Miscellaneous goods photos

Despite NII’s weaknesses, solid alpha

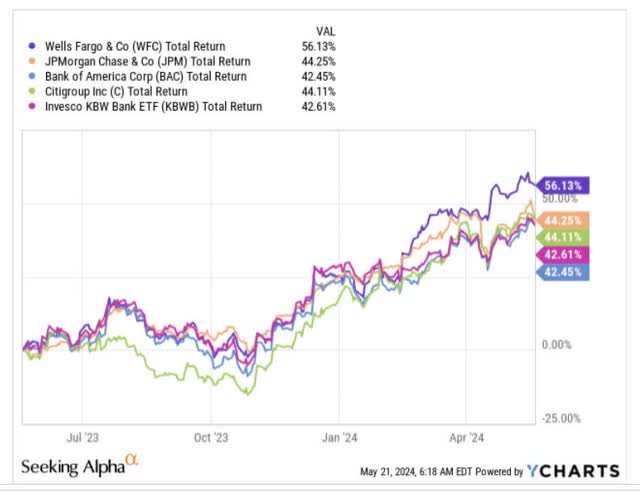

Over the past year, Wells Fargo’s stock price (New York Stock Exchange:W.F.C.), third largest The company, which is the largest bank in the United States by market capitalization, provides shareholders with: At over 56%, it outperforms not only the big banks, but also a diversified portfolio of 25 other bank stocks.

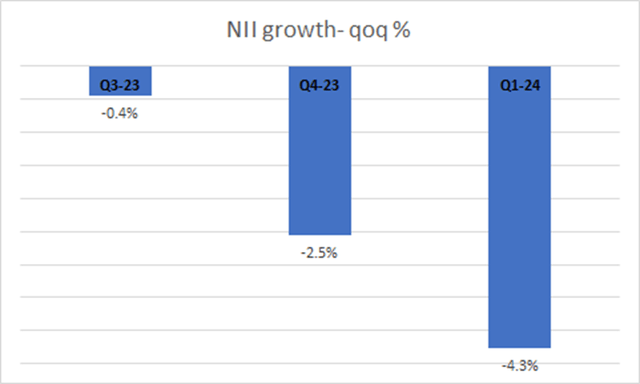

WFC’s outperformance is interesting to note, given that we were not in the most favorable environment for the development of NII (net interest income), a traditional indicator of a bank’s business performance. For context, his NII in WFC peaked in his fourth quarter of 2022. $13.4 billion However, it has since declined consecutively over the past five quarters, and the pace of decline has worsened over the past three quarters. On a year-over-year basis, NII is currently shrinking at an 8% pace, with management pointing out that it is shrinking at a similar pace. Annual pace (7-9% (decreased in 2014).

Much of this weakness is due to rising funding costs and WFC customers’ migration to higher-yield deposit products. For example, the percentage of interest-free deposits is 35% Of the total deposit composition at the end of Q4 2022, only a small 26%Meanwhile, note that average deposit costs rose 174 bps in the first quarter, while average lending yields increased only 69 bps.

In the current high interest rate environment, WFC lending is down both QoQ (-1%) and Q1 annual (-2%), and there will be little appetite for lending growth. . As of the first quarter, WFC’s loan growth was trending lower than management expected, but they said NII declines could bottom out by the fourth quarter and pick up in the second half. thinking about. However, note that WFC bases this scenario on the expectation that the Fed will cut interest rates three times in FY24. However, from the looks of it, it is likely that there will only be two rate cuts this year, totaling 50 bps.

While NII’s progress has been a challenge for WFC, the market is likely taking note of the resilience of its non-interest income component, which has grown at a solid 17% annually over the past two quarters. Instruments such as asset management fees and trading are rising due to market strength. Management hinted that it is likely to perform even better in the second quarter, given that it is linked to current market valuations. April 1st. Compared to some of its peers, his WFC’s thrust in the area of trading and investment banking is not that great, but considering the low base of this business, the potential to grow at a high rate is very high. Please note that it is expensive. WFC’s transaction fees rose 8% in the first quarter, even though, unlike its peers, it is not in the business of financing these transactions.

Hopes for the abolition of asset limits

All of this could change for the better if the WFC’s six-year asset cap of less than $2 trillion is lifted. The market is still looking for clear clarity from the Fed, but there is hope that we will get some clarity from the Fed. Q1-25once the presidential election is over.

