Studio 504/DigitalVision (via Getty Images)

Dear readers

My previous coverage of S&P500 (Knee search:spy) has been focused on the short term, especially since the beginning of this year. First, I gave him a HOLD rating in his article. It’s hedging time.Here’s how to do it He suggested that investors consider hedging the downside below 5,000 points via a zero-cost option collar. The request was based on a view that momentum was being lost related to the growing risk of a reacceleration of inflation and the Fed’s reluctance to cut interest rates. And just recently, I upgraded the index to “buy” in the article below. Positive outlook, revising hedges He then proposed unwinding half of the original hedge to preserve all the upside.

S.A.

The upgrade to buy, which returned around 6% RoR, is primarily based on the following facts: (1) I used to look at inflation as It is very likely that it will fall below 2% in the second half of this year. (2) The market-implied probability of a rate cut does not take this decline into account. My theory on declining inflation is that the headline number, which was 3.5% at the time of my last article. 3.4% Since then, the lagging nature of the home and auto insurance CPIs has continued to bias them upward. I discussed this movement in detail in a previous article and concluded that it is only a matter of time before this lag is overcome, and using real-time inflation data for these items, headline inflation is already as low as 1.1. I assumed that it would be. %, well within the Fed’s 2% target.

I remain with the options discussed and my short-term outlook on inflation remains unchanged in light of the latest April inflation data. What I would like to discuss in this article is long term approach We then focus on the most important long-term valuation factor: liquidity (i.e. money supply).

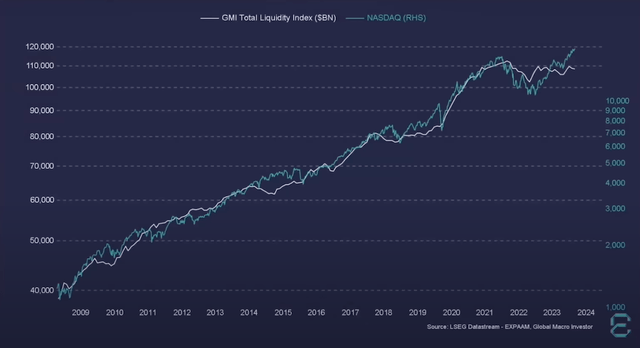

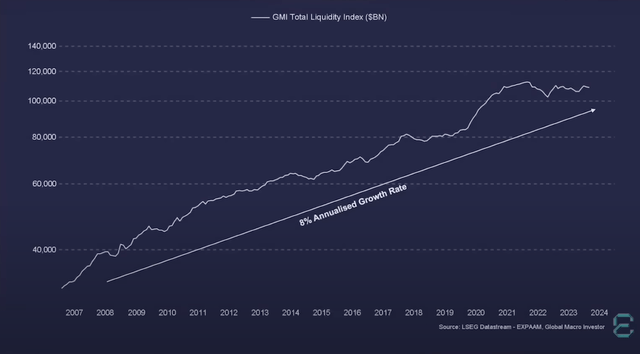

To illustrate how important a factor this is, consider the graph below that shows a 97.5% correlation between the World Liquidity Index and the Nasdaq 100 (NDX). I couldn’t find this chart for the S&P 500, but I can assure you that the correlation is just as high, as the two indexes have been moving pretty much in sync for the past 10-15 years. In fact, the only reason broad market indexes are outperforming liquidity increases is because of long-term growth trends driven by technological advances. Logically, if you want to predict where prices will go in the future, you need to predict liquidity. Fortunately, there are many hints to guide us.

LSEG data stream

Short-term liquidity outlook

the government 4 main tools To affect liquidity. Among the best known are: (1) Quantitative easing/tightening to reduce/expand the Fed’s balance sheet; and (2) The federal funds rate affects all interest rates in the economy. Besides these two, there are two more things that are really important – (3) repository/reverse repository operations, and (Four) General Account of the Ministry of Finance.

