chameleon 007

investment thesis

On the other hand, WESCO International, Inc. (New York Stock Exchange:WCC) has seen growth slow over the past few quarters, but easing comparisons and stable demand trends should help drive revenue growth in the coming quarters. Additionally, rising spending Infrastructure, electrification, broadband expansion, grid modernization, and data center initiatives should drive good end-market demand and contribute to medium- to long-term revenue growth. Additionally, the company has a strong track record of outperforming its peers and listed suppliers in sales growth thanks to its superior execution, which we expect will continue to help the company drive above-market growth. . Apart from organic growth, the company’s reasonable net leverage of 2.6x will also allow it to pursue a bolt-on acquisition strategy that complements its organic growth.

Regarding profit margins, we expect them to expand gradually. This was due to benefits from cost-cutting activities in recent quarters, operating leverage from improved sales outlook, and the sale of the low-margin Wesco Integrated Supply business in the Utilities & Broadband Solutions segment. The long-term profit outlook is also positive, with continued gains from increased productivity and the implementation of digital solutions. In terms of valuation, the company is trading at a discount to peer distributors, and I think the P/E ratio could be revalued if the company continues to have good execution. Therefore, I will raise the rating to “buy”.

Earnings analysis and outlook

I Last featured WCC In December 2023, the company discussed concerns about revenue growth given the declining backlog and moderating demand trends. The company has since reported its fourth-quarter 2023 and first-quarter 2024 results, where it saw similar developments.

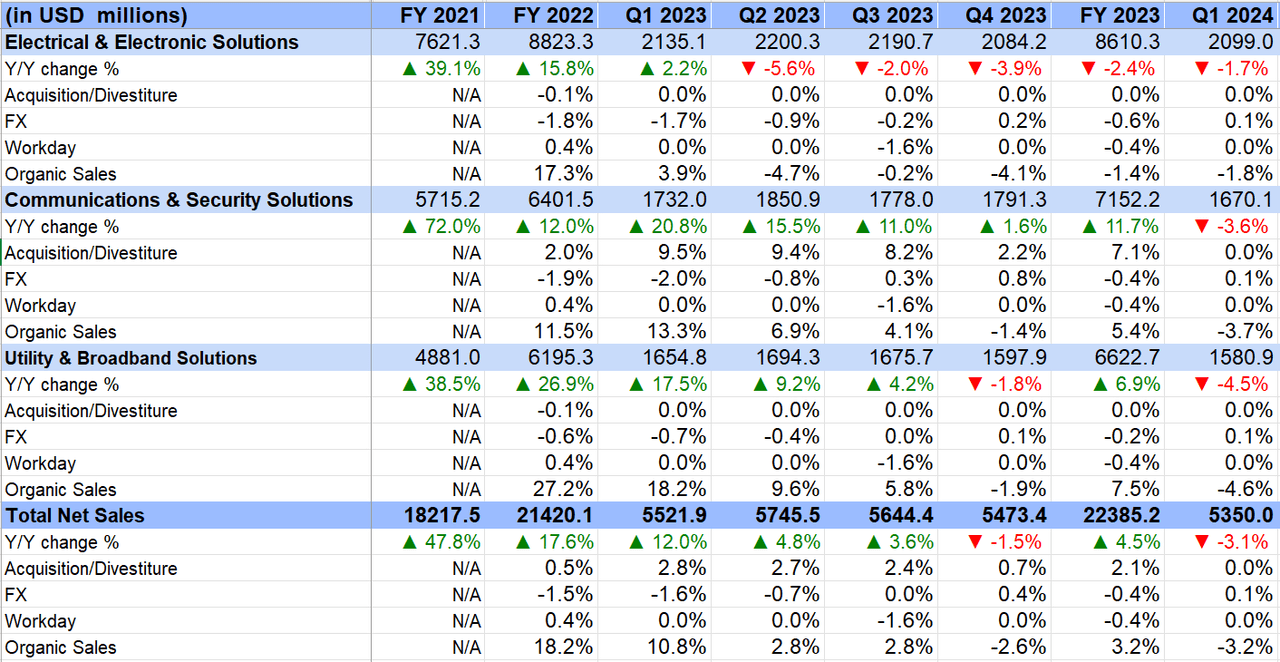

The company’s sales for the first quarter of 2024 were $5.35 billion, down 3.1% year-on-year. Excluding favorable currency effects of 0.1%, organic sales decreased 3.2% year over year due to lower volumes across all segments, partially offset by a 1% contribution from price increases.

