J. Michael Jones/iStock Editorial via Getty Images

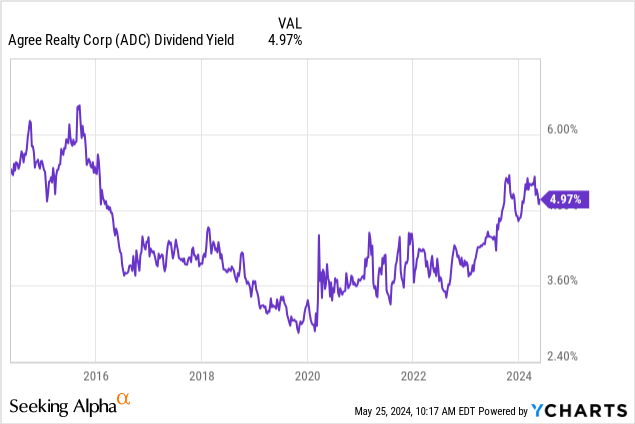

I am a member of Agree Realty.New York Stock Exchange:Advanced) Common and preferred stocks have declined since the start of the year in response to continued weakness in these securities. Common stocks are down 9%. Past year 4.25% Series A Preferred stock (New York Stock Exchange:ADC.PR.A) is trading at a steep 32% discount to its liquidation value of $25 per share. Commons paid its last monthly cash dividend $0.250 per shareAt $3 per share per year, ADC’s dividend yield is 5.1%, unchanged from last month. The yield is near its highest in 10 years, and ADC is trading at 14.4 times the midpoint of its full-year 2024 adjusted operating earnings (AFFO) guidance. $4.10 to $4.13 per shareThis ratio is approximately That’s a 19x return by 2022, just as the Fed raises base interest rates to their highest in more than two decades. Thus, lower interest rates remain a key driver of positive total returns for both common and preferred stocks.

ADC owns 2,161 properties with a total leasable area of 44.9 million square feet As of the end of the first quarter of fiscal 2024, the portfolio was 99.6% leased with a weighted average remaining lease term of 8.2 years and 68.8% of annual base rents from investment grade rated domestic tenants. Importantly, my investment in ADC is based on its AFFO growth prospects, growing dividend, and strong balance sheet. The REIT’s guidance is to grow AFFO 4.2% year over year at the midpoint, with a recent dividend of 137% annualized and a dividend payout ratio of approximately 73%. Since I acquired ADC, the common stock has risen and the preferred stock has fallen. Last covered REITs.

AFFO Growth, Investments, and Free Cash Flow

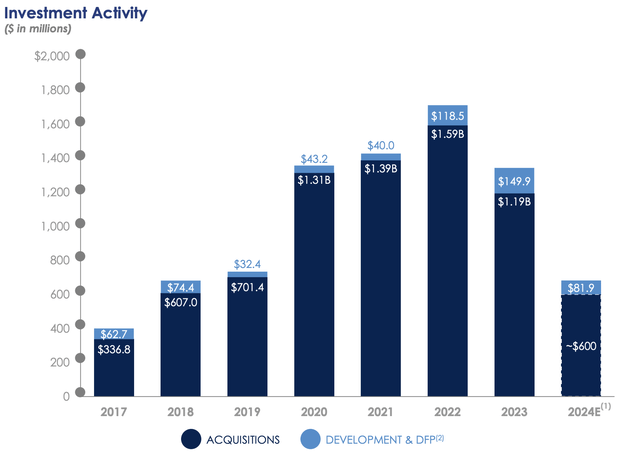

ADC reported first-quarter sales of $149.45 million, up 18% from the same period last year and beating market expectations. AFFO per share was $1.03 Continued investment momentum from net-lease REITs led to a 4.6% increase from a year ago. ADC invested $140 million in 50 retail net-lease properties in the first quarter, but its 2024 acquisition guidance is $600 millionThe REIT also sold six properties for gross proceeds of $22.3 million, a weighted average capitalization rate of 6.2%, and expects full-year sales to be between $50 million and $100 million.

