Trevor Williams

As a dividend growth investor, healthcare is one of my favorite sectors because you can find proven growth companies that can deliver dividend growth over the long term.

This sector tends to be recession-proof Regardless of the economic situation, people will seek cures for their ailments, so these companies are more likely than most to see steady growth in revenue and profits, allowing shareholders to enjoy growing annual dividends.

One name that has always intrigued me is Cardinal Health.New York Stock Exchange:C.A.H.) has increased its dividend for nearly 40 consecutive years.

The stock has also performed well, up more than 13% in the past 12 months.

Find Alpha

As stock prices rise, the valuation of stocks That makes it an average, and in my opinion, unattractive investment choice.

Background and Recent Achievements

Together with McKesson Corporation (M.C.K.) and Cencora, Inc. (coreCardinal Health, formerly known as AmerisourceBergen Corporation, is one of the three largest pharmaceutical distribution companies. The company provides solutions to hospitals, clinical laboratories, clinics and pharmacies.

Cardinal Health consists of three operating segments: Pharmaceutical & Specialty Solutions, which sells branded and generic pharmaceuticals and consumer products in the United States; Global Medical Products & Distribution, which sells branded medical and surgical products in domestic and international markets; Home Solutions, Nuclear and Precision Medicine Solutions, and Other, which offers Optifreight logistics.

Cardinal Health report Third quarter earnings announcement on May 2and2024. Revenues increased 9% to about $55 billion, and adjusted earnings per share were $2.08 compared to $1.74 a year ago. Adjusted earnings per share beat expectations, but revenues were $1.2 billion lower than the analyst community had expected.

Revenues from the Pharmaceuticals and Specialty Solutions segment, which represents the majority of sales, increased 9% to $50.7 billion. Profits for the segment increased 4% year over year. Growth in the quarter was primarily driven by increased sales volumes of branded and specialty pharmaceuticals to existing customers. Despite these increases, the segment’s margins declined 5 basis points to 1.15%.

Global Medical Products and Distribution sales increased 4% to $3.1 billion. Segment profit totaled $20 million, a significant improvement from a loss of $46 million in the prior quarter. Segment margin turned positive, improving 218 basis points to 0.64%.

Other income increased 14% year over year to $1.2 billion driven by gains across all businesses, while segment profit increased 4.7% to $111 million. Profit margin decreased 83 basis points to 9.51%.

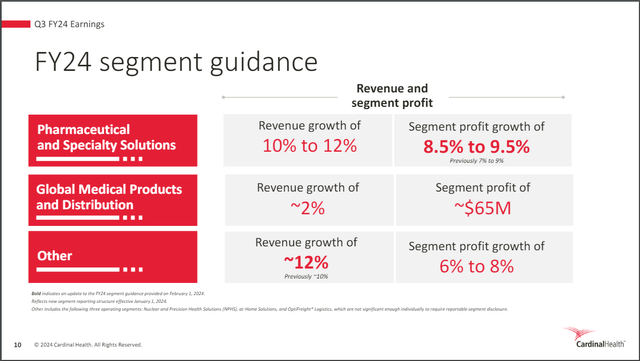

Cardinal Health provided updated guidance for a fiscal year that is certainly exciting.

Cardinal Health Investor Relations

The company now expects double-digit revenue growth in its Other and Pharmaceuticals and Specialty Solutions segments, with the median segment profit growth rate for the latter rising to 9% from 8% previously.

This has resulted in expectations for adjusted earnings per share to rise to a range of $7.30 to $7.40 from a range of $7.20 to $7.35. At the midpoint, this would imply growth of 27% from fiscal 2023.

Additionally, Cardinal Health issued interim guidance for fiscal year 2025. Growth in the next fiscal year is expected to be at least 2% compared to the midpoint of revised guidance.

Dividend Analysis

Operating in a sector of the economy less affected by recessions has allowed Cardinal Health to increase its dividend for 37 consecutive years, which is why the company is one of fewer than 70 companies to have achieved the 25 years of dividend increases necessary to earn the Dividend Aristocrat title.