By segment, sales in the Electrical and Electronic Solutions (EES) segment decreased 1.7% year-on-year due to a decline in OEM sales, and sales decreased 1.8% year-on-year on an organic basis. The decline in organic sales was partially mitigated by higher industrial sales due to growth in automation, electrical equipment upgrades, and strength in the oil and gas market. Construction sales were flat year-over-year as growth from large-scale project shipments and strong performance in Canada were offset by continued weakness in solar power, which made year-over-year comparisons difficult.

Sales in the Communication & Security Solutions (CSS) segment were down 3.6% year over year on a reported basis and down 3.7% year over year on an organic basis. Enterprise network infrastructure sales decreased due to continued weakness in the service provider market. Security sales decreased in the low single digits as year-on-year comparisons were difficult to make. However, these negative factors were partially offset by increased data center sales due to growth in hyperscale solutions.

Revenues in the Utilities and Broadband Solutions (UBS) segment decreased 4.5% year over year on an organic basis and 4.6% year over year, primarily due to lower broadband and utility revenues.

WCC’s revenue growth history (Corporate data, GS Analytics Research)

The company’s future earnings growth prospects are positive. The first quarter provided the toughest comparison, with organic revenue growth in Q1 2023 at 10.8% year-on-year. Organic revenue growth slowed to his low single digits in Q2 2023 and Q3 2023, and turned negative in Q4 2023. So the comparisons are softening as the year progresses.The company’s order backlog also remains flat, indicating stable demand trends, and management is shown Robust quoting and bidding activity. Improvements are expected in the coming quarters due to easing economic conditions and stable demand trends.

In the medium to long term, the company is poised to benefit from electrification, broadband expansion, demand for infrastructure and data centers, and increased investment by utilities to strengthen the grid.

Due to deleveraging over the past few years, the company’s net leverage is a reasonable 2.6x. Therefore, I believe the company will once again become active in the M&A market and bolt-on acquisitions will further accelerate internal growth in FY25 and beyond. As a large multinational company, Wesco offers a wider range of products and has better access to capital, which gives it a competitive advantage compared to smaller companies, making it an integrator in the sector. can function.

