master 1305

Abita Medical Co., Ltd. (Nasdaq:RCEL) specializes in regenerative medicine. It features an innovative device for skin repair that treats full-thickness skin defects and vitiligo. RCEL’s RECELL device uses a patient’s skin cells to create a spray suspension that delivers healing. and repigmentation. The differentiating factor of this system is that less donor skin is required, resulting in faster and improved wound recovery. In addition, RCEL offers an automation system called RECELL GO to improve efficiency and consistency of treatment preparation to enhance patient care. In addition, RECELL GO mini for small wounds is in the verification testing stage. Unfortunately, I am concerned about the company’s financial concerns and its unprofitability, which, combined with the recent drop in revenue, led me to give it a “hold” rating.

Skin regeneration business: Business overview

AVITA Medical is a regenerative medicine company based in Valencia, California. Founded in 2020, RCEL specializes in developing innovative devices For skin repair and healing cell therapy. The company’s main products product is its RECELL device, and RCEL complements RECELL GO and RECELL GO mini.

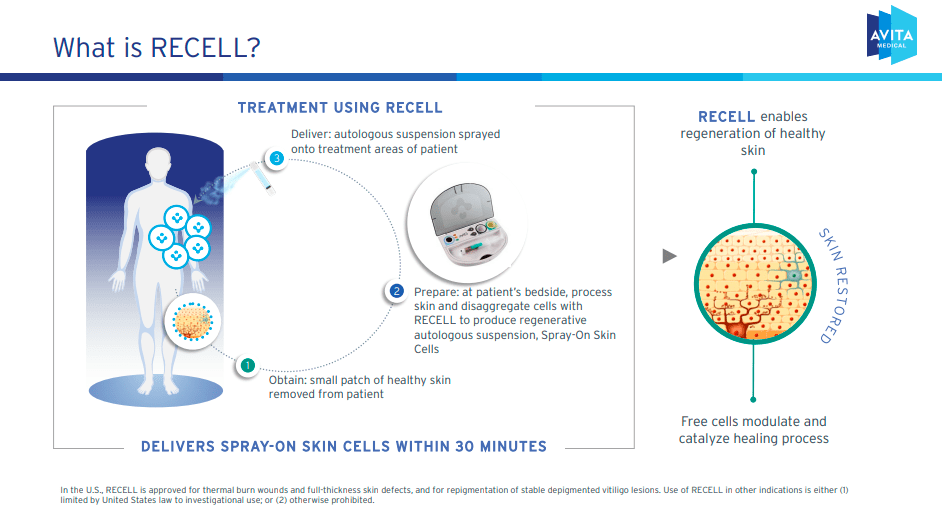

From a bird’s-eye perspective, RCEL’s proprietary technology platform is the FDA-approved RECELL system, designed to treat burns, full-thickness skin defects, and vitiligo lesions. This medical device processes a sample of a patient’s skin to create a spray of skin cells that is applied to a wound or area in need of repigmentation.

Source: Q1 2024 Investor Presentation.

Therefore, RCEL’s technology can be used for wound healing by targeting the affected skin. Essentially, this is deliver Keratinocytes for epidermal regeneration, dermal fibroblasts for extracellular matrix proteins, and melanocytes to produce melanin and restore pigmentation. For burns and full-thickness skin defects, less donor skin is needed to harvest cells to close the wound than with traditional autografts. This advantage is possible because smaller skin samples are processed to cover a larger area. This allows for faster wound closure and further improves aesthetic and functional results.

