Adrian Wojcik

We’re nearly though the Q1 Earnings Season for the Gold Miners Index (GDX) and one of the more recent companies to report its results was Torex Gold (OTCPK:TORXF)(TSX:TXG:CA). Overall, the company had a solid start to the year with production tracking at ~26% of its guidance midpoint, with the company well on track to deliver on its guidance even adjusting for the softer Q4 due to a planned shutdown for tie-in of copper and iron flotation circuits. Meanwhile, the company continues to have one of the stronger balance sheets among its peer group despite being in the heart of spending on a significant development project (Media Luna), ending the quarter with ~$70 million in net cash.

In this update, we’ll dig into the Q1 results, recent developments and where the stock’s updated low-risk buy zone lies:

El Limon Guajes Operations – Company Website

Torex Gold Q1 Production & Sales

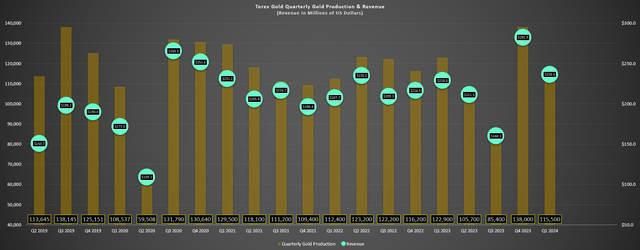

Torex Gold released its Q1 results earlier this month, reporting quarterly production of ~115,500 ounces of gold, a 6% decline from the year-ago period. The lower production in Q1 was related to lower open-pit grades (lapping difficult comparisons from Q1 2023) and lower underground grades, partially offset by higher a recovery quarter for recovery rates (90.7%) and slightly higher throughput year-over-year. In fact, this marked the fifth consecutive quarter where Torex maintained a throughput rate of 13,000+ tonnes per day, with ~1.19 million tonnes processed in Q1 at an average grade of 3.15 grams per tonne of gold.

Torex Gold Quarterly Production & Revenue – Company Filings, Author’s Chart ELG Underground Mine Production & Grades – Company Filings, Author’s Chart

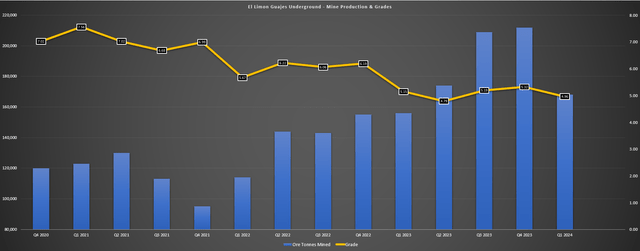

Digging into the results a little closer, underground mine production was up year-over-year but dipped back below 2,000 tonnes per day, a slight headwind to grades in the period given that underground grades are much higher than open-pit grades on average. Still, underground mining rates were up year-over-year to ~1,840 tonnes per day (Q1 2023: ~1,740 tonnes per day), with ~168,000 tonnes processed in Q1 at an average grade of 4.96 grams per tonne of gold. And while mining rates were down, we should see mining rates improve back to what the company has called its new steady state rate of 2,000 tonnes per day underground, with Q1 impacted by backfilling a crown pillar and resulting in a minor drag on overall feed grades (~15,000 fewer high-grade tonnes vs. at the 2,000 tonne per day rate) making it to the ELG Plant in Q1.

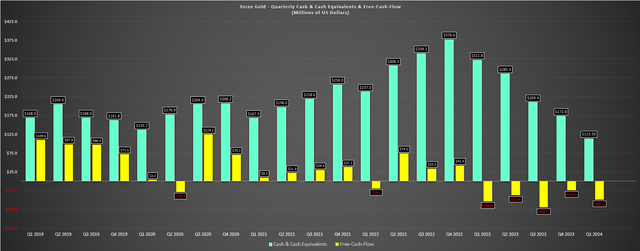

Fortunately, Torex still managed to increase revenue year-over-year in Q1 even with the lower production, reporting revenue of ~$236.5 million which was up over 3% year-over-year. The revenue growth was related to a higher realized gold price ($2,023/oz) offset by fewer ounces sold, with ~111,600 ounces sold in Q1 which was below its production rate and below Q1 2023 levels (~118,500 ounces). And despite the impact of hedging a portion of production in Q1 and it being the tax-heavy quarter of the year, Torex still generated ~$80 million in operating cash flow and ~$77 million in mine site free cash flow while reporting a moderate free cash outflow of $49.1 million given the ~$126 million of spending on Media Luna in the period.