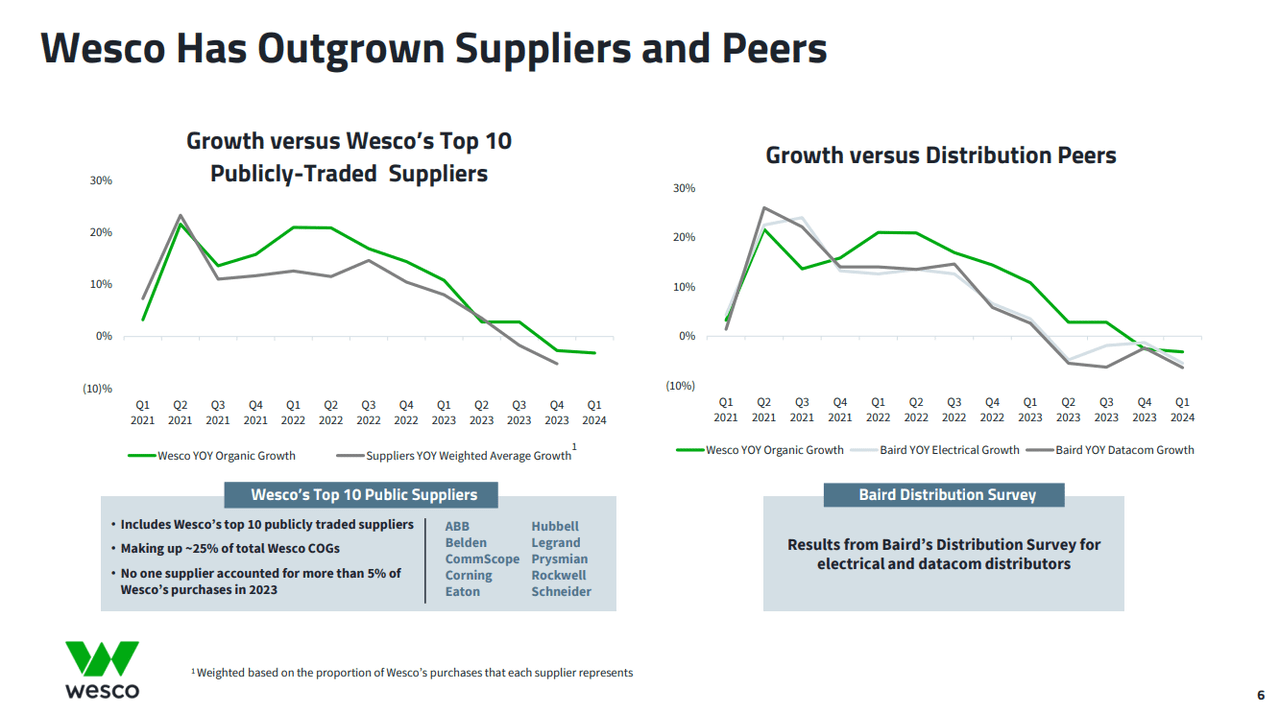

The company has a track record of achieving sales growth that outpaces its peers and even outpaces the growth of publicly traded suppliers.

WCC Growth vs. Peer Distributors and Listed Suppliers (Company’s Q1 2024 presentation)

Therefore, the company has done a good job in terms of gaining share, and we expect its good execution to continue to help Wesco achieve above-market growth.

