James Bray

introduction

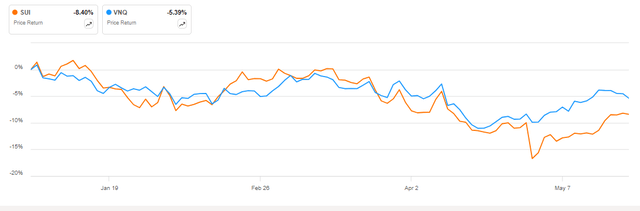

Sun Community (New York Stock Exchange:Sui dynasty) is a Vanguard Real Estate Index Fund ETF (VNQ) So far in 2024, the decline has been in the low single digits.

SUI vs VNQ in 2024 (In search of alpha)

I think this makes the stock more attractive. The company offers an enterprise value yield of 6.3%, recession resistance given the nature of its low-end portfolio, and net operating income (NOI) growth that beats inflation.

Company Profile

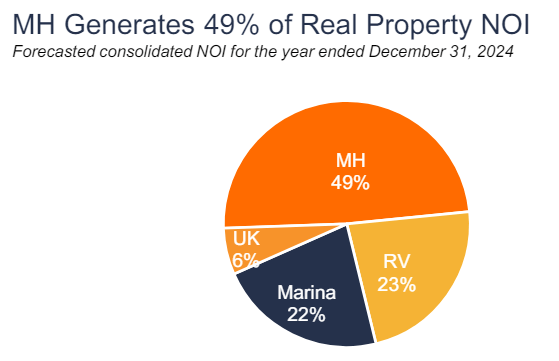

Access results for all companies hereSun Communities is a prefabricated housing REIT with a highly diversified revenue base, with manufactured homes (MH) accounting for 49% of NOI, recreational vehicles (RV) 23% and marinas 22%. Smaller locations account for the remaining 6% of NOI.

Breakdown of operating income in 2024 (Sun Community May 2024 Presentation)

Operational Overview

Sun Community Report Occupancy US/Canada and In the UK, US/Canada MH and RV occupancy was 97.5% at the end of Q1 2024, an increase of 0.6% year-over-year. In contrast, the UK occupancy rate was 88.9%, down 1.2% year-on-year, indicating that the UK portfolio is in serious trouble and underperforming.

Core FFO Earnings per share for the quarter were $1.19, down 3 percent compared to the year-ago period, driven by higher cost of services and interest expense, partially offset by higher revenue.

During the quarter, Sun issued $500 million of five-year senior unsecured notes at an interest rate of 5.5%.

Updated outlook for 2024

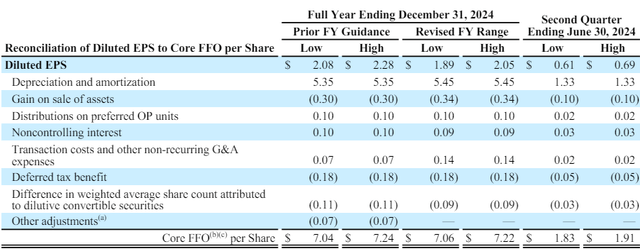

With no major surprises in the company’s business heading into 2024, management lowered its 2024 core FFO guidance to $7.06-$7.22 per share.

Updated outlook for 2024 (Sun Communities Q1 2024 Results Press Release)

As a result, core FFO is expected to grow only 1% year over year in 2024.

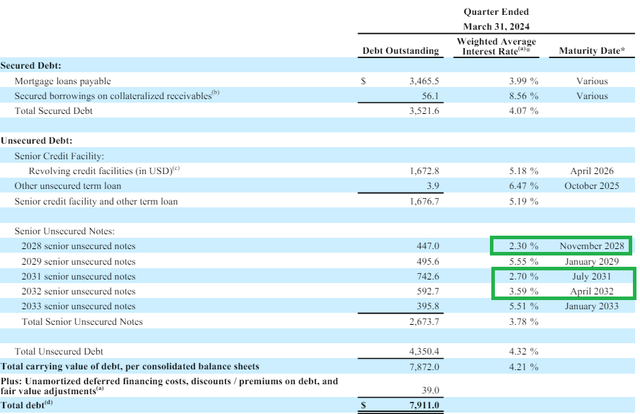

Debt status

Sun Communities has a conservative capital structure with net debt of just $7.8 billion and 33% of its enterprise value. 89% of the debt is fixed rate, with a weighted average maturity of 6.8 years; average interest rate Only 4.21%Importantly, about 23% of the debt is fixed at around 3%, with maturities in 2028, 2031, and 2032.

