JHVE Photo

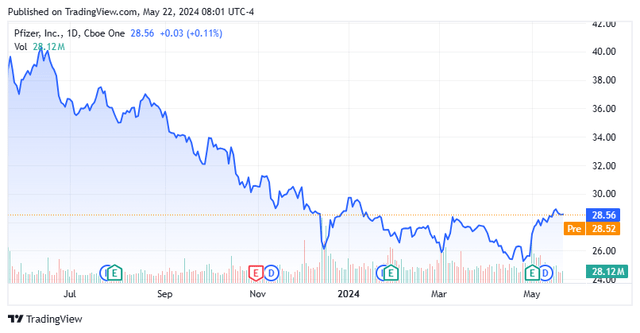

It probably doesn’t need any introduction, Pfizer Japan Inc(New York Stock Exchange:PFE) is a New York City-based biopharmaceutical giant that generated more than $240 billion in revenue from 2021 to 2023, primarily from vaccines and cancer treatments, which are sold in more than 200 countries around the globe. of December 2023 $43 billion Acquisition of Seagen The company has added at least two soon-to-be blockbuster products to the nine products it launched in 2023. This acquisition brings the company’s total number of clinical programs to 112 (as of January 30, 2024). Pfizer was founded 175 years ago in 1849 and went public in 2020. 1942. PFE stock is trading at just over $28.50 per share after hitting an 11-year low in April. The stock has a market capitalization of just over $160 billion, and options on the stock are highly liquid.

Popular item

Since hitting an all-time high of $61.71 Its stock price per share fell by more than half in December 2021, largely due to a sharp decline in demand for COVID-19 products and concerns about patent expirations for many of its best-selling treatments in the coming years.

Cominati. Somewhat surprisingly, Pfizer’s best-selling product remains its coronavirus vaccine Comilnati, with sales of $11.2 billion in fiscal 2023, accounting for 19% of the total. Moreover, the revenue for the fourth quarter of 2023 was $5.4 billion, accounting for 38% of the company’s total. That said, the FY23 numbers were down 70% from FY22, when sales were $37.8 billion, up 3% from FY21. U.S. sales in fiscal year 2023 were just $2.4 billion, even as the FDA continues to amend its emergency use authorization to include updated versions of highly questionable booster shots.

paxrovidIn the same situation is the oral COVID-19 drug paxlobide (nilmatrevir-ritonavir), which generated $18.9 billion in revenue in FY2022, before declining 92% to $1.3 billion in FY2023. It became a dollar. Sold primarily to government agencies, 2023 numbers include $3.5 billion in non-cash revenue reversals, with approximately 6.5 million treatment courses in U.S. government inventory recorded as sales in fiscal 2022. reflects the return of In any case, the demand for this pandemic drug is currently almost non-existent.

Eliquis. Pfizer’s second-largest revenue source in fiscal 2023 was Eliquis (apixaban), an oral blood thinner approved for the treatment of non-valvular atrial fibrillation, deep vein thrombosis, and pulmonary embolism; This amounted to $6.7 billion, an increase of 5% from FY2012. Sold in partnership with Bristol-Myers SquibbBMY)It is scheduled to face generic competition from April 2028.

Prevnar. The company’s next best source of revenue is its pneumonia vaccine Prevnar, which includes Prevnar 13 and Prevnar 20. This brought him $6.4 billion in revenue for FY23, an increase of 3% from FY22. Unlike many other top-selling products, Prevnar 20 is scheduled to have its patent protection lifted until 2033.

IbrancePfizer’s fourth largest seller in FY23 was Ibrance (palbociclib), a CDK4/6 inhibitor approved for HR+/HER2- metastatic breast cancer. Sales were $4.8 billion, down 6% from FY22. It is already under pricing pressure internationally and will lose patent protection in 2027.

VindakelOther asset families in the company’s portfolio that generated more than $3 billion in revenue in FY23 were myocardial and polyneuropathy drug Vyndaqel (tafamidis meglumine), which together with Vyndamax/Vynmac (tafamidis) generated $3.3 billion in revenue. of sales, an increase of 36% from FY22. This is primarily due to significant adoption by prescribers for transthyretin amyloid cardiomyopathy. However, Vyndaqel’s patent protection is scheduled to end in December 2024, although Pfizer has applied for an extension of the patent term until 2028.

Other blockbuster drugs facing imminent generic competition include Inlyta (2025), Xeljanz (2025) and Xtandi (2027).

