Jim Valley

Interest rates rose as inflation risks resurfaced, prospects for rate cuts faded and the dollar strengthened. Credit spreads, as measured by the CDX High Yield Credit Spread Index, also widened.

moreover, The yield curve steepening process has stalled and further signs of inversion are beginning to re-emerge. The inversion process appeared to be over, but recent high inflation and questions surrounding monetary policy tightening could cause the yield curve to rise faster in 2-year rates than in 10-year rates, pushing the inversion to even more severe levels.

10-2 Curve Breakdown

The spread between the 2-year and 10-year Treasury notes fell below -40 bps last week, breaking an uptrend that dates back to mid-December. If the spread falls below -54 bps, Based on economic trends, the 10/2 curve will likely decline further, perhaps to -77 bps. The area around -16 bps has acted as significant resistance since September 2022, with this level having been held twice since October.

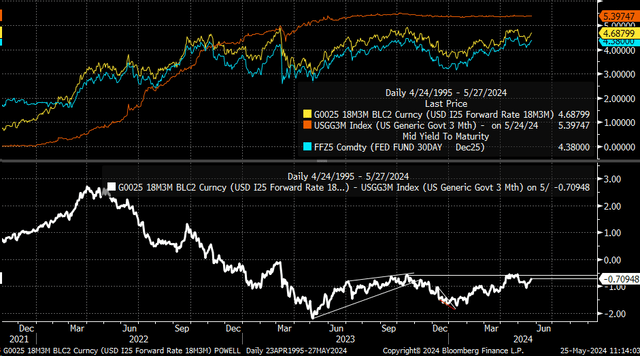

A similar phenomenon is occurring with the “Powell” index, which is the 18-month forward contract for the 3-month Treasury note rate minus the spot 3-month Treasury note rate. This spread has fluctuated dramatically since early 2024 and is now rising again as the market rules out the possibility of a rate cut and the 18-month forward contract for the 3-month Treasury note rate rises.

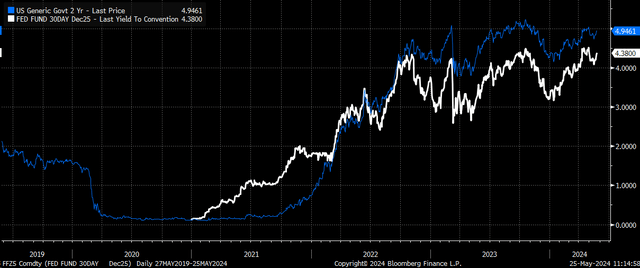

The 2-year note is roughly tied to the Fed Funds futures, and currently, the further 2025 Fed Funds futures rise, the more likely it is that 2-year note rates will continue to rise. This suggests that the 10/2 curve will continue to invert to lower levels as the market expects not only fewer rate cuts in 2024 and 2025, but also a rise in the neutral interest rate in the economy.

Rising neutral interest rates

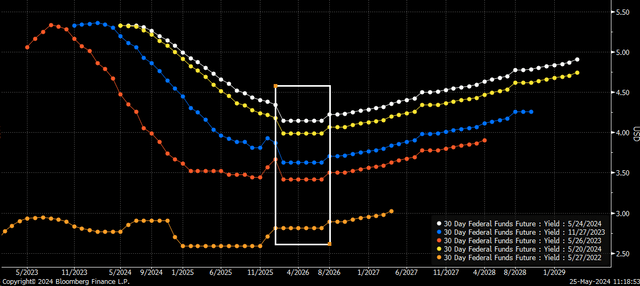

Over time, the market has been moving the 2026 point higher and higher, which is the best and easiest way to assess the long-term neutral interest rate for the economy as the market sees it at this point, because 2026 was the low point of the easing cycle before interest rates start to rise again in 2027.

In May 2022, interest rates were expected to be around 2.8% in 2026, but have risen to 3.4% in May 2023, 3.6% in November 2023, and 4.15% as of this week. The bond market is sending a clear message that the interest rates of the past decade no longer exist and that based on current economic data, the neutral interest rate for the economy is higher than it was before.

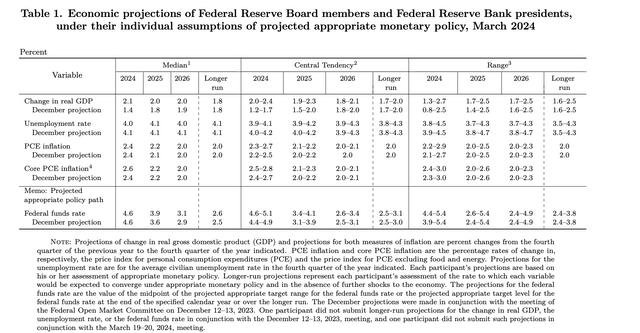

These market-price expectations are significantly higher than the Fed’s expectations as of its March Economic Outlook Summary. The Fed currently expects interest rates to be 3.1% in 2026, which implies a real interest rate of 1.1% if the Fed expects a PCE rate of 2%. Meanwhile, the market expects rates to be 4.15% and a PCE rate of 2.0% implies a real interest rate of 2.15%.

At this point, it seems clear that all Fed interest rate forecasts should rise after the June FOMC meeting.

Market pricing suggests that the outlook for Fed tightening is too low, and as a result, 2-year rates are beginning to rise above the 5% threshold, confirming that the market is not just excluding rate cuts from consideration, but is beginning to price them in. chance Because of interest rate hikes.

If another rate hike is likely to be necessary in the future, and the market recognizes that this is likely to occur, it will be priced in well before the Fed speaks and should start to be reflected in the financial conditions index, signaling tightening.

This does not mean that the Fed will be raising interest rates anytime soon, but it does mean that markets are already beginning to assess and increase the likelihood of such an event occurring, especially if the data continues to support the idea that neutral rates are rising and current Fed policy is not tightening enough to bring inflation back on target.