Margin analysis and outlook

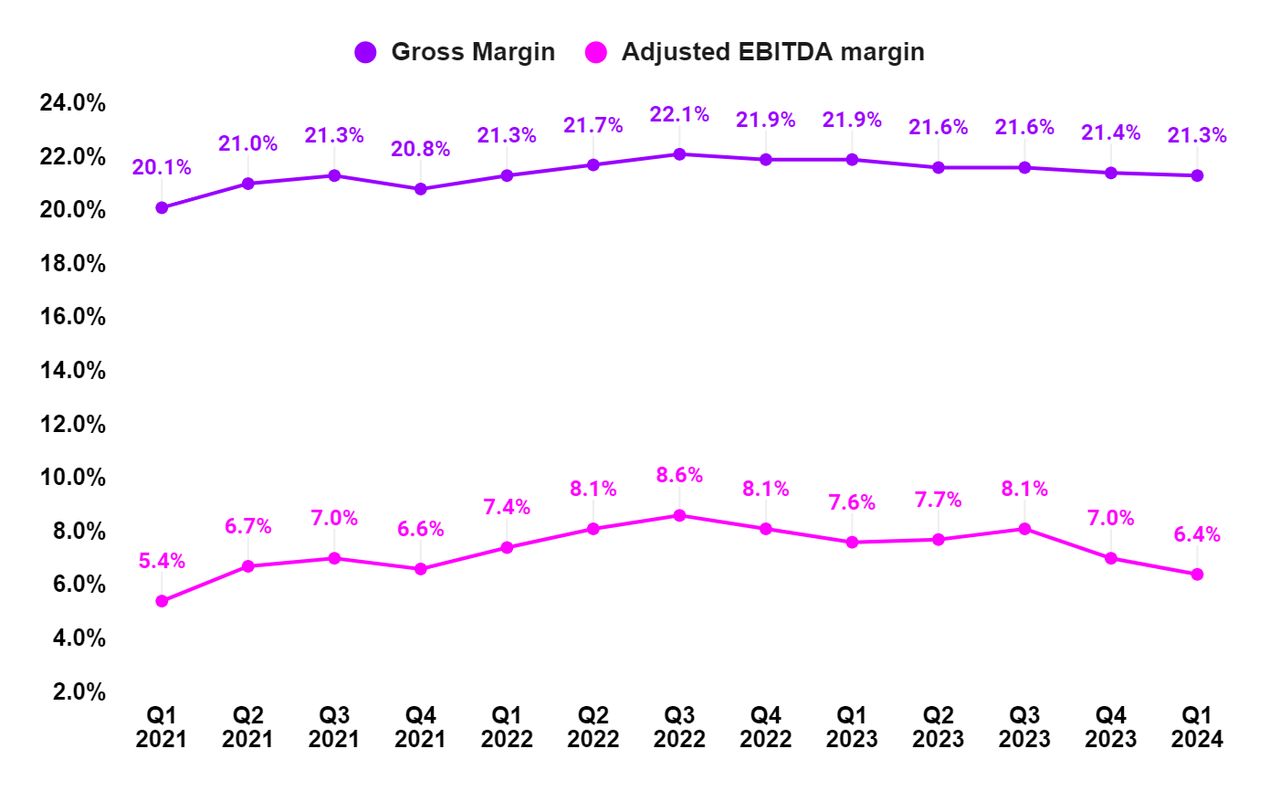

In the first quarter of 2024, the company’s margins were negatively impacted by lower supplier volume rebates and unfavorable inventory adjustments. This more than compensates for the benefits of cost-cutting measures taken in 2023. As a result, gross margin decreased 60 bps year over year to 21.3% and adjusted EBITDA margin decreased 120 bps year over year to 6.4%.

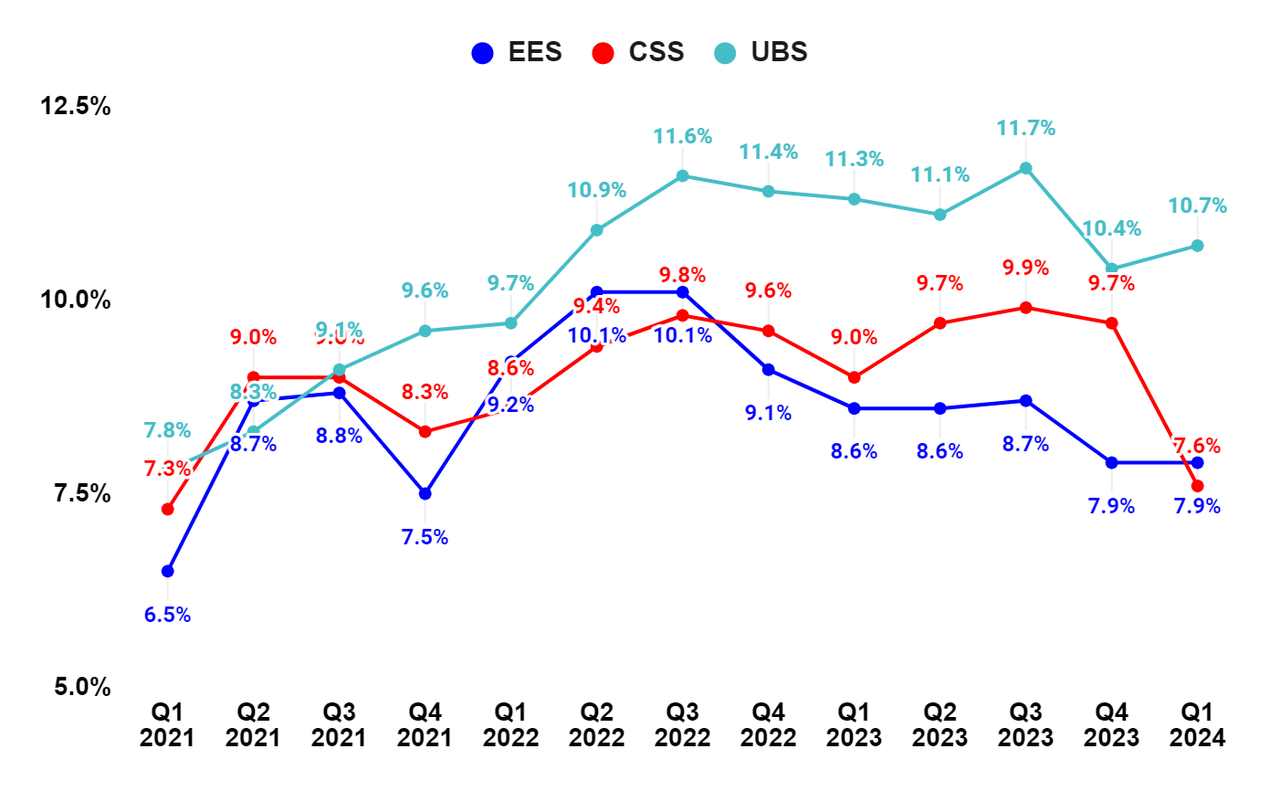

On a segment basis, adjusted EBITDA margin decreased by 70 bps year-on-year in the EES segment, 140 bps year-on-year in the CSS segment, and 60 bps year-on-year in the UBS segment.