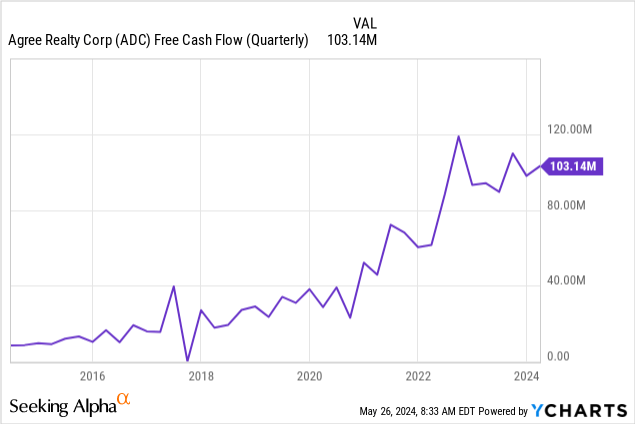

Ugly Realty Q1 FY24 Presentation

ADC’s weighted average cap rate increased 50 basis points sequentially to 7.7% in the first quarter as management targets investment spreads of at least 100 basis points above its cost of capital. The REIT’s free cash flow has been steadily increasing, providing an internal engine for growth even as rising base interest rates have reduced acquisitions from highs in 2022. Combining AFFO growth and dividend yield, ADC’s near-term total return is at least 9%, with returns likely to increase further if the Fed cuts interest rates later this year.

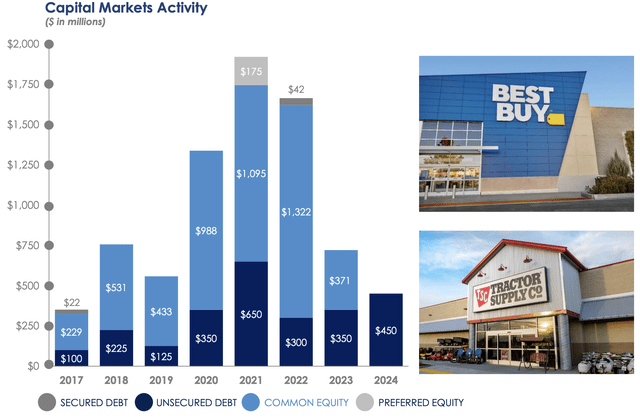

Preferred Stock Opportunities, Debt Maturities, and the Fed

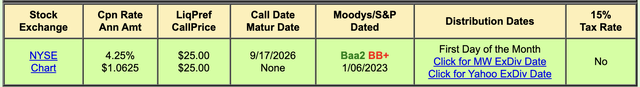

ADC’s preferred shares offer an asymmetric investment profile. The securities were rated “Baa2” investment grade by Moody’s at the time of their issuance in the summer of 2021. The $1.0625 annual coupon has a monthly distribution schedule and offers a cost yield of 6.2% at $17.01 per share, compared to the preferred shares trading at 68 cents per share. They were issued with a competitively low headline coupon rate of 4.25% and therefore face duration risk from liquidation discounts that are subject to fluctuations in the federal funds rate. ADC’s recent May 2024 maturity Issuance of senior unsecured bonds The preferred shares due 2034 completed at a yield of 5.625%, 138 basis points higher than the yield on the preferred stock.

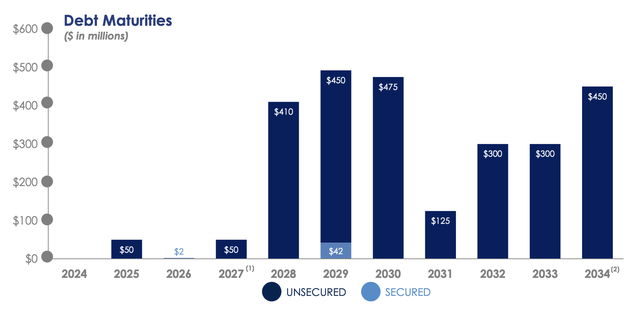

Ugly Realty Q1 FY24 Presentation

ADC’s debt maturities are also very slow, with only $52 million of debt maturing through the end of 2026. The REIT has total liquidity of $920 million As of the end of the first quarter, $620 million of this was from revolving loans.With no maturing debt, ADC doesn’t face the same refinancing risks as other equity REITs, enhancing the REIT’s ability to pursue acquisition volume and grow AFFO.

Ugly Realty Q1 FY2024 Presentation

So ADC offers a near-record dividend yield from its expanding portfolio of net-lease retail properties, and the preferred stock is trading well below liquidation value despite the safety of the underlying REITs and scheduled Fed rate cuts. I bought both securities for the safety of scale and strong total return potential wrapped in an investment grade rated balance sheet. The near-term returns of both securities are expected to continue to grow as inflation exceeds the Fed’s target and the CME FedWatch tool indicates at least 25 basis points The reduction numbers as a base projection for the end of 2024. You will receive monthly dividends while you wait.