Thomas Brown/Digital Vision via Getty Images

Investment Thesis: At present, we continue to recommend buying MakeMyTrip.

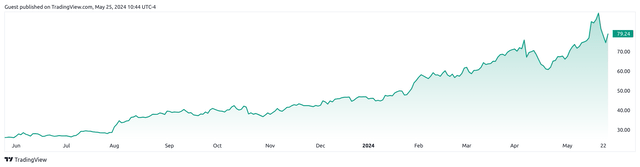

The previous article In February, I joined MakeMyTrip Limited (Nasdaq:About MMIT) is likely to rise We are increasing our price target to $77 based on continued sales growth, but will continue to monitor increases in customer-driven costs across the hotel and packages division.

The stock has since surpassed this target price, up over 35% since our last article, and is trading at $79.24 at the time of writing.

The purpose of this article is to assess whether MakeMyTrip is likely to see further upside in the future.

performance

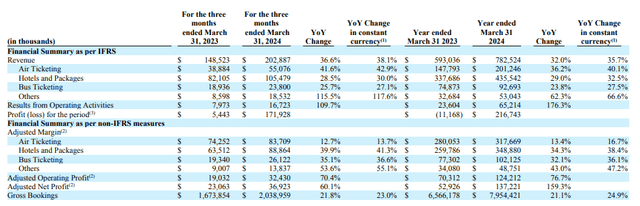

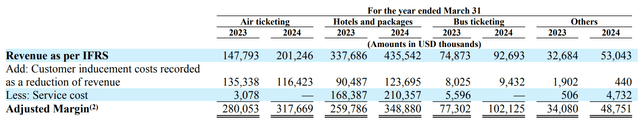

If we look at the fourth quarter and fiscal 2024 resultWe can see that revenue increased 36.6% year over year and 32% year over year. On an annual basis:

MakeMyTrip Limited: Fourth Quarter and Full Year Financial Results Announcement

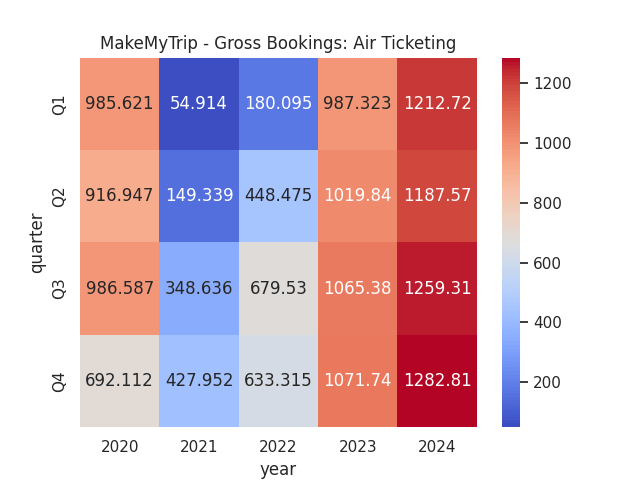

In terms of total air ticket bookings, we can see that they increased by 19.7% compared to the same period last year and 1.9% compared to the third quarter of 2024.

Figures are taken from previous MakeMyTrip earnings announcements (Q1 2020 to Q4 2024). Figures are provided in millions of USD. Heatmaps were generated by the author using Python’s seaborn visualization library.

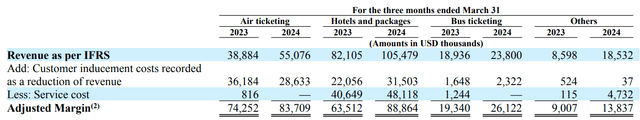

I have previously said that we will be watching to see if MakeMyTrip can ultimately drive revenue growth across the hotels and packages segment while simultaneously lowering the growth rate of customer inducement costs.Hotels and packages revenue grew 28.5% YoY and 29% YoY, showing encouraging growth across the segment.

In terms of customer-driven costs, on a three-month basis, we see that hotel and package costs increased 42% year-over-year and accounted for 30% of fourth-quarter 2024 revenue.

MakeMyTrip Limited: Fourth Quarter and Full Year Financial Results Announcement

On a full-year basis, customer acquisition costs increased by 36%, with costs as a percentage of revenue increasing to 28% from 27% the previous year.

