translator

Gran Tierra Energy (New York Stock Exchange:G.T.E.) joins the growing list of companies that are reducing debt to make their balance sheets more acceptable to the market. Reverse Stock Split A reverse stock split took place in 2023. Bond Exchange To give the company time to build up cash flows (especially free cash flow). The debt exchange resulted in increased interest expense. But it also gave the market time to convince management that they were serious about their restructuring efforts to meet the market’s demands for a debt-to-equity ratio of 1.0 and free cash flow to return capital to shareholders.

Strategy for the Future

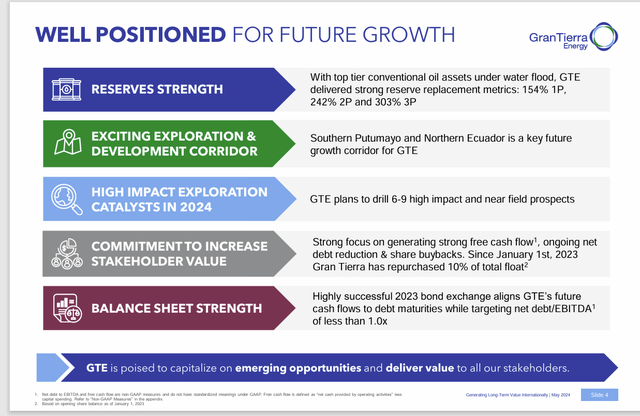

Management acknowledged this in its latest overall strategic outlook.

Gran Tierra Energy’s Future Strategy (Gran Tierra Energy Q1 2024 Earnings Conference Call Slides)

The management team Beyond that, they started buying back debt. All that’s needed now is either higher commodity prices or more profitable wells that will boost free cash flow enough that the companies can show the market they’re meeting the demands of the modern debt market.

Currently, commodity prices are low, and the company’s situation is made worse by the cost of infrastructure available in its main operating regions of Colombia and Ecuador, with significant discounts on quality and transportation. The company is effectively selling at a discount.

Business Environment

Management has had to deal with social issues in Colombia in the past, resulting in production disruptions. Management says agreements are currently in place to “keep the peace.” But those agreements could fall apart at any time, which is bad news for the company as it tries to reduce its debt load.

Colombia itself and Ecuador also need the funds that this industry brings. In general, the business environment is supportive of the industry. However, the government is not as effective in doing business as other places, and the infrastructure is similarly not as good as in the United States. So there are some challenges to doing business in South America.

Perhaps social issues that occasionally cause production interruptions are what keep the price-earnings multiples low for this company, which has significant operations in Colombia and some in Ecuador.

debt

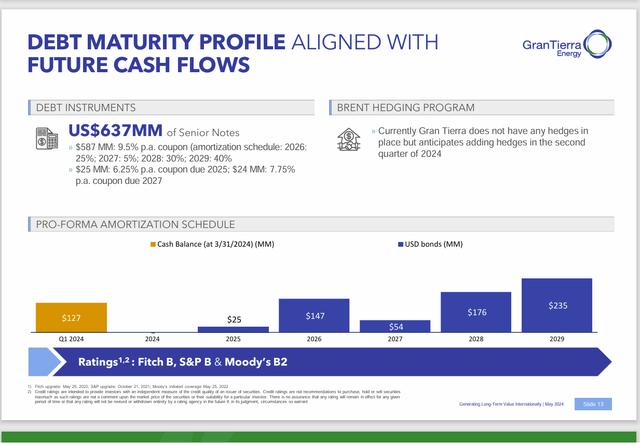

Management has time to raise free cash flow to a level where it can service its debt.

Gran Tierra Debt Repayment Schedule (Gran Tierra Energy Q1 2024 Earnings Conference Call Slides)

Management needs to be able to repay debt due in the near future with available cash flows.Currently, the majority of cash flows generated under GAAP rules are reinvested in the business.

