JulPo/iStock via Getty Images

Dear Baron WealthBuilder Fund Shareholder

Performance

Baron WealthBuilder Fund®’s (MUTF:BWBIX) (the Fund) performance in the first three months of 2024 was below our expectations. While the Fund increased 4.87% (Institutional Shares), it trailed both its primary benchmark, the S&P 500 Index (SP500, SPX, the Index), and the MSCI ACWI Index (Global Index), which were up 10.56% and 8.20%, respectively. The Morningstar Aggressive Allocation Category Average (the Peer Group) increased 7.28% in the quarter.*

The Fund has made little progress in the past three years. Its results in 2024’s first quarter contributed to the Fund’s three-year return trailing the Index’s. Over the past three years, the Fund’s annualized return was 0.80% compared to the Index’s annualized return of 11.49%.

Since inception, however, the Fund’s absolute performance is good while its relative performance is more in line with the Index. The Fund’s annualized return since its inception is 13.10%. This compares to the Index’s annualized return of 13.37%, while the Global Index had an annualized return of 8.92%.

This in-line performance since inception was achieved despite the Fund’s strategy facing considerable headwinds. Baron Capital’s consistent investment philosophy and process has not changed since the Firm’s founding in 1982. This Fund provides clients with broad exposure to our strategies. We favor small and mid-cap sized growth companies since we believe they offer the greatest long-term return potential. Our long-term investment horizon enables the Fund to benefit when companies in which we are shareholders achieve their long-term strategic objectives. We have historically owned growing businesses that often penalize their short-term earnings by making ongoing investments to become larger businesses. As a result of these capital investments, these businesses often appear more highly valued than the broad market. Although our long-term strategy has periodically led to short-term underperformance, we believe it has enabled our Firm to achieve exceptional performance over extended periods. But these businesses have been out of favor over the life of the Fund. Since the Fund’s founding, the Russell 2000 Growth Index has appreciated 6.89% compared to the Russell 1000 Growth Index, which appreciated 17.04%. 70.7% of the Fund’s investments are in, small- and mid-sized companies, as defined by Russell.

Despite this headwind, the Fund is ranked as the number one fund in its Morningstar category since its inception.

Table I. Performance Annualized for periods ended March 31, 2024

Baron Wealth Builder Fund Retail Shares1,2 | Baron Wealth Builder Fund Institutional Shares1,2 | Baron Wealth Builder Fund TA Shares1,2 | S&P 500 Index(1) | MSCI ACWI Index1 | |

Three Months3 | 4.83% | 4.87% | 4.87% | 10.56% | 8.20% |

One Year | 19.11% | 19.42% | 19.43% | 29.88% | 23.22% |

Three Years | 0.56% | 0.80% | 0.80% | 11.49% | 6.96% |

Five Years | 13.88% | 14.18% | 14.14% | 15.05% | 10.92% |

Since Inception (December 29, 2017) | 12.84% | 13.10% | 13.09% | 13.37% | 8.92% |

