Monty Rakusen/DigitalVision via Getty Images

The Buy Thesis

WEC Energy Group (NYSE:WEC) has a strong track record of growth and a clear pathway to continue that growth. Energy demand ramping up in WEC’s markets as well as a need for revitalized energy infrastructure has paved the way for greater than $20B of fresh investments from WEC. These come at an expected ROE of 9.8%-10% which can fuel significant EPS growth for the next 5 years.

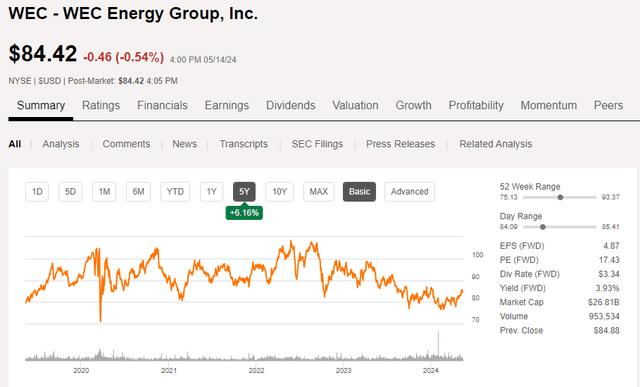

This growth pathway is right in line with what WEC has produced for the last 2 decades, but in the past, investors have had to pay a premium to get the reliable growth. Over the last 5 years, WEC’s share price has not kept up with its dividend, its GAAP EPS or its cash flows such that WEC can now be purchased at an unusually high dividend yield and unusually low valuation multiples.

Let us begin with a review of the demand environment for a Wisconsin-based electric utility and follow with WEC’s projects to address the incremental demand. Finally, we will analyze WEC’s valuation and risks to assess its overall opportunity as an investment.

Growing and changing demand for energy in Wisconsin

Wisconsin is a low population density state. It has long had a substantial agricultural economy and is increasingly important for manufacturing. The capital city, Madison, is a bit of a midwestern tech hub with a highly educated population and is particularly known for its biological sciences The University of Wisconsin-Madison, my alma mater, is responsible for the discovery of Warfarin and the process of enriching milk with vitamin D.

31% of Wisconsin’s energy is consumed for industrial purposes. That is likely to go even higher as data centers are moving to Wisconsin in a big way.

“Microsoft will invest $3.3B between now and the end of 2026 to expand its national cloud and AI infrastructure capacity through the development of a state-of-the-art datacenter campus in Mount Pleasant, Wisconsin.”

The draws for Microsoft to locate in Wisconsin are:

- Low cost of living (cheaper qualified employees)

- Abundant land, wind, and sun resulting in cheaper energy inputs

AI datacenters are power greedy, so reducing cost of power is a significant consideration.

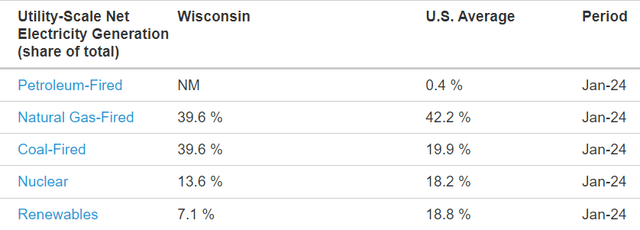

Presently, Wisconsin’s power generation is primarily natural gas and coal.

The nuclear comes largely from a single plant in Point Beach, with which WEC has a long-term power purchase agreement.

Note that Wisconsin’s 39.6% coal generation is substantially higher than the US average at 19.9%. As you know, the US government as well as some parts of private industry are pushing for a transition away from coal. Decommissioning of coal power plants is already underway and is expected to slowly happen through about 2035. For WEC, there are 2 key financial implications of the transition away from coal:

- Coal plants are in the cash cow stage. With plans to shut down, almost no capex is being spent on the plants other than safety related which makes it very high cashflow.

- Capital projects in natural gas, wind, solar and perhaps nuclear are abundant as a means of servicing both incremental demand and replacing existing coal. Since the government is pushing for the transition in power generation, it is inclined to approve the rate packages which for WEC are coming at ROE of about 9.8%-10%.

