Pgiam/iStock via Getty Images

Investment Thesis

my Initial pessimism About UiPath (New York Stock Exchange:path) has aged well, as its shares have fallen 22.5% over the past three months, compared with a 6.3% decline in the S&P 500. The company reports quarterly earnings on May 29. And today, I want to update my analysis in light of this important event and also share my perspective on recent developments. While last quarter’s revenue was strong, it was not part of a solid trend and was likely an outlier. Revenue growth and EPS trends are expected to slow significantly in the first quarter, which is a warning sign. Market sentiment toward the stock also appears weak, with mixed expectations for Wall Street’s upcoming earnings release. Valuation remains unattractive even after the stock’s 24% decline year-to-date. Overall, I reiterate my Sell rating on PATH.

Recent developments

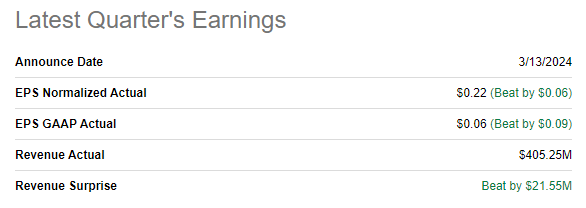

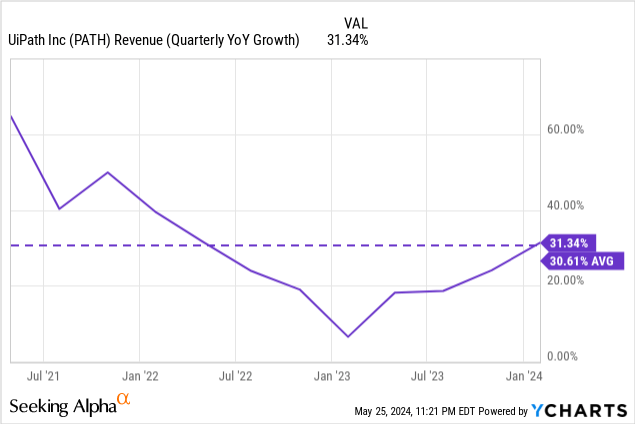

PATH reported its latest quarterly results on March 13, beating consensus estimates for both revenue and EPS. Revenue growth accelerated to 31% year over year, while adjusted EPS expanded from $0.15 to $0.22.

Find Alpha

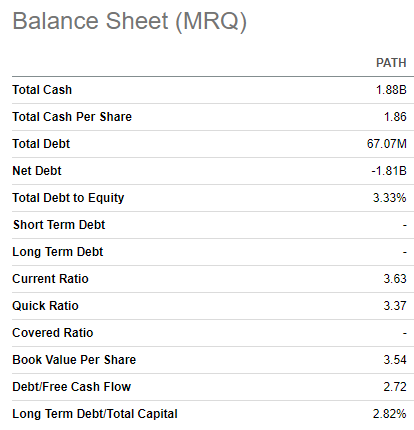

The last quarter was notable as the first quarter in the company’s history in which it achieved a positive GAAP operating margin of nearly 4%. However, part of this improvement was due to a significant decrease in R&D-to-revenue ratio from 26% year-over-year to approximately 21%. Free cash flow (FCF) was also positive in the fourth quarter, reaching $121 million, further improving PATH’s strong financial position with $1.9 billion in cash and low leverage levels. The company’s clean balance sheet is a clear strength, giving PATH the financial flexibility to drive further growth.

Find Alpha

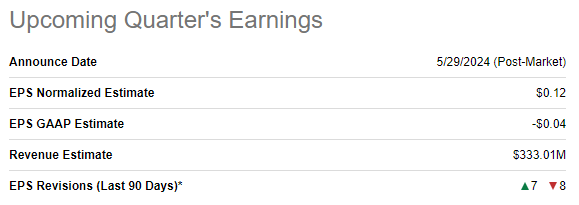

The company’s next earnings release is scheduled for May 29. Expectations are mixed on Wall Street, with EPS estimates revised upwards seven times and downwards eight times in the past 90 days. First-quarter revenue is expected to be $333 million, up 15% year over year. The slowdown in growth is notable when compared to fourth-quarter revenue trends. Adjusted EPS is expected to grow by around 1 cent.