Performance listed in the above table is net of annual operating expenses. The gross annual expense ratio for the Retail Shares, Institutional Shares, and T A S hares as of December 31, 2023 was 1.47%, 1.22%, and 1.22% (includes acquired fund fees of 1.14%), respectively, but the net annual expense ratio was 1.44%, 1.19%, and 1.19% (includes acquired fund fees of 1.14%, net of expense reimbursements), respectively. The performance data quoted represents past performance. Past performance is no guarantee of future results. The investment return and principal value of an investment will fluctuate; an investor’s shares, when redeemed, may be worth more or less than their original cost. The Adviser reimburses certain Fund expenses pursuant to a contract expiring on August 29, 2034, unless renewed for another 11-year term and the Fund’s transfer agency expenses may be reduced by expense offsets from an unaffiliated transfer agent, without which performance would have been lower. BAMCO, Inc. (“BAMCO” or the “Adviser”) has agreed that, pursuant to a contract expiring on August 29, 2034, unless renewed for another 11-year term, it will waive and/or reimburse certain expenses of the Fund, limiting net annual operating expenses (portfolio transaction costs, interest and dividend expense, acquired fund fees and expenses, fees and expenses related to filing foreign tax reclaims, and extraordinary expenses are not subject to the operating expense limitation) to 0.30% of average daily nest assets of Retail Shares, 0.05% of average daily net assets of Institutional Shares and 0.05% of average daily net assets of TA Shares, without which performance would have been lower. Current performance may be lower or higher than the performance data quoted. For performance information current to the most recent month end, visitBaron Funds – Asset Management for Growth Equity Investmentsor call 1-800-99-BARON. * As of 3/31/2024, the annualized returns of the Morningstar Aggressive Allocation Category average were 20.20%, 4.91%, 9.32%, and 7.15% for the 1-, 3-, 5-year, and since inception (12/29/2017) periods, respectively. 1The S&P 500 Index measures the performance of 500 widely held large cap U.S. companies. The MSCI ACWI Index Net (‘USD’) is an unmanaged, free float-adjusted market capitalization weighted index reflected in US dollars that measures the equity market performance of large- and mid-cap securities across developed and emerging markets. MSCI is the source and owner of the trademarks, service marks and copyrights related to the MSCI Indexes. The MSCI ACWI Index Net (‘USD’) and the Fund include reinvestment of dividends, net of foreign withholding taxes, while the S&P 500 Index includes reinvestment of dividends before taxes. Reinvestment of dividends positively impacts performance results. The indexes are unmanaged. Indexperformance is not Fund performance; one cannot invest directly in an index. 2The performance data in the table does not reflect the deduction of taxes that a shareholder would pay on Fund distributions or redemption of Fund shares. 3Not annualized. As of 3/31/2024 the Morningstar Aggressive Allocation Category consisted of 184, 177, 163, and 175 share classes for the 1-, 3-, 5-year, and since inception (12/29/2017) time periods. Morningstar ranked Baron WealthBuilder Fund Institutional Share Class in the 68th, 92nd, 1st, and 1stpercentiles, respectively. On an absolute basis, Morningstar ranked Baron WealthBuilder Fund Institutional Share Class as the 126th, 169th, 1st, and 1stbest performing share class in its Category, for the 1-, 3-, 5-year, and since inception periods, respectively. Morningstar calculates the Morningstar Aggressive Allocation Category Average performance and rankings using its Fractional Weighting methodology. Morningstar rankings are based on total returns and do not include sales charges. Total returns do account for management, administrative, and 12b-1 fees and other costs automatically deducted from fund assets. ©2024 Morningstar. All Rights Reserved. The information contained herein: (1) is proprietary to Morningstar and/or its affiliates or content providers; (2) may not be copied, adapted or distributed; (3) is not warranted to be accurate, complete or timely; and (4) does not constitute advice of any kind, whether investment, tax, legal or otherwise. User is solely responsible for ensuring that any use of this information complies with all laws, regulations and restrictions applicable to it. Neither Morningstar nor its content providers are responsible for any damages or losses arising from any use of this information. Past performance is no guarantee of future results. MORNINGSTAR IS NOT RESPONSIBLE FOR ANY DELETION, DAMAGE, LOSS OR FAILURE TO STORE ANY PRODUCT OUTPUT, COMPANY CONTENT OR OTHER CONTENT. |

The significant reason for the Fund’s underperformance this quarter stemmed from our underlying investment in Tesla, Inc. (TSLA) Baron Capital has had a 10-year investment in the company, and it is the largest underlying position held at the Firm and within the Fund. Tesla’s shares fell 29.3% during the period and detracted 2.32% from the Fund’s first quarter results. Although Tesla has contributed importantly to the Fund’s performance since its inception, on occasion it has detracted from quarterly performance. In previous instances when Tesla’s shares have underperformed during a discrete period, they have shortly afterwards reflected the strong growth of its underlying business and the stock has appreciated considerably. We believe that will be the case again, although we cannot guarantee it.

