by calculated risk May 22, 2024 03:48:00 PM

Note: This index is primarily a leading indicator for new commercial real estate (CRE) investments.

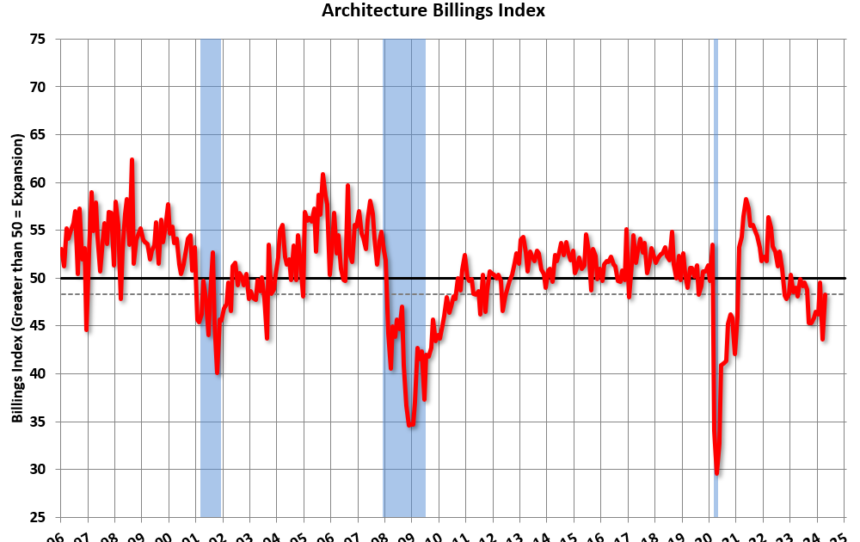

From AIA: ABI April 2024: The pace of decline in billings for construction companies slows slightly.

This month’s AIA/Deltek Architecture Billings Index (ABI) score is up from 43.6 in March. April was 48.3it shows the following Billings continued to decline for the majority of companies (A score below 50 indicates a decrease in claims). Interest in starting new projects remains high, and inquiries about new projects continue to increase. However, the value of newly signed design contracts fell slightly in April as customers remained hesitant to take on new work. Businesses had hoped that the Federal Reserve would begin cutting interest rates this spring, which would spark new initiatives, but the cuts are likely to be held off until late summer or early fall, leading to an even weaker few months for businesses. may be waiting.

Billings to construction companies continued to decline in April for firms in all regions of the country, with firms in the Midwest and South reporting the largest declines. Currently, businesses in the West are experiencing the longest period of decline, with claims declining for the past 19 consecutive months. Business conditions continue to be weak for companies in all specialized fields, The toughest situation continues for companies specializing in apartment complexes.then those with institutional specialization, and then those with commercial/industrial specialization.

…

The ABI score is a leading economic indicator of construction activity and provides a glimpse into the future of nonresidential construction spending activity for approximately 9 to 12 months. This score is derived from a monthly survey of architecture firms that measures changes in the number of services provided to clients.

add emphasis

• Northeast (56.9). Midwest (44.2); South (44.6); West (47.8)

• Sector index breakdown: Commerce/Industrial (47.4). Institutional (46.1). Apartment complex (45.6)

This chart shows the Architecture Claims Index since 1996. The index for April was 48.3, up from 43.6 in March. A value below 50 indicates a decline in demand for the architect’s services.

Note: This includes commercial and industrial facilities such as hotels and office buildings, apartment complexes, schools, hospitals, and other facilities.

Typically, this index leads CRE investments by 9 to 12 months, so this index signals a slowdown in CRE investments in 2024.

Note that multifamily claims decreased in August 2022, marking the 21st consecutive month of negative charges. (with corrections). This suggests that Multifamily’s start will be even weaker.