PM image

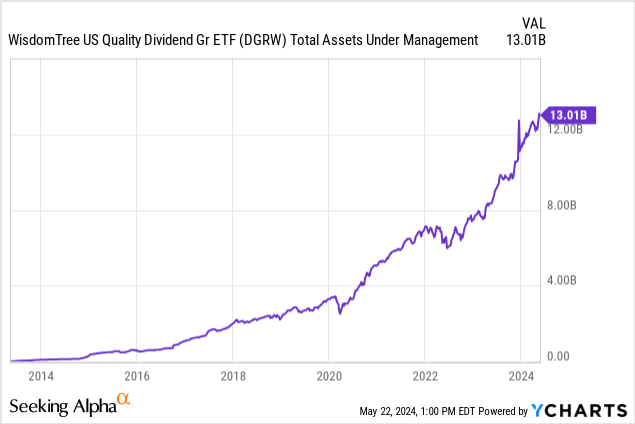

WisdomTree U.S. Quality Dividend Growth Fund ETF (Nasdaq:DGRW) is a popular dividend growth fund with over $13 billion in assets under management and has experienced strong growth in recent years.

This article We’ll take a closer look at DGRW, compare it to its peers, assess its effectiveness as a dividend growth investment, and consider how it could be improved.

DGRW as a Passive Income Snowball

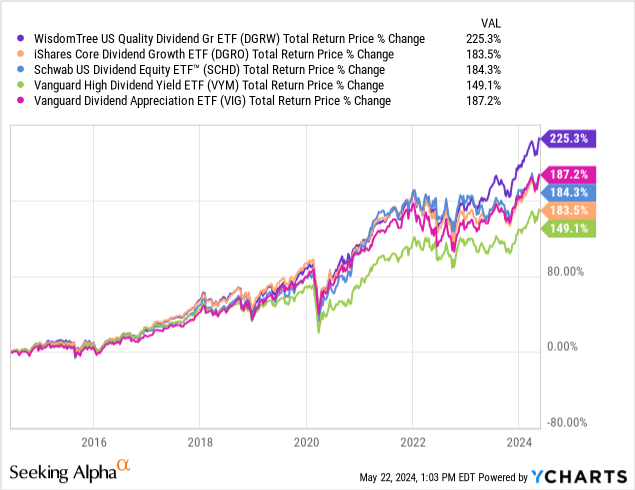

First off, DGRW has demonstrated a solid track record from a total return perspective relative to its peers in recent years.

However, once you look under the hood, it becomes much less appealing. For example, its expense ratio is relatively high at 0.28%, and the Schwab U.S. Dividend Stock ETF (SCHD), Vanguard Dividend Gratitude ETF (V.I.G.), and Vanguard High Dividend Yield ETF (VYM), both of which have very low expense ratios of 0.06%. Furthermore, despite the positive monthly payment feature, the trailing 12-month yield of 1.63% is lackluster compared to its peers. For example, SCHD’s yield is well above 3%, while VYM’s is close to 3%.

On top of that, DGRW has some attractive long-term benefits. Dividend growth recordWhile it boasts a CAGR of 10.92% over the past decade, this growth has been erratic, plummeting to a CAGR of 4.87% over the past five years and 6.48% over the past three years, with dividends actually declining by 1.2% over the past 12 months. This makes it a somewhat unreliable fund for investors looking for sustainable, high dividend growth. This volatility is especially problematic given the fund’s already low dividend yield.

DGRW overview Portfolio breakdown It becomes clear why these contradictions exist. Approximately 30% of his portfolio is allocated to technology, with top companies including Microsoft, Apple, and Broadcom, and further down the list, NVIDIA ranks No. 7 on his list. Masu. These megacap tech stocks have performed well recently due to the AI boom, but their dividend growth is often non-existent, inconsistent or weak. This may be contributing to the disconnect between high total returns and relatively low current dividend yields, as well as the volatile and slow rate of dividend growth.

Better options for dividend snowballing

To improve DGRW from a dividend investor’s perspective, it may be best to consider another fund with a lower expense ratio, higher dividend yield, and more stable dividend growth rate. His alternative funds such as SCHD and VYM, which we have already discussed in this article, can be good alternative funds. Additionally, those looking for a more high-tech fund may prefer an alternative fund such as VIG, which has a more stable dividend growth rate and a much lower expense ratio.

Additionally, DGRW’s sector diversification is limited, with energy at 3.74%, communications at 2.4%, basic materials at 1.95%, real estate at 0.25%, and utilities at just 0.19%. These sectors generally offer higher yields, and increasing exposure to them can help you create a more diversified, higher-yielding portfolio. The Energy Select Sector SPDR Fund (XL) and Alerian MLP ETF (AMLP) When it comes to energy, the Vanguard Real Estate ETF (VNQ) or Cohen & Steers Quality Income Realty Fund, Inc. (RQI) Real Estate and Utilities Select Sector SPDR Fund (XLU), Cohen & Steers Infrastructure Fund Co., Ltd. (UTFL format), or Reaves Utility Income Fund (U.T.G.). All of these options offer attractive dividend yields and have the potential to significantly improve both a portfolio’s sector allocation and overall dividend yield.

Investors can take advantage of Enterprise Products Partners (EPD) and ExxonMobil (XOM) In the energy sector, AT&T (T) or Verizon (VZ) Rio Tinto (rio) Basic information, real estate income (oh) or W.P. Carey (Worldwide) Real Estate, and Brookfield Infrastructure Partners (VIP)(Bipook) or Brookfield Renewable Partners (bep)(BEPC) with utilities. All of these stocks are investment grade, have well-diversified asset portfolios and/or well-established business models, are relatively defensive, and have attractive and well-covered dividend yields. This will improve the overall diversification of DGRW without exposing investors to significant risks.

Investor View

Overall, DGRW has performed well on a total return basis in recent years due to its significant investments in mega-cap technology, but it underperforms other dividend growth funds in terms of dividend yield, expense ratio, dividend growth stability, and portfolio diversification. Therefore, we believe dividend growth investors should consider other funds. Even if DGRW remains the core of your portfolio for some reason, we believe investors would be wise to add some of the funds and individual stocks mentioned in this article to their portfolio to increase their overall dividend yield and balance their portfolio allocation.