MakeMyTrip Limited: Fourth Quarter and Full Year Financial Results Announcement

The reason I initially expressed concern about hotel and package customer inducement costs is because revenue growth in this segment has been slower than other segments, at 21.5% in 3Q24 compared to the same period last year.

However, we believe the increased customer-driven costs are tolerable given that hotel and package revenues for the fourth quarter of 2024 are up 29% year over year, resulting in higher revenues.

Risks and future prospects

My take on the above results is that the higher growth rates seen across hotel and package revenues are encouraging and, despite my earlier concerns about rising induced costs, the fact that we are seeing higher revenue growth justifies the higher costs in the short to medium term.

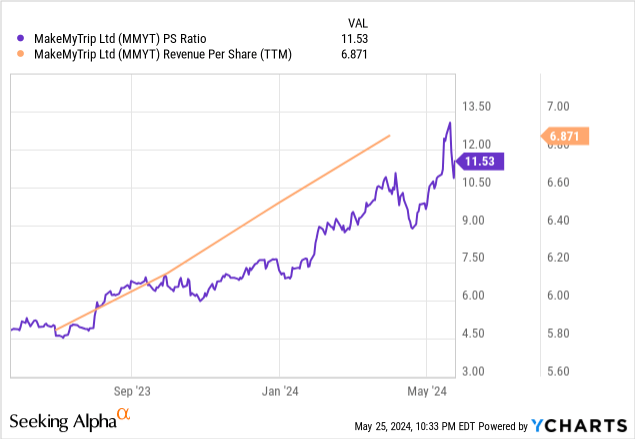

In February, I previously expressed the view that a fair value for the stock could be $77 if earnings per share continue to recover to their all-time high of $9, given the stock’s price-to-sales multiple of 8.646 ($9 earnings per share * 8.646x price-to-sales multiple = $77.81). At the time, earnings per share were trading at $6.519.

Since then, the PS ratio has increased by 33.36% and earnings per share have increased by 5.40%.

Sales price ratio

ycharts.com

From this perspective, we can see that the price-to-sales multiple growth has significantly outpaced the earnings per share growth, which is why I believe the stock is trading at a fair price at the moment.

Going forward, MakeMyTrip believes it has the ability to continue to grow revenue across its hotels and packages divisions, especially given the strength of India’s domestic travel market, including the continued rise in weekend travel in India. Popularity Popular destinations such as Jim Corbett have seen a 131% increase in searches. Additionally, spiritual tourism has also grown, with searches on the platform increasing by 97% in the past two years.

While I have previously expressed concerns that MakeMyTrip’s revenue may slow outside of the October-March peak season for international travel to India, India as a whole is benefiting from a strong domestic travel market and as such, I expect to continue to see robust revenue growth going forward.

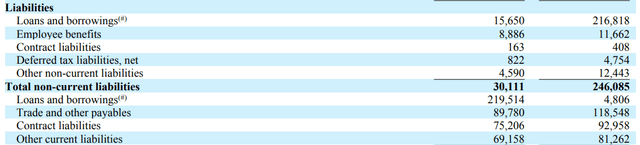

With regard to potential risks, it is noteworthy that short-term loans and borrowings increased significantly from US$15.65 million in March 2023 to US$216.818 million in March 2024 due to maturing repayments of illiquid borrowings.

MakeMyTrip Limited: Fourth Quarter and Full Year Financial Results Announcement

While revenue growth has been strong so far, investors will be closely watching the company’s ability to pay down its short-term debt while continuing to invest in further revenue growth.

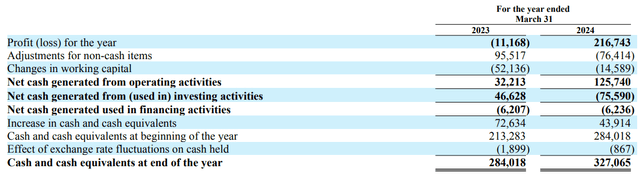

That being said, the company’s cash and cash equivalents have increased by a significant 15% during this period, indicating that the company is in a sound financial position and has the ability to repay its current liabilities.

MakeMyTrip Limited: Fourth Quarter and Full Year Financial Results Announcement

Conclusion

In conclusion, MakeMyTrip is experiencing strong revenue growth and domestic tourism growth is also strong. We believe the company’s shares are fairly priced at present, but there is potential for upside in the long term given the strong performance of the overall hotel and packages division and continued growth in domestic tourism.