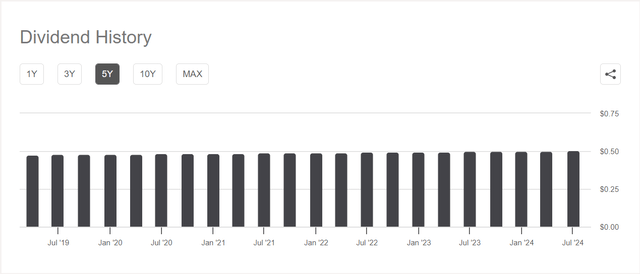

However, the dividend amount has remained largely unchanged over the past five years.

Find Alpha

The compound annual growth rate of dividends is just 0.7% over the past five years, but from 2014 to 2023 it is expected to grow at a compound annual rate of 4.7%. Announced Earlier this month, it was just 1%.

While a significant slowdown in dividend growth portends an imminent cut, Cardinal Health expects its dividend payout ratio to be 28% this fiscal year, which compares favorably to its 10-year average payout ratio of 35%. Therefore, we think it’s highly unlikely that Cardinal Health will cut its dividend as it’s well covered by earnings.

The company’s shares offer a yield of 2.1%. Find Alphais above the healthcare sector median but below Cardinal Health’s five-year average return of 3.2%.

Risks of investing in Cardinal Health

While earnings growth expectations are improving, there are some risks investors should be aware of before buying the stock.

Cardinal Health has razor-thin margins, and this is evident in the performance of each of its divisions in the most recent quarter. Profit margins for the period were just 1.3%, up from 1.2% last year. Operating on razor-thin margins makes it extremely difficult to weather a downturn.

This can be true even in periods of growth: Pharmaceuticals and Specialty Solutions delivered solid revenue and profit growth in the first quarter, but margins still declined. On the plus side, margins in Other categories remained high after declining, and it was a good sign that Global Medical Products and Distribution margins turned positive.

Looking ahead, Cardinal Health’s fiscal 2024 is expected to be a significant improvement over fiscal 2023, with adjusted earnings per share growth in the high 20% range, but this is expected to remain a one-off surge in performance. The company’s initial guidance for fiscal 2025 expects growth closer to recent performance. For reference, Cardinal Health’s compound annual growth rates for earnings per share over the past five and past 10 years are 1.8% and 4.2%, respectively.

Given its high earnings per share base, it may be difficult for Cardinal Health to achieve a higher growth rate over the medium to long term than investors are accustomed to.

It is contract cancellations that impact a company’s ability to grow. An example of this is the expiration of the next contract. OptumRxA subsidiary of UnitedHealth Group (United Nations UniversityThe contract, which expires at the end of June, covered bulk shipments of mostly non-specialty products.

The imminent loss of this revenue stream wouldn’t necessarily put Cardinal Health in a bind, but customers do occasionally let their contracts lapse, and if there were too many of these losses, Cardinal Health’s already razor-thin profit margins would come under even more pressure.

OptumRx accounts for 16% of fiscal 2023 revenue, meaning near-term profit expectations may be harder to achieve.

Evaluation Analysis

Cardinal Health shares closed this week at just over $96, trading at 13.1 times forward earnings. Healthcare field Overall, the stock is trading above its medium-term historical average of 11.4. There’s potential for high growth while the market is paying an above-average multiple for the company’s shares.

I typically set a valuation range for what I’m willing to pay for a stock, which I believe helps me take into account developments, both positive and negative, that may affect the multiple the market assigns to the stock.

Cardinal Health has established itself as a leader in the pharmaceutical distribution industry and has a strong track record of growing dividends.

That said, any earnings growth the company will experience this year will likely be temporary and may be affected by the loss of a major contract. While the dividend is likely stable, the lack of dividend growth over the past five years is a concern, and even the recent increases have been nominal. I believe the low yield does not adequately compensate for the lack of dividend growth.

I have set an earnings per share target multiple for the stock of 10-11 times expected earnings, resulting in a target price range for Cardinal Health of $73.50-$80.85. At my price range, the stock is currently overvalued by about 16-23%.

Final thoughts

Cardinal Health has some attractive qualities, including being an industry leader and having a nearly four-decade long streak of growing dividends.

However, there are some issues with this stock, namely low profit margins, declining dividend growth, and a higher than normal share price. I would rate the stock a Sell at current levels, as the stock price would need to fall by at least a mid-teens percentage point for Cardinal Health stock to be attractive.