morsa images

As Generative AI impacts pharmaceutical research, this paper was published by Exscientia plc (Nasdaq:exercise) and indicate that it is a purchase based on the strength of its technology platform. Remarkably, I became bullish again. Covering The stock price in April 2022 was $12. It did go up to $15.21, but then it fell to $4.28 because the Federal Reserve raised interest rates at these levels. Aggressive This pace was only seen during the Paul Volcker era.

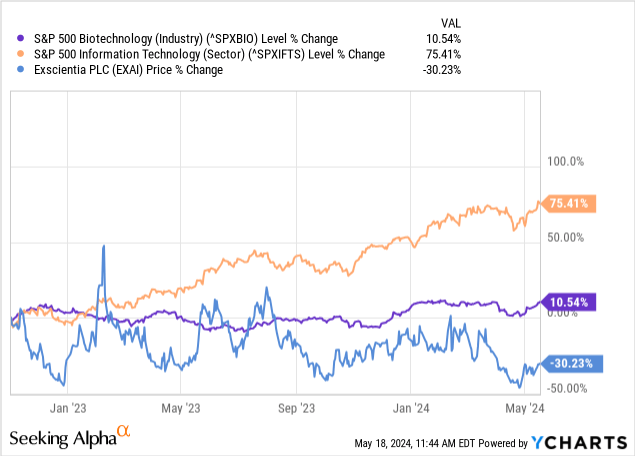

The stock, which trades at about $5 at the time of writing, underperforms the S&P 500 biotech sector and the S&P 500 IT sector, as shown below, and is undervalued by cash flow, potential paths to profitability, and artificial This is unusual considering the opportunity for intelligence.

First, BCG (Boston Consulting Group) research shows how AI is specifically changing pharmaceutical research and development.

How is AI transforming the pharmaceutical industry? Research and Development

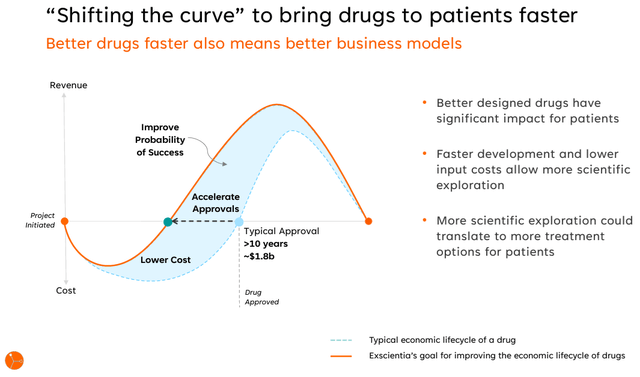

Traditional procedures in drug discovery research are time-consuming and costly, involving the following tasks: 5 steps, Including clinical trials. Even before clinical studies testing a potential drug candidate in humans, the candidate must be identified in the laboratory and undergo preclinical testing in animals. After clinical development, new drugs are submitted to health authorities for approval and sale. Long-term monitoring for side effects then begins. More than 10 years.

This will accelerate the adoption of artificial intelligence. Accelerate Approvals Accelerate time to market, as Exscientia does. Already in the field for more than 10 years, he is innovating with new automation facilities to integrate AI design and automated experimentation, which will reduce the time it takes to develop and deploy medicines from 10 years to It could be shortened to one year. ”A few years” This suggests a faster return on investment.

Company information session (Excientia IR)

Looking across industries, BCG researchers say: AI-derived The molecules have shown success rates higher than the average 80% to 90% in Phase I of clinical development. This is illustrated by rapid scanning of vast datasets to screen for important details such as toxic effects. Therefore, intelligent software can reduce drug development time while improving quality.

How Exscientia uses Gen AI to differentiate from big data companies and other biotechs

However, when it comes to applying technology to biotech research, this is not a new idea and has been around for years, long before the advent of ChatGPT, as exemplified by collaborations between big data companies like International Business Machines. It has existed for a long time (IBM) in the context of High Performance Computing Consortium To accelerate the development of a COVID-19 vaccine, Alphabet (google) has invested billions of dollars to build an intelligent infrastructure that large pharmaceutical companies can use instead of partnering with Exscientia.

Therefore, product differentiation is important to Exscientia, and we focus on specifics, such as identifying molecules that can be used to treat specific diseases. 12 Years of experience in technology-enabled drug design.