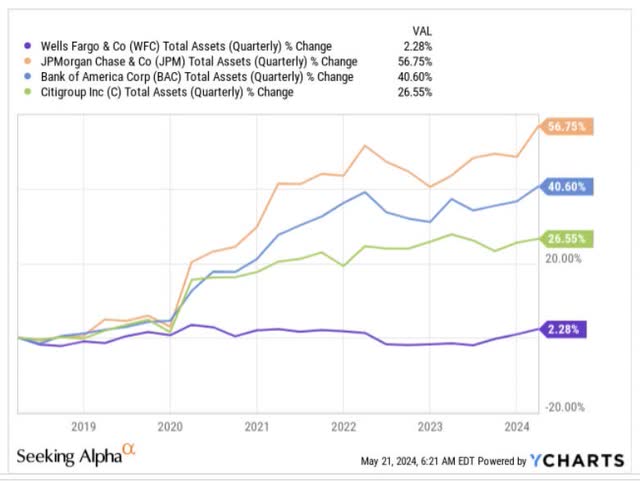

If WFC gets a reprieve, just think about the potential revenue growth it could see over the next few years as it deploys more and more assets into more lucrative areas like investment banking and trading, which haven’t yet fully built out their cloud. As you can see in the image below, WFC is priced at $1.2 billion compared to its largest peers (JP Morgan Chase, 2016).J.P.M.), Bank of America (BAC), and Citigroup (C)) increased their asset base by 26% to 57% during a period when WFC had to remain flat given the asset cap.

This pent-up powder is likely one reason why the market continues to price WFC stock higher, even though the broader environment is less favorable for banking.

Meanwhile, the bank continues to improve its cost base efficiency, with headcount and branch numbers down 9% and 4%, respectively, and staffing adjustments. Continue Throughout the year, we put our Opex components in a healthy position by the end of the year.

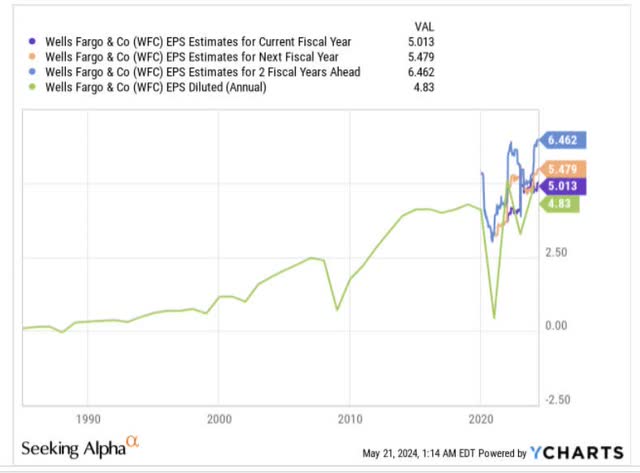

As it stands, WFC’s ROTCE (Return on Tangible Common Equity) is 12.2%, but the long-term goal is to take this to the 15% level, which certainly doesn’t seem that unrealistic given the extent of it. is. The percentage of revenue growth that the sell side has budgeted to WFC over the next three years. To expand on this note, revenue growth over the next three years is likely to expand to 4% in FY24, 9.3% in FY25, and 18% in FY26, respectively.

Risks – Why WFC is not a good buy now

expensive rating

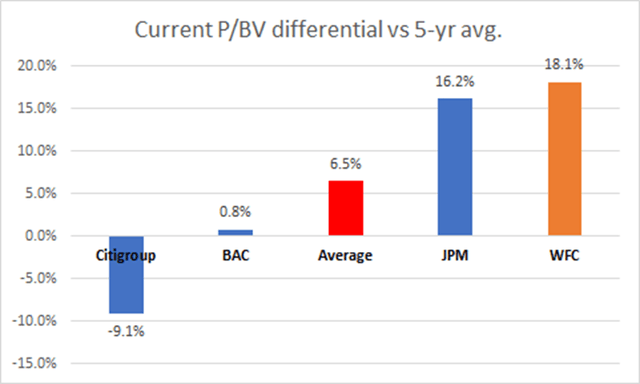

Even though WFC may have some favorable prospects, investors may want to note that WFC’s current valuation is already quite impressive compared to its historical average. To explain this in more detail, WFC’s price-to-book ratio is currently 1.31x, which is 18% above its five-year moving average of 1.11x. In contrast, the three largest banking peers currently trade at an average price-to-book value premium of 6.5% to Citigroup.C) is trading at a 9% discount.

