PM Images/DigitalVision (via Getty Images)

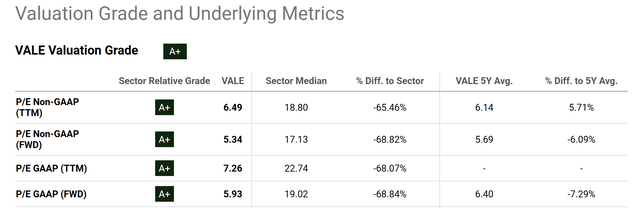

VALE stock trades at 5x FWD P/E only

Vale SA (New York Stock Exchange:veil) is likely attracting the attention of investors looking for deep value investment opportunities. In fact, the stock’s valuation metrics are very attractive on both an absolute and relative basis. More specifically, the following diagram shows: VALE evaluation index Comparison of sector median to historical average. As you can see, the stock is currently trading at just 5.3x FWD P/E (on a non-GAAP basis). In contrast, the median forward P/E ratio for this sector is over 17x. As such, his P/E multiple for VALE is only about 1/3 of the sector median. Even compared to the company’s historical averages, it trades at a notable discount of 6% to 7% on FWD GAAP P/E or non-GAAP P/E.

Searching for Alpha

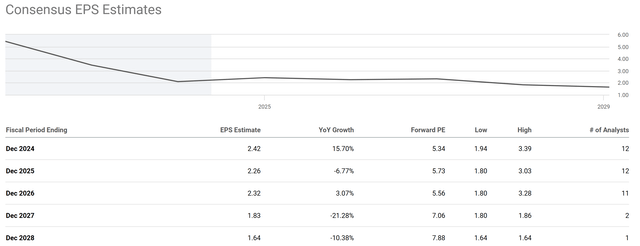

From this background, the rest of In this article, we’ll explain why the stock is so cheap for good reason (or good reason). First, the market has a fairly negative view of his EPS growth, as seen in the next graph below. This graph shows that Consensus EPS estimate Outlook for VALE stock over the next five years. As you can see, the market consensus expects VALE’s EPS to decline overall over this period. EPS is expected to grow to $2.42 in fiscal 2024, an increase of 15.7% year over year. After that, EPS is expected to trend downward overall. Overall, the downward trend is expected to continue in FY2027 and FY2028, with EPS expected to be around $1.64 in five years. As a result, its estimated FWD P/E will rise significantly in the coming years from its current 5.34x. For example, by the end of FY2024, the estimated P/E will rise slightly to 5.73x and by FY2028 to 7.88x.

Next, I explain why I see such a bleak outlook as very likely given its exposure to China and capital projects.

In search of alpha

VALE stock: Too much exposure to China

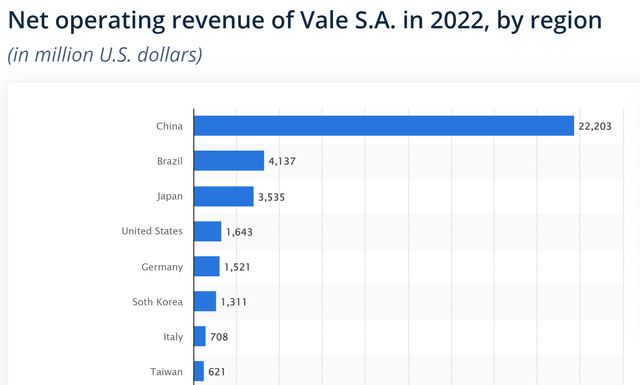

The biggest factor in my mind is the downturn in the Chinese economy and VALE’s dependence on the Chinese market. As discussed in Previous article:

China’s real estate and infrastructure markets (both big consumers of steel products) continue to struggle, and the recent stimulus appears to have had limited effect so far in my eyes. We remain concerned about problems in the real estate sector of China, which is a large consumer of raw materials. There are signs that these problems are far from over, including sluggish new home sales, potential default risks for major developers, and hidden bad debt issues.

As you can see from the chart below, VALE is very sensitive to the above concerns as China contributes significantly to the company’s operating profit. In 2020, the company earned more than $22 billion in operating revenue from the Chinese market. To put things into better context, the second-largest market (home to Brazil) had operating profits of only about $4 billion.

