hapa bapa

Since I published my last work, article upon Palo Alto Networks, Inc. (Nasdaq:Pan-u) In February 2024, the stock rose about 14%, outperforming the S&P 500 Index (SP500).I highlighted the company’s new near-term risks from platforming strategies and slowing growth in U.S. federal business; The company is Third quarter results After market close on May 20, revenue growth was 15%, adjusted for 26%. Growth in net income. I maintain a “buy” rating, with a fair value of $330 per share.

Platform strategy continues

As mentioned in the previous article, Palo Alto has been implementing a platformization strategy with the aim of consolidating all services for its customers. If customers embrace platforming, Palo Alto could expand its total addressable market and accelerate future annual recurring revenue growth. As shown above, financial statementachieved 65 incremental platform sales among its top 5,000 customers in the third quarter.

I believe platform selling has the potential to be successful in the future for the following reasons:

- Platformization allows customers to simplify their cybersecurity operations by dealing with a single service vendor. Cybersecurity is a complex and holistic solution that requires multiple types of products and services including firewalls, IDS, antivirus, endpoint protection, security operating centers, etc. For optimal cyber protection, these hardware and software components must work seamlessly. This makes platformization a great way for enterprises to reduce operational complexity. As demonstrated during the call, Palo Alto estimates that customers can achieve 30%-40% efficiency gains in security outcomes through platformization.

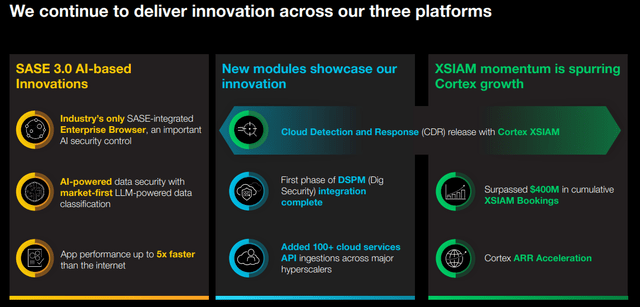

- Palo Alto is a leading provider of cybersecurity solutions in both software and hardware. It seems to me that only Palo Alto can integrate the platform effectively. As shown in the slide below, Palo Alto offers three main platforms consisting of AI-based solutions, cloud service APIs, and security operations center platforms.

Palo Alto Networks Investor Presentation

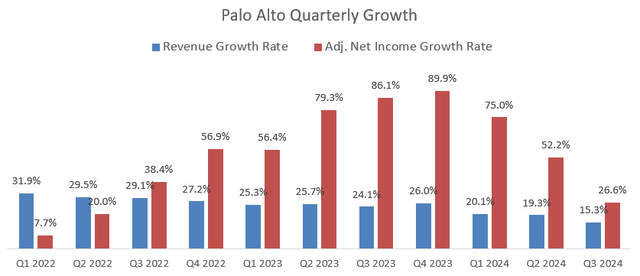

in 3rd quarter of FY24, Palo Alto achieved revenue growth of 15.3% and adjusted net income growth of 26.6%. However, total claims increased by only 3% year-on-year, disappointing the market. Palo Alto is implementing a platforming strategy, so I don’t think billings are a good indicator of Palo Alto’s future growth.

Palo Alto Networks quarterly results

The slowdown in bill growth is primarily driven by two main reasons:

- The high interest rate macro environment is causing companies to move from a multi-year payment approach to annual payments, which is slowing Palo Alto’s bill growth. We expect annual payments to become more frequent among business customers in the near future. The pattern may change as the macro environment improves.

- Palo Alto is implementing a platformization strategy, so deal sizes are likely to be larger than siled product/service deals. In this case, I believe the customer may prefer an annual billing approach. Palo Alto management expects modest billing growth to continue in FY2025 as the company furthers its platformization efforts next year.

Overall, it was a decent quarter for Palo Alto, and I don’t think investors should be surprised to see lower billing growth.

Outlook for FY25

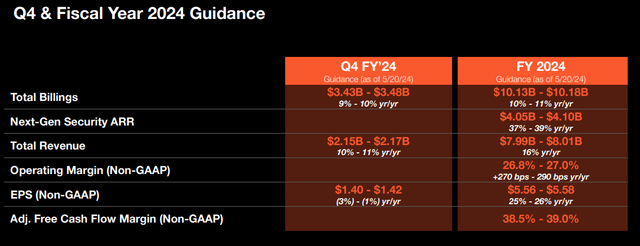

Given the performance over the past three quarters, I would not be surprised to see Palo Alto report FY24 results as shown below: At this point, I believe the market’s focus is on FY25 growth.