A significant decline also occurred at the end of 2022. In that instance, investors had become concerned about a host of external factors. Investors believed company founder, visionary, and CEO Elon Musk was distracted by his acquisition of Twitter. They also believed a weak Chinese economy that was emerging from COVID-19 (COVID) and U.S. government policies would curtail sales of Tesla vehicles. These fears proved to be overblown. As the company achieved milestones in the succeeding year, the stock subsequently doubled over the next 12 months.

Today, investors are again concerned. They believe there is increased competition from Chinese automakers who are supported by a protectionist government. They worry about product-level margins after announced price cuts. They are skeptical about the company’s ability to achieve Full Self Driving (‘FSD’) and the feasibility of Tesla’s Robotaxi. And they debate if a mass appeal vehicle can be produced at scale and profitably.

Just like in late 2022, we believe investors’ concerns are overblown. Electric vehicle (‘EV’) competition will always be present. The Chinese automakers make a good, value product. But we believe Tesla’s offering is superior and will garner a meaningful market share within China. We also believe the Chinese OEM advantage will be minimized outside of its home market because of tariffs. We are already seeing traditional internal combustion engine (‘ICE’) manufacturers scrap their EV plans as plant conversions are too costly and their technology is inferior. They have instead attempted to fight for market share in the outdated ICE category.

We also believe a lower cost Tesla product will eventually be introduced and gain wide acceptance. Timing is uncertain, however, as the company attempts to develop both the new lower cost vehicle and fully autonomous vehicles in parallel. We have experienced Tesla’s FSD versions and believe they are close to achieving success. While the combination of these two feats may extend the timeline, we believe it meaningfully improves profitability and solidifies Tesla’s competitive advantage. Additionally, other ongoing projects within Tesla (e.g., battery packs, energy storage, humanoids, database, software, AI compute, distributed inference) make the company a lot more dynamic than when we first invested in 2014.

We remain focused on Tesla’s ability to achieve its mission of accelerating the world’s transition to sustainable energy rather than on how much it earns in any given quarter. After extensive and frequent meetings with Tesla executives and engineers, manufacturing and technology consultants, and competitors, we have increased confidence in Tesla’s ability to accomplish its mission.

But the Fund is diversified across market caps, sectors, and geographies. Our small-and mid-cap Baron Funds performed well on an absolute basis, however, they generally trailed their indexes. The shortcoming largely stems from what is not owned in these funds, rather than what is owned. This is particularly true for our small-cap offerings. With inflation appearing contained by some metrics, investors believe the interest rates have peaked and their appetite for risk has increased. As explained in depth in the Baron Discovery Fund and Baron Growth Fund letters, Super Micro Computer, Inc. (SMCI) and MicroStrategy Incorporated (MSTR), generated over 50% of the Russell 2000 Growth Index’s total return in the period. These companies are not owned in the Underlying Funds, and do not meet our criteria for investment. Super Micro Computer has limited recurring revenue and poor free-cash-flow conversion. MicroStrategy has made a significant investment in Bitcoin and its stock’s value is closely tied to the cryptocurrency rather than in its business operations. Steadier growth businesses that we favor lagged in such an environment. While our larger-cap portfolios performed better on an absolute basis and modestly exceeded their respective benchmarks, they too faced headwinds because of the investment environment. Out of the five top stock-specific detractors, four were from those that were underweight in the Fund.

We encourage you to read the various Baron Funds’ quarterly letters to gain a deeper understanding of the underlying holdings and strategies that constitute the Fund.

