Ashiro

This brief market report looks at the various asset classes, sectors, stock categories, exchange-traded funds (ETFs), and stocks that drove the market up, as well as the market segments that bucked the trend and fell.

pocket identification Knowing the strengths and weaknesses allows you to know the direction of important money flows and their origins.

The S&P 500 has hit new highs 23 times so far this year.

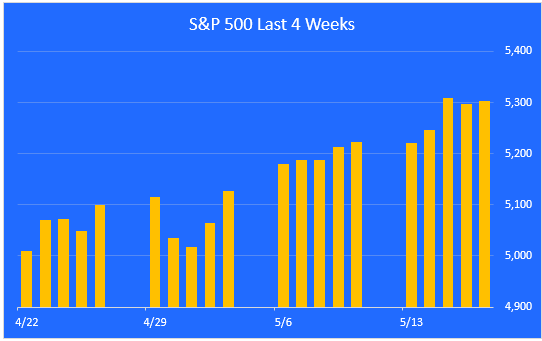

The S&P 500 hit its 23rd all-time high last Wednesday. In a typical year, the market hits new highs 14 times during the year. The first five months of this year were particularly strong. Here’s how things have been over the past four weeks.

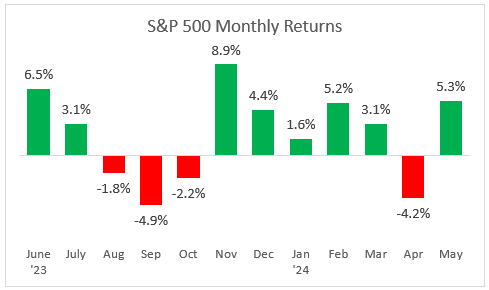

Let’s take a look at your monthly earnings.

This chart shows monthly revenue over the past year. After being positive for 5 consecutive months since November The market saw strong growth in April, up from March. The gains so far in May have more than made up for the declines in April.

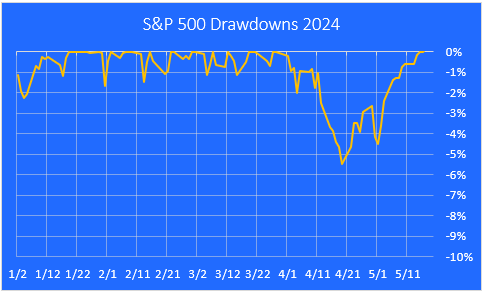

Let’s look at the decline in April.

Here we take a closer look at April’s decline using a drawdown chart. The maximum drawdown was 5.4%.

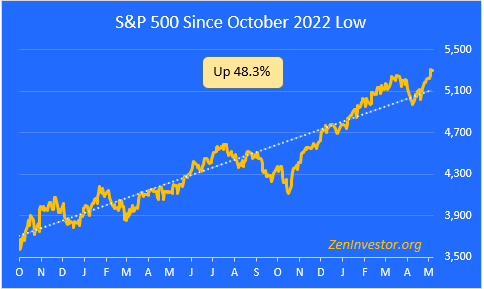

A look back at the bull market since it began last October.

This chart highlights that the S&P 500 rose 48.3% from its October 2022 low to Friday’s close. Last week saw good progress, even though first-quarter corporate earnings have so far shown only modest improvement compared to last year.

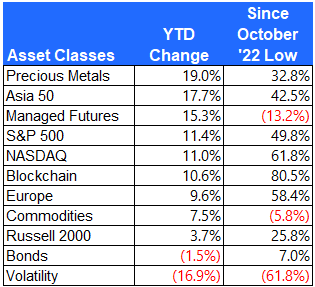

Performance of major asset classes

Below is the performance of the major asset classes, ordered by year-to-date returns. We have also included returns from October 12, 2022, for additional context.

Precious metals have been the best performing year-to-date. Silver hit an 11-year high on Friday.

The long-sluggish Chinese market is buoyant after Barron’s suggested Chinese authorities could inject $200 billion to support falling prices.

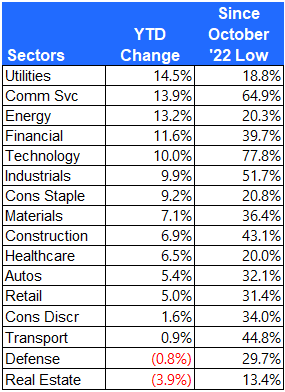

Stock sector performance

This report uses extended sectors published by. ZackThey use 16 sectors instead of the standard 11 sectors. This provides more detailed information when investigating winners and losers.

It’s hard to believe that utilities have been the hottest sector this year, but you can’t argue with the numbers. After selling off in January and February, utilities have been on a tear, especially over the past four weeks.

Real estate has been on the decline since the beginning of the year, but has been on the rise over the last month.