Abundant cash flow to fund growth

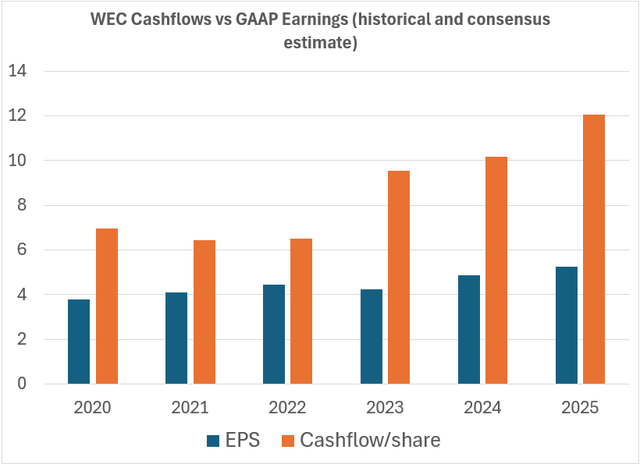

WEC’s cash flow is significantly larger than its earnings.

Consensus Data from S&P Global Market Intelligence, graphed by 2MC

So while WEC has consistently raised its dividend for 21 years straight, its cash flow greatly exceeds its payout.

- $3.34 – annual dividend

- $10.17 – 2024 Cash flow per share

That leaves $6.83 per share of retained cash flow.

With cash flow expected to increase further going forward, WEC has quite a bit of capital available to invest.

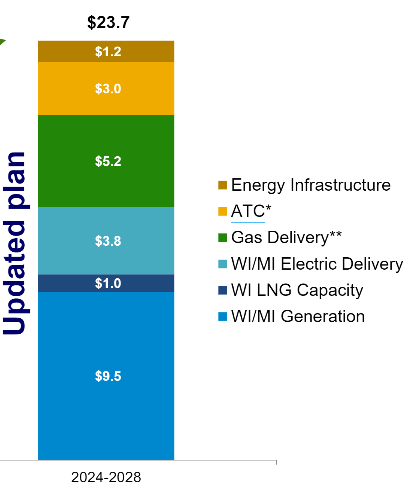

It has identified $23.7B in projects through 2028.

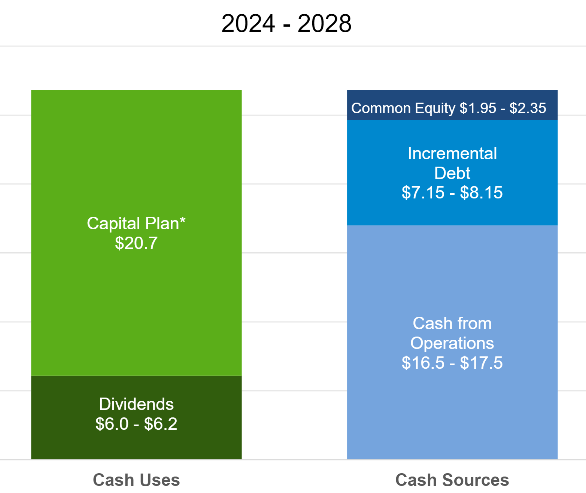

WEC

Despite the magnitude of investment, most of it is to be funded with retained cash flows.

WEC

As such, WEC anticipates only having to issue a tiny bit of equity. These retained cash flows make the projects more accretive to earnings per share and is likely why WEC’s growth rate is a couple percentage points higher than peer utilities.

Transmission and other infrastructure

Energy generation used to be about megascale plants – a concentrated source of generation which is then distributed throughout the grid.

It is increasingly more diffuse, with more power generation sources in more locations. This is necessitated by wind and solar, which tend to be more spread out. As power comes from a broader variety of sources and more locations, transmission needs to be built out to service generation and distribution.

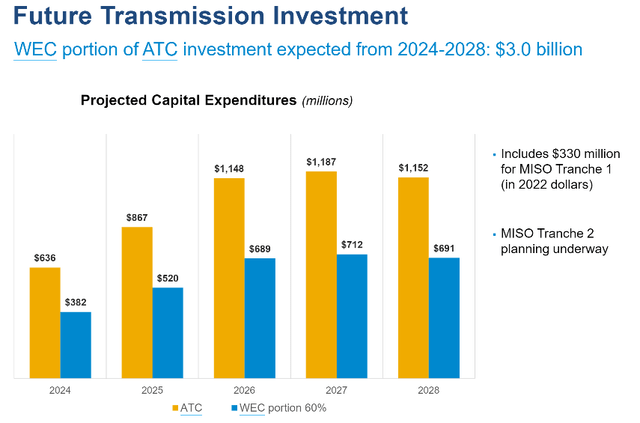

Through its 60% ownership of American Transmission Company, or ATC, WEC will be investing about $3B in transmission buildout.

