sol stock

paper

Pen Entertainment Co., Ltd. (Nasdaq:pen) recently announced its first-quarter results, but once again disappointed investors, with the stock falling more than 17% in one day and ending the day down about 9%. In my opinion, in the current stock market, investors value companies that: We aim to generate profits quickly, rather than incurring high costs through investments without a profit plan. This seems to be the case with PENN, with ESPN bets reducing revenue and increasing costs. However, despite disappointing first-quarter results, there is still potential. With historically low valuations in terms of price-to-sales multiples, it’s worth investors being patient as the interactive sector could spark upward momentum in the stock.

First quarter earnings summary: Bad results, but some good news

Review of first quarter earnings

The company’s performance report

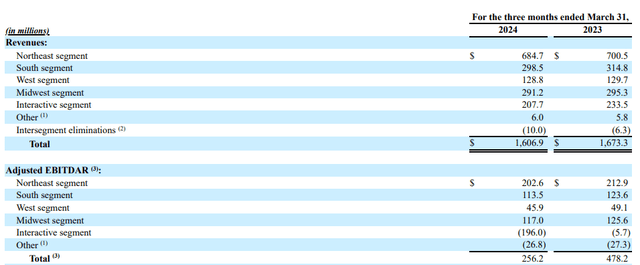

Compared to the overall First quarter of 2023the revenue of 1st quarter Cost of goods sold decreased by 4% in the first quarter of 2024, and gross profit margin plummeted from 41.8% to 29.6%. Cost of goods sold for the first quarter of 2024 was $1,130.7 million, compared to $973.8 million for the first quarter of 2023. Approximately $157 million of the difference is due to gaming expenses attributable to ESPN Bet, which is approximately $150 million, according to the company’s earnings report. Looking at these numbers, I believe ESPN Bet continues to be a loophole that increases costs for the company.

Looking more closely at each segment, the retail business recorded $1.4 billion, down approximately 3% from the first quarter of 2023. This decrease is understandable as he was adversely affected by the bad weather in January. You will recover gradually. On the margin front, adjusted EBITDAR margin decreased to 34.1% from approximately 35.5% in the current quarter due to higher costs such as personnel expenses. In the interactive division he recorded a loss of $207.7 million, and in EBITDAR he incurred a loss of $196 million. Compared to the first quarter of 2023, significant expenses were incurred and revenue decreased by 11%.

Revised guidance

The company has updated its guidance for 2024. The company now expects retail segment revenue to be between $5.61 billion and $5.76 billion, and EBITDAR between $188 million and $2.0 billion. Compared to previous guidance, revenue may increase slightly, but margins will be lower. As for the interactive division, the company currently expects it to generate revenue of $1.02 billion to $1.07 billion. This is a significant decrease from the company’s previous guidance, which had expected sales to be between $1.28 billion and $1.42 billion. In contrast, the company expects higher losses in the range of -$475 to -$525. Overall, we think this guidance is negative and may have put pressure on the stock.

Qualitative points

Although the first quarter earnings report was disappointing, from my perspective there are some positive steps the company took during the quarter.

First, Disney CTO Aaron LaBerge, who has led Disney’s technology initiatives such as Disney Plus, has been appointed CTO of PENN Entertainment. One of the key factors the company needed to retain sports bettors was to improve the user experience of the ESPN Bet application. I think management understands what the problem is and is heading in the right direction by focusing more on improving the ESPN Bet application overall and making an effort to increase parlays similar to their competitors.

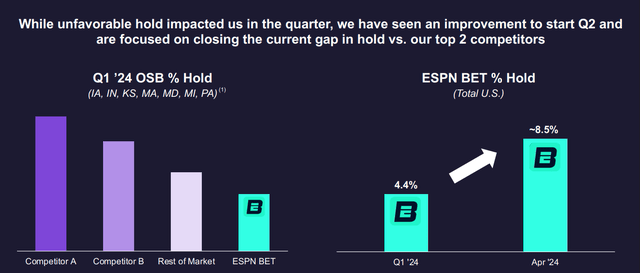

Second, ESPN Bet’s performance improved in terms of hold percentage despite a decline in market share. To summarize ESPN Bet’s performance in Q1 2024, the sportsbook achieved an increase in hold rates with fewer promotions, but experienced a decline in market share despite interstate differences. These states are examples.

Marylandfrom January to March, ESPN Bet’s market share was 6.8%, 5.2%, and 6.1%, respectively, while its hold percentage remained at 4.4%, 7.9%, and 1.5%, respectively.

in iowaFrom January to March, ESPN Bet’s market share was 7.0%, 5.3%, and 4.3%, respectively, while its ownership percentage was 0.4%, 4.8%, and 7.4%, respectively.

About Massachusetts From January to March, ESPN Bet’s market share was 7.1%, 5.8%, and 5.4%, respectively, while its hold percentage was 4.5%, 7.3%, and 7.5%, respectively.

Penn Entertainment Financial Results Presentation

For AprilThe company reported that its overall ownership rate improved to 8.5% from 4.4% in the first quarter. In my opinion, ESPN Bet’s market share and hold rate are still not quite there, but they are moving in the right direction.

- We calculated market share by dividing the company’s handle by its total handle.

- We calculated the hold ratio by dividing the company’s earnings by the handle.

- We’ve looked at it a few times, but we recommend investors look at the numbers independently.

evaluation

As in the previous article, we will continue to use the P/S multiple to see if PENN is undervalued. To better understand why I use his P/S multiple and follow the company’s stock price history, I recommend investors read the article below. My previous post.

In my previous article, I argued that the historical low for the company’s valuation in terms of P/S multiple was around 0.3. The stock price fell sharply after the first quarter results were released, but rebounded after hitting $13.5. The revised earnings guidance gives the company a P/S multiple of approximately 0.306 at a stock price of $13.5, which I believe is a near-term floor. At the current market capitalization of $2.4 billion, the P/S ratio remains at around 0.36. We believe that negative factors such as the huge loss related to ESPN Bet are partially reflected in the stock market, and the current market valuation is by no means expensive.

danger

- Potential for disappointing earnings

Revised guidance related to ESPN Bet announced during the first quarter conference call is based on April hold rates and current market share trends. However, the approximately 8% hold rate recorded in April is somewhat high compared to historical trends. Investors are encouraged to track ESPN Bet’s monthly handle and hold rate from each state’s official homepage to see if the company can meet guidance.

- Decreasing discretionary spending

We believe that the basic scenario for investing in the company is that the retail sector acts as a cash cow supporting the investment in ESPN Bet. However, if rising interest rates and inflation reduce disposable income, consumers will likely spend less on casinos.

My investment approach at PENN focuses on deep value rather than a growth-oriented style. If money flows back into growth stocks such as AI-related companies, I think they will be less likely to attract stock market interest and investors may need to be patient for a longer period of time.

conclusion

Although first-quarter revenue fell short of expectations, given that ESPN Bet is gradually moving in the right direction and PENN’s current valuation is near its historical bottom, I maintain a buy recommendation on the stock.