Certainly, the price of iron ore (VALE’s flagship product and key raw material for steelmaking) could move in a direction more favorable to the company. However, I believe that the slowdown in Chinese demand is a structural issue and will continue for the next few years (say 3-5 years), and if iron ore prices rise, the slowdown in demand will lead to a decline in prices. It will more than offset the movement.

statistics

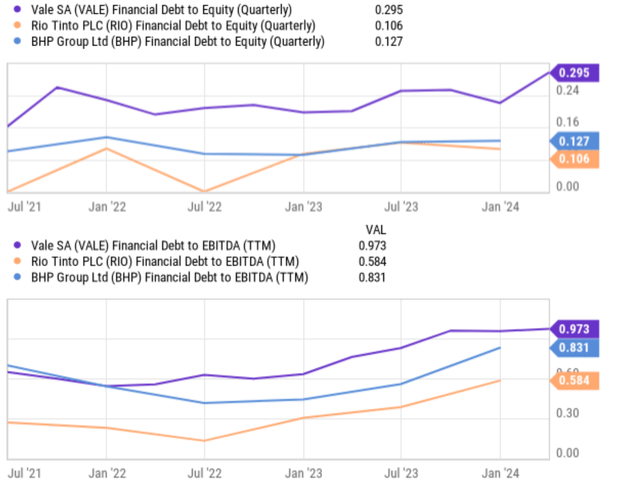

VALE stock: balance sheet and capital expenditures

As a stock that is very sensitive to commodity prices, VALE’s balance sheet is a little weaker than I like. As such, I believe VALE’s balance sheet is overextended both in absolute and relative terms. For example, VALE’s debt-to-equity ratio is currently 0.295x (as shown in the top panel of the chart below). In my opinion, this is a bit too high for a company with volatile earnings. Relatively speaking, this is significantly higher than other large miners. For example, RIO and BHP’s debt-to-equity ratios are just 0.106x and 0.127x, respectively, less than half of VALE. We see the same thing with other indicators. For example, the bottom panel of the graph shows VALE’s debt-to-EBITDA ratio compared to RIO’s and BHP’s debt-to-EBITDA ratios. As you can see, VALE’s EBITDA to EBITDA ratio is 0.973x, which is also significantly higher than his RIO’s 0.584x and BHP’s 0.831x.

search for alpha

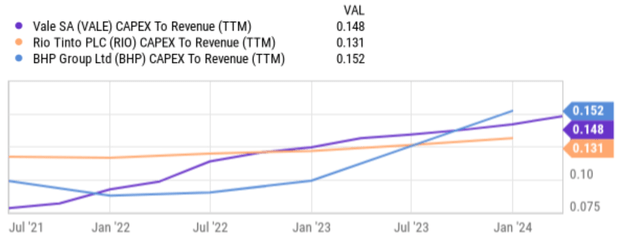

Meanwhile, VALE has significant capital investment needs (see chart below) and expects its capital expenditure budget to continue to increase over the next few years. For example, CAPEX expenses last year were approximately $5.9 billion, approximately 9% higher than the approximately $5.5 billion budget for 2022. Most of the funds were earmarked for iron ore expansion projects. This will definitely contribute to profits. if Iron ore demand and prices move in a more favorable direction. However, as discussed above, I am not optimistic that such a favorable scenario will occur in the coming years.

In search of alpha

Other risks and final thoughts

In terms of upside risk, the company is also paying significant attention to its nickel business. We expect that a portion of the aforementioned capital expenditure budget will be used in this area in order to diversify our revenue sources. Additionally, the company has some involvement in the copper business, but copper and nickel together will only account for about 18% of its 2023 revenue. Other upside risks include expansion plans in Brazil and Indonesia and potential acquisitions. For example, the company has an agreement with Anglo American to buy a 15% stake in Anglo American Brasil, which owns the Minas Rio iron ore complex.

Overall, VALE stock shows some signs of a value trap. The current low P/E ratio of around 5x may seem very attractive, but in my opinion there are several good reasons why the stock is cheap. The implied FWD P/E is much higher considering the stock’s lackluster growth prospects. Analyst estimates predict that the company’s EPS will decline in the coming years, but such a gloomy prediction seems quite plausible given the weak Chinese economy and VALE’s heavy exposure to the Chinese market. That’s what I’m looking at. Finally, the combination of leverage and high capital expenditures further exacerbates my concerns about future profitability.