Find Alpha

A strong fourth quarter performance does not necessarily inspire optimism ahead of the next earnings release. Given that revenue growth is expected to slow significantly and adjusted EPS declined significantly quarter-over-quarter, we believe the fourth quarter’s success was likely an anomaly and not a sustainable trend.

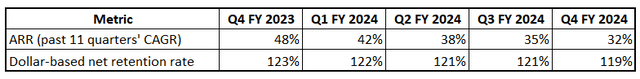

My opinion that the sharp rise in key financial metrics in Q4 FY24 is unsustainable is also supported by the worsening trends in two key business metrics: annual renewal run rate (ARR) and net retention rate in dollars. Over the past five quarters, ARR CAGR has decelerated from 48% to 32%. Net retention rate in dollars has also worsened almost every quarter since Q4 FY23. I understand that as comparisons get larger, growth rates tend to slow as well. But a 3-4 percentage point decline in ARR CAGR seems too steep for a company with annual revenues of around $1.5 billion.

Additionally, it’s important to remember that we shouldn’t expect any major market bull runs during the first quarter earnings season. Latest Earnings Insights from FactSet“The market values positive earnings surprises reported by S&P 500 companies slightly below average and values negative earnings surprises reported by S&P 500 companies above average.” Additionally, the percentage of S&P 500 companies with negative EPS guidance for Q2 2024 is 59% (60 of 101).

Weak stock market sentiment ahead of earnings announcements was reflected last month not only in the overall U.S. market but also in the iShares Russell 2000 Growth ETF.international).

In conclusion, I am fairly cautious about the company’s upcoming earnings release. Last quarter’s strong performance is likely an exception, and growth in key business metrics has been consistently worsening. Market sentiment toward PATH’s first quarter earnings also appears weak.

Rating Update

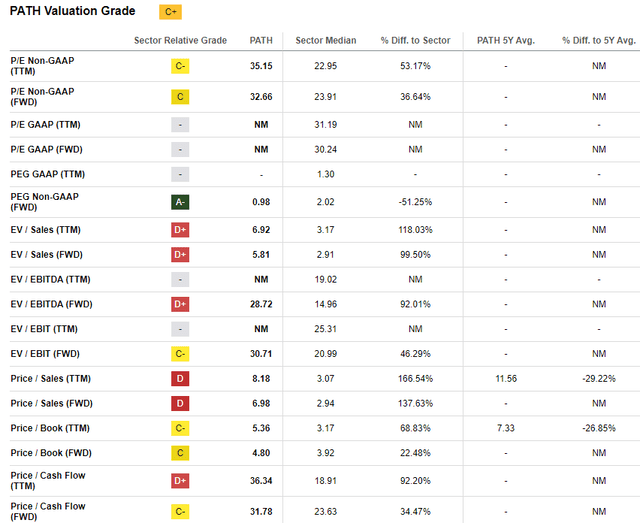

The stock has risen 16% over the past 12 months, but is off to a rough start in 2024, down 24% so far this year. Seeking Alpha Quant is on PATH Evaluation grade: “C+”indicates that the stock is about fairly valued. Certainly, a non-GAAP PEG of 0.98 is good. On the other hand, a forward P/E ratio of over 30 and a forward P/S ratio of 7 do not seem like attractive multiples.

Frankly, looking at ratios alone doesn’t provide a full answer, so simulating a discounted cash flow (DCF) model is essential to understanding PATH’s valuation.

