by calculated risk May 22, 2024 07:00:00 AM

From MBA: Latest MBA Weekly Survey Shows Increase in Mortgage Applications

According to data from the Mortgage Bankers Association’s (MBA) Mortgage Applications Weekly Survey for the week ending May 17, 2024, the number of mortgage applications increased 1.9% from the previous week.

The composite market index, which measures mortgage applications, rose 1.9 percent from a week ago on a seasonally adjusted basis. On an unadjusted basis, the index rose 1.1 percent from the previous week. The refinance index rose 7 percent from the previous week and 21 percent from the same week a year ago. The seasonally adjusted purchasing index decreased by 1 percent from the previous week. The unadjusted purchasing index decreased by 2% compared to the previous week; 11 percent decrease compared to the same week a year ago.

“The 30-year fixed mortgage rate declined for the third consecutive week, dropping to 7.01%, the lowest level in seven weeks,” said MBA Vice Provost and Principal Deputy Economist Joel Kan. “The decline in interest rates from recent highs prompted some borrowers to take action, resulting in increases in both conventional and government refinance applications. VA refinances saw double-digit increases for the third consecutive week, but current refinance levels remain well below historical averages. Despite the recent decline in interest rates, purchasing activity continues to slow, with potential buyers facing limited inventory for sale and high list prices.”

…

The average contract interest rate for 30-year fixed-rate mortgages with conforming loan balances ($766,550 or less) decreased from 7.08% to 7.01%, and points for loans with an 80% LTV (loan-to-value ratio) decreased from 0.63 (including origination fees) to 0.60.

Emphasis added

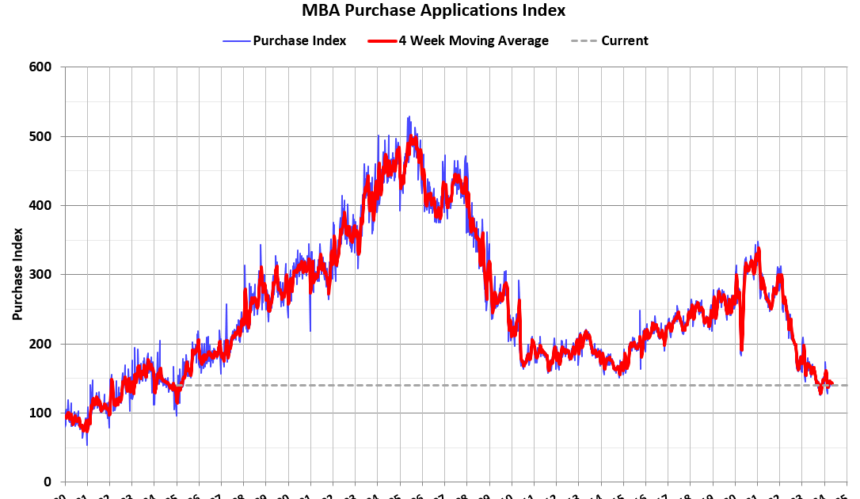

The first graph shows the MBA Mortgage Purchase Index.

According to the MBA, buying activity was down 11% year-over-year on an unadjusted basis.

Red is the 4-week average (blue is weekly).

Purchase application activity is up slightly from its lowest level in late October 2023 and below its lowest level during the housing crisis.

Rising mortgage rates caused the refinance index to decline sharply in 2022, remaining roughly flat since then, and rising slightly recently.