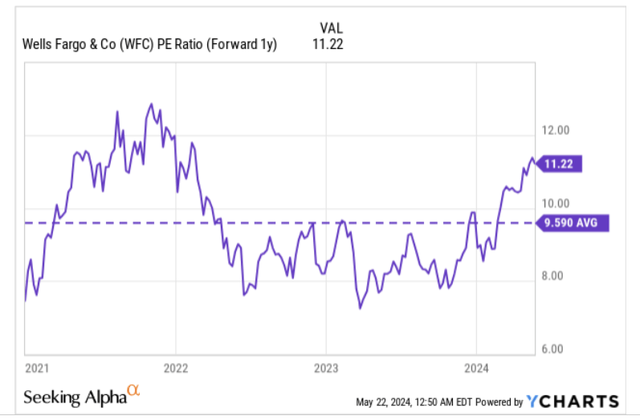

Furthermore, in terms of forward P/E ratio, the stock is trading at 11.22 times, which is a 17% premium over the five-year average, which is not at all reassuring compared to the history of the stock itself.

unattractive yield

WFC stock is also popular among dividend investors, but considering how much the stock has typically paid in dividends over the past five years, you probably won’t get much benefit from buying it at its current yield. As it stands, WFC’s yield is just 2.31%, which is nearly 90bps below its five-year average and not very attractive. Judging from the past two years of dividend hikes, we could see an additional $0.05 hike, bringing the quarterly dividend to $0.4, but even at that level, CMP still has a standard yield of just 2.61%. It will be below.

Risk and reward on the chart is not very good

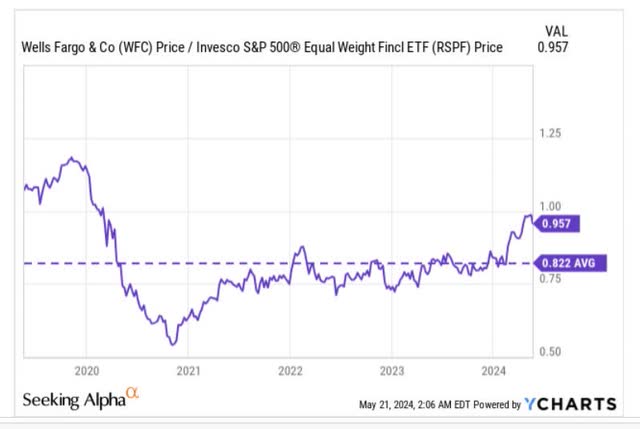

We also believe that rotation specialists looking for opportunities within the financial stocks that make up the S&P 500 are unlikely to be interested in WFC at this time. The graph above shows how his WFC’s relative strength ratio to an equal-weighted portfolio of financial large-cap stocks has recovered above average reversal and is currently trading at a 17% premium to its long-term average. is shown.

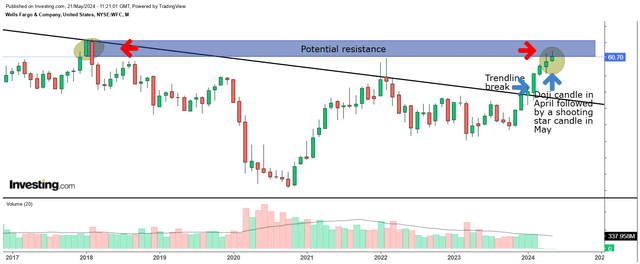

And based on where WFC stock itself currently sits on the long-term monthly chart, it’s hard to get too excited about long positions at this stage.

Note that the last time the stock peaked was at the $66 level in January or February 2018, when the Federal Reserve’s asset cap went into effect. Since then, the stock has mainly trended downward, with a clear downward trend line limiting efforts to stem the upward trend. However, in early February of this year, we finally saw some traction with the stock breaking through the trend line, and there is no doubt that that technical event added even more momentum to the bulls’ pursuit.

WFC stock has been performing well for a while now, but it may warrant some caution given the top-heavy nature of the candlesticks over the past two months. Basically in April, Doji The one in the shape of a candle indicates fatigue and indecision of market participants, following this: shooting star The May candlestick typically appears after an uptrend and signals a reversal (unless sentiment reverses significantly in the remaining eight trading sessions of the month).

On the other hand, consider that the stock is just a breath away from hitting its old resistance level from 2018 at $66. While we acknowledge that WFC’s CET-1 level is 11.2%, currently 230bps above the regulatory minimum, and that there is plenty of room to proceed with share buybacks, given the current share price level. We believe share buyback support may slow in 2019. these levels. And even though management plans to spend more on stock buybacks this year than last year. ($11.8 billion), already deployed 50% of last year’s total in the first quarter alone, and quarterly execution rates are expected to slow.

Overall, we think WFC is a holdout at current levels.