Dario Gaona

The Silver Miners Index’s first quarter earnings season is coming to a close (Sil), many silver producers generated positive free cash flow this year, but First Majestic Silver Corporation (New York Stock Exchange:A.G.) was not one of them, despite a much larger production profile. In fact, the free cash outflow continued in the first quarter despite shutting down its most costly asset last year (Gerritt Canyon). Although the outlook for the second quarter has improved, the stock continues to trade at an unattractive free cash flow multiple of more than 70 times estimated 2024 free cash flow. In this update, we dig into the first quarter’s results, its valuation compared to other mid-sized producers, and why the stock continues to be a poor buy candidate.

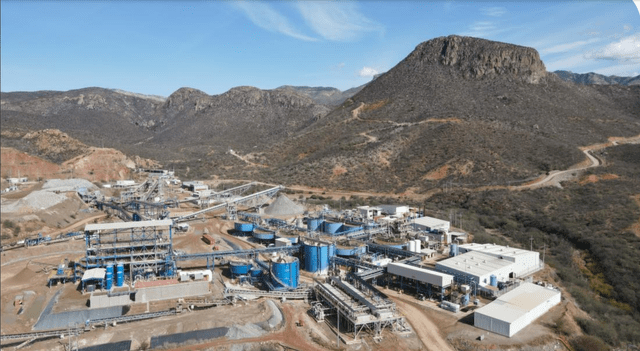

Santa Elena Mine – Company Website

First Majestic Silver Q1 production and sales

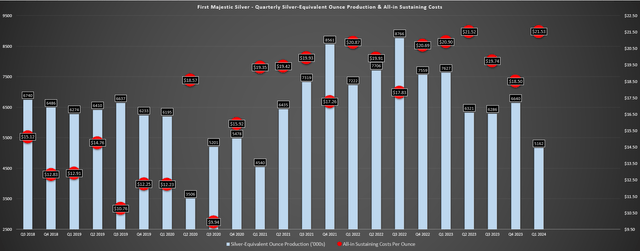

First Majestic released: First quarter results Earlier this month, it reported quarterly production of approximately 5.2 million silver equivalent ounces (SEO), or approximately 1.98 million ounces of silver and 35,900 ounces of gold. This means silver production fell by 22% and gold production by 41%. Gold production was significantly impacted by having to delay production at Gerrit Canyon, with the asset taken offline in the second quarter of last year. Meanwhile, silver production has declined due to lower production in La Encantada (limited water supply to the factory) and lower grades in San Dimas (mining in low-grade areas), as well as labor shortages. It decreased due to the suspension.

First Majestic Silver Quarterly Production and Costs – Company Returns, Author’s Charts

On a positive note, First Majestic is circling these troubled companies towards Q2 2024. Gerrit Canyon contributed approximately 16,300 ounces of gold and approximately $24.1 million in revenue in the first quarter of 2023, negatively impacting year-over-year results (with limited production). this year). Meanwhile, the company said additional water sources have been identified and processing rates are expected to return to 3,000 tons per day by the third quarter, with better H2 available from the smallest La Encantada mine. I expect it to be. Finally, San Dimas is expected to benefit from improved performance and productivity in the second half of the year and is hopeful of successful union negotiations, with First Majestic expected to increase headcount, base pay and bonuses at San Dimas. He pointed out that negotiations regarding the issue continued into the second quarter.

Another positive worth noting is that Santa Elena performed well thanks to Ermitano, producing approximately 2.28 million silver equivalent ounces at all-in sustaining costs of $14.70/oz. This was actually an improvement year-over-year despite the stronger Mexican peso (1Q23: $15.18/oz), and saw higher throughput (approximately 224,400 tonnes processed), higher silver grades, and better gold/silver recoveries. The mine also benefited from zero ounces produced on royalty lands attributable to silver flows, with the only impact being royalties held at Ermitano. That said, Santa Elena’s strong quarter was not enough to make up for lower sales at San Dimas, Gerritt Canyon, and La Encantada.

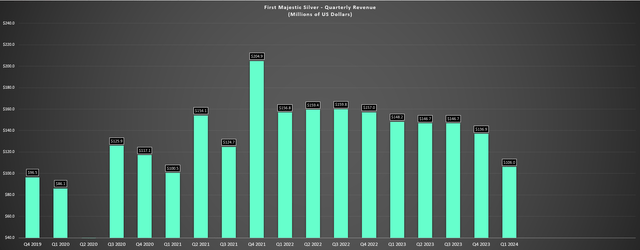

First Majestic Silver Quarterly Earnings – Company Filings, Author’s Graphs

Financial results were largely unremarkable, with First Majestic reporting a 32% year-over-year decline in sales despite benefiting from higher metal prices. This is related to the lack of revenue from Gerrit Canyon, much lower throughput from La Encantada and San Dimas, and much higher costs, as mentioned above.

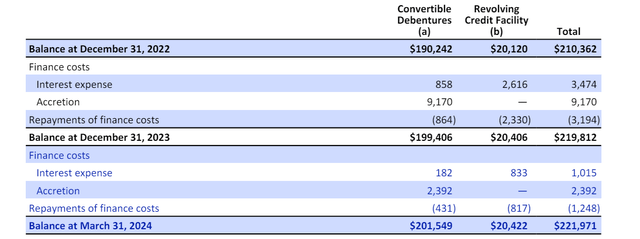

First Majestic Silver Debt Scheme

First Majestic Silver Debt Plan – Company Filings

San Dimas’ AISC for Q1 2024 was $20.49/oz, while production costs per ton rose to ~$200.7 compared to $14.67/oz and ~$157.4/t in the year-ago period .