If management is going to move the stock price, they need to generate enough free cash flow to return adequate cash to shareholders. If not, like many of the companies I follow in this situation, the stock is unlikely to move significantly from its current trading range. A commodity price upswing similar to what happened in FY22 would be very helpful for the current debt repayment schedule. Who knows if such a period will ever occur again.

Gran Tierra Energy Cash Flow and Free Cash Flow Guidance (Gran Tierra Energy Q1 2024 Earnings Conference Call Slides)

In general, the market seems to demand free cash flow equal to at least half of debt, which means that free cash flow projections for 2027 will be important.

One of the biggest problems with debt is that it has to be serviced and repaid regardless of industry conditions. Therefore, the debt levels shown here are not recommended. Cutting the debt level in half seems like a must-have goal for the company going forward (in the current debt market environment).

Because the company operates in South America, the market may also demand further reductions in debt levels. This is especially true for a company in a place like Colombia, where operations are regularly disrupted.

operation

Operating costs are generally low. This, combined with the generally supportive governments in the regions in which the company operates, makes the current business plan appear viable over the long term.

Gran Tierra Energy Reserve Growth by Basin (Gran Tierra Energy Q1 2024 Earnings Conference Call Slides)

Gran Tierra is a secondary recovery specialist that relies heavily on water injection and is considering using polymers in the future. Management has high hopes for the new discovery. Discussed in a conference callHowever, the market is likely to wait for the results to show up in the form of additional free cash flow.

summary

Management appears serious about transitioning from a reserve-based strategy that is independent of free cash flow to the current market-preferred, low-leverage cash flow model. It will take time for the company to get there, but I think the odds of management’s plan succeeding are high.

Gran Tierra Energy Key Business Progress Indicators (Gran Tierra Energy Q1 2024 Earnings Conference Call Slides)

Going clockwise from the top, adjusted EBITDA has only recently entered a satisfactory range for debt levels. Management needs to prove that EBITDA will remain satisfactory even under more conservative assumptions. Typically, the market seems to be pricing WTI at $40 in the US. No one knows what Colombian Brent crude prices will do right now. At this point, given the history above, management clearly has a challenge to address before they can achieve reasonable targets in this area.

Reserve metrics were important prior to 2015. Growth is still important to the market, but that growth needs to be backed by an adequate level of free cash flow. At the moment, the previous chart clearly shows that this is not the case.

The market no longer wants production growth in principle. From a market perspective, production growth may have been necessary to the extent that it enabled companies to obtain the free cash flow they needed to adequately service their debt. But from the market’s perspective, capital recovery has replaced production and reserve growth as the priority.

The last chart is crucial for the market. However, in the current environment, the market wants the current debt ratio to be less than 1, so the debt needs to be reduced further. Otherwise, the stock price is not likely to break out of the current trading range anytime soon. In this regard, management has made solid progress.

All of this combined makes the company a highly speculative investment depending on whether the ongoing recovery is successful. The biggest risk to the company is that it will probably be several years before it can meet the current demands of the stock and bond markets. A lot can happen in that time in a volatile and less visible commodity business.

The stock is volatile enough for an upstream company that it could be a good trading vehicle to profit from price fluctuations.

risk

The company’s strategy needs some help in the form of favorable lower commodity prices, but that’s by no means guaranteed. Commodity prices are highly uncertain and highly volatile. Meanwhile, debt must be paid off regardless of industry conditions. That’s a really bad combination.

Reverse stock splits and debt exchanges are common occurrences for companies with financial problems, and both events need to fade into history for stock prices to receive a better valuation.

The periodic social unrest that plagues the industry, while often having little (or nothing) to do with the industry, is a flagship issue in Colombia that must be factored into company performance until it becomes clear that the future has changed for the better.

For a company like this, losing a key employee would be devastating.

Commodity prices are uncertain and highly volatile. Management hedges to guarantee a minimum future outcome. However, the results of hedging are rarely valued by the market.