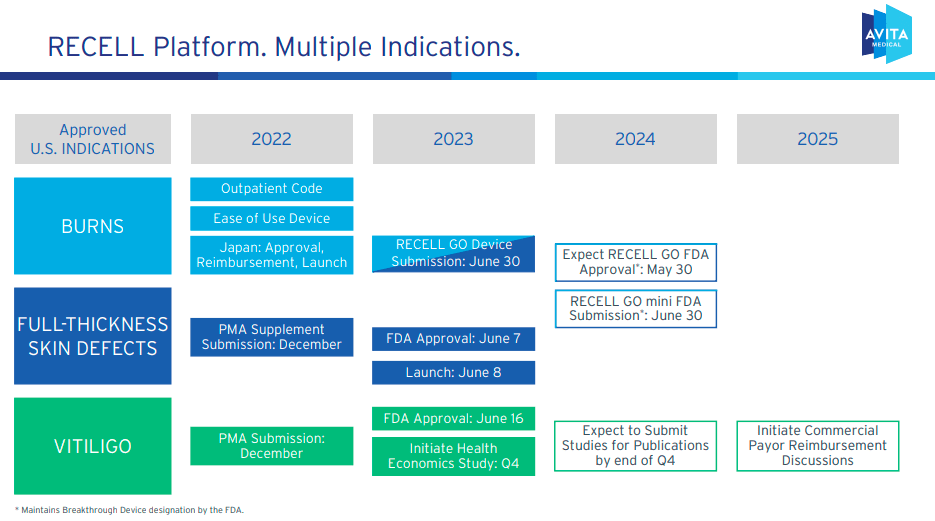

Additionally, on June 7, 2023, FDA Approved The RECELL system restores full-thickness skin defects due to severe burns and other serious injuries. A full-thickness skin defect is a wound that extends through the outer layer of the skin, the epidermis, to the inner layer, the dermis. This damage includes surrounding tissues such as subcutaneous fat caused by burns, trauma, surgical removal of tumors, or chronic lesions. Traditional treatments to heal multiple skin layers and restore function require complex procedures such as skin grafts. This is where the RECELL system comes in, which is much less invasive and uses an autologous cell suspension.

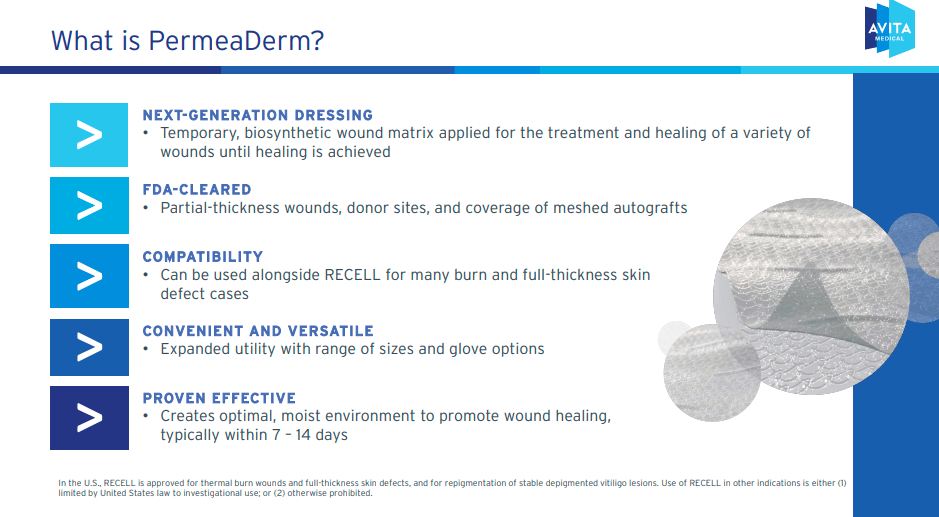

Additionally, on June 19, 2023, the FDA approved the application of the RECELL system. vitiligo. This autoimmune disease causes immune cells to destroy melanocytes, causing depigmented spots. The device is the first treatment system to offer her one-time treatment of vitiligo lesions, using a small sample of a patient’s skin to isolate and transfer healthy skin cells to restore pigmentation. The company also sells Stedical’s PermeaDerm, which is FDA cleared. This biosynthetic wound dressing is suitable for acute wound protection.

Overall, the FDA approval of RCEL to date gives confidence in the underlying science and capabilities of this system in regenerative medicine, making it an effective option for healthcare professionals. I think it is possible that, over time, this type of technology will become part of the standard of care in dermatological applications. After all, this is a device that provides equal visible improvements in beauty and health.

Source: Q1 2024 Investor Presentation.

Finally, as mentioned earlier, RECELL is resel go A system that improves the efficiency of the RECELL system. This device controls skin cell breakdown, filtration, and saturation time. Automate cell suspension preparation, avoid manual intervention and possible human error, and achieve product consistency. As a result, this should speed up treatment, reduce patient waiting times and standardize its application. The company expects RECELL GO to improve treatment efficacy if approved by the FDA.