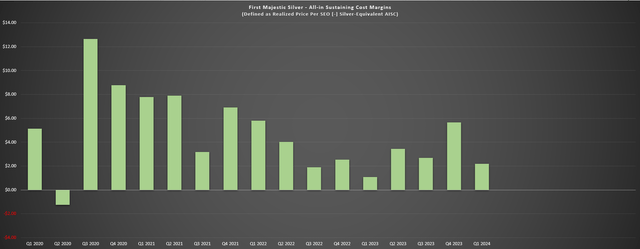

In terms of costs and margins, First Majestic’s sustaining costs per ounce of silver equivalent in the first quarter of 2024 were $21.53/oz, an increase of 3% year-over-year. The cost increase comes despite taking its most costly operations offline (Gerritt Canyon), and First Majestic is facing the downgrading of San Dimas, the downsizing of La Encantada (lack of water resources), and the The company was hit by a major headwind from the strong peso.

. And while silver prices have certainly risen since the first quarter, the company won’t be able to fully reflect that benefit in its second quarter results. This means it will be another moderate production quarter this year (La Encantada is still trending higher) and despite the recent rally in silver prices, he spent much of the second quarter below $28.00/oz. This is due to the fact that I spent time inFirst Majestic Silver AISC marginFirst Majestic Silver AISC Margin – Company Declaration, Author’s Chart

USD/MXN has averaged approximately $16.9 against the US dollar year-to-date, down significantly from approximately $18.4 a year earlier, and cost guidance of $20.00/oz (guidance midpoint) is based on the USD/MXN rate. From 18.0 to 1.0.

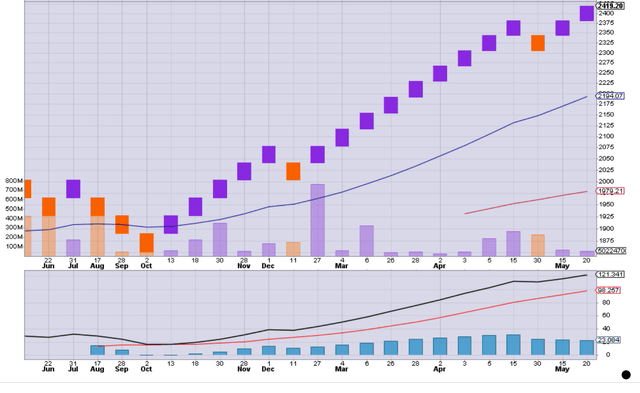

Quarterly Gold Prices – Stock Charts

Regarding the future Second quarter The result will be like thisreported in august, a small impact from La Encantada processing at a lower rate could increase the AISC. However, his AISC margin in silver terms should improve to over $4.00/oz. If achieved, this would represent a nearly 90% quarter-over-quarter increase compared to the $2.19/oz reported in Q1 2024, while the company was still with Gerrit Canyon. The company will also see strong revenue growth after a difficult first quarter performance. online. evaluation Based on approximately 293 million fully diluted shares and a price of $8.00, First Majestic has a market capitalization of approximately $2.34 billion and an enterprise value of approximately $2.5 billion. This continues to make the company one of the highest market cap stocks in its peer group of 300,000 oz producers, and trades at a similar enterprise value.trex gold( OTCPK:TORXF) and K92 mining (

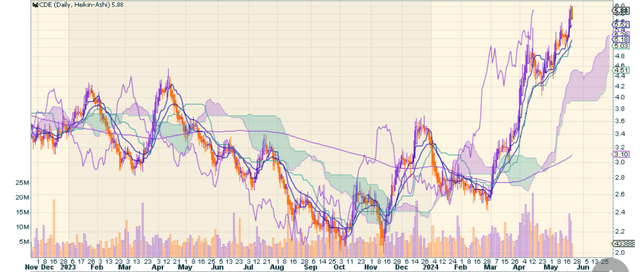

CombinedTo put this in perspective, First Majestic will be lucky to generate $100 million in free cash flow in 2026, while both companies will generate roughly $100 million in free cash flow over their relatively short mine lives.$600 millionin total free cash flow. And while some premium is justified as it is a highly liquid silver producer, First Majestic is one of the most expensive producers in the entire industry when compared to its size, margins, and estimated NAV. continues to be one of theCDE daily chart

CDE daily chart – StockCharts.com

Endeavor Silver (EXK) and cool mining (Electronics and Information Technology), a rising tide (silver price) lifts all boats. Still, I continue to think that stocks like AG are the least attractive way to invest in this sector, and while they may trade higher, there is no way to invest without valuation. And at today’s prices, investors would have to believe that gold and silver prices would average $2,800/oz and $32.00/oz, respectively, for First Majestic to justify Gerrit’s current valuation. I also have to believe they will reopen the canyon. Therefore, I see the stock being fully valued here at $8.00 and see no reason to chase this rally as the stock is currently susceptible to a sharp correction. Masu.

summary

Some high-quality precious metals stocks continue to trade at very reasonable multiples, with First Majestic trading at a higher P/NAV multiple than Wheaton Precious Metals (WPM) and Franco-Nevada ( FNV). This is despite First Majestic being a low-margin silver producer with three short-lived assets and a large portion of its NAV tied to a Tier-2 ranked jurisdiction (Mexico), making the investment This is the exact opposite of what should be sought in (lower). expensive in terms of relative quality, relative value). Rising silver prices will lift all boats, and AG is technically not as overbought as it was in 2021. This suggests that even if the short-term correction is delayed, there may be further upside potential in the medium term. Still, for those looking for value in this sector, I think there are far more attractive bets than chasing First Majestic Silver Corporation, which is up 90% above $7.90 per share.