Torex Gold Quarterly Cash & Cash Equivalents & Free Cash Flow – Company Filings, Author’s Chart

While the continued free cash outflows might disappoint some investors that are watching their other producers generate consistent free cash flow, it’s important to note that Torex is in the most capital intensive period of a major multi-year build at Media Luna which has resulted on the drag on free cash flow. And for a single-asset producer with capex of nearly ~$130 million in the most recent quarter and up to $400 million for the year, the fact that it’s seeing only moderate outflows and has maintained a strong cash and liquidity position is a testament to the team’s operational excellence (14 million hours worked LTI free at ELG) and consistency with cash flow from operations continuing to pad its balance sheet (~$69 million in net cash at end of Q1 2024).

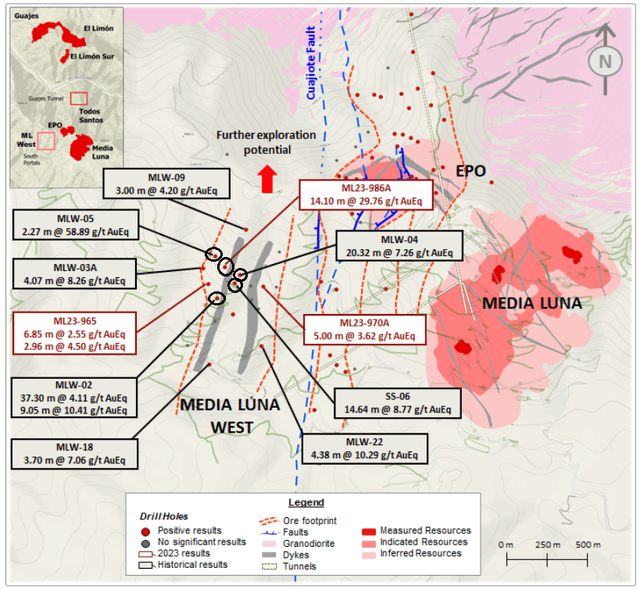

Besides, Torex has only two more significant quarters of capex on deck (Q2, Q3) before it morphs into a free cash flow machine next year when Media Luna enters commercial production (first concentrate production expected next year). And even at a $2,250/oz gold price assumption, Torex should generate upwards of $320 million in free cash flow next year, leaving the stock trading at barely 4.5x FY2025 EV/FCF. Hence, there is certainly a light at the end of the tunnel when it comes to returning to consistent free cash flow generation, and given the continued exploration success across the Morelos Property, and I would expect several more $250+ million free cash flow years than the current mine plan assumes, with the ability to fill the mill and displace low-grade stockpiles with continued resource growth at ELG Underground and the company churning out high-grade intercepts with each drill it pokes into Media Luna Greater (EPO, Media Luna West).

Media Luna West Drilling – Company Website

Costs & Margins

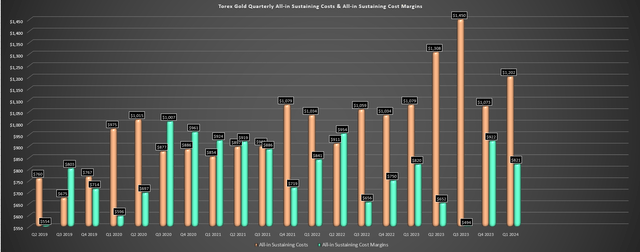

Looking at costs and margins, Torex reported all-in sustaining costs of $1,202/oz in Q1, a significant increase from the $1,079/oz reported in the year-ago period. However, the higher costs were largely out of the company’s control with the impact of a much stronger Mexican Peso, with an additional impact from fewer ounces sold than produced in Q1 2024 and compared to the year-ago period. On a positive note, the strip ratio at ELG is expected to drop materially as the year progresses, and I would still expect costs to come in within the company’s guidance of $1,100/oz to $1,160/oz for the year. This implies significant margin expansion in Q2 2023 if we assume AISC of ~$1,120/oz and an average realized gold price of ~$2,180/oz when factoring in the impact of hedges in Q2, Q3, and Q4 of this year.

Torex Gold AISC & AISC Margins – Company Filings, Author’s Chart

As for Q1 2024 AISC margins, they slipped to ~39% (Q1 2023: ~43%), but were still industry-leading at $821/oz which is a solid feat given that Torex has a far worse setup than peers given the currency headwinds it’s experienced with its only asset in Mexico. Besides, as noted, AISC margins should climb back above $1,000/oz in Q2 and Q3 2024 given the strength we’re seeing in the gold price and while the ~114,000 ounces of hedges (~35% of remaining 2024 production hedged at $1,975/oz gold) will be a drag, they were a prudent move to de-risk this growth phase given that Torex is a single-asset producer with everything relying on ELG for cash flow during the Media Luna build. However, with no plans to hedge in 2025 and even assuming AISC of ~$1,150/oz and just a $2,250/oz average realized gold price, we should see AISC margins climb to ~$1,100/oz next year or ~49%.

