Dot Hippo

introduction

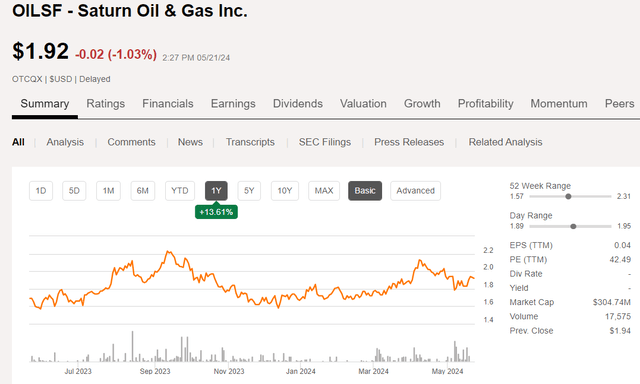

Saturn Oil & Gas (OTCQX:Oil SF)(TSX:Soil: CA) is another example of a Canadian junior oil operator trading well below normal valuations. The Canadian market is a mix of companies like the oil drilling giants and Natural Resources Canada (CNQ) are trading at EV multiples closer to 8x, while smaller companies like Saturn are trading at a smaller percentage at EV/EBITDA multiples of 2x or 3x.

OILSF Price Chart (Seeking Alpha)

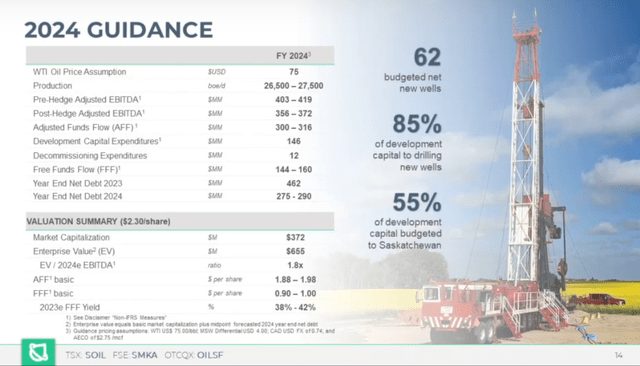

Free cash yield is another metric that many investors overlook. In Saturn’s case, investors are ignoring this metric. This is surprising given that current free cash per share is $0.18, which translates to a 9.5% yield at current prices. Not bad, but not exciting. This was a down quarter. On a TTM basis, this yield has ranged between 38% and 42%, as shown in the slide below. Is this interesting?

The company is not well covered due to its small size, but the unanimous Considered a buy There are 4 analysts covering the stock. Price targets range from $4.00 to $5.80. The median is $4.47. Either of these figures would indicate a significant upside from the current price. OILSF missed its EPS target by almost 50% in the first quarter, coming in at -0.42. Featured Companies WC-MSB ended the quarter with severe weather shutdowns and a larger than normal price spread due to U.S. refinery maintenance and export restrictions. The Seagulls raised their expectations for Q2 and set an EPS target of $0.19.

Saturn has grown through bolt-on acquisitions, assuming debt and diluting existing shareholders with new stock issued to pay for it. While this has not been accretive to Saturn’s stock price in the short term, the new assets have been transformative for the company, extending its future glide path and providing additional production and additional drilling inventory. This is likely something buy-side analysts are keeping an eye on, and so are we.

First, let’s take a snapshot of the variables influencing the oil market: The current volatility helps explain why oil stocks of all stripes are currently underperforming.

A quick overview of the oil market

To be honest, it’s a bit unclear right now. Competing priorities are to keep prices in the mid-to-high $70s, but occasionally rise to the mid-$80s if things heat up in the Middle East. I’ve previously warned readers not to get too excited about a “war premium,” which is based on the idea that there will be attacks on tankers, infrastructure, and oil fields that will affect supplies and distribution. This hasn’t really happened since the first Gulf War. (For those of you who are younger, that was when Iraq invaded Kuwait, was driven out by US coalition forces, and Kuwait’s oil fields were set ablaze.The reason is probably that it would be an overreaction and invite a massive retaliatory reaction: Once supply concerns subside, prices will slowly begin to deflate while waiting for new buying signals, which is roughly what is happening now, at least for U.S. producers.

As we have noted before, the next turning point for crude oil will come from the long-anticipated signs that demand-driven drawdowns in crude oil inventories or reduced liquids production from drilling are not enough to offset the decline in traditional production. Until then, the downturn is likely to continue.

Conversely, Canadian companies have approximately 600,000 BOPD of new demand to meet with the coming online of the TMX pipeline, which is why we are interested in Canadian microcaps.