Promoting global expansion and product innovation

recently financial statement, management said that international expansion in the EU and Australia will be done through distribution agreements. The RECELL GO CE mark is expected to be achieved around the fourth quarter of 2024. Additionally, RCEL plans to submit a premarket approval (PMA) supplement for his RECELL GO Mini for small wounds, which should increase his TAM for the technology. Additionally, RCEL’s TONE study is evaluating repigmentation outcomes, and management expects preliminary data to be available in the second quarter of 2024. The company also plans to begin commercial application of RECELL in Q4 2025, and then expand to patients with vitiligo to make it more accessible. However, while vitiligo may not be such a large market, it is still an area with even more potential for new revenue.

We also note that RCEL’s sales process was influenced by Value Analysis Committee (VAC) approvals in hospitals and health systems across medical specialties such as plastic surgery, trauma, and general surgery with multiple reimbursement scenarios. worth it. These committees ensure that products or treatments meet clinical and economic standards. Closing of new accounts has been delayed due to VAC approval. However, management says it is now able to deal with these complexities more efficiently, so it expects revenue growth to pick up in the coming quarters.

Source: Q1 2024 Investor Presentation.

RCEL finally announced new product It could complement RECELL’s value proposition. One is to prepare the wound bed and maintain an antimicrobial layer and a moist environment. The other is a dermal scaffold that vascularizes the tissue and supports wound closure. These innovations theoretically extend RCEL’s existing IP into complementary services that improve healthcare outcomes. If the company positions these services and sets premium prices for patients who are particularly concerned about the beauty effects of skin regenerative medicine, I think these initiatives could lead to further revenue areas.

Cheap is justified: evaluation analysis

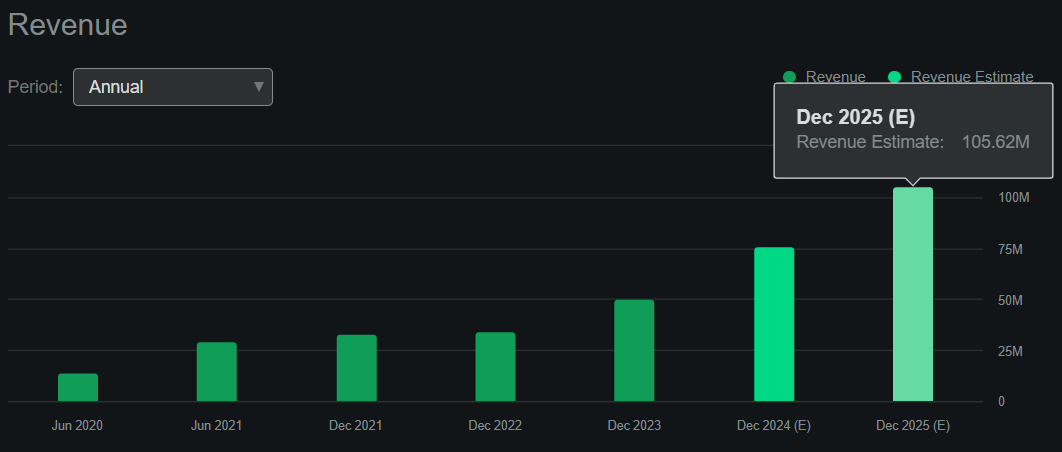

The company is definitely still small from a valuation perspective, with a market capitalization of just $210.8 million. However, according to Seeking Alpha; Dashboard According to RCEL, the company should generate approximately $105.6 million in revenue by 2025. This means the stock is trading at a forward P/S ratio of approximately 2. this is, sector forward median The P/S ratio is 3.7, suggesting that the stock is trading at a discount at this level.

Source: In Search of Alpha.

Also, the company’s Balance sheet has $17.0 million in cash and $51.2 million in short-term investments, resulting in total liquidity of $68.2 million. However, RCEL says he has long-term debt of $41.3 million. Mature in 2028. I think the company’s profit was $22.1. cash burn In the first quarter of 2024, this translates into an annualized cash burn of $88.4 million. These numbers were obtained by adding his most recent quarterly CFO and net capital expenditures. However, the company’s revenue is expected to nearly double by 2025 compared to 2023, which could provide significant cash flow to sustain the business. Please note. However, the current cash burn indicates a cash runway of less than a year, and I think management needs to focus on cost control at this stage, or dilution is imminent.