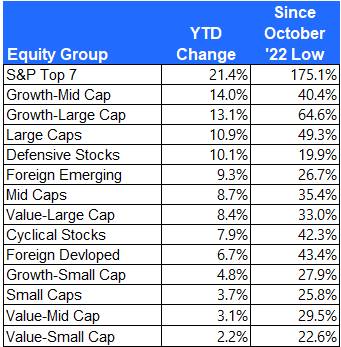

Stock group performance

For groups, stocks in the S&P 1500 Composite Index are categorized by common characteristics such as growth, value, size, cyclicality, defensiveness, and whether they are domestic or foreign.

The best-performing group since the beginning of the year has been the Magnificent 7. While these seven stocks continue to lead the market, market participation is expanding, which is a healthy sign.

Small- and mid-cap value stocks are struggling to keep up with larger-cap stocks that continue to grow.

ZenInvestor.org

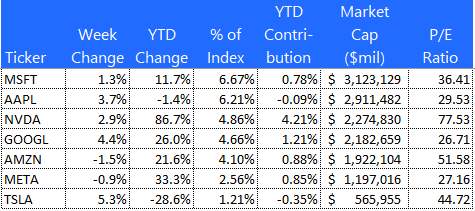

S&P Top 7

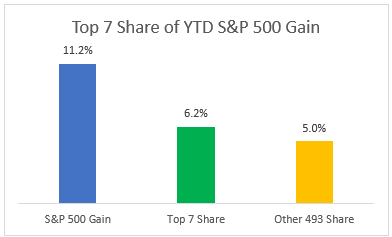

Here are seven mega-cap stocks that have led the market over the past year. These seven stocks account for 54% of the S&P 500’s total year-to-date gain. This is down from 87% just a few months ago and is evidence that participation in the bull market is growing again.

ZenInvestor.org

The S&P Top 7’s dominance is fading

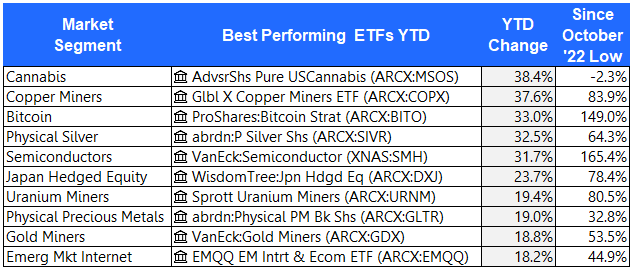

The 10 best-performing ETFs last week

Stocks of cannabis growers and dispensaries are soaring now that the Federal Reserve is moving toward decriminalizing marijuana.

ZenInvestor.org

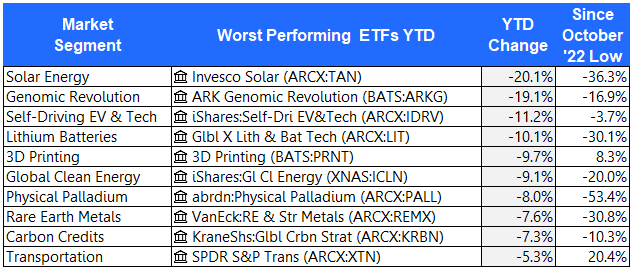

Top 10 worst performing ETFs last week

Solar energy companies are struggling. High interest rates are making financing solar systems prohibitively expensive, leading consumers to delay or postpone solar purchases.

zen invester

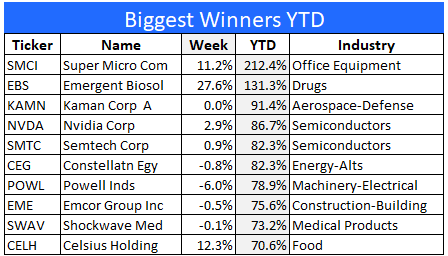

10 stocks that performed best last week

Here are the 10 best-performing stocks in the S&P 1500 index last week.

Super microcomputer (SMCI) server maker is under fire. It’s up 212% since the beginning of the year. Its servers are used for cloud computing and AI applications.

ZenInvestor.org

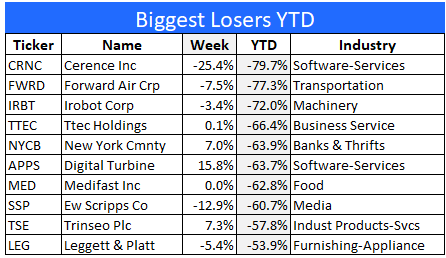

10 stocks that performed worst last week

Here are the 10 worst performing stocks in the S&P 1500 last week.

Cerence (CRNC) exceeded first-quarter revenue and revenue estimates, but lowered its outlook due to goodwill impairment.

ZenInvestor.org

final thoughts

The market has achieved in the first five months of this year what it would normally take a full year to achieve: an 11.2% increase in five months compared to a 10% increase in 12 months in a normal year.

The 23 new highs so far this year are also a bullish indicator. Over the past 96 years, 23 new highs have been reached, resulting in an average annual increase of 23%.

If the Fed starts lowering rates before the end of the year, the market is likely to finish strong. Overall, 2024 looks to be on a good pace.

Editor’s note: The summary bullet points in this article were selected by Seeking Alpha editors.