Adam Galt

Welcome to the latest edition of the BDC Market Weekly Review, where we cover market activity in the Business Development Company (“BDC”) sector from both a bottom-up (highlighting individual news stories and events) and top-down (giving a broader market overview) perspective.

We also strive to add historical context, as well as themes that we believe are driving the market and that investors should take note of. This update covers the period up to the third week of May.

Market trend

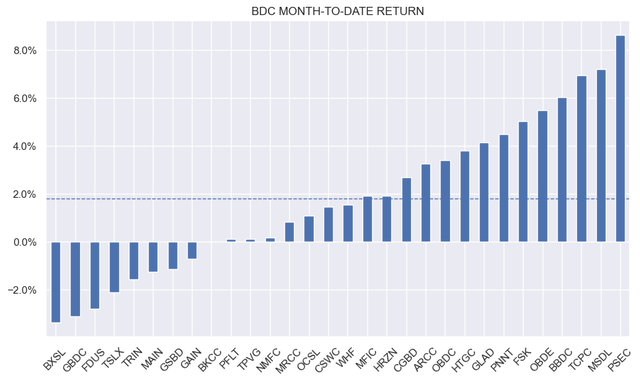

BDCs were flat this week, underperforming the broader earnings space. Year to date, the BDCs we cover have posted fairly strong gains, averaging about 2%, with returns supported by ample earnings and a prolonged high Fed environment.

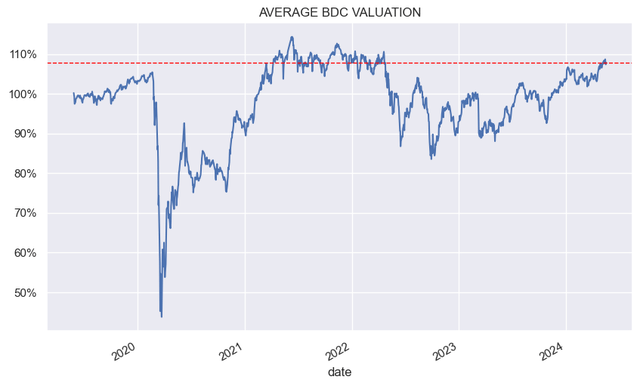

The average rating for our coverage is ongoing It is trading not far from its highest level in five years.

Market Themes

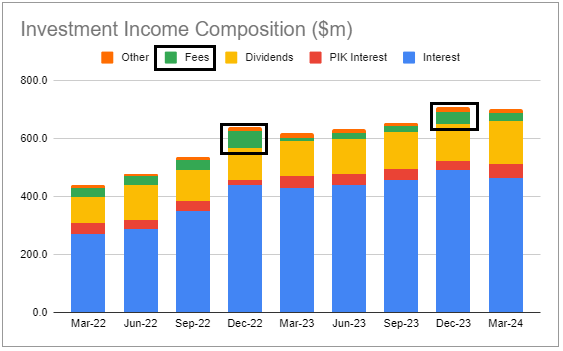

One interesting trend in BDC revenue reports to date is the fairly consistent decline in net income. Of the BDCs (18) whose revenue we have serviced to date, 82% have seen a decline in net income.

This downward trend appears to be continuing for a couple of reasons. One is that December tends to be a seasonally higher quarter for repayment fees as private equity firms compete to close deals, meaning fee income tends to decline in the March quarter. A good example of this is ARCC, whose income profile is shown in the graph below.

Systematic Income BDC Tools

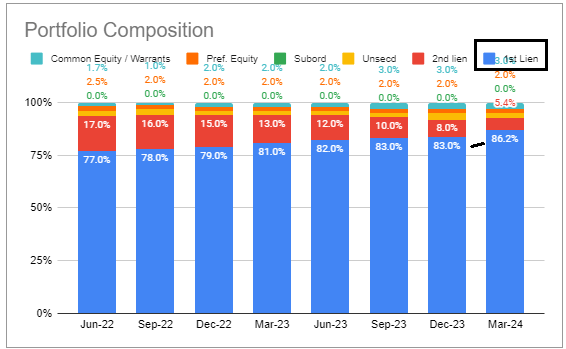

Second, many companies, including OCSL, OBDC, etc., are converting to first lien assets. These assets tend to trade at tighter spreads than assets such as second lien loans. OCSL’s allocation profile is shown below.

Systematic Income BDC Tools

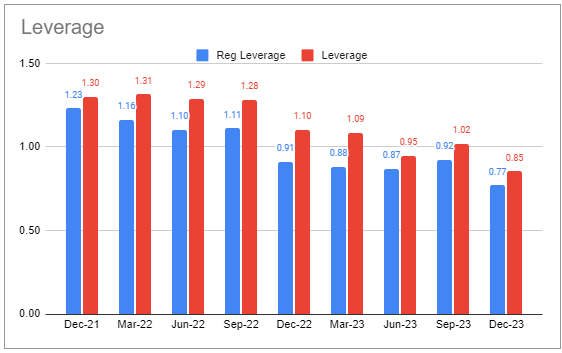

Third, many BDCs continue to deleverage for a number of reasons, including relatively high valuations allowing companies to issue new equity, temporarily diluting earnings, and tight spreads reducing attractive lending opportunities. CSWC’s declining leverage trend is shown below.