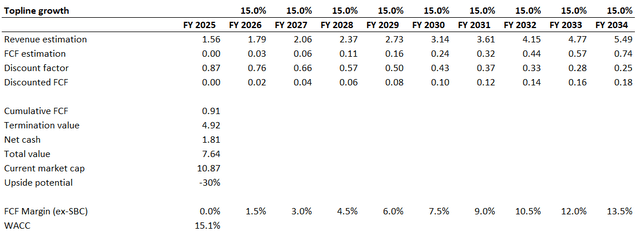

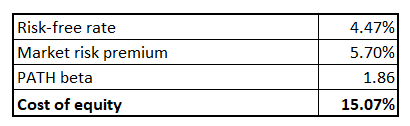

PATH has very low debt levels. Therefore, I use PATH’s cost of equity capital as the discount rate. To calculate PATH’s cost of equity capital, I choose the Capital Asset Pricing Model (CAPM). The risk-free interest rate is the current 10-year U.S. Treasury yield, Yahoo FinanceMy risk assumptions for the US stock market are 5.7%According to Seeking Alpha, the beta version of PATH is 1.86%When all these variables are incorporated into the CAPM formula, the cost of equity capital is 15.07%.

Author’s calculations

The other two key assumptions I have to make are the trends in revenue growth and FCF margins over the next 10 years. Consensus Estimates $1.56 billion. The base year FCF less stock-based compensation (SBC) margin is zero due to slightly negative TTM levels.

according to StatistaRPA software is expected to grow from $3.4 billion in 2023 to $23.9 billion in 2030, a CAGR of about 34%. PATH has achieved a CAGR of 31% since 2021. As the industry gets bigger, it becomes more attractive to new entrants, and the competition is poised to intensify. Moreover, the larger PATH’s revenue comparisons are, the more its revenue pace should naturally slow.

Therefore, it is hard to see PATH’s revenue CAGR accelerating to 34% over the next decade. Consensus Estimates We expect PATH’s revenue growth to slow to 15.4% by fiscal 2027. Therefore, we believe incorporating a 15% revenue CAGR is a fairly optimistic assumption. In terms of FCF margin expansion, PATH is Proven track record of improving metricsTherefore, I expect 150 basis points of expansion per year, which implies a strong correlation with earnings growth.

The company’s fair value is $7.6 billion, 30% below its current market cap, so the stock still doesn’t appear to be attractively valued.

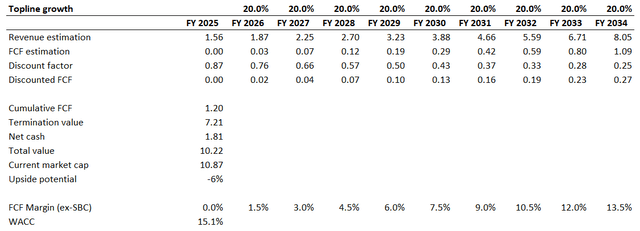

Bulls might say that PATH’s assumption of 15% revenue growth is too conservative. So let’s simulate a different scenario, assuming a revenue CAGR of 20% and keeping all other assumptions unchanged.

Even with a compound annual growth rate (CAGR) of 20% in earnings over the next decade, the fair value of this company is slightly below its current market cap, so even factoring in very generous earnings growth assumptions, the stock is overvalued.

The risks to my bearish argument

In late November 2023, PATH was trading very close to current levels, meaning the stock was likely overvalued at the time as well. But overvaluation has not been a hindrance for PATH. 25% increase The stock could surge again after the company reports third-quarter earnings last year, proving my bearish view wrong.

Strong sentiment towards artificial intelligence could also be a positive for PATH, as the stock is viewed by the market as having strong exposure to AI, so any notable positive developments in the industry could also help the stock rise.

If PATH announces a strategic partnership with a hyperscaler, this could also be a strong near-term positive for the stock price.

Conclusion

In conclusion, PATH remains a Sell. While any stock can always surge after an earnings release, several indicators suggest that investor sentiment toward this stock is fairly weak. Additionally, in my opinion, the stock still appears significantly overvalued.