Solar and wind

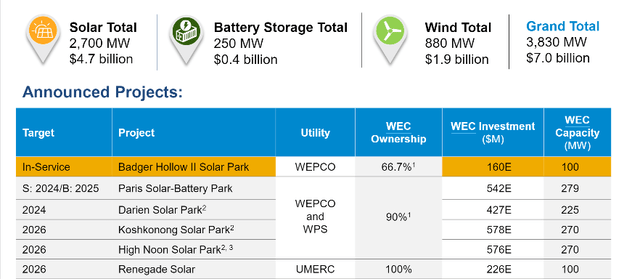

While WEC’s current generation is overwhelmingly natural gas and coal, it is building out about $7B in solar, wind and batteries with the following delivery dates.

Each project comes with rate cases anticipated to result in ROE just under 10%.

This ROE strikes me as quite standard for electric utilities. WEC’s higher growth rate comes from its particularly large volume of projects. $23.7B in the next 4 years is quite a bit for a company with a $26.6B market cap.

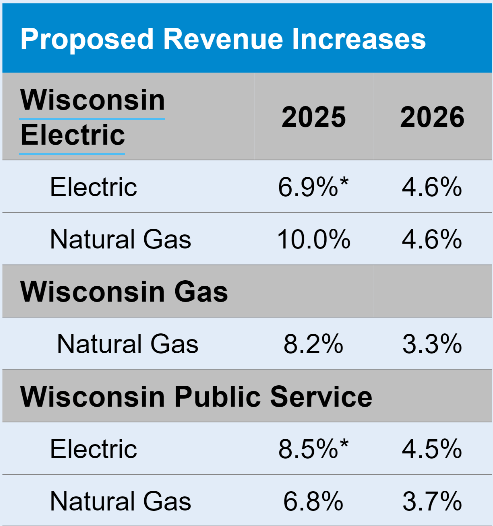

External growth is likely to be supplemented with organic growth from rate increases.

WEC’s Rate cases

Inflation of the past few years along with higher cost of capital makes forward energy production more expensive. Utilities pass these costs along to consumers by submitting rate cases. WEC has some outstanding rate cases which, if approved, will commence starting in 2025.

Specifically, they are requesting revenue increases of 6%-10% across various segments.

WEC

I anticipate these cases passing for 3 reasons:

- In-line with inflation

- WEC charges rates below national averages

- WEC’s ROE is industry appropriate.

Summary of growth outlook

An environment of increasing demand facilitates substantial investment volume, which at standard ROEs, WEC can turn into a healthy amount of growth. This growth is in-line with WEC’s track record and also in-line with consensus estimates. As such, I do not anticipate much pushback on the idea of WEC continuing its steady fundamental trajectory.

In my opinion, the aspect which makes investment in WEC opportunistic is that while its growth is normal relative to the company, its valuation is well below normal. By buying at the discounted price, it amplified forward expected returns via 2 mechanisms:

- Higher going in yield

- Capital appreciation as WEC prices back toward its normal range

WEC Valuation

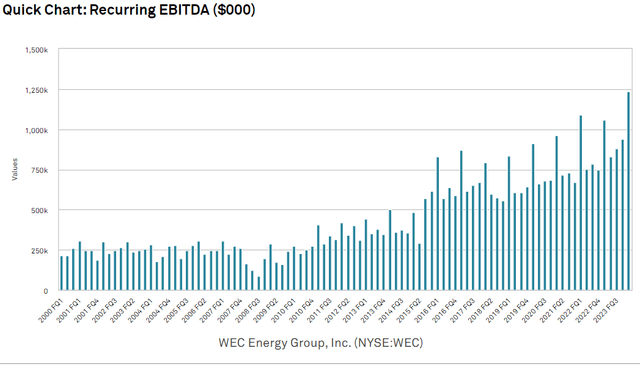

WEC’s market price has largely stagnated for the last 5 years.

During those same 5 years, fundamentals continued to grow. EBITDA generation has improved steadily.

S&P Global Market Intelligence

Earnings per share and cash flow per share also increased materially, which allowed the company to raise its dividend significantly.

Price stagnation combined with fundamental growth over the past 5 years has made WEC a substantially better value.

Price to cash flow has dropped to about 8X.

