Jose Luis Pelaez Inc/DigitalVision via Getty Images

Myo-mother (New York Stock Exchange:my) is a wearable medical robotics company that designs, develops and manufactures myoelectric prosthetics for people suffering from neurological diseases. The company’s prosthetics are primarily used to increase the range of motion of stroke patients’ paralyzed arms.

So far, the stock’s performance has been disappointing. MYO went public in 2017 at $433 per share, but the stock has been trending downwards for several years. Most recently, MYO is trading at $3.8 per share, losing nearly all of its value since listing. That said, MYO has gained significant momentum over the past year, with the stock delivering a return of over 700%. Still, MYO is down more than -20% year to date.

I rate MYO a Buy and my one-year price target of $4.42 per share suggests an upside of about 16%. At these levels, MYO represents an attractive buying opportunity. The company believes it will continue to benefit from recent policy changes from CMS that have given MYO the impetus to expand its TAM.

Financial Review

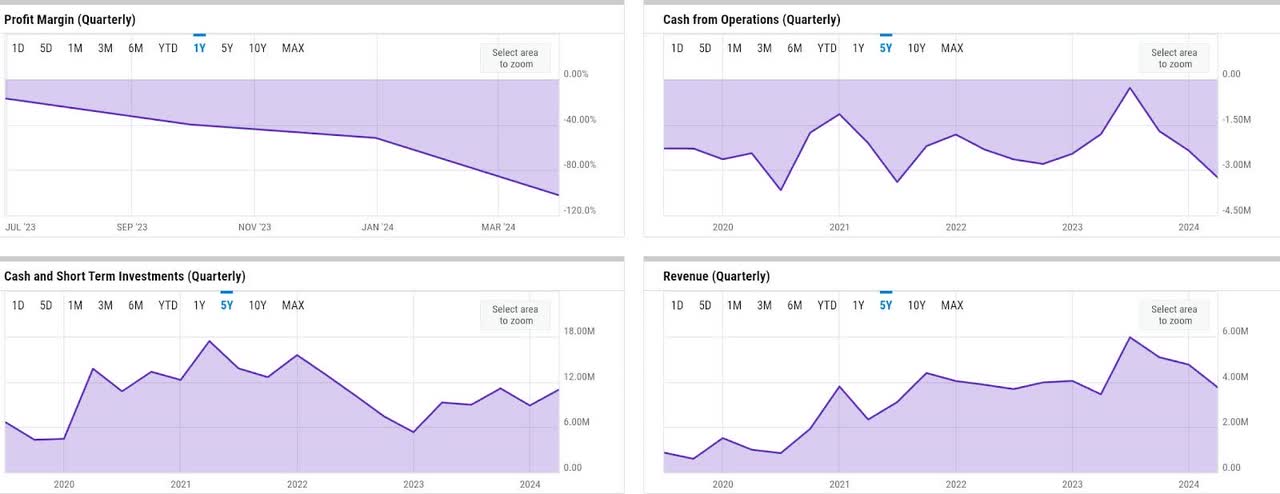

The fundamentals are very disappointing. Revenue growth has normalized to approximately 20% as of the last fiscal year, but profitability and operating cash flow (OCF) generation continue to weaken as of Q1. MYO posted revenue growth of just under 9% year over year in Q1, but its net loss margin widened to -102%. MYO also burned over -3.2 million of OCF, higher than in the past few quarters.

In fact, MYO has never generated positive OCF in the past five years, with its primary source of liquidity being equity financing through the issuance of common stock. In Q1, MYO raised over $5.3 million through the issuance of common stock. This allowed MYO to maintain stable liquidity, but also resulted in significant dilution during the same period. In Q1, MYO ended the quarter with approximately $11 million in cash and short-term investments. However, with 36.75 million shares outstanding in Q1, this represents almost 5x dilution since the end of 2022 alone.

catalyst

Beyond fiscal year 2024, I believe MYO should continue to benefit from the recent policy change by CMS, which will reclassify MYO’s flagship product, MyoPro, into the prosthetics category and establish new pricing. As management commented on the first quarter earnings call, I expect this to be a major catalyst for MYO, as the new classification will allow more patients to access MYO’s products under standard Part B Medicare.

These decisions by CMS have made MyoPro more accessible to many patients enrolled in standard fee-for-service Medicare, or Part B, and have opened a new world for stroke patients and others with neurological injuries or diseases. Prior to this reimbursement clarification, MyoPro was unavailable to traditional Medicare patients, about half of older adults in the U.S. covered by standard Part B Medicare. Most of the rest are enrolled in Medicare Advantage plans and have had mixed results with payers.

sauce: First quarter earnings report.