Looking specifically at Gen AI, Exscientia is already 6th Molecules are expected to enter the clinical stage through the generative AI platform. By comparison, Recursion Pharmaceuticals (RXRX) announced Collaboration with NVIDIA (NVDA) last July to accelerate the training of AI models on the semiconductor giant’s DGX cloud. This will eventually be released on BioNeMo, his Nvidia cloud service for generative AI in drug discovery.

Corporate presentation (Exscientia IR)

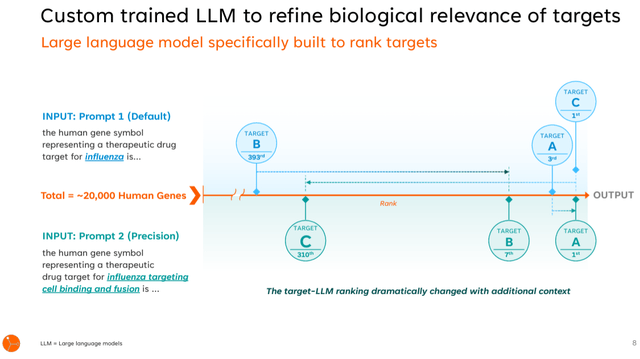

So it’s still a competitive field, and Recursion is relying on Nvidia’s compute power and eleven The company has spent years working on inputting data into LLMs (large-scale language models). But now, Exscientia seems to be ahead in Gen AI-based molecular design. Here’s why: Integrated Molecule synthesis and generation Software that manages the experimental capabilities of the AI design itself. In this way, the computational environment is closer to a real lab setup.

In this context, Gen AI models can provide positive ideas about drug-target interactions without actually physically testing them, for example when trying to identify antiviral drug treatments. , making it possible to quickly select the best compounds during research.

Finance and Risk

But even after reducing the time to develop a new drug, the company still has to spend money building the platform. $33.7 million I spent the last year alone.

In this respect, $463 million With cash-to-debt of $24 million for fiscal year 2023, which ended in December. $150 million It will pay more than double that amount in cash in 2022. And its operating costs are $213 million That’s at least 9x total revenue, indicating it could take a while to break even.

This means the risk of compressing debt, especially if interest rates spike. 0.08% By the beginning of 2022, it will be 5.33%. It may also need to issue shares like in 2021. $722 million The equivalent of common stock was sold. But at the time, it was worth more than $20 per share, or about four times its current value. Therefore, in the case of an initial public offering, more shares must be issued to obtain the same amount.

Therefore, the risk for investors is that if there is a delay in monetizing the drug discovery program, they may have to finance growth through potential new equity dilution. Additionally, because they do not generate operating cash flow, they remain interest rate sensitive stocks or stocks whose performance is influenced by the hawks or doves of the Federal Reserve. Therefore, despite me bullish According to the paper, in April 2022, it was trading at $12.13, but fell to $4.28 as the Federal Reserve raised interest rates at such levels. Aggressive This pace was only seen during the Paul Volcker era.

However, management says existing cash provides ample runway through 2026. I continue to see $463 million in cash on the balance sheet at the end of 2023, with annual outflows of $150 million, although this is a worst-case scenario that ignores partnership-driven revenues.

A cash-generating, profitable partnership

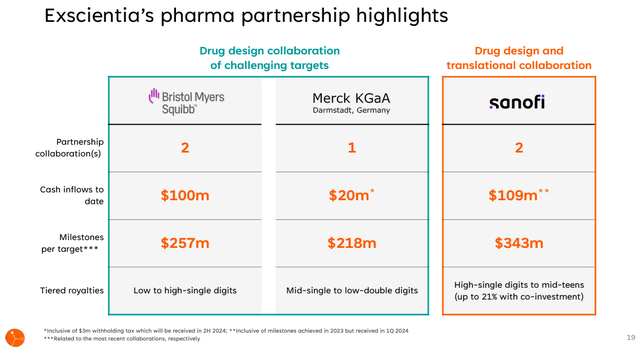

As such, biotech companies do not necessarily need to advance to the fourth or commercialization stage, which involves clinical trials, to monetize their pipeline. To this end, the company has selected Sanofi (SNY), Bristol-Myers Squibb (BMY), Merck KGaA (OTCPK:MKKGY) As a result, $229 million Here’s the cash inflows into Exscientia to date:

Company information session (Excientia IR)

Sanofi’s strategic research collaboration started In January 2022, $100 million upfront in cash and $5.2 billion in potential milestones and royalties to develop an AI-powered precision medicine pipeline focused on oncology and immunology. Expected to be $. This agreement: expanded Established in December 2023 as part of a drug discovery stage program, Exscientia is eligible to earn up to $45 million in upfront fees and preclinical milestone payments in the first quarter of 2024.

