Thomas Berwick/Digital Vision via Getty Images

Over the years, I have found that patience is very important when it comes to investing. This is especially true during difficult times. It is rare to expect strong upside potential immediately after purchasing a stock. work. But in an era where substandard performance reigns, the psychological strain it brings can be difficult to cope with. Here are some great examples of companies that have significantly underperformed my expectations, but that I still feel very bullish on. Marine Max (New York Stock Exchange:HZO).

For those unfamiliar with MarineMax, management claims that MarineMax is the largest recreational boat and yacht retailer on the planet. As of the end of fiscal year 2023, the business will have 130 locations worldwide, including 81 retail dealerships. It also owns and operates 66 marinas and storage locations. Back in March Last year, I realized that I was drawn to this business.I ended up buying it because the stock price was low. rate it This is a Strong Buy, reflecting my view that investors should expect the stock to outperform the broader market for some time. But so far, exactly the opposite has happened. Since then, the stock has actually fallen 8.4%, which is much worse than the S&P 500’s 33.8% rise over the same period.

Digging into the bigger picture, we see that management has continued to grow revenue, even in a difficult environment. Having said that, this came at a considerable cost in terms of significantly reduced margins. In the short term, this trend will likely continue. But despite the pain the company has been through, the stock looks very attractive both in absolute terms and when compared to similar companies. For this reason, despite the poor performance, I’m keeping my rating on the company as Strong Buy for now.

Sales increase but profits decrease

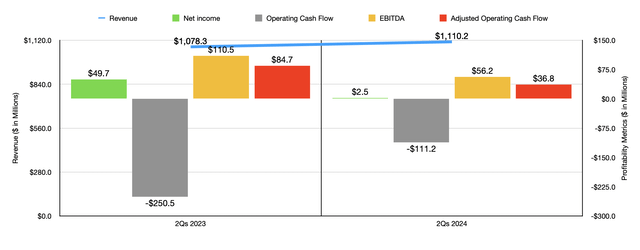

From a stock price perspective, the situation is not particularly favorable for MarineMax or its investors. However, the actual fundamental data itself is a mixed bag. For example, consider the following financial results: first half Revenue managed to increase from $1.07 billion last year to $1.11 billion this year, even though management said the current recreational boating market is tough. This approximately 3% increase was made possible by a 3% increase in same-store sales. Management attributes this revenue primarily to new and used boat revenues rather than other revenues such as services. However, the acquisitions the company made during this period netted him $400,000 in profits.

While it’s always great to see increased revenue, this comes at a significant cost. The business’s net income was $49.7 million in the first half of 2023, compared to just $2.5 million in the same period this year. This was caused by multiple factors. For example, the company’s gross profit decreased by $21.9 million, with lower margins on new and used boats as the company grew sales “aggressively” in what management described as a “softer” environment. As a result, gross profit margin shrank from 36% to 33%. Retail Environment”. But that wasn’t all. Selling, general and administrative expenses increased $29.6 million primarily due to inflationary pressures and the aforementioned acquisitions. On top of this, rising interest rates and increasing debt balances have increased his interest expense by $14.9 million, and it’s easy to see that the company’s bottom line is in trouble.

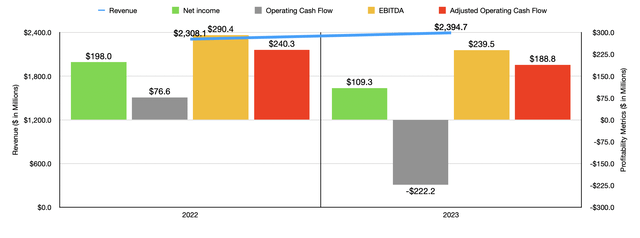

Other profitability metrics are following a very similar path. Operating cash flow was the only exception. It went from negative $250.5 million to negative $111.2 million. However, adjusting for changes in working capital would reduce his $84.7 million to $36.8 million. Meanwhile, the business’ EBITDA fell by almost half, from $110.5 million to $56.2 million. In the chart above, you can also see the following financial results: 2023 compared to 2022. Again, revenue is up, but profits and cash flow are down. Given these results, it’s no wonder the market is cautious.

