Full Value

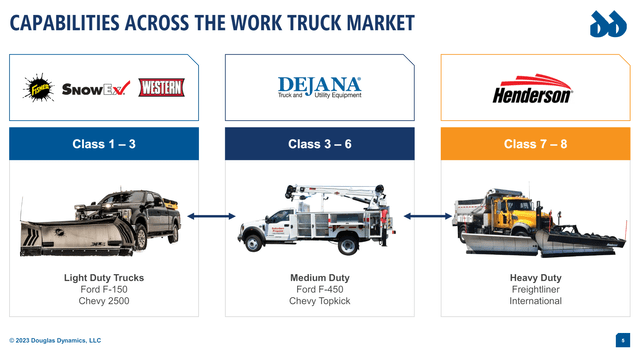

Douglas DynamicsNew York Stock Exchange:Plow) is the market leader in snow and ice control equipment for light trucks, with 50-60% of the market share for these products. It is a premium provider and demands premium prices. Distributors and end users These products are known for their high quality and reliability under the Fisher, Henderson, SnowEx and Western brands, and PLOW’s Work Truck Attachments division is responsible for these products.

Plow Products (Announced in May 2024)

PLOW’s Work Truck Solutions segment manufactures snow and ice removal equipment for large trucks used by municipalities and converts Class 3-8 commercial work vehicles engaged in snow and ice removal and other general professional purposes. The segment was created with the acquisitions of Henderson and Dejana in 2014 and 2016. This segment is expected by management to be a stronger growth segment. PLOW has a large market share in snow and ice management equipment, and the maturity of the market makes it difficult for it to grow much faster than nominal GDP.

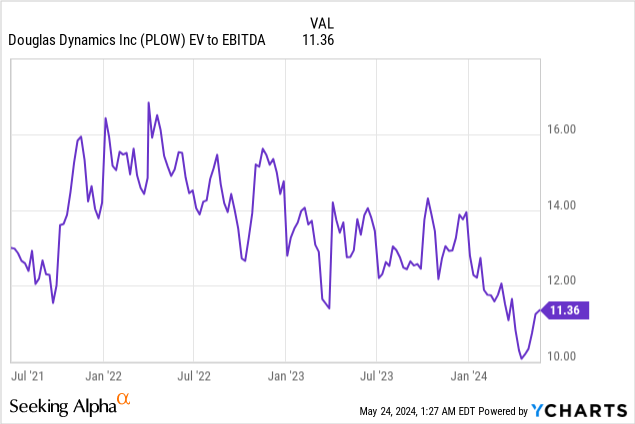

The investment thesis is relatively simple. PLOW’s shares are currently trading near rock bottom due to declining revenues resulting from well below average snowfall over the past few years on the US East Coast and Midwest. In fact, according to PLOW’s management, this year has been the worst year for snowfall in the company’s 75+ year history. I believe investors are becoming frustrated with the revenue levels over the past two years, especially since management announced an EPS target of $3 by 2025. If snowfall returns to its long term average (which it will), PLOW’s revenues should rise and the stock’s price-to-book multiple should expand.

Additionally, I believe investors are underestimating the potential margin expansion as demand increases. PLOW has been cutting costs more aggressively in the current environment, and the company should see strong benefits from its operating leverage once demand recovers.

Considering these factors, we believe PLOW will likely trade at $35-40 within 12-18 months as FCF rises, which would represent a 40-50% upside from the current price.

First Quarter Earnings

Revenues in the first quarter of 2024 improved significantly compared to the same period last year. The improvement was primarily due to continued strength in the Work Truck Solutions segment, improved snow conditions which led to increased volumes in the Work Truck Attachments segment, and cost reduction initiatives. Consolidated sales increased 16%, driven by a 23% increase in the Attachments segment and a 23% increase in the Solutions segment. PLOW’s Adjusted EBITDA margin also expanded by more than 10% compared to the same period last year, again driven by the Attachments segment, where Adjusted EBITDA margin expanded by an impressive 34.5%, and the Solutions segment, where Adjusted EBITDA margin expanded by 4%. The Attachments segment results speak to how poor snow conditions were in the same period last year.

Management’s comments were largely positive, with the exception of the weather discussion. With regard to the Solutions segment, management noted that although supply chain improvements are improving the company’s ability to process the backlog, the backlog remains at historically high levels.

Work Truck Solutions Industry Commentary

While a general slowdown in heavy-duty and medium-duty truck production may seem worrying for PLOW’s Solutions division, an upfitter that handles custom requests, production of Class 3-8 trucks has declined and is expected to continue to decline as potential demand is nearly met and the freight industry weathers the deep downturn it is currently in, PLOW only needs some of the strength of the truck market.