S&P Global Market Intelligence

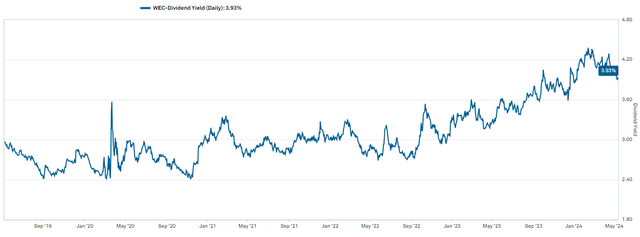

Dividend yield has increased to around 4%.

S&P Global Market Intelligence

Price to earnings is down to 19X from its usual mid-20s.

S&P Global Market Intelligence

At this cheaper valuation, I believe WEC presents a strong forward return. The 4% dividend yield in combination with roughly 6%-7% annual earnings per share growth suggests forward annual returns of about 10-11% assuming the multiple stays the same.

Interest rate counterargument

Many may suggest that the reason WEC has gotten cheaper is because interest rates went from near 0% to over 4%. As the “risk free” rate serves a key role in the denominator when determining the present value of a series of cash flows, one could make the argument that multiples should have come down.

If a 25X multiple was appropriate for WEC in the low interest rate environment, perhaps a 19X multiple is appropriate for WEC in the now moderate to high interest rate environment.

That is a fair argument. I largely agree with the concept. The opportunity is how it relates to relative valuation.

The denominator effect of higher interest rates should affect ALL financial instruments. Price to earnings ratios should be lower across the board. Yet, it seems like only utilities and REITs got the memo.

S&P earnings multiples remain high. NASDAQ multiples are sky high.

So, while WEC perhaps should have gotten cheaper given the move in interest rates, the way it played out is that it got much cheaper relative to the rest of the market.

Given forward growth rates and multiples, I anticipate WEC outperforming the market.

Risks to thesis

With how utility price regulation works, the returns to the utility company should be equally good whether the mode of production is expensive or cheap. As such, a utility can largely be agnostic to type of production and pivot to building whatever type is in demand by customers and by regulators.

As long as projects are executed well and underwritten conservatively they are profitable. The risk would be that some change to operating efficiency happens after underwriting such that costs come in above budget or production comes in below budget. In such an event, the rate which was anticipated to generate a 10% ROE could come in well south of that.

WEC has a strong execution track record, but the world is changing. Different modes of power and different grid transmission could perhaps throw a wrench in underwriting. A key early indicator would be to watch for projects completing on time and generating the anticipated level of power.

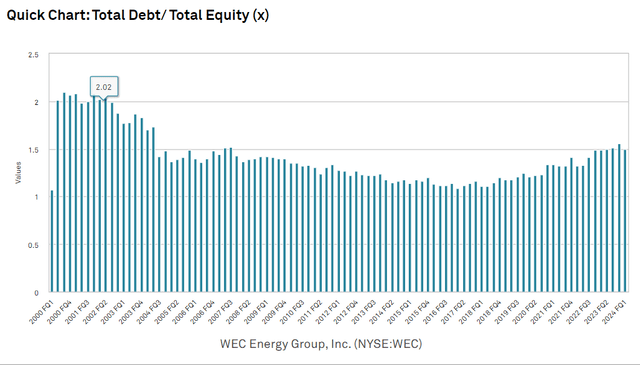

Another risk to watch is that WEC operates at fairly high leverage.

S&P Global Market Intelligence

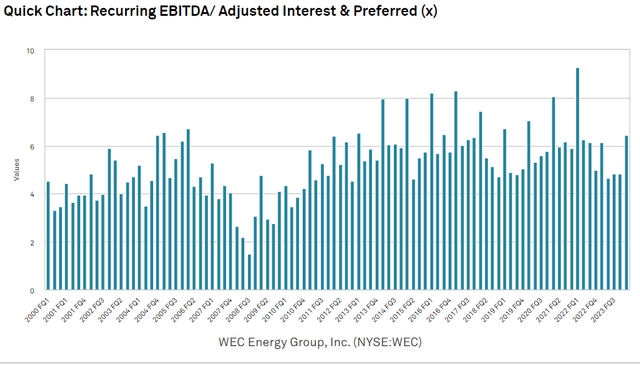

Extremely high cashflows make the debt well covered by EBITDA at a rate of 5X to 6X.

S&P Global Market Intelligence

That is enough to earn WEC an A- credit rating from the major agencies. Thus, it is a creditworthy company, it just should be noted that it is a capital-intensive business and the debt load can amplify changes.

Wrapping it up

Overall, I view WEC as a steady grower well positioned to extend its 21-year dividend growth streak. Steady cash flows are only opportunistic when bought at the right valuation, and given how far WEC’s multiples have fallen, I like it here.