Rathke/iStock Editorial via Getty Images

Boeing (New York Stock Exchange:BA) has had a rough start to the year, with its stock price falling more than 30% since the start of the year amid regulatory scrutiny. The company has certainly faced some challenges that have already had a negative financial impact, but While the company’s financial position has deteriorated and its performance has been lackluster in recent months, there is reason to believe it remains a solid investment because it is too big to fail.

Too big to crush

In January I wrote a bullish outlook. article Regarding Boeing, I said that the current crisis is unlikely to lead to a complete grounding of its aircraft, as happened during the 2019 crisis. 737 MAX CrisisSince then, Boeing’s stock price has fallen about 20%, and while the momentum is not on the company’s side, I still believe Boeing It’s a buy, especially at the current price.

There are several reasons why I am optimistic about Boeing’s future. First, the 2019 scenario has so far been avoided, so I think my initial thoughts were probably correct. Shortly after the door plug issue was resolved, the FAA approved The path to Boeing’s newest aircraft returning to service has become clear. At the same time, the company work The company is working with regulators to develop a plan to fix its systemic quality control issues, which is expected to be revealed in the coming days, so it’s safe to say there’s a good chance the company will be able to handle ongoing regulatory scrutiny without facing serious financial damage like it did in 2019.

On top of that, Boeing was able to report relatively strong results for the first quarter. Earnings Report Boeing maintained strong performance last month despite ongoing challenges. First-quarter revenues were down 7.5% year over year to $16.6 billion, despite some of its most advanced aircraft being grounded for weeks in January. At the same time, first-quarter non-GAAP EPS was -$1.13, beating expectations by $0.30. Moreover, Boeing appears to have ample growth opportunities to mitigate the downside of ongoing risks and challenges.

One of Boeing’s biggest strengths is that the air travel market has fully recovered to or above pre-pandemic levels. reason This year’s annual air travel demand is expected to continue to grow in the coming months and is expected to exceed the level of 2019. At the same time, the growth of the Chinese market and expansion Routes originating from China are also showing signs of a full recovery, given Boeing’s first-quarter backlog. grown At $529 billion, it’s safe to assume that the crisis will not have a significant impact on the company’s performance in the long term and that the worst-case scenario has likely been averted.

Additionally, Boeing remains a key defense contractor and is benefiting greatly from increased federal defense spending aimed at addressing growing geopolitical challenges. In the first quarter, Boeing’s defense division continued to win new orders for military aircraft from the U.S. and its allies, growing revenue 6% year over year to $6.95 billion. Given Boeing’s importance to U.S. interests, the company is too big to fail, and the ongoing regulatory investigations are unlikely to significantly harm the company’s business.

Given all these developments, there is reason to be optimistic about Boeing’s future. Despite ongoing challenges and weak first-quarter sales, the market remains favorable. believe We believe Boeing will be able to improve its year-over-year revenue and profit performance from FY24 onwards. Therefore, we decided to create a DCF model to see if Boeing shares are an attractive investment at their current prices after the latest depreciation.

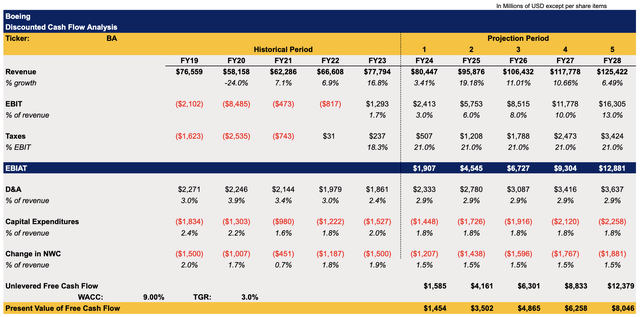

The revenue growth assumptions in the model correlate closely with the latest forecasts issued by the market. Revenues in the model are expected to grow gradually over the coming months thanks to various growth drivers, which should help minimize the negative impact of the latest developments. The tax rate in the model is 21%. All other metric assumptions correlate closely with Boeing’s historical performance. The terminal growth rate in the model is 3% and the WACC is 9%.

Boeing DCF Model (Historical Data: Seeking Alpha, Assumptions: Author)

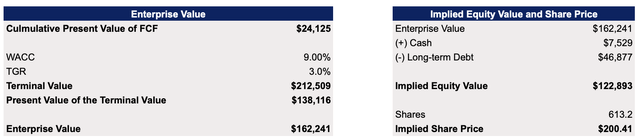

According to my DCF model, Boeing has an enterprise value of $162.2 billion and a fair value of $200.41 per share, which indicates a significant upside of about 15% for the company’s stock at current prices.

Boeing DCF Model (Historical Data: Seeking Alpha, Assumptions: Author)

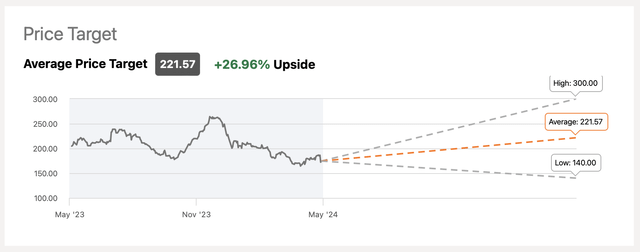

The Street also believes Boeing is currently undervalued. consensus The price target is around $222 per share. With this in mind, I’ve decided to maintain my buy rating for now.

Boeing Consensus Price Target (Seeking Alpha)

Key risks to consider

There’s no question that Boeing is facing a major PR crisis, which is already impacting its business and stock price. story The doubts about the safety of its planes are hurting the company’s credibility, even though the thousands of planes Boeing builds are safe. transportation It serves thousands of passengers every day and the company itself take Failure to take all safety concerns seriously could result in serious reputational damage to the brand name and minimise overall future business gains.

Chinese Comac manufacturers are actively Expanding The company has been ramping up production capacity for its C919 narrow-body jets in recent months, seeking to grab some of Boeing’s market share in China. Meanwhile, European manufacturer Airbus SE (OTCPK:EADSY)teeth receive Boeing is expected to receive large orders from international customers this year, but those customers are now taking Boeing’s reputation into account when deciding who to do business with. Therefore, while Boeing is likely to weather the reputational turmoil and improve its overall performance in the next quarter, there is a risk that international orders will start to decline due to increased global competition. This could leave the company overexposed to the US market, which itself comes with various risks.

Conclusion

Boeing is too big to fail. While recent troubles have certainly led to financial losses and underperformance, there is reason to believe a 2019-like scenario is likely to be avoided, in which all nine of the company’s 737 MAX aircraft were grounded worldwide for years. The company may continue to underperform in the coming months due to regulatory scrutiny, but for now I believe its long-term prospects remain solid. That’s why I am sticking with my buy rating, as at current prices Boeing looks like a decent investment.

Editor’s Note: This article discusses one or more securities that do not trade on a major U.S. exchange. Please be aware of the risks associated with these stocks.