results last quarter. Adjusted EBITDA plummeted more than 74% for him, and profits fell sharply year-over-year. The company is currently in an active restructuring phase, including closing unprofitable shafts and implementing cost-cutting measures. Despite liquidity concerns and general financial deterioration, the market has surprisingly responded positively to all of this. In my view, the reasons behind this event and the magnitude of the market reaction suggest that SBSW’s stock price is likely at or nearing its bottom. Therefore, I expect this stock to continue to grow in the near future, albeit in a speculative manner.

Therefore, I rate SBSW a ‘buy’ today over the medium term. Let us know what you think about all this in the comments section below.

thank you for reading!