bgwalker/iStock Unpublished (via Getty Images)

tapestry (New York Stock Exchange:TPR) sells women’s handbags, accessories, and other products from Coach, Kate Spade, and Stuart Weitzman brands. The Coach brand brings in the majority of the company’s revenue. Geographically, the company’s revenue primarily comes from North America. 65% One of our 2023 revenues, the remaining revenues are primarily from Asia.

Over the past decade, Tapestry’s stock has delivered very poor returns despite financial turmoil and a stable price. The company pays dividends at the current forward yield. 3.31%. Currently, he has high profit margins, stable revenues, and is in a dispute with the FTC over his acquisition of Capri Holdings (CPRI), this stock appears to have a good balance of risk and reward.

10 year stock price chart (In search of alpha)

Financial profile: Historical turmoil has stabilized in recent years

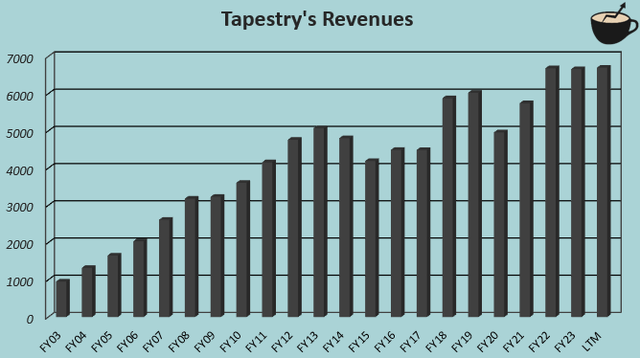

After economic turmoil, From fiscal year 2013 to fiscal year 2017 and during the coronavirus pandemic, Tapestry stabilized the company’s performance. revenue It is currently below $6.7 billion. While the great growth of the 2000s was achieved almost entirely organically, more recently growth has been primarily acquisition Kate Spade’s sales in 2018 were $2.4 billion. The Tapestry brand has now reached a mature position within the industry, and we believe further organic growth significantly above inflation is unlikely.

Author calculations using TIKR data

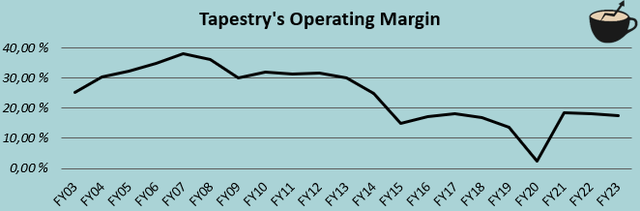

Although Tapestry’s long-term margins are on the decline, the company’s margins remain at a significantly trailing level of 18.8%, and it will also gain some leverage during FY2024. Tapestry continues to generate stable profits, so I think we can expect similar profit margins in the future.

Author calculations using TIKR data

Stuart Weitzman Brand, Tapestry’s performance deteriorates

Although the Stuart Weitzman brand only accounted for approximately 3.1% of Tapestry’s revenue in the third quarter of 2024, the brand appears to be significantly hurting the company’s financial performance. The brand’s revenue is down -17% year over year, and it has Tapestry’s lowest gross margin and highest SG&A expenses relative to sales. As a result, the brand’s third quarter operating income was -$5 million, with an operating margin of -8.4%.Brand sales in the first half Diminished -11% decrease.

Tapestry continues to invest heavily in this area with increased marketing and product innovation, but we have yet to see any financial improvement. Increased marketing spending increased operating costs without improving demand.

Capri Holdings takeover battle

on the 10th, following speculation of an agreement with Capri Holdings.th august tapestry announced The company has agreed to acquire the company at a valuation of approximately $8.5 billion, or $57.00 per Capri Holdings share. Prior to the announcement of the planned transaction, Capri Holdings’ stock price closed at $34.61, representing a sizable 64.7% premium to the acquisition. Tapestry investors did not like the announced deal, even though it was expected to have run-rate synergies of $200 million. This is because the stock price fell nearly -16% on the 10th.th of August.

