by calculated risk May 21, 2024 08:20:00 AM

we are watching scary article Talking about debt again. It’s worth remembering that at the turn of the millennium, there were concerns that the United States was paying down its debt too quickly.

The following is an excerpt from a speech given by then-Fed Chairman Alan Greenspan in April 2001. federal debt repayment

“Today I would like to address a topic in which your group and the Federal Reserve share a strong interest: repayment of the federal debt and its impact on the economy and financial markets. Although the amount of surplus in the future unified federal budget is uncertain, It is likely that the large scale will continue for some time.. …

(C) Current projections are based on a reasonably wide range of possible tax and spending policies. The resulting surplus will enable the repayment of Treasury debt held by the people.. Furthermore, long before that, Be debt-free– surely, Probably within a relatively few years“Reducing public debt further, as most of the remaining debt consists of savings bonds, solid holdings of long-term marketable bonds, and perhaps other types of debt that will prove difficult to reduce. Things can be difficult.”

What has gone wrong over the past 20+ years?

Below is a list of events and policy choices that have significantly increased debt since 2000.

1) The predictions for 2000 were overly optimistic.

2) The 2001 recession.

3) Bush tax cuts in 2001 and 2003.

4) 9/11, Homeland Security Spending and the Afghanistan War

5) Iraq War

6) Financial crisis and Great Recession

7) Trump tax cuts

8) Pandemic.

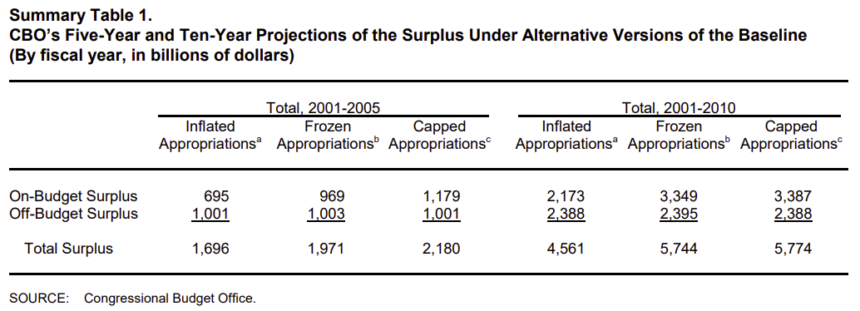

1) Overly optimistic predictions: Here are CBO’s forecasts for July 2000: Budget and economic outlook: Latest information

CBO projects approximately $6 trillion in debt reduction from 2001 to 2010.

In 2000, I argued that these predictions ignored possible negative events, such as an investment-driven recession due to the bursting of a stock bubble. These predictions were clearly too optimistic.

2) 2001 Recession: Mr. Greenspan referred to the “current slowdown in economic activity” in his April 2001 speech, but did not acknowledge that economic conditions were worsening. already in recession.from May 2000 FOMC Minutes:

“Information reviewed at this meeting suggested that economic growth remained rapid through early spring.”

The economy was already in recession!

3) Bush tax cuts: These tax cuts were sold (under the cover of Greenspan’s speech) as slowing surplus growth! Instead, tax cuts (mainly for the wealthy) turned surpluses into deficits, reducing revenue by more than $1.5 trillion from 2001 to 2010.

Four) 9/11, Homeland Security Spending and the Afghanistan War: The attacks of September 11, 2001 led to a surge in homeland security spending and the war in Afghanistan.

Five) Iraq War: The Bush administration claimed the war would cost about $80 billion. Vice President Dick Cheney said on Meet the Press, “The cost of this war itself, by every analysis, is about $80 billion.” Instead, the cost of the war was well over $1 trillion (and countless lives lost). Note: Years ago, I wrote on this blog that I opposed the Iraq war, but I was taunted and called “Saddam’s lover” for questioning the veracity of the information. Stated.

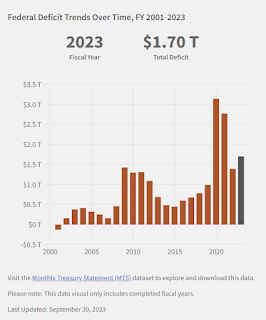

6) The financial crisis and the Great Recession. This was the worst US recession since the Great Depression. This resulted in the first $1 trillion annual budget deficit in U.S. history and a dramatic increase in the national debt. The cause of the bubble was rapid changes in the mortgage industry and rating agencies that did not take these changes into account. Coupled with lack of regulatory oversight. I think he was talking to regulators in the field in 2005 and 2006 and they were all scared. We hear that appointees at the top of government agencies are blocking any efforts to tighten standards.

This photo shows John Reich (then FDIC vice chairman, then OTS), Office of Recycling Superintendent James Gilleran (with a chainsaw), and representatives of three banking industry organizations. : James McLaughlin of the American Bankers Association, Harry Doherty of the Community Bankers of America, and Ken Guenther of the Independent Community Bankers of America.

“This tax plan not only pays for itself, it pays off the debt,” Treasury Secretary Steve Mnuchin said. September 2017

“I think this tax bill will reduce the size of the deficit going forward,” Sen. Pat Toomey (R-Pennsylvania) said. November 2017

Total nonsense.

8) Pandemic: The pandemic has caused a spike in deficit spending.

Note: This is not adjusted for economic growth.

So what happened to “debt repayment”? series of adverse events (9/11, pandemic); and inappropriate policy choices..

note that All the “bad policy choices” came from Republicans. These include tax cuts, the Iraq War, and the failure to properly regulate before the Great Recession.

While we can’t always avoid harmful events like 9/11 and pandemics, I opposed each of these poor policy choices. So these are clearly avoidable.

What are those scary stories? They seem to be ignoring history.