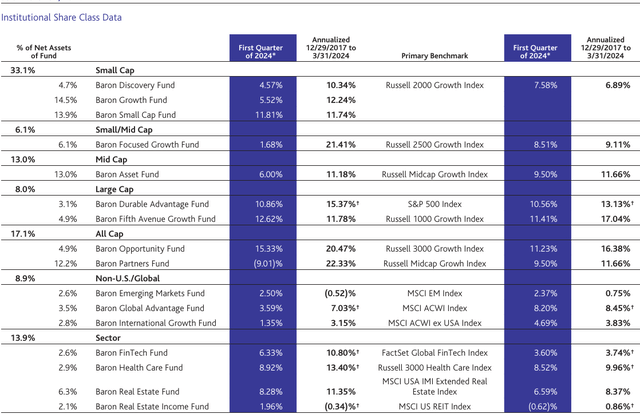

Table II. Baron Funds PerformanceasofMarch31,2024

Institutional Share Class Data

* Not annualized. †Performance is calculated from the time the Fund was added to Baron WealthBuilder Fund: Baron Durable Advantage Fund – 3/13/2018; Baron Global Advantage Fund – 1/9/2018; Baron FinTech Fund – 2/27/2020; Baron Health Care Fund – 10/18/2018; and Baron Real Estate Income Fund – 5/17/2021. Performance data quoted represents past performance. Past performance is no guarantee of future results. The indexes are unmanaged. The index performance is not Fund performance;one cannot invest directly in an index. |

Fund of Funds Structure and Investment Strategy

The Fund is a compilation of our Baron Funds and provides broad equity exposure. All Underlying Baron Funds follow a consistent investment philosophy and process. We do not try to mimic the indexes, and we do not alter our strategy to coincide with short-term macro events that we regard as unpredictable. We remain focused on underlying business fundamentals.

We believe small- and mid-cap growth stocks offer attractive return potential relative to their risk over the long term. Small- and mid-cap businesses represent 70.7% of the Fund (compared to only 16.8% for the Index). While our small- and mid-cap growth investments have been successful over our Firm’s 42-year history, these styles are occasionally out of favor. Today’s environment is one of those times. Large-cap growth companies outperformed small-cap growth companies in the year and in many instances over the last decade. Since the Fund’s inception over six years ago, the one-year rolling monthly returns of the Russell 1000 Growth Index have outperformed the Russell 2000 Growth Index 77% of the time, including five out of the past six calendar years.

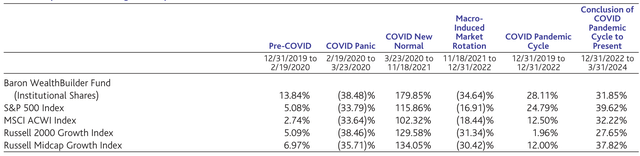

Rather than only examining the Fund’s performance over a quarter or a year, we believe it is equally important to understand how the Fund has performed over the course of an economic cycle. The COVID and subsequent Macro-Induced Market Rotation periods have been very difficult for small- and mid-sized growth companies. Investors have favored larger-cap, value-oriented businesses that are deemed safer during a time of uncertainty. We believe this offers a great opportunity for long-term investors to invest in small- and mid-cap growth businesses at attractive prices. Markets first peaked in late February 2020 before rapidly dropping as the economy braced for COVID. It recovered quickly, followed by another sizable drop based on macroeconomic factors. Over the three years of COVID ended 12/31/2022, the Russell 2000 Growth Index, a small-cap growth index, gained only 1.96% on a cumulative basis. The Russell Midcap Growth Index fared better with a cumulative 3-year return of 12.00%. With that backdrop, the Fund performed better and appreciated 28.11%. We believe protecting and growing clients’ assets during this challenging period positions long-term investors well for meaningful appreciation once the macro landscape changes. Table III provides a more complete look at how the Fund and various indexes performed during the pandemic and its aftermath.

