Rear chic

NN Group (OTCPK:NNGPF) (OTCPK:NNGRY) currently offers a long-term sustainable high dividend yield and is undervalued within the European insurance sector.

As I mentioned Previous articleI saw the NN group Its high dividend yield and attractive valuation make it a recognized source of excellent returns in the European insurance sector.

Since then, the company’s shares have risen by over 25%, including dividends, and following such a strong share price increase, I believe now is a good time to revisit the investment case to see whether the company remains an attractive source of income in the European insurance sector.

Overview of the project

Dutch National NN Group is a Dutch insurance company offering life insurance, non-life insurance and banking products. Its largest market remains the domestic market, but it also has a presence in several other European countries and Japan. The company’s shares are traded over the counter in the United States and its current market capitalization is approximately $14 billion.

The company operates in 11 countries, has approximately 19 million customers, and operates with a multi-brand approach. This business was sold To segment Goldman Sachs (GS) in 2022 for approximately 1.7 billion euros.

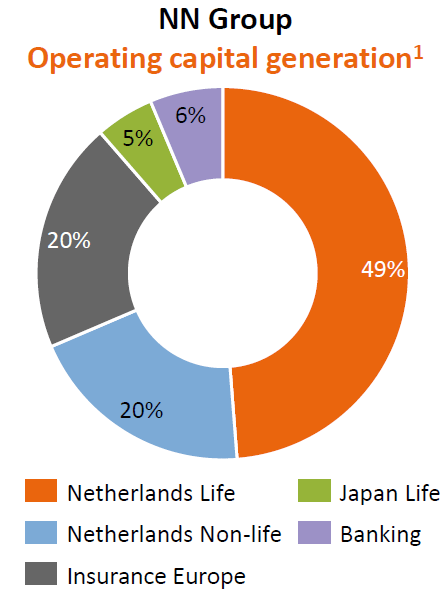

The asset sale will further focus NN Group’s operations on its domestic insurance business, which accounted for around 69% of organic capital generation over the past year, followed by insurance businesses in other European countries, with Japan and banking making much smaller contributions.

Organic Capital (NN Group)

This indicates that while NN Group’s core business is life insurance, it also offers complementary non-life insurance and banking products (mainly mortgages and savings). As this business is focused on the life insurance sector, NN Group’s closest peers are other European insurance companies with significant operations in the life insurance sector. AXA SA (OTCQX:AXAHY), age (OTCPK:AGESY), or ASR Netherlands (OTCPK: Ernie).

In the Dutch life insurance market, it holds the number one position in the pensions segment with a market share of about 40%, while in the non-life insurance segment it is the second largest with a market share of about 27%. In the Netherlands, it has bancassurance partnerships with four of the top five banks in the country, with the only exception being Rabobank. In other European countries, it holds top three positions in several countries, but generally speaking it is not a top player.

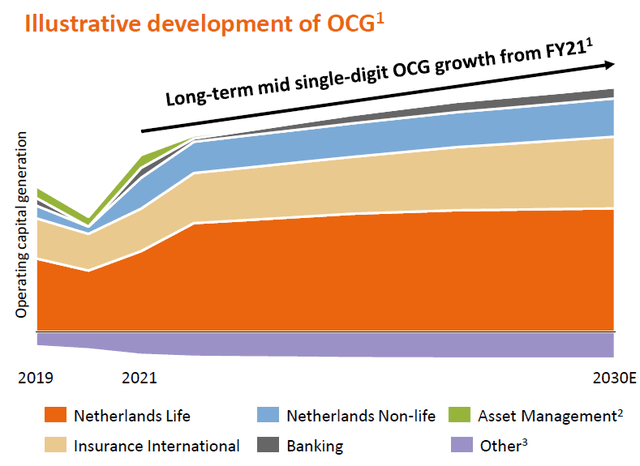

Given its strong market presence in the Netherlands and the maturity of the insurance industry in Europe and Japan, NN Group’s long-term growth prospects are relatively modest. Indeed, one of the company’s key operating indicators is working capital generation (OCG), which will reach €1.9 billion in 2023, already in line with the new target for 2025 (recently revised from €1.8 billion). In the long term, the company aims to grow OCG at a mid-single digit rate, with relatively low operational growth expected in the coming years.

This means that while the company’s growth strategy is expected to remain focused on organic growth initiatives in nature, aiming to improve efficiency and profitability over the next few years, the company’s business profile is not expected to change significantly in the near future compared to its current profile.

Financial Overview

the Financial PerformanceNN Group reported relatively strong financial results last year, with insurance income up 1.8% year-on-year to about €10.5 billion, and operating profit improving to more than €2.5 billion in 2023. Adjusting for the sale of NN Group’s asset management business, operating profit increased 7.6% year-on-year.

The improvement was mainly driven by European insurance and banking activities, while the domestic divisions (both life and non-life) experienced a slightly lower operating result last year. In the life division, the improvement was justified by lower risk adjustment releases and in the non-life division by higher claims costs in the disability insurance business line. Net income from continuing operations, adjusting for the sale of NN Investment Partners and other one-time effects, was nearly double the previous year at nearly 1.2 billion euros.

Investors expect NN Group to acquire the company in the fourth quarter of 2023. Unit-linked litigation issuesIn that case, a customer had complained about some cost cutting, but a Dutch court ruled against NN.