Acquisition of Seagen

Given that two of the company’s nine blockbusters have experienced significant sales declines and six more are subject to patent cliffs in the coming years, it is no wonder that PFE shares are trading at less than 2.7 times projected fiscal 2024 sales. In response, Pfizer chose to buy itself a new line of patent-protected blockbuster oncology drugs when it acquired Siegen. Specifically, the acquired company markets four products, three of which are antibody-drug conjugates (ADCs), two of which, namely frontline treatment ADCETRIS for advanced Hodgkin lymphoma and urothelial carcinoma treatment PADOSEV, have the potential to become multiple blockbusters. While fiscal 2023 sales are somewhat uncertain due to the December 2023 acquisition, ADCETRIS sales and PADOSEV sales for the first nine months of 2023 were $751 million and $479 million, respectively, up 25% and 46% year-over-year.

In the near future, Pfizer expects to launch five new treatments and six indication expansions covering 12 indications (subject to favorable clinical data) in oncology alone by 2026. Revenues from biologics (such as ADCs) in this area are expected to increase from his 20% to 60% of cancer revenue by the end of the year. Pfizer’s vision is that its oncology drug pipeline could produce eight blockbusters by 2030. For the time being, Seagen plans to shore up sluggish sales of oncology drugs, with sales of $11.6 billion in FY23 and 2022 growth, despite Seagen’s $120 million contribution in late December. It decreased by 4%.

Overall, the company expects to generate $45 billion in revenue by 2030 from new molecular entities, new indications, and business development deals.

strategic priorities

The Seagen acquisition covered to some extent two of Pfizer’s five strategic priorities: becoming an industry leader in oncology and delivering the next wave of pipeline innovation. Other strategic priorities include maximizing the performance of new products, rebalancing our cost base to increase margins, and efficiently allocating capital to increase shareholder value. In rebalancing its cost base to reflect further oncology efforts, Pfizer will invest approximately $3 billion from the fourth quarter of 2023 to fiscal year 2024 to drive annual cost savings of approximately $4 billion. It is planned.

2023 Q4 results:

With this as a backdrop, the company reported fourth-quarter 2023 financial results on January 30, 2024, reporting revenue of $14.2 billion and earnings per share of $0.10 (non-GAAP), compared to revenue of $24.3 billion and earnings per share of $1.14 (non-GAAP). These results resulted in fiscal 2023 revenue of $58.5 billion and $1.84 per share (non-GAAP), compared to revenue of $100.3 billion and $6.58 per share (non-GAAP), reflecting declines of 72% and 42%, respectively. Excluding its Covid-19 products Comirnaty and Paxlovid, Pfizer’s sales improved 8% in Q4 2023 and 7% in FY2023. Note that the Paxlovid reversal in Q4 2023 impacted both GAAP and non-GAAP EPS by $0.54 per share.

Results for Q1 2024:

Pfizer announces first quarter numbers It was a solid quarter for the pharmaceutical giant, at least compared to expectations. Non-GAAP earnings per share were 82 cents per share, beating consensus by about 30 cents. Sales fell 19.5% from a year ago to $14.9 billion, but exceeded analysts’ median estimates by $900 million. Management reiterated its 2024 guidance for revenue in the range of $58.5 billion to $61.5 billion and non-GAAP earnings per share in the range of $2.15 to $2.35.

Balance sheet and analyst comments:

To acquire Seagen, Pfizer incorporated $31 billion in additional debt. by 10-Q According to its first-quarter earnings report, Pfizer had just under $12 billion in cash and marketable securities at the end of March, compared with just over $61 billion in long-term debt. Management remains committed to raising quarterly dividends, even though they account for (annualized) 91% of non-GAAP earnings in FY23E and 78% of non-GAAP earnings in FY24E2024. The first stanza of the year increases from $0.01 to $0.42 per share. EPS. With notable net leverage (target 3.25x), Pfizer has no plans to buy back shares in 2024, repeating last year’s inaction.

With the pandemic days fast fading into the rearview mirror, the Street is largely unfazed by management’s attempts to negotiate the upcoming patent cliff for six of the seven non-COVID blockbuster treatments. At the moment, hold/neutral ratings from analyst firms slightly outnumber buy/outperform ratings from the analyst community. On average, they are: expect Pfizer earned $2.35 (non-GAAP) per share on revenue of $60.6 billion in FY24, and is expected to follow with earnings of $2.74 (non-GAAP) on revenue of $62.9 billion in FY25. There is.

verdict:

Despite a 42% decline in revenue in 2023 compared to 2022, Pfizer Inc. has more than 620 million people worldwide using its treatments, nine FDA approvals, and a global It has generated more pharmaceutical sales than any of the companies above and has taken significant steps to address current and impending declines in product sales. Pfizer’s stock is reasonably valued based on its expected 2025 EPS of 10.4, especially considering its current yield of 5.9%. So the stock, which just hit an 11-year low in April, appears to be doing well. covered call candidate. This strategy provides some downside protection and increases yield by capturing option premiums on top of quarterly dividend payments.

Note: This research was initially made available exclusively to members of our investment group one week prior to the release of our first quarter results, when the stock was trading at approximately $26.00 per share. Updated to include first quarter results and other data reported since then.