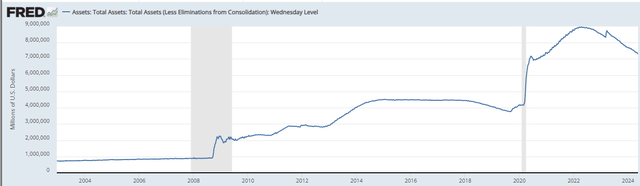

Over the past year and a half, the Fed has tightened policy, shrinking its balance sheet from about $9 trillion to $7.3 trillion. They did this by selling short-term bonds they had accumulated during the pandemic. This, combined with interest rates in a restricted area, forms a relatively unfavorable background for stocks.

fred

However, from now on, three elements This will likely result in a significant increase in liquidity, which will have a positive impact on asset prices, including the S&P 500.

1. Drained reverse repo

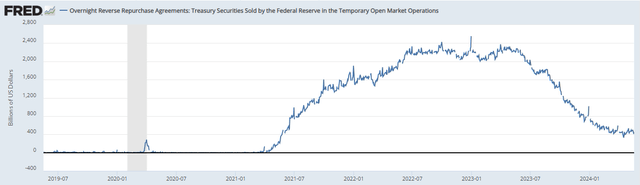

The Fed’s ability to shrink its balance sheet is very strongly tied to its repo/reverse repo operations. This is a program that allows commercial banks to deposit funds with the Fed overnight and, more importantly, is the easiest way for the Fed to influence the money supply.

In 2021-2022, the Fed purchased unprecedented levels (about $2 trillion) of these ultra-short-term bond-like securities, but over the past year and a half reverse repos have all but dried up, and the Fed means there is a lack of securities that can be easily sold. We expect our ability to extract liquidity from the market through this channel to be hampered in the future.

fred

2. Lower interest rates

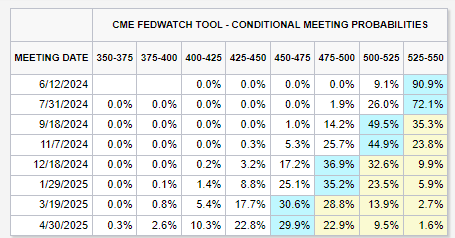

It also appears highly likely that the Fed will cut rates in the second half of this year, with the probability of at least one rate cut being 26% by July, 65% by September, and 76% by November. As I argued in a previous article, I believe these probabilities could increase further as inflation declines towards 2%. Additionally, the Fed will likely be under considerable pressure come election time due to ever-increasing government debt and rising interest payments (more on this later). Lower interest rates will inevitably lead to easing financial conditions, likely freeing up significant liquidity in the second half of this year.

CME FedWatch Tools

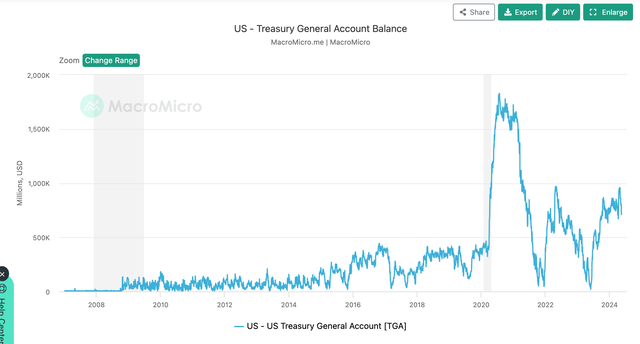

3. National treasury expenditure

Finally, I expect a significant increase in Treasury spending around this fall’s elections, which will also increase liquidity in the system. Since last fall, Janet Yellen has built up the Treasury’s general fund from almost nothing to nearly $1 trillion by collecting her taxes, but she didn’t put all of that money to use right away. . This is having a negative impact on liquidity, but I expect Yellen to start deploying that money as the election approaches, increasing liquidity in the process. Again, we expect this to happen in the second half of this year.

Macro Micro

As a result of these three factors, we expect liquidity to increase and the S&P 500 to perform well in the second half of the year, and we would not be surprised if the index ends the year at least above 5,500 points. Sho.

Long-term liquidity outlook

In the longer term, liquidity will be driven by demographic trends and rising debt levels.

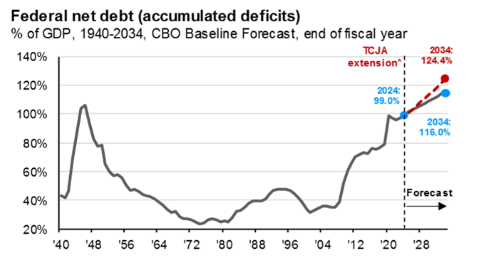

Currently, the United States has an aging population, GDP growth is unlikely to exceed 2% per year, and budget deficits are likely to continue increasing to cover rising Social Security obligations.

all these at once (1) Public debt has reached 100% of GDP and is almost certain to continue to rise.

