Gill Nature

Investment Thesis

The company has more than doubled its revenue since its founding. Initial public offering Despite selling shares in December 2019, the stock price has halved. The company’s core business is Leading Position The company has driven revenue growth through expanding product sales in its core markets and through organic product offerings in new areas. High Interest Rates Expansion in Brazil has impacted the company’s growth and profitability over the past two years. Nevertheless, the company has grown profitably and is on track to benefit from lower interest rates this year. Given management’s ambitious, yet achievable, medium-term growth and profitability targets, the company’s shares are trading at an attractive valuation for investors.

Company Profile

XP Inc. (Nasdaq:experience) provides a technology platform that delivers financial products and services. The company offers a wide range of investment products to private and corporate clients in Brazil and has strong relationships with over 14,000 independent financial advisors (IFAs). 17 of the top 20 IFAs associated with XPThe company also launched multiple services in new areas such as credit cards, pension plans, and insurance. Acquisition of Banco Modal To strengthen investment banking operations.

Highlights from recent investor meetings

XP’s management team: Investor Day Management highlighted the incredible progress the company has made since the IPO in terms of market share gains and strong revenue and earnings growth, and outlined its strategy to further accelerate these milestones in the future.

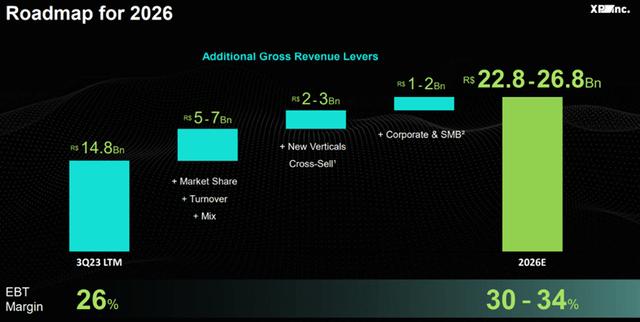

Investor Presentation (Slide 79)

According to slide 15, Investor PresentationThe company plans to expand its market share of private client assets from 11% to 14.5% in 2026. By expanding market share and growing in additional verticals, management targets revenues of R$22.8-26.8 billion in 2026, representing a revenue CAGR of approximately 18% through 2026 at the midpoint. Additionally, management targets EBT margin of 32% at the midpoint in 2026, which would represent a 600 basis points improvement from last year.

Reaffirming targets and delivering solid performance in Q1

Steady earnings growth despite tough environment

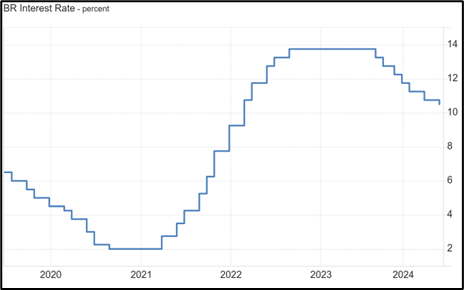

Trading Economics

XP’s revenue growth is facing headwinds due to rising interest rates in Brazil, as shown in the chart above. As interest rates rose to nearly 14%, XP’s clients opted for safer fixed investment options, which became less profitable for XP. However, interest rates are now falling, It is expected to fall below 10% by the end of this year.This backdrop should be more favorable for XP, and CEO Thiago Maffra confirmed this during the first quarter earnings call by saying:

We believe the worst is over. But as you said, as Bruno said, we’re more optimistic now than we were a year ago, two years ago. We believe the worst is over, but it’s going to take some time to recover to the levels that we saw again in 2020, 2021.

XP reported net revenues of R$4.05 billion in the first quarter of 2024, up 29% year-on-year. This growth was positively impacted by a weak first quarter of last year. Quarterly revenues have remained roughly flat since the third quarter of 2023. However, fundamental metrics such as total client assets, total active clients and total IFAs have increased. Strong growth this quarterManagement believes that interest rates have passed their peak and that growth rates will improve going forward.

XP management has not provided guidance for fiscal 2024, instead providing mid-term guidance through 2026, which we’ve noted before. Analyst Estimates Net revenues for this year are expected to be 17.4 billion reais, implying 15% growth compared to last year.

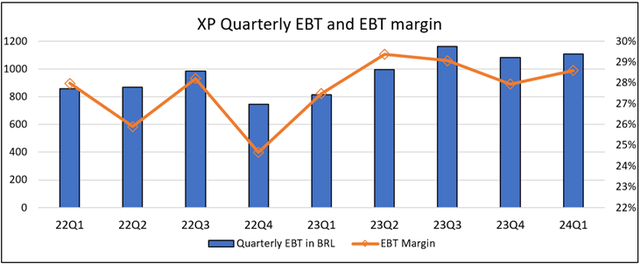

Steady improvement in profitability

The company has initiated a cost reduction program and has seen EBT margins increase steadily since the fourth quarter of 2022. Staff reduction Selling, general and administrative expenses then totaled R$ 1.4 billion in the first quarter of 2023, a decrease of 9% compared to the previous quarter. Selling, general and administrative expenses as a percentage of net revenues was 35% compared to 38% in the previous quarter. Management points out that the ability to stabilize expenses even as revenues grow demonstrates the operating leverage of the underlying business. Furthermore, CFO Bruno Constantino reaffirmed the company’s goal of achieving the margin targets set at the Investor Day, stating:

Going forward, in line with our published medium-term guidance, we aim to achieve a pre-tax margin of 30% to 34% by the end of 2026. This target underlines our commitment to progressing gradually towards these levels.