Palo Alto Networks Investor Presentation

I am thinking of the following as the driving force for growth in fiscal 2025.

- Large transaction growth: As we reported in the third quarter, Palo Alto experienced strong large transaction growth, with deals over $1 million up 22% year-over-year. Notably, the number of transactions over $10 million increased by 28% year over year. Growth in large deals is driven by platforming sales and new logo deals. It’s clear that these big deals will contribute to his 25 year growth.

- Cloud Security: As we discussed in our previous article, Palo Alto is well-positioned in the cloud security market with its Prisma Cloud solution. Under Prisma Cloud, the company successfully deployed its first phase. Managing your data security posture In a quarter. Fortune Business Insights predicts that cloud security will grow at a CAGR of 18.1% from 2022 to 2029. Additionally, Palo Alto is adding AI-related capabilities to Prisma Cloud. I predict that the company’s cloud security business will grow at more than 20% annually for the foreseeable future.

- palo alto launched Cortex XSIAM, Autonomous Security Operations Center (SOC), 18 months ago. SOCs represent a vast untapped market for large cybersecurity companies. AI-driven platforms have the potential to automate cybersecurity workflows and reduce cyber response times. Palo Alto revealed that it has $400 million in cumulative XSIAM reservations as of the third quarter of 2024, showing that adoption in the industry is accelerating.

Mordor Intelligence Predict The cybersecurity market is expected to grow at a CAGR of 11.44% from 2019 to 2029. With the three key growth drivers outlined, we expect Palo Alto to grow faster than the market and achieve annual revenue growth of 15%.

Rating update

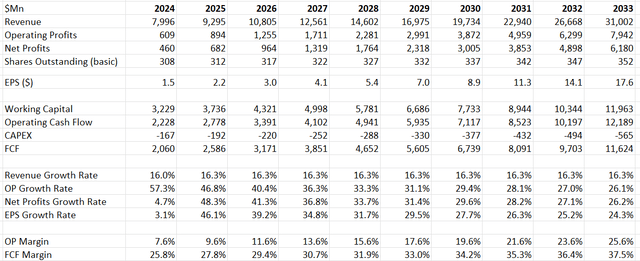

My assumptions for FY24 are consistent with official guidance as I do not expect any major surprises in the last quarter of FY24. I predict that the company will achieve his 15% growth in organic revenue in the near future. Since the company has made some small acquisitions, we estimate that it spends 5% of its revenue on acquisitions and contributes 1.3% to its revenue growth.

Palo Alto’s business is expected to gradually shift from hardware to platform solutions, which could improve gross margins over time. Additionally, we expect Palo Alto to generate operating leverage from both sales and marketing and research and development expenses. In total, this model calculates that Palo Alto’s operating expenses will increase by 13.5% per year.

Palo Alto Networks DCF – Author’s calculations

WACC is calculated as 8.6% based on the following assumptions:

- -Risk-free rate: 4.5% (US 10-year Treasury bond yield).

- – Equity risk premium 7%. The cost of debt is 7%.

- -Beta 1.1 (SA).

- -$2 billion in debt. Capital is $3.7 billion.

- -Tax rate: 22%.

Based on my calculations, after discounting all future free cash flows and adjusting the net cash position, the fair value is estimated at $330 per share.

Main risks

On May 15, Palo Alto agreed to the following: get International Business Machines Corporation (IBM) QRadar SaaS assets and the companies will facilitate the migration of QRadar SaaS clients to the XSIAM platform. Additionally, IBM will platform Palo Alto products. Palo Alto will pay $500 million plus earn-out consideration based on actual transition results. I think this partnership makes sense for Palo Alto and could potentially strengthen its SOC platform, but the migration of customers from IBM to Palo Alto may introduce some uncertainty. Customers may choose not to renew their contracts with Palo Alto.

Additionally, investors should monitor CrowdStrike Holdings, Inc.’s performance.CRWD), a rising star in endpoint protection and SOC. I see CrowdStrike as the biggest threat to Palo Alto’s future growth because it provides a comprehensive solution under a unified platform. If you’re an investor interested in CrowdStrike, check out my primer. report Scheduled to be published in March 2024.

conclusion

Palo Alto Networks, Inc.’s platforming strategy strengthens the company’s leadership position in the cybersecurity market, and larger deals could accelerate ARR growth. I support Palo Alto’s comprehensive solution across hardware, software, SOC, and services. I maintain a “buy” rating, with a fair value of $330 per share.