Moreover, MYO appears to have felt the positive impact of these changes in Q1, with a robust backlog and future revenue growth. Authorizations and orders increased significantly in Q1, up 48% year over year, and backlog, including Part B patients, increased 56% year over year.

danger

While the tailwinds here should be large enough to drive MYO’s business, I believe execution risk is the major risk factor for MYO. In particular, the risks are in clinical reimbursement and the manufacturing process to capture the backlog opportunity, while backlog conversion remains the only driver of revenue generation.

Additionally, as management noted on the earnings call earlier today, MYO is also investing heavily to meet growing demand, as evidenced by the 44% increase in operating losses due to additional hiring within the clinical reimbursement team. As such, in my opinion, this could increase market expectations for the stock and any news regarding execution-related issues could put downward pressure on MYO’s share price.

Rating/Pricing

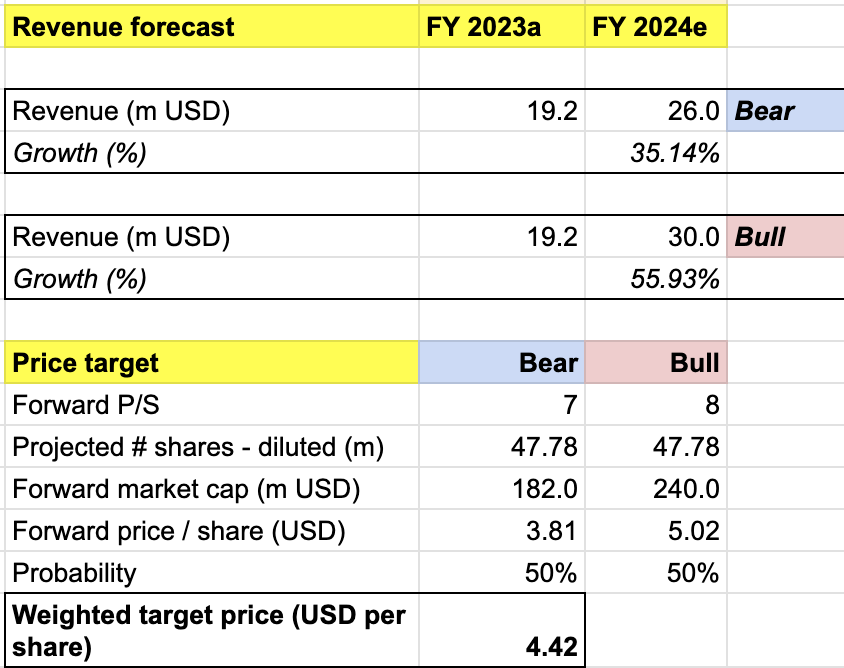

My price target for MYO is based on the following assumptions for bull and bear scenarios for the FY24 forecast.

Bullish Scenario (50% Probability) Assumptions – We expect revenue to grow 56% YoY to $30M, in line with company guidance. If MYO can deliver accelerating revenue growth through solid execution, we expect the market to react strongly, therefore assuming a forward P/S expansion of 8x and a share price rise to the $5 level.

Assuming a bearish scenario (50% probability) – MYO expects FY2024 revenues of $26 million, up 35% year over year and $2 million below the company’s lowest target. That said, 35% growth is still a solid outlook for the company, even if it missed the target. Therefore, we expect the stock price to remain flat through FY2024, but the P/S to expand slightly to 7x.

Original analysis

Integrating all of the above information into my model, I arrive at a weighted price target of $4.42 per share for fiscal 2024, projecting an upside of roughly 16% over the course of the year. I rate the stock a Buy.

Overall, I believe policy tailwinds provide a chance for a recovery in FY2024, making MYO an attractive buying opportunity now. My 50/50 bull/bear probability allocation remains conservative, especially as MYO’s revenue outlook looks good today and its strong backlog speaks for itself. Additionally, I have also lowered my bear scenario revenue forecast by $2 million, again at a conservative assumption.

In my opinion, the key thing investors should monitor here is equity dilution, which is one of the key drivers of my price target. My price target model assumes 30% equity dilution in FY2024. While that seems a bit high, it is already lower than the 50% dilution year-to-date. Based on my simulations, if MYO maintains its current dilution levels in FY2024, my price target would be even lower.

Conclusion

MYO is a company that develops myoelectric orthotics primarily for the US market. Recent policy changes by CMS have placed MYO’s solutions in a more accessible category for Part B patients, which should be an opportunity for the company to expand its TAM. Given the robust backlog, the challenge remains to execute strongly to convert it into revenue. MYO has indeed provided strong guidance for fiscal year 2024. This may be the reason why the stock has risen more than 10% in the past month alone. However, my target price of $4.42, implying a 16% return in one year, suggests there is still room for upside in the current fiscal year. I recommend buying the stock.