Debt Overview (Sun Communities 2024 Q1 Financial Results Press Release)

Its conservative capital structure allows the company to borrow at just 0.85% above the Secured Overnight Financing Rate (SOFR), which is currently around 5.3%, and gives the company a marginal cost of debt of around 6% on floating rate revolving loans.

Market Suggested Cap Rate

Due to seasonality built into the company’s business (Q1 and Q4 are typically the slowest quarters, with Q3 being the peak), annualizing Q1 results is not a good starting point. Instead, using the $1.432 billion in net operating income generated in 2023 and applying a 4.5% growth rate to 2024, we arrive at approximately $1.5 billion in NOI in 2024.

Taking into account the potential conversion of the preferred stock units, the company’s enterprise value is approximately $23.7 billion, resulting in a market implied cap rate of 6.3%, which is attractive given the defensive nature of the company’s operations and solid growth prospects.

Resilience from the downturn

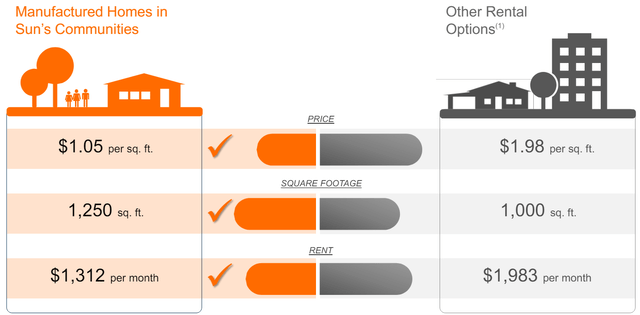

Residential properties in general are one of the most resilient segments of the real estate market. This is especially true for prefabricated homes, which sit at the lower end of the market. As Sun Communities highlights, prefabricated homes are roughly 50% less expensive per square foot, yet offer 25% more space.

Comparing pre-built homes with other rental options (Sun Communities May 2024 Presentation)

The company’s portfolio has low costs, so a potential economic downturn could help overall occupancy rates. While occupancy rates in the US/Canada are already high, this could help the struggling UK segment.

risk

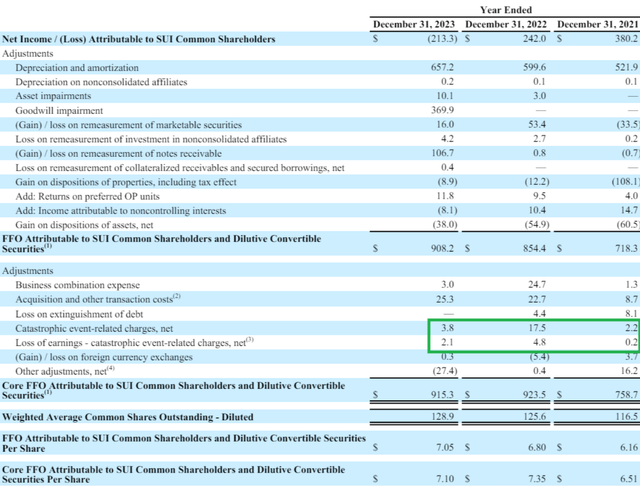

With steady growth and low leverage, there are no major red flags with respect to investing in Sun Communities. That said, the company continues to adjust its core FFO for catastrophic event-related charges ($7 million in Q1 2024), which are recurring operating expenses looking back through the 2021-2023 period.

Core FFO Bridge 2023-2021 (Sun Communities 2023 Annual Report)

When it comes to calculating NOI, the same treatment is used for disaster costs, so it is reasonable to assume that revenues will be overstated by about 2%, especially during periods of high natural disasters such as 2024 and 2022. .

Conclusion

Sun Communities is a defensive stock with solid growth prospects and moderate financial leverage. As the index reached all-time highs and fears of a hard landing for the economy eased, Sun Communities unsurprisingly underperformed both the broader market and sector real estate ETFs. This gives the stock a 6.3% yield on enterprise value, with growth expected to at least match, and possibly outpace, inflation over the medium term. Therefore, we think this stock is attractive at the moment and rate it a Buy, with the potential for a high-single-digit return.

thank you for reading.