Recent Developments

As for recent developments, Torex continues to make solid progress at Media Luna and has the balance sheet to support the final leg of its growth phase, with a ~$300 million RCF ($30 million recently drawn) and ~$70 million in net cash at the end of Q1. This provides the company with over $400 million in liquidity separate from the $220+ million in operating cash flow it’s set to generate over the remainder of this year, giving it significant flexibility to fund the remaining ~$257 million in capex expected to complete construction. As it stands, Media Luna is ~70% complete, 95% of capex is committed and 71% has been incurred, and engineering is over 90% complete. And while the Mexican Peso continues to be a thorn in the side of Torex during this major build (~$875 million in estimated upfront capex), there’s no real risk of a capex blowout given how much is already committed and the company’s Peso hedges, as discussed below from the company’s Q1 filings (*):

(*) “The Company has entered into a series of zero-cost collars to hedge against changes in foreign exchange rates of the Mexican peso. The average floor price of the collars is 17.38 Mexican pesos per U.S. dollar and the average ceiling price is 20.0, with the collars covering the remaining project period (through December 2024). Approximately 45% of the remaining expenditures are expected to be denominated in pesos and the level hedged represents approximately 38% of the peso-denominated expenditures.” (*)

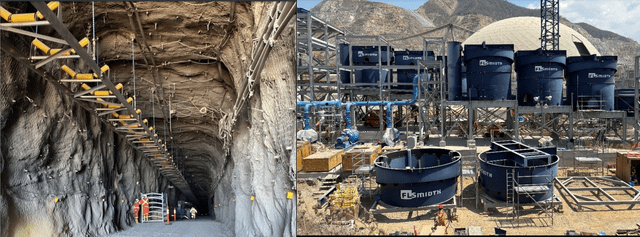

Media Luna Project Construction – Company Website

In terms of project progress, two-thirds of concrete has been poured for surface construction, copper flotation cells are being installed, and 78% of conveyor tables are installed, with images of construction shown above. Torex reaffirmed that it expects first concentrate production by year-end (though Q4 will be weaker due to a planned shutdown for tie-ins) and I would expect the company to announce commercial production by Q2 of next year latest. This is certainly an exciting development for investors that might have been worried about a major capex blowout like we saw at other mid-sized and mega projects like Rochester, Cote, and Magino, and it materially de-risks the thesis with Torex doing an excellent job with what it could control (breakthrough of Guajes Tunnel ahead of schedule), with the only negative being the elevated Mexican Peso which was obviously a headwind out of its control.

Finally, when asked on M&A, Torex had the following to say in its Q1 2024 Conference Call:

So that really opens up the opportunity with good solid cash generation to look at growth beyond Guerrero State. And in terms of jurisdiction, we’re looking at the Americas, Canada, the United States, Mexico. We believe we’re good at what we do in Mexico. We have a three-pronged strategy in terms of the type of asset we’re looking at.”

“One is an MOE type transaction. I’d like to get our share price up a little bit before we do something like that. The other is a project that we can add value to and create really real value for our investors by deploying what is now a very experienced project team who will have successfully built Media Luna into the next one. We think we have the skills to do that. We can accrue a lot of value in doing that. And then the third stream is smaller, very early stage exploration plays.

– Torex Gold CEO, Jody Kuzenko – Q1 2024 Conference Call

Overall, I would view an acquisition for Torex as very positive given that the market is not willing to assign a proper multiple to the company, even with the Morelos Complex being one of the best assets from a production/cost standpoint not owned by a senior producer. This would suggest that diversification might help the company to trade at a higher multiple in line with some of its multi-asset producer peers, and the company certainly has its currency in favor for the first time in years, as well as a strong balance to support any potential acquisitions. And while some investors might be worried about a poor acquisition choice, this is a team that has been very disciplined under CEO Jody Kuzenko the past few years in a very difficult period (global pandemic, Mexican Peso headwinds, difficulties at nearby operation Los Filos, spiking interest rates), so I would be surprised to see if they did anything sloppy from an M&A standpoint given how they’ve executed in other facets of the business.

Valuation

Based on ~87 million fully diluted shares and a share price of US$16.00, Torex trades at a market cap of ~$1.39 billion and an enterprise value of ~$1.32 billion. This makes Torex one of the lower market cap names in the 400,000+ ounce producer basis, lending to its position as a single-asset producer in a non-Tier-1 ranked jurisdiction that’s in the middle of a major construction project. However, as discussed in past updates, the company has done a phenomenal job constructing Media Luna and de-risking this transition to primarily mining south of the Balsas River. The company has also done an excellent job maintaining a strong balance sheet to protect against any cost overruns to ensure no share dilution related to upfront capex misses like smaller peers (Argonaut, Marathon).