Table III. Cumulative performance throughout the pandemic and its aftermath

Performance data quoted represents past performance. Past performance is no guarantee of future results. The indexes are unmanaged. The index performance is not Fund performance; one cannot invest directly in an index. |

We do not yet know if the challenges caused by COVID will persist. Volatility has remained high, but we are hopeful that interest rate increases, policy factors, and COVID hangovers are ending. Global conflict has increased, and geopolitics remains uncertain. But growth stocks have recently begun to outperform value stocks. Perceived safer large caps have continued to perform better than smaller companies. So far, we are optimistic that companies will again be valued on their fundamentals rather than on macroeconomic concerns. We have started to see the performance of some individual securities diverge. This divergence of returns, we believe, should favor growth investors. Given our weightings, the Fund’s performance has trailed the Index since the start of this cycle. However, the Fund’s return has continued to meaningfully exceed small-cap growth indexes.

Table IV. Performance based characteristics since inception through March 31, 2024

Baron WealthBuilder Fund (Institutional Shares) | S&P 500 Index | Morningstar Allocation 85%+ Equity Category | |

Alpha (%) – Annualized | -1.86 | 0.00 | -4.67 |

Beta | 1.19 | 1.00 | 0.92 |

Sharpe Ratio | 0.48 | 0.64 | 0.30 |

Standard Deviation (%) – Annualized | 23.03 | 17.79 | 16.85 |

Upside Capture (%) | 107.93 | 100.00 | 81.20 |

Downside Capture (%) | 113.53 | 100.00 | 98.44 |

Source: FactSet SPAR. Except for Standard Deviation and Sharpe Ratio, the performance-based characteristics above were calculated relative to the S&P 500 Index. |

Table V. Sector exposures as of March 31, 2024

Percent of Net Assets | S&P 500 Index | MSCI ACWI Index | |

Consumer Discretionary | 21.5% | 10.3% | 10.9% |

Information Technology | 20.7 | 29.6 | 23.7 |

Financials | 19.1 | 13.2 | 16.1 |

Health Care | 12.2 | 12.4 | 11.1 |

Industrials | 12.1 | 8.8 | 10.8 |

Real Estate | 8.7 | 2.3 | 2.2 |

Communication Services | 4.1 | 9.0 | 7.6 |

Materials | 0.8 | 2.4 | 4.2 |

Consumer Staples | 0.7 | 6.0 | 6.4 |

Energy | 0.1 | 3.9 | 4.5 |

Utilities | 0.0* | 2.2 | 2.5 |

* Represents less than 0.1%. |

Table VI. Fund of fund holdings as of March 31, 2024

Percent of Net Assets | |

Baron Growth Fund | 14.5% |

Baron Small Cap Fund | 13.9 |

Baron Asset Fund | 13.0 |

Baron Partners Fund | 12.2 |

Baron Real Estate Fund | 6.3 |

Baron Focused Growth Fund | 6.1 |

Baron Fifth Avenue Growth Fund | 4.9 |

Baron Opportunity Fund | 4.9 |

Baron Discovery Fund | 4.7 |

Baron Global Advantage Fund | 3.5 |

Baron Durable Advantage Fund | 3.1 |

Baron Health Care Fund | 2.9 |

Baron International Growth Fund | 2.8 |

Baron FinTech Fund | 2.6 |

Baron Emerging Markets Fund | 2.6 |

Baron Real Estate Income Fund | 2.1 |

Thank you for joining us as fellow shareholders in the Fund. We continue to work hard to justify your confidence and trust in our stewardship of your hard-earned savings. We remain dedicated to providing you with the information we would like to have if our roles were reversed. We hope this letter enables you to make an informed decision about whether this Fund remains an appropriate investment.