The acquisition has since come under scrutiny from the Federal Trade Commission. In an ongoing legal battle, the FTC alleges that the merger of the two companies would create a company overly focused on the handbag market, with Tapestry owning six of the most important brands in the market.A tapestry is coming out press release It said the FTC misunderstood the handbag market and that the company was actively working to have its lawsuit against the acquisition dismissed.I’m currently looking for an alpha report on the 13thth In May, one of Tapestry’s court claims was denied. The acquisition is unlikely to go through. Capri Holdings’ stock is currently trading at $35.95, well below the announced acquisition price, and market confidence in the deal’s completion is also very low.The tapestry has already been painted in large quantities debt It was intended to finance acquisitions, but the debt it took out no longer appears to be able to serve its intended purpose.

In my opinion, the acquisition price of $8.5 billion seems a little too high, despite the significant expected synergies. Capri Holdings has average annual operating income of $758 million from FY 2018 to FY 2022 and an implied enterprise value of $10.1 billion, resulting in expected synergies of $200 million in operating income. Adding this, the implied EV/EBIT from the acquisition is 10.5. Tapestry itself currently has an EV/EBIT of around 7.9, making the acquisition price suspiciously high. The failed acquisition appears to be a positive for his Tapestry shareholders and a negative for Capri Holdings.

Valuations that provide balanced risk versus reward

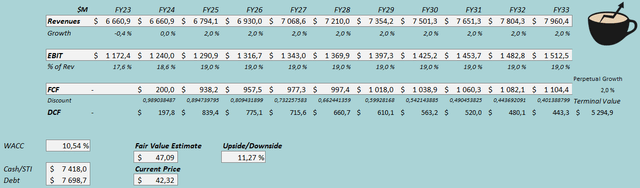

As always, we built a discounted cash flow model to estimate the stock’s rough fair value. The DCF model predicts stable performance going forward with continued growth of 2% after stable earnings in FY2024. The Capri Holdings acquisition is expected to fail under this model. Regarding EBIT margin, we expect continued strong performance with a constant margin of 19.0%. The company has modest capital expenditure and working capital increases, and cash flow conversion is mostly positive.

Based on the aforementioned estimates, the DCF model estimates Tapestry’s fair value to be $47.09, which is approximately 11% above the stock price at the time of writing. However, we do not believe the upside provides sufficient risk-reward for a Buy rating, as complex factors related to the Capri Holdings acquisition and past financial turbulence may cause the DCF model’s fair value estimate to be too high. .

DCF model (author’s calculation)

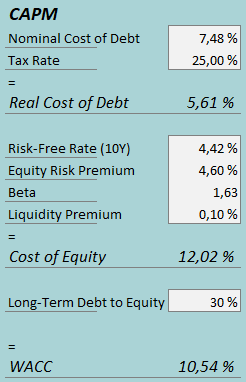

The DCF model uses a weighted average cost of capital of 10.54%. The WACC used is derived from the capital asset pricing model.

CAPM (author’s calculation)

Tapestry’s senior notes were offered at average interest rates 7.48%, used for CAPM interest rate estimation. However, as the company’s acquisition is likely to be rejected, we believe that Tapestry’s balance sheet cannot sustain its current debt over the long term, and we estimate a long-term debt-to-equity ratio of 30%. For the risk-free rate on the equity cost side, we use his 10-year US bond. Yield 4.42%. The equity risk premium of 4.60% is based on Prof. Aswath Damodaran’s Latest quote Updated on the 5th for the USth of January. Yahoo Finance estimates Tapestry’s beta at a certain number. 1.63. Finally, add a small liquidity premium of 0.1%, creating a cost of capital of 12.02% and his WACC of 10.54%.

remove

Tapestry has stabilized its revenue and earnings at a good level in recent years, and while the Stuart Weitzman brand continues to underperform, the company as a whole has reported strong results. Still, the investment is currently on shaky ground, with the previously announced acquisition of Capri Holdings now seen as likely to fail due to FTC litigation against the deal. I believe the failure of this deal does not bode well for Tapestry investors due to the high price of the proposed acquisition. This valuation offers modest upside, but the risk/reward in the stock looks balanced as the Capri Holdings acquisition and historic financial turmoil pose risks. Therefore, we will give it a Hold rating for the time being.