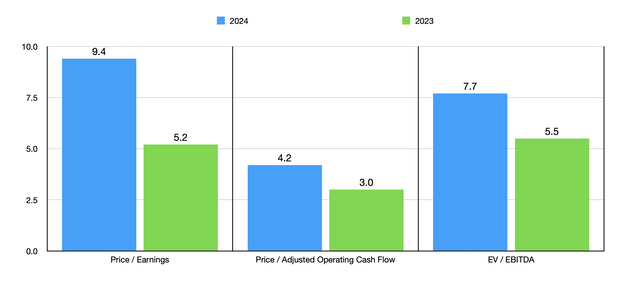

Even with this downside, the stock looks attractively priced. For the current fiscal year, management expects his earnings per share to be from $2.20 to $3.20. This is a fairly significant correction from his initial guidance of $3.20 to $3.70. But even so, the net profit should be worth about $60.2 million. In addition to this, EBITDA is expected to be between $155 million and $190 million. This is $215 million below the original guidance of $190 million. Using the midpoint guidance provided by management, adjusted operating cash flow should be approximately $136 million.

Using these numbers, I valued the company as shown above. The company looked incredibly cheap, but now it’s just a cheap company. But still, this trading multiple is incredibly attractive in this type of environment. In addition to being cheap on an absolute basis, the stock is also cheap compared to other similar companies. In the table below, we have compared MarineMax to his five similar companies. On a price-to-earnings basis, only one in five companies was cheaper. Our outlook ended up being the cheapest on a price-to-operating cash flow basis. It’s only when you use the EV to EBITDA approach that the playing field becomes somewhat even, with 3 out of 5 companies being cheaper than that on this basis.

| company | Price/Earnings | Price/operating cash flow | EV/EBITDA |

| marine max | 9.4 | 4.2 | 7.7 |

| brunswick (B.C.) | 15.2 | 9.5 | 8.7 |

| Master Craft Boat Holdings (MCFT) | 6.1 | 4.7 | 3.2 |

| Marine Products Co., Ltd. (MPX) | 12.1 | 9.0 | 8.1 |

| Malibu Boat (Mbuu) | 13.9 | 6.1 | 7.2 |

| BRP Group (doo) | 9.8 | 4.4 | 6.0 |

When I see basic performance worsening, I always ask myself what’s causing it. In this case, perhaps the best kind of deterioration occurs. I say this because management is making a conscious decision to maintain sales. Ultimately, what this means is that profit margins are shrinking due to the downturn in the industry. Industries have booms and busts. And now it seems to be bankrupt. The good news is that this is unlikely to last forever. I say this because, National Ship Manufacturers Associationaccounts for approximately 85% of recreational boat, marine engine, and accessory manufacturers in the United States, and an estimated 85 million Americans go boating each year.

This large market is expected to continue to grow as the population increases. However, this does not mean that the situation will be resolved soon. Last year, for example, the number of powerboats sold at the retail level was 258,000. We expect to see similar numbers this year. This downturn, which represents a year-on-year decline of up to 3%, is primarily driven by the impact of high interest rates and declining consumer confidence. But to be honest, I don’t think a quick recovery is necessary to justify a bullish outlook. As mentioned, the company’s stock price is attractively priced. The management team thinks so too.For example, in March of this year, the company announced A $100 million stock repurchase program that replaces the company’s previous authorization. I generally prefer investing in growth strategies, but I think there could be some attractive assets given how weak the current environment is, but I think there are some attractive assets to be had at such low levels. It seems logical to buy back the .

remove

As far as I can tell, Marine Max is in a bit of a slump. Still, it’s great to see that management has managed to maintain earnings growth, even if only by a small amount. Things will improve someday. And when that happens, the returns for shareholders can be substantial. From this perspective, there is nothing wrong with continuing to rate the company as a “strong buy” at this point.