Respectfully,

Ronald Baron, CEO and Portfolio Manager

Michael Baron, Portfolio Manager

Investors should consider the investment objectives, risks, and charges and expenses of the investment carefully before investing. The prospectus and summary prospectus contain this and other information about the Funds. You may obtain them from the Funds’ distributor, Baron Capital, Inc., by calling 1-800-99-BARON or visitingBaron Funds – Asset Management for Growth Equity Investments. Please read them carefully before investing. Risks: The Fund is a non-diversified fund because it invests, at any given time, in the securities of a select number of Baron mutual funds (the Underlying Funds), representing specific investment strategies. The Fund can invest in funds holding U.S. and international stocks; small-cap, small to mid-cap, large-cap, all-cap stocks; and specialty stocks. Each of the Underlying Funds has its own investment risks, and those risks can affect the value of the Fund’s investments and therefore the value of the Fund’s shares. To the extent that the Fund invests more of its assets in one Underlying Fund than in another, it will have greater exposure to the risks of that Underlying Fund. For further information regarding the investment risks of the Underlying Funds, please refer to the Underlying Funds’ prospectus. The Fund may not achieve its objectives. Portfolio holdings are subject to change. Current and future portfolio holdings are subject to risk. The discussions of the companies herein are not intended as advice to any person regarding the advisability of investing in any particular security. The views expressed in this report reflect those of the respective portfolio managers only through the end of the period stated in this report. The portfolio manager’s views are not intended as recommendations or investment advice to any person reading this report and are subject to change at any time based on market and other conditions and Baron has no obligation to update them. This report does not constitute an offer to sell or a solicitation of any offer to buy securities of Baron WealthBuilder Fund by anyone in any jurisdiction where it would be unlawful under the laws of that jurisdiction to make such offer or solicitation. Active Share is a term used to describe the share of a portfolio’s holdings that differ from that portfolio’s benchmark index. It is calculated by comparing the weight of each holding in the Fund to that holding’s weight in the benchmark. Positions with either a positive or negative weighting versus the benchmark have Active Share. An Active Share of 100% implies zero overlap with the benchmark. Alpha measures the difference between a fund’s actual returns and its expected performance, given its level of risk as measured by beta. Beta measures a fund’s sensitivity to market movements. The beta of the market is 1.00 by definition. EPS Growth Rate (3-5-year forecast) indicates the long term forecasted EPS growth of the companies in the portfolio, calculated using the weighted average of the available 3-to-5 year forecasted growth rates for each of the stocks in the portfolio provided by FactSet Estimates. The EPS Growth rate does not forecast the Fund’s performance. Sharpe Ratio is a risk-adjusted performance statistic that measures reward per unit of risk. The higher the Sharpe ratio, the better a fund’s risk adjusted performance. Upside Capture explains how well a fund performs in time periods where the benchmark’s returns are greater than zero. Downside Capture measures how well a fund performs in time periods where the benchmark’s returns are less than zero. Standard Deviation (Std. Dev) measures the degree to which a fund’s performance has varied from its average performance over a particular time period. The greater the standard deviation, the greater a fund’s volatility (risk). Free cash flow (‘FCF’) represents the cash that a company generates after accounting for cash outflows to support operations and maintain its capital assets. The Russell 2000®Growth Index measures the performance of small-sized U.S. companies that are classified as growth. The Russell Midcap® Growth Index measures the performance of medium-sized U.S. companies that are classified as growth. All rights in the FTSE Russell Index (the “Index”) vest in the relevant LSE Group company which owns the Index. Russell®is a trademark of the relevant LSE Group company and is used by any other LSE Group company under license. Neither LSE Group nor its licensors accept any liability for any errors or omissions in the indexes or data and no party may rely on any indexes or data contained in this communication. The Fund includes reinvestment of dividends, net of withholding taxes, while the Russell Indexes include reinvestment of dividends before taxes. Reinvestment of dividends positively impacts the performance results. The indexes are unmanaged. Index performance is not Fund performance. Investors cannot invest directly in an index. BAMCO, Inc. is an investment adviser registered with the U.S. Securities and Exchange Commission (SEC). Baron Capital, Inc. is a broker-dealer registered with the SEC and member of the Financial Industry Regulatory Authority, Inc. (FINRA). |

Editor’s Note: The summary bullets for this article were chosen by Seeking Alpha editors.