JPMorgan Asset Management

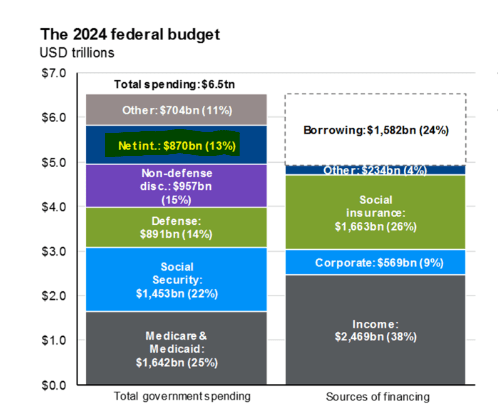

(2) Debt servicing costs (i.e. net interest) already account for 13% of GDP.

JP Morgan Asset Management

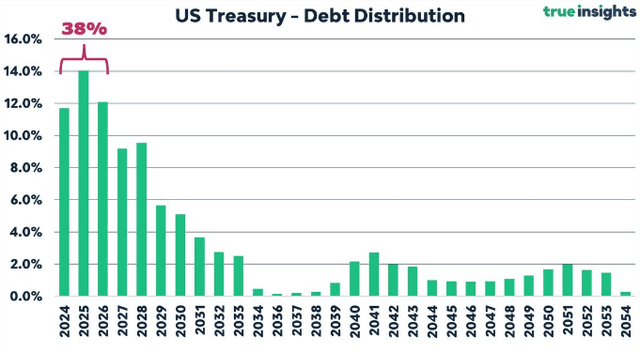

and (3) A significant amount of debt will need to be refinanced in just a few years, and the interest rate will likely be higher than current interest rates.

true insight

This cycle works as follows. The government is running a large deficit due to low economic growth and an aging population. The only way to make up for this deficit is to borrow more. This increases already large debt and interest payments, leading to even larger deficits. And this cycle repeats.

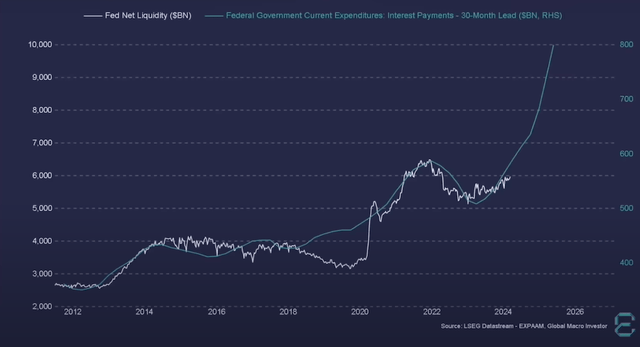

This has been the norm since 2008, but it’s only recently that interest payments have actually started compounding. We currently have a good idea of future interest payments as a percentage of GDP, but interest payments are likely to rise rapidly as a result of compounding, and with important maturities looming this year and next, the outlook is Not very good.

LSEG data stream

These increased interest payments can only be supported by increased liquidity, which I believe is all but guaranteed at this point. This surge in liquidity should lead to higher asset prices in the long run, and with a near 1:1 correlation between the index and the S&P 500 Index, it’s highly likely that the index will continue to provide at least a 10% return. We’re getting used to it.

conclusion

Tracking liquidity is great because it has a near-perfect correlation with asset prices, allowing you to not only predict short-term price movements, but also help you make long-term financial decisions.

Over the past 15 years, global liquidity (which basically represents the decline in the value of currencies) has increased at a CAGR of 8%, slightly less than the S&P 500’s average annual return of 10%. This means that investors won’t make much money by owning this index, but at least they will maintain their purchasing power, unlike bonds or money market funds.

LSEG data stream

For this reason, despite the lack of better alternatives and its relatively expensive valuation, I rate the S&P 500 as a Buy and continue to support the S&P 500 against fixed income alternatives.