For example, Rush Enterprises. Inc.RushaA US truck dealership operator. First quarter earnings press releaseexpects commercial truck customers to perform well in its aftermarket parts and service division in fiscal year 2024. Most of PLOW’s solutions division customers are likely commercial customers who require trucks specially equipped for specific jobs, as opposed to freight fleets who purchase general-purpose Class 3-8 trucks directly from OEMs or dealers. In a relevant section of the press release, it states:

Looking ahead, long-haul carriers continue to be challenged by challenging economic factors and the current freight downturn, which we currently expect to continue through at least the second half of 2024. We expect new Class 8 and Class 4-7 truck sales to improve in the second quarter compared to the first quarter, primarily due to the timing of deliveries to some of our larger customers, and we believe demand for new Class 4-7 trucks will remain stable for the remainder of the year. In the aftermarket, we expect operating conditions to remain challenging, but we expect the normal seasonal uptick during warmer months, as well as strong demand from professional customers throughout the year.

This relative end-market strength, along with PLOW’s ability to grow organically and gain market share, bodes well for investors. For reference, Solutions segment revenues are expected to grow from $137 million in FY2017 to $276 million in FY2023, a CAGR of approximately 12%. This growth is even more impressive in FY2023, which was also negatively impacted by reduced chassis supplies from OEMs.

Given continued strong demand from vocational truck customers and PLOW’s history of impressive growth in its Solutions segment, investors should be confident that the segment will remain strong for the foreseeable future. Weather, while an uncontrollable factor, should be a primary focus. Investors with a long-term perspective should view investor impatience to wait for the weather to improve as an opportunity to invest in a market-leading, growing company at a price that reflects sluggish earnings and near-rock-bottom multiples.

Financial Model and Valuation

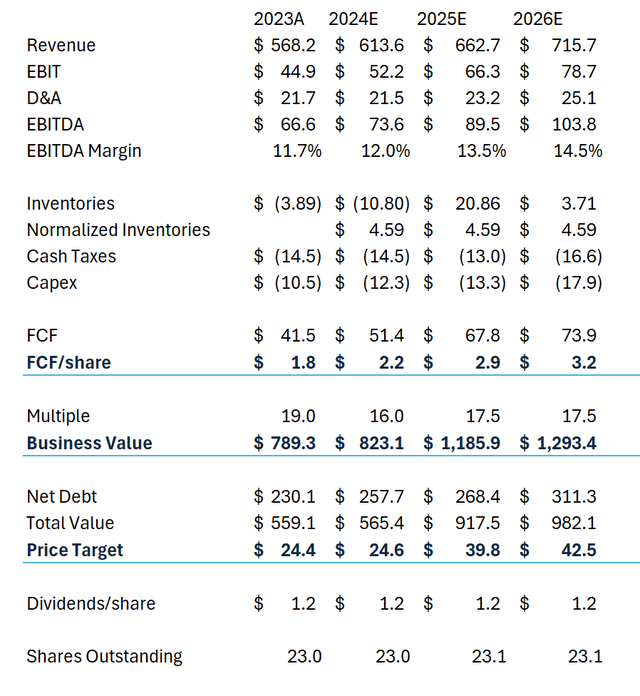

Below is a financial model that reflects PLOW’s reliable forecasts for the next several years. Of course, it is impossible at this point to predict next winter’s snowfall, but we can say with confidence that the current low snowfall trend will eventually rise toward the long-term average. If that happens, PLOW’s earnings will be like a coiled spring. In particular, current cost reductions should provide additional operating leverage when demand recovers. Note that when calculating free cash flow, the model uses normalized inventory changes. This is because we believe the market will view the current inventory build as non-recurring. The current inventory build is due to unsustainable low demand.

PLOW Financial Model (Created by the author)

Based on FY2025 and FY2026 FCF per share and a 15-20x multiple, we believe the stock could trade between $35-40 over the next 12-18 months. Given the stock’s historical multiples and that PLOW has a market-leading, cash-generating business in the Attachments segment, and a growing business with a long history of stable growth in the Solutions segment, a 15-20x multiple seems reasonable.

The primary risk to this stock is weather uncertainty, as evidenced by historically poor weather over the past few seasons. This not only reduces revenue, but also lengthens sales cycles and causes inventory to build up, impacting FCF not only this year but also next. If this poor weather continues, PLOW’s inventory may become increasingly stale, making storage costs even higher.

Another risk is the recent departure of the company’s CEO, Robert McCormick, which, while it does not appear to be related to operational issues, could mean that he foresaw future difficulties for the business, or that the business suffers from operational issues during the CEO transition.