The good news is that while some discount for the stock made sense two years ago when there was less certainty around a smooth transition to mining primarily at Media Luna, the project is now 70% complete, nearly 100% of capital is committed and we’re now just six months away from first concentrate production. Hence, while a discount is appropriate for being a single-asset producer in Mexico, the stock has a clear path to a re-rating for two reasons.

1. Torex could be a dual-asset gold producer by 2026 if it looks at acquiring an advanced developer or smaller producer, and this would likely provide a meaningful lift to its cash flow and P/NAV multiple with geographical/asset level diversification more in line with mid-tier peers.

2. I would expect some of the construction period uncertainty related discount to roll off by Q2 2025 when Media Luna is in commercial production, with the market not pricing construction-stage stories appropriately because of worries about them being over-budget/behind schedule (*) after a tough few years for development projects sector-wide.

(*) As discussed previously, Torex is delivering well to its schedule, has nearly 75% of capital spent with Mexican Peso hedges and I don’t see any reason to worry about a capex blowout so it is unique in this sense. (*)

So, how does the stock’s valuation look today, and what is a fair value for the stock?

Using what I believe to be conservative multiples of 4.5x FY2024 P/CF estimates and 0.90x P/NAV (6.5%), a 65/35 weighting (P/NAV vs. P/CF) and an optimized mine plan given the company’s continued exploration success at Greater Media Luna and ELG Underground, I see a fair value for Torex of US$20.40. This points to a 27% upside from current levels, suggesting Torex could make a run at all-time highs if it were to trade up to fair value. That said, I am looking for a minimum 45% discount to fair value when it comes to single-asset producers in non-Tier-1 ranked jurisdictions. Hence, while Torex does have meaningful upside from current levels and could certainly see new highs over the next year, the stock’s low-risk buy zone currently comes in at US$13.55 or lower, suggesting the stock is nowhere near a low-risk buy zone currently.

Summary

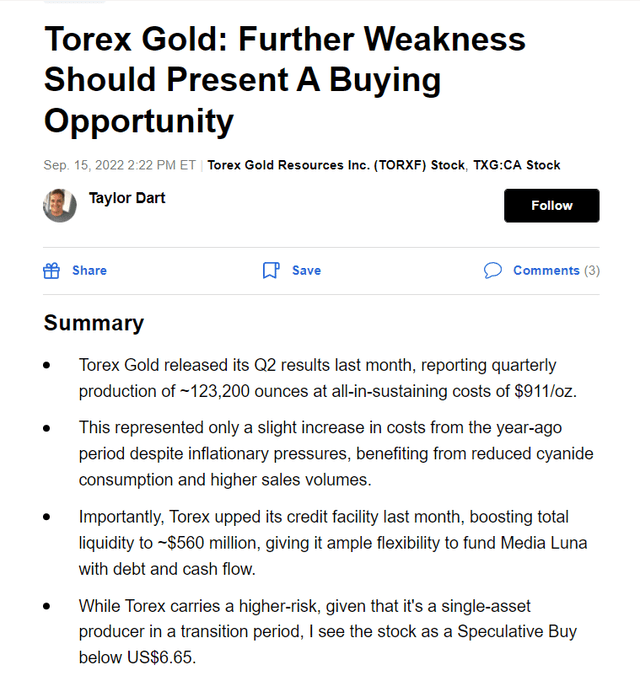

Torex had another solid quarter in Q1 and has continued its track record of outperformance when it comes to overall safety and delivering on promises within its mid-tier producer peer group. Meanwhile, the long-awaited start to production at Media Luna which will significantly increase the company’s exposure to copper is less than six months away and the story is substantially de-risked with most capital committed and construction sitting at over 70% complete. That said, I want to buy miners when they’re hated and on the sale rack and while Torex may still have meaningful upside to fair value (US$20.40), it’s neither hated nor in a low-risk buy zone after doubling off its lows when I highlighted the stock a Speculative Buy under US$6.55.

Torex Gold Speculative Buy Rating September 2022 – Seeking Alpha Premium/PRO

In summary, while I think an M&A transaction could help with a further re-rating in the stock and could push fair value higher medium-term, I think the better course of action here is looking to buy sharp pullbacks vs. chase the stock above US$16.00.

Editor’s Note: This article discusses one or more securities that do not trade on a major U.S. exchange. Please be aware of the risks associated with these stocks.