Currently, RCEL is gross profit It’s around 86.4%, which is very healthy. The problem is that as sales increase, SG&A expenses also increase. If this trend continues, it will lead to unprofitable and unsustainable growth. I don’t think this is necessary because this device has a very attractive value proposition for healthcare providers and patients. However, it is true that managers need to adopt appropriate sales strategies to ensure cost-effectiveness, but my impression is that this is not currently the case. After all, sales are increasing at roughly the same pace as SG&A expenses.

While I’m bullish on the underlying technology and RCEL’s value proposition through its device, I can’t ignore these financial concerns. latest quarterly magazine loss of revenue And due to the lack of profitability, I rate RCEL as a Hold. Piper Sandler too Downgraded RCEL This is based on revenue concerns and management’s intention to continue expanding OPEX. I have similar concerns, and given RCEL’s liquidity, I’m not a “buy” on the stock at this stage, even though it has a great product and should be financially successful without it. cannot be evaluated.

Risk Analysis

Additionally, it is worth noting that RCEL is still pending FDA approval for additional indications for its technology and device. I don’t think these are essential to short-term profitability, but they could be a driver for the stock price. Therefore, investors still face the potential downside of an FDA setback or rejection.

Additionally, I cannot ignore my financial concerns regarding RCEL’s liquidity and cash burn. The company could be forced to increase its capital or take on more debt unless it becomes structurally profitable in the coming quarters. In my view, this is unlikely to happen. We also believe that equity dilution is likely to occur in the coming years as management is keen to increase operating expenses rather than focus on profitable growth.

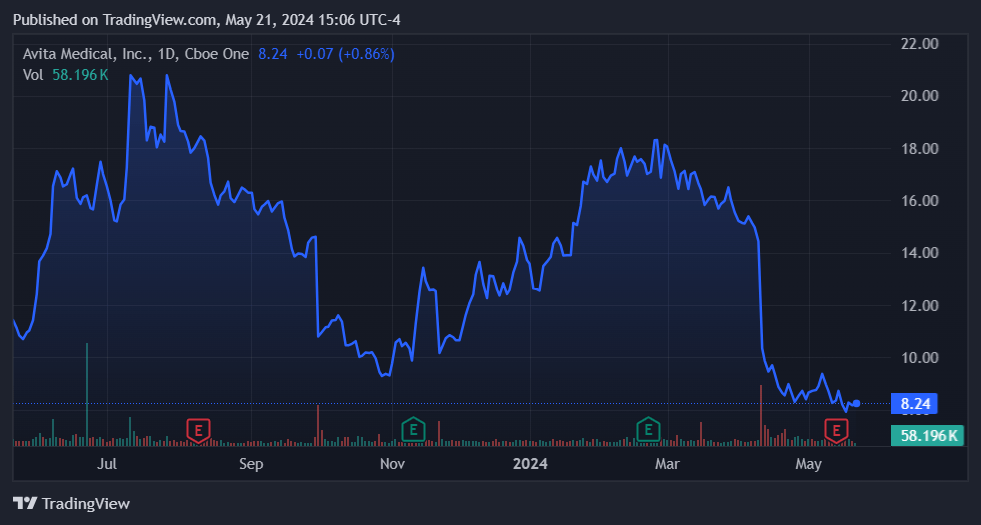

Source: TradingView.

conclusion

Overall, RCEL has promising technology through its devices in dermal regenerative medicine. These devices can improve patient outcomes, which should be a competitive differentiator. However, the company’s revenue miss is a sign of disappointing execution in rapidly rolling out this product. Furthermore, rapidly increasing SG&A expenses will negate RCEL’s impressive revenue growth and expose current investors to future dilution of their shares to fund operations. These dynamics have led me to “hold” RCEL as RCEL’s underlying technology and products appear to have great potential. Yet, management has yet to find a way to deliver returns to investors. RCEL is no longer a research-stage company. It must successfully transition to a profitable venture. Unfortunately, I don’t think that will happen in the near term, so overall, I am neutral.