The company reached a settlement with interest groups in January and set aside a provision of €300 million, but customers not affiliated with interest groups only represent a small portion of the potential lawsuits, and the company decided to set aside a further provision of €60 million to cover these lawsuits. NN considers the remaining risk to be immaterial, given the steps it has taken to compensate policyholders over the long term, and therefore is unlikely to incur any further costs related to this matter.

Another positive step taken by NN to reduce balance sheet risk was the decision to enter into reinsurance agreements in the Dutch life insurance division to reduce the longevity risk of pension products linked to pension liabilities of around EUR 13 billion. Reducing this risk on the balance sheet improved the solvency ratio by around 8 percentage points and was also beneficial in terms of reducing the interest rate sensitivity of the solvency ratio in future.

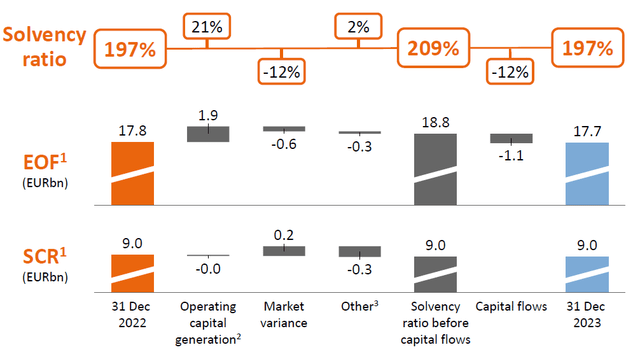

Nevertheless, NN Group’s solvency ratio remained broadly unchanged from the previous year at 197% at end-2023, as strong organic capital generation and benefits from long-term trading were offset by market trends and capital returns to shareholders.

This solvency ratio is very favorable and broadly in line with the European insurance industry average, enabling NN Group to return a significant portion of its annual capital generation to shareholders.

In fact, over the past few years, the company dividend and share buybacks.The most recent annual dividend was €3.20 per share, with an interim dividend of €1.12 per share and a final dividend of €2.08 per share, representing an annual increase of 14.7% year-on-year.At the current share price, NN Group is offering a dividend of around 7.1%, which is very attractive for income investors.

In addition to the dividend, the company will also undertake share repurchases worth €250 million, bringing total capital return to approximately €1.05 billion in 2023. For 2024, the company plans to increase the dividend by approximately 12.5% year-on-year and implement a €300 million share repurchase program, increasing total capital return to €1.2 billion.

While a high dividend yield can sometimes be a sign of a dividend’s unsustainability, this isn’t the case for NN Group: the company’s dividend is well covered by organic free cash flow generation, which amounted to around €1.4 billion in 2023 and is expected to grow to around €1.6 billion by 2025. This means that NN Group is generating enough cash to fund its dividend policy and share buyback program, plus it is keeping some cash at holding levels due to its conservative approach.

So the company’s dividend is clearly sustainable and has good growth prospects over the next few years, which Wall Street seems to agree with. Analyst forecastsNN Group’s dividend is expected to grow over the next few years, reaching around €3.88 per share by 2026, which could lead to further improving dividend yields in the medium term.

Evaluation and Risk

The current valuation of the NN Group is transaction The valuation of just 0.65 times book value isn’t that high compared to its closest peers, but it is in line with the historical average over the past few years, despite some improvement in profitability in recent years.

On a relative basis, I believe ASR Nederland and Ageas, which are both focused on the Benelux insurance market, are the best peers. Both competitors are currently trading at around 1.2 times book value, which may indicate that NN Group is undervalued.

However, NN Group’s profitability has historically been quite low compared to its peers (return on equity has averaged around 6-7% compared to double digit levels for its peers), so I think it’s also worth doing an absolute valuation to see if NN is truly undervalued.

Using the Gordon Growth Model and assuming a cost of equity capital of approximately 7%, based on a beta of 0.7x over the past few years and a risk-free interest rate of 2.86% (Dutch 10-year government rate), the fair value is close to book value, indicating that the company’s shares are currently undervalued, although a small discount relative to peers is justified due to lower profitability levels.

In terms of risk, investors should be aware that life insurance companies typically have a longer duration on the liability side than on the asset side, resulting in a duration mismatch. If an insurance company does not hedge its interest rate risk, this will be negative for its solvency ratio during periods of low interest rates. NN Group is aware of this and has hedged its interest rate risk to some extent, but this may not be a perfect hedge and future declines in interest rates could have a negative impact on its solvency ratio and therefore its ability to pay dividends and undertake share buybacks in the future.

Another potential risk that should not be overlooked is the widening of credit spreads, given that current spreads are relatively narrow compared to historical levels. Therefore, a widening of credit spreads could lead to investment losses in fixed income portfolios and also have a negative impact on solvency ratios.

Conclusion

NN Group’s high exposure to mature insurance markets and therefore very low growth prospects make the investment proposition highly dependent on capital return. Indeed, its high dividend yield and share buybacks are its most attractive features for shareholders. Moreover, its valuation does not appear to be very high, both relatively and in absolute terms, making NN Group an interesting income option in the European insurance market.

Editor’s Note: This article discusses one or more securities that do not trade on a major U.S. exchange. Please be aware of the risks associated with these stocks.