Systematic Income BDC Tools

Fourth, BDCs continue to shift toward higher coupon debt (e.g., 6-8%) as they reduce their low coupon (2-4%) debt. We’ve seen this trend in about a dozen BDCs over the past 6-9 months, and we expect this trend to continue over the next 12 months unless long-term interest rates unexpectedly decline.

Fifth, as in the case of OBDE, there are idiosyncratic factors such as one-time exchange listing fees.

Overall, this revenue decline is likely to continue in the second quarter, but at a slower pace than in the first quarter, as some of the factors mentioned above are likely to ease. However, if the Fed cuts interest rates, the decline in net revenues should accelerate.

Market Commentary

Capital Southwest (CSWC) underperformed this week, though it’s unclear whether the immediate catalyst was its earnings report or a downgrade to in-line with the market rating from JMP.

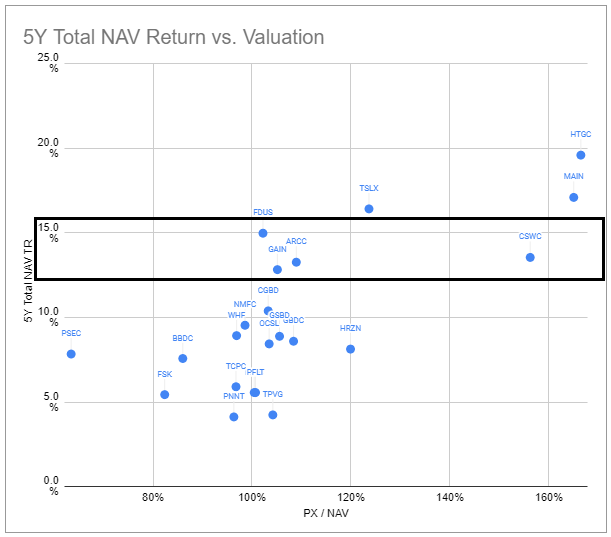

Calendar Q1 performance was decent but not great. Dividends remained the same, NAV remained the same, and net income was down compared to calendar Q4. For a company trading at roughly 160% valuation (MAIN, HTGC, etc.), this is a bad quarter.

CSWC is clearly the outlier of this trio. There are two things to consider here. First, CSWC’s total NAV returns over various time periods are significantly lower than the HTGC/MAIN pair. Second, while CSWC’s returns have been otherwise strong, a large portion of them have been driven by aggressive equity issuance, which is heavily dependent on a high premium. Once the premium is gone, so is much of its superior performance. Without this equity tailwind, its performance is quite ordinary.

ARCC and FDUS have performed equally or better over the long term and trade at much lower valuations than CSWC. CSWC would need to improve its performance substantially to justify its current valuation.

Systematic Income BDC Tools

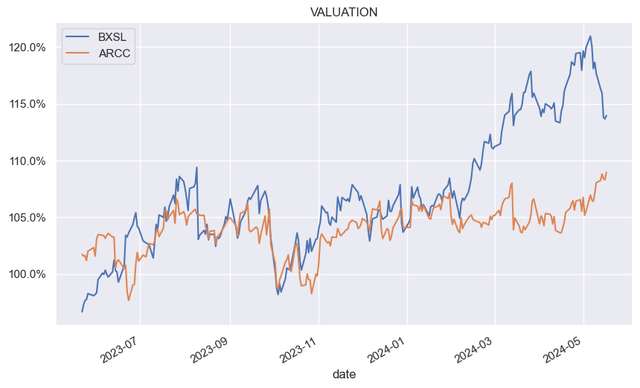

Blackstone Secured Lending (BXSL) issued $400 million of 5.875% 2027 notes. With no upcoming debt issuance, it could use the proceeds to lend (its leverage is very low at 1.03x) or reduce secured financing, which costs 7.1%-7.8%, to trim interest expense toward 5%, one of the lowest in the sector and a source of alpha.

Many BDCs are taking advantage of premium valuations to issue additional shares through at-the-market programs. BXSL shares increased 6.6% in the first quarter and have increased about 19% over the past year. This additional share issuance has had a debt-reducing effect and is one of the reasons why the sector’s net income has declined (BXSL’s net income was down about 10% sequentially in the first quarter).

We are closely monitoring the valuation relationship between ARCC and BXSL, with BXSL continuing to trade at 5-10% premium to ARCC despite lower total NAV returns. In a downturn scenario, the valuation advantage makes sense as the BXSL portfolio is primarily first lien and ARCC is lower in the capital structure. However, so far that advantage has not played out as the health of the companies has been fairly good. We continue to prefer ARCC over BXSL.