WCC Gross Profit Margin and Adjusted EBITDA Margin (Company data, GS Analytics Research)

WCC adjusted EBITDA margin by segment (Company data, GS Analytics Research)

Looking ahead, the company’s profit margins should gradually improve over the next few quarters. Comparing year-over-year gross profit margins is also becoming easier as the year progresses. Management has provided guidance for full-year adjusted EBITDA margin of 7.5% to 7.9%, compared to 6.4% in the first quarter of 2024, indicating improvement as the year progresses. The company’s margins will benefit from operating leverage from improved sales guidance, as well as from cost-cutting activities in 2023 and the first quarter of 2024. Additionally, the recent sale of low-margin Wesco Integrated Supply should boost profits for the company’s UBS (Utilities & Broadband Solutions) division. Partially offsetting these positives will require the reinstatement of performance-based incentive compensation, which has been suspended for the past several quarters.

In the long term, we should benefit from improved productivity, continued adoption of digital solutions, leverage from increased sales, and continued realization of synergies from the Anixter acquisition. Management shares a goal of increasing the company’s EBITDA margins to ~10% in the long term, indicating that it expects to make significant leaps towards margin improvement in the coming years.

evaluation

Wesco is trading at $14.25, 12.99 times the FY24 consensus EPS estimate, and $16.63, 11.13 times the FY25 consensus EPS estimate. This is a huge discount compared to other distributors.

peer | Current period performance PER | Next PER |

Fastenal (fast) | 31.62 | 28.88 |

MSC Industrial Direct (MSM) | 15.91 | 14.24 |

WW Granger (GWW) | April 24th | 21.94 |

Applied industry Technology (AIT) | 20.52 | 19.42 |

Core and Main (CNM) | June 24th | 21.47 |

Source: Seeking Alpha Consensus Estimates

The company also has strong EV/EBITDA and sector median comparisons. The company’s EV/EBITDA is 9.32x; EV/EBITDA is 9.32x (Front-wheel drive) is 8.52x, while the sector medians are 13.12x and 11.37x, respectively.

Most stocks associated with megatrends such as electrification, data center demand, and investments in power grid reinforcement have seen increased revaluation in recent years. If Wesco begins to benefit from these trends over the next few years, I think its stock price will likely be revalued. Additionally, the company has a solid track record of execution and has outperformed expectations and generated significant shareholder value following the Anixter acquisition. I think investors should understand this story well, as the company continues to do well.

I last covered Being a Neutral rated stock in December 2023, I was concerned about short-term backlog easing and demand trends. This situation is already on display, with the stock falling sharply following disappointing fourth-quarter results and then rebounding toward first-quarter earnings. Backlog remains flat, demand is stable, and with the upcoming easing of competition, the company is poised to return to growth in the coming quarters, giving the stock good upside potential. Even if the stock trades at his P/E ratio in the low 10s (lower range for the aforementioned publicly traded distributor peers), there could be significant upside potential. Applying a P/E ratio of 13x to the FY25 consensus EPS estimate of $16.63, the one-year price target is $216, implying an upside of 16.7% from current levels. Therefore, I’m upgrading the stock to Buy.

risk

The company has an excellent track record of growing through M&A. However, inorganic growth is relatively risky compared to organic growth, and there are always risks associated with integration failure, overpaying for acquisitions, and corporate leverage when making acquisitions. If future acquisitions fail, our stock price could be adversely affected.

The company faces risks from the current macroeconomic environment, including high interest rates. If macro conditions worsen, it could impact the company’s end-market demand and delay the expected recovery in earnings.

remove

The company is expected to return to revenue growth in the coming quarters due to easing comparisons and stable demand trends. The medium to long-term outlook remains positive, supported by strong end market demand from electrification, broadband expansion, infrastructure development, data center demand and grid enhancement investments. Market share expansion and inorganic growth opportunities should further support revenue growth. Margins should also expand from current levels due to operating leverage, cost reduction benefits, divestitures of low-margin businesses in the UBS segment, productivity gains, and continued synergies from the Anixter acquisition. The valuation is also cheap compared to peer sellers, and we believe the stock will appreciate significantly as the company continues to perform well. Therefore, I raise my rating on WCC stock to Buy.