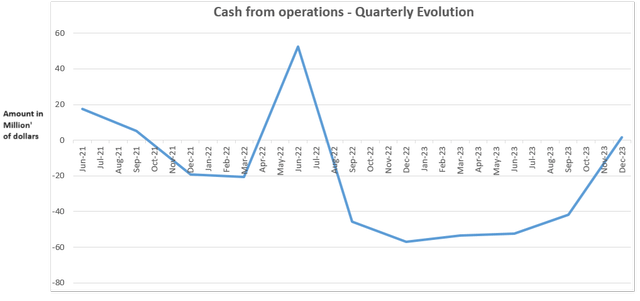

This means cash burn is likely to be less than last year, and the graph below showing the cash flow generated each quarter may maintain an upward trend.

Chart generated using data from (Seeking Alpha)

In addition, we have the potential to earn more than $300 million in sales-based royalties from Sanofi over the next 18 to 36 months, and our partnership with Bristol-Myers has been expanded to include an upfront payment of $50 million and It could earn $125 million in stones and tiered royalties.

This means an additional $425 million (300 + 125) to partially offset the annual operating loss figure (based on 2022 and 2023) of approximately $212 million. First, the path to profitability becomes clearer when you factor in the efficiency-related benefits realized by approximately $60 million in budget savings last year. Second, the company’s differentiated platform is likely to generate more sales as it remains aggressive in terms of business development this year.

Purchase based on technology platform strengths

To this end, here are the analyst consensus earnings forecasts for fiscal year 2024. $73.5 million; 127% YoY growth compared to FY23 decline. Additionally, Sanofi’s expanded contract indicates that Exscientia’s technology platform capabilities willsolved New classes of drugs have significant limitations,” said CFO Ben Taylor.

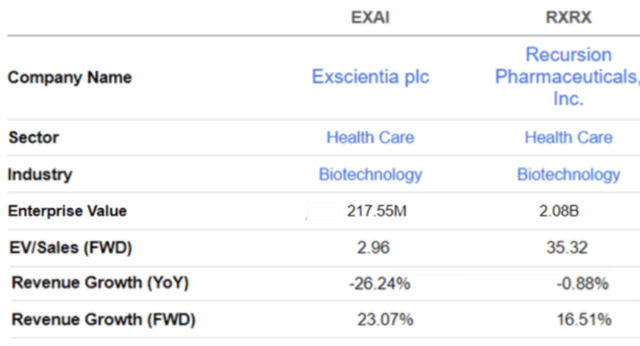

This means it’s a better value, and for evaluation purposes, Nvidia $50 million Exscientia has a higher proportion of stocks in the company’s capital structure. However, as shown below, his Exscientia is expected to have higher growth in the future, so its EV/Sales multiple is higher than his 2.96x. When increased by 50%, the multiplier is approximately 4.5x, which is approximately 1/8th of Recursion.

Comparing indicators (Seeking Alpha)

Therefore, we increased our stock price by 50% to $5 to get our target of $7.5.

Now, 50% may seem modest compared to Wall Street averages. $8.72However, considering the risks, it is a reasonable choice. In this regard, recent price movements have been largely determined by lower-than-expected inflation rates, increasing the likelihood that the Federal Reserve will cut interest rates soon. consumer price index April print. At the same time, Moderna (mRNA) By partnering with OpenAI to deploy chat-based interactive tools. Synergy For stocks etc.

Another reason I have a medium target is that the last time I covered this stock, it was trading at about 17x price-to-earnings, compared to the current price of 25x, or 47% upside. That’s what happened. Therefore, although volatility is expected in the absence of a catalyst, the stock price is still well above the stock price.level of support for 4 dollars It arrived last month. Finally, considering the underperformance compared to tech and biotech as seen in the introductory chart, it is still a reasonable price considering the attractiveness of the platform to big pharma.