Great business at an attractive price

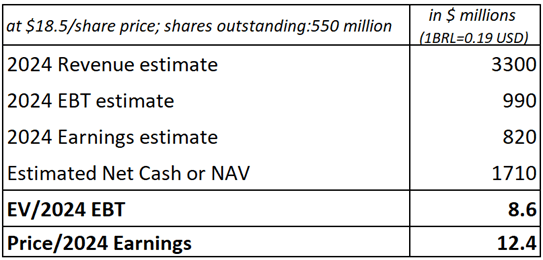

FY24 estimates suggest XP is trading at a price-to-earnings ratio of 12.4. On an EV/EBT basis, the valuation is much lower at just 8.6. This is primarily due to the value of the excess assets held on the balance sheet, which is also represented by the company’s net cash or NAV shown on Slide 23. 2024 Q1 Earnings AnnouncementFor simplicity, all figures are in US dollars, assuming R$1=$0.19.

Created using company and Seeking Alpha data

Charles Schwab, a competitor of XP operating in the U.S. market,Shu) and Interactive Brokers Group (Bank of India) has a lower growth rate and a price-to-earnings ratio of 23.8 and 19.2 Given that management’s medium-term targets (2026) are for revenues of nearly $4.8 billion, margins of approximately 32%, and EBT of $1.5 billion, more than 50% above expected earnings for the year, XP stock appears significantly undervalued.

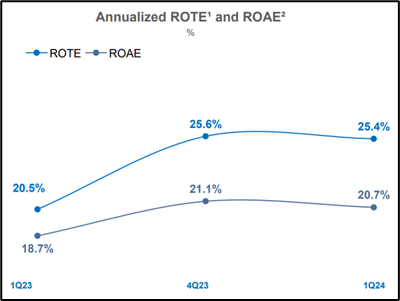

The discounted valuation is likely due to the company’s operations in the Brazilian market and the challenging economic environment it currently faces due to high interest rates. Nevertheless, XP’s business quality is stellar, allowing the company to generate a return on tangible equity of over 25%, as shown below.

Company Information Session Q1 2024

Potential catalysts for stock price appreciation

Low interest rates

XP has so far seen low growth rates in Brazil’s low interest rate environment. twenty four% and 37% If interest rates in Brazil were to fall further and reach mid-single digit levels, investor interest in XP’s products and services would increase, accelerating revenue growth.

Shareholder return through share buybacks and special dividends

The company recently announced a new Share buyback program That amounts to $190 million, roughly 2% of the company’s current market cap. Additionally, the company may declare a special dividend toward the end of the year to return some of its excess capital to shareholders, as explained by its CFO during the company’s Q1 2024 conference call.

Each year, we analyze our capital needs, liquidate them, and determine how much of the excess capital to return to shareholders. This typically occurs in the second half of the year, when we also budget for the next year. As a profitable, cash generating, leveraged, and capitalized company, it is reasonable to assume that we will distribute capital to shareholders at some point in the second half of the year.

Risks to consider

Interest rates will remain high for a long time

If interest rates remain high, it will be a headwind for XP’s growth and make it difficult for management to achieve its medium-term targets, as the CFO noted during the company’s Q1 2024 conference call, stating:

So the 30% to 34% target by 2026 is going to be very hard to achieve if the same macro environment we have today continues through 2026. That’s for sure. But we do anticipate a different scenario, and it doesn’t have to be one where interest rates are very low and capital markets and equities are booming, but that’s not built into our assumptions.

Intense competition for customers and IFAs

XP faces stiff competition from established players such as: BTG Pactual Itau Unibanco (ITUB), and Nubank (newThe company aims to attract customers by providing services in new areas.

Government Regulations

Our business is subject to new government regulation, which may affect the markets in which we operate and may prevent us from obtaining exclusivity with certain IFAs.

Buy XP

Management has set ambitious, yet achievable, goals for the company through 2026. Management’s performance to date has been promising, and even if the company’s performance does not actually live up to expectations, I believe today’s modest valuation provides an attractive opportunity for investors with limited downside potential. The recent sell-off is not justified, especially given the current backdrop of declining interest rates, which is favorable for the business. Therefore, I recommend buying XP shares.