Hiroshi Watanabe

In March of this year, I article Saratoga Investment Corporation (New York Stock Exchange:Russia) have assigned Neutral or Hold ratings to SAR despite the very attractive features it represents (e.g., diversified portfolio, focus on cash flow businesses, and the majority of exposure). (located at the first lien level).

The main reason for my moderately bearish stance is SAR’s massive leverage, which makes other segments of the business more risky as well: SAR’s debt-to-equity ratio is over 200% and the sector is average Approximately 117%. Due to excessive leverage, BDC regulations cap the leverage of BDC balance sheets, forcing SAR to rely increasingly on internal financing. However, at a 13% discount to SAR’s NAV, issuing additional shares would be value-destructive to existing shareholders. Even taking this into account, SAR was forced to sell in Q3 2023. The company decided to sell its shares in order to raise capital to fund new investments and gradually reduce its financial risk.

These trends were enough for me to avoid investing in SAR and look at other BDC alternatives that have a similar dividend yield to SAR (approximately 12.5%) but with a more balanced risk profile.

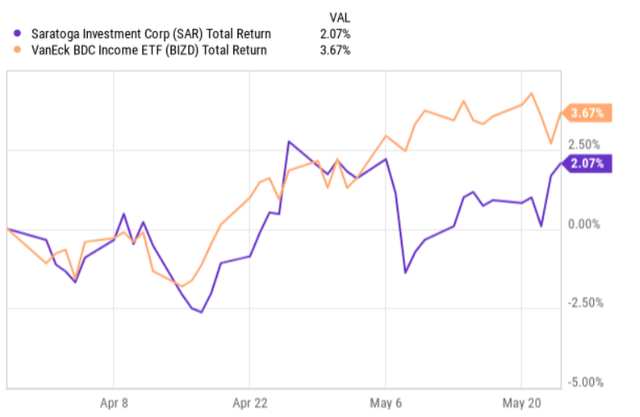

Since the publication of my article, SAR has achieved positive total return results but underperformed the BDC index, which ties in closely with the expected momentum this year, where SAR has consistently lagged the overall BDC market.

Now, relatively recently, SAR released its Q4 2024 earnings report, which I think is worth evaluating to understand if there have been any fundamental changes that would trigger a buy rating. SAR’s stable track record of a 12.5% dividend yield and roughly 13% discount to NAV suggest enough potential to make SAR an attractive investment, at least on the surface.

Thesis Review

SAR’s core performance is broadly consistent with the less-than-optimal share price movement we’ve seen so far this year: Nearly all of the major metrics remain in solid territory and SAR has maintained its underlying dividend, but in terms of percentage change, performance has worsened (and has already worsened for two consecutive quarters).

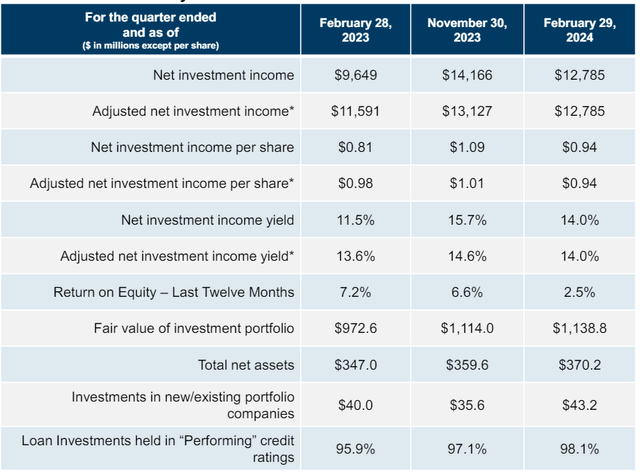

The adjusted net investment income figure is one of the most important measures of a BDC’s cash generation strength and is typically tied to dividends to determine how much cash they can keep on their books to fund growth or provide a needed safety margin. As can be seen in the table below, SAR has an adjusted net investment income per share of $0.94 for the quarter, $0.07 lower than last quarter.

Saratoga Partners Earnings Presentation

There were two main factors behind this decline.

The first is a result of SAR’s decision to leverage the equity markets to strengthen its liquidity profile; namely, weighted average shares outstanding increased to 13.7 million shares in Q4 2024 compared to $11.9 million last year and $13.1 million in Q3 2024. In theory, if the additional equity issuance had been driven by a growing investment pipeline, the net impact would have been neutral or positive to adjusted net investment income per share. However, as the majority of the equity proceeds raised were dedicated to optimizing the balance sheet and strengthening our liquidity profile, there was not enough incremental cash generation to offset the dilutive effect.

The second relates to the decline in core performance, with adjusted net investment income declining in absolute terms by around 2.6% compared to the previous quarter, the decline being mainly explained by narrower spreads and higher borrowing costs resulting from the rollover of fixed debt.

Now, the question is whether SAR is in a position to produce decent results and stabilize adjusted net investment income going forward. Unfortunately, looking at the trends mentioned above and current fundamentals, I don’t see that happening.

In my opinion, the risks associated with SAR’s leverage profile are too high at this point. Even after taking notable steps with additional equity issuance, SAR’s debt-to-equity ratio remains the highest in the BDC sector. In the latest quarterly data, it is easy to see that the newly issued shares pose a significant headwind to cash generation per share. SAR still has a long way to go to optimize its balance sheet, which means that the risk of further equity issuance and the associated negative dilutive effects are certainly high.

Another aspect worth highlighting is that over the past three quarters, SAR has not experienced any headwinds of underperforming investments or significant accrued interest accumulation. For example, credit quality was very strong this quarter with over 98% of SAR investments performing in line with or above expectations. As such, we have not yet experienced any impairment impacts that could adversely affect SAR’s adjusted net investment income numbers, given the significant amount of external leverage. Admittedly, this is merely a possibility, but the downside risks are certainly significant given the weak economy, rising defaults, and SAR’s track record (prior to 2022, when accrued interest consumed a significant portion of its investment base).

Conclusion

Even after Q4 2024 earnings are released, there is still insufficient foundation of positive data points to justify a long position in SAR.

Currently, SAR is in a precarious position of having one of the highest leverage profiles in the BDC sector while struggling to stabilize its existing adjusted net investment income results. This is all occurring despite SAR’s record portfolio quality levels and no hiccups yet on the accrued interest side. It is clear that sooner or later, SAR will be forced to recognize an impairment, and when it does, the impact will be very significant given the presence of very significant leverage.

The current price-to-NAV discount of about 13% is not enough to open a position in Saratoga Investment Corp.