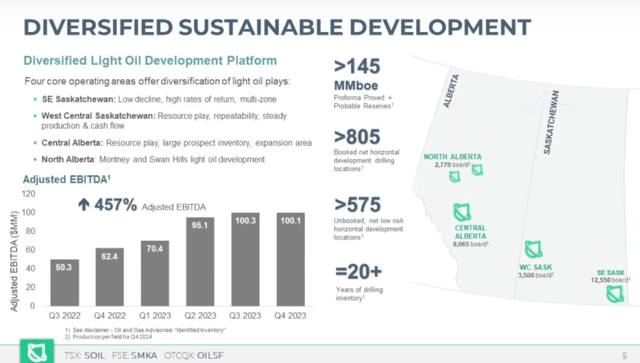

Saturn Papers

The company is focused on Alberta and Saskatchewan, as the slide below shows. Most of these assets have low declines and are over 85% light oil. Over the past year or so, the company has made several significant acquisitions. Ridgeback Energy 2023,and Saskatchewan Asset Acquisition The company just announced additional production of 13K BOPD, 96% primarily oil derived, in the first quarter. The company claims to have approximately 20 years of Tier I inventory at projected development rates. Costs have decreased 23% from 2021, resulting in a solid netback in the mid-$40s in 2023. The company has hedged approximately 60% of its 2024 production.

The company appears to be heavily discounted with respect to its P-2 booked reserves. A conservative rough calculation puts Saturn’s NPV at about $1.1B, or $7.24 per share using SA’s numbers. The company targets exit production rates of about 40K BOPD, primarily oil-weighted production, by 2024. Using less conservative calculations, the same numbers could land you at a $10 per share valuation, but it’s best to be conservative when playing with numbers.

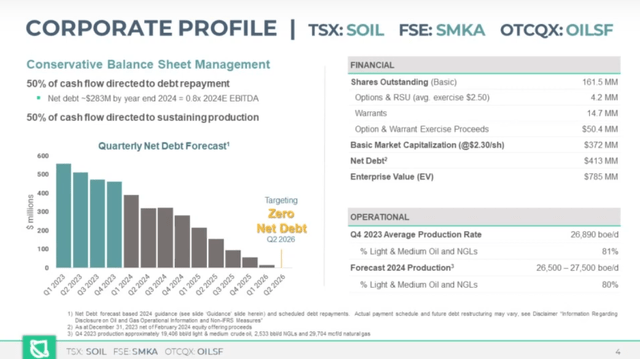

The company is taking on significant debt from these transactions, but appears to be working on debt reduction as a priority. Net debt is expected to be C$792 million, or 1.2x trailing 12-month EBITDA, and is targeted to decrease significantly over the next 12 months to approximately $600 million, which would result in a debt-to-EBITDA ratio of 0.9-1.0 on a trailing 12-month basis. The transaction is expected to close on June 14th with an effective date of January 1, 2024. With this mindset and the cash flows supporting it, we’d be interested to see the company make incremental progress, as CFO Scott Sanborn noted on the conference call.

In total, Saturn paid down $76 million in debt, leaving its net debt at the end of the quarter at $386 million, or 1.4 times annualized.

OILSF Company Profile (Oil SF)

risk

At this point, the management argument for the company’s low production decline is well understood as many of the companies we cover have a similar profile. The risks are primarily oil prices, the discount of WCS to WTI, and of course export access via the TMX line. Export access should not be an issue due to the vacuum created by TMX withdrawal demand.

The company’s ambitious growth plans come with risks: If for some reason it can’t achieve those volumes, its stock price may not rise as analysts expect.

Your takeaway

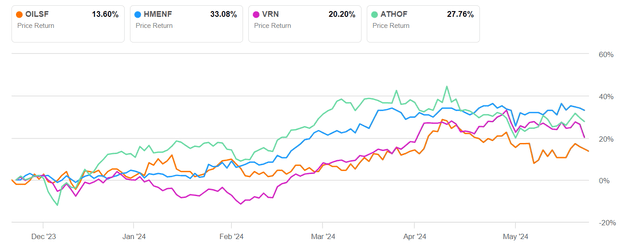

OILSF is trading at roughly 2x EV/EBITDA and $27,500K per barrel. This is based on 40K BOPD production by the end of 2024. These are very attractive metrics. Relative to its potential cohort group, we see that OILSF has underperformed in the market, up only 13.8% over the past 6 months. This can be explained by acquisitions, debt assumptions, and equity dilution. This is likely offset by management’s commitment to reduce debt and right-size the balance sheet.

OILSF Cohort Group (Seeking Alpha)

The carrot here is that once the debt is paid down, cash flow will be available for regular shareholder returns. As mentioned above, if the company meets or beats second-quarter expectations, the stock could soar. An orderly repayment of debt and an increase in shareholder equity could push the stock toward analysts’ expectations. We’ll leave it to analysts’ numbers to see what the upper limit will be. At the same time, we note that astute and patient investors may want to invest in Saturn Oil & Gas Inc. stock given the significant discount to NAV.

Editor’s Note: This article discusses one or more securities that do not trade on a major U.S. exchange. Please be aware of the risks associated with these stocks.