ljubaphoto/E+ via Getty Images

A brief introduction to Actuate Therapeutics, Inc.

Actuate Therapeutics, Inc. (ACTUAccording to an SEC S-1, the company has filed to raise $50 million in an IPO of common stock. Registration information.

The company is in the clinical stage Biopharmaceuticals developing treatments for pancreatic and other cancers.

Actuate Therapeutics, Inc. showed encouraging efficacy results in a Phase 2 trial of its lead program.

We will provide a final opinion once we know more about the IPO.

Actuate Overview

Actuate Therapeutics, Inc., headquartered in Fort Worth, Texas, was formed to license a technology known as GSK-3 inhibitors, which block the function of the enzyme GSK-3B, a master regulator of a complex biological signaling cascade that leads to tumor cell survival, growth, migration and invasion.

The manager has been with the company since March 2015. He previously served as Chief Operating Officer at Genus Oncology and has extensive experience in the pharmaceutical industry.

The company’s lead drug candidate is erraglusib, which is being developed to treat a variety of cancers.

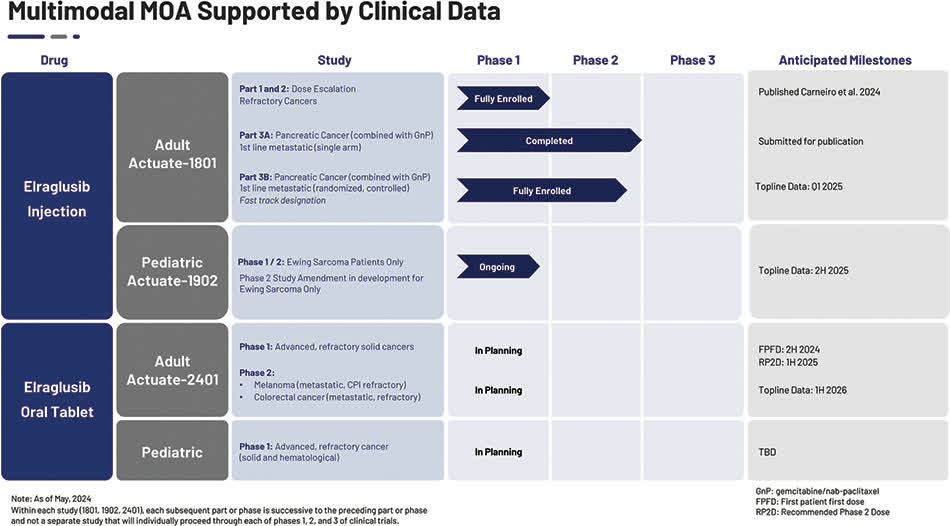

The company’s pancreatic cancer program is the most advanced, having completed a Phase 1/2 trial, and management is also conducting a treatment trial for Ewing’s sarcoma as part of the “Actuate-1902 Phase 1/2 Trial in Pediatric Refractory Malignancies.”

The current status of the company’s development pipeline is as follows:

SEC

Actuate has booked investments with a fair market value of $99.8 million as of March 31, 2024 from investors including Bios Equity Affiliated Funds and Kairos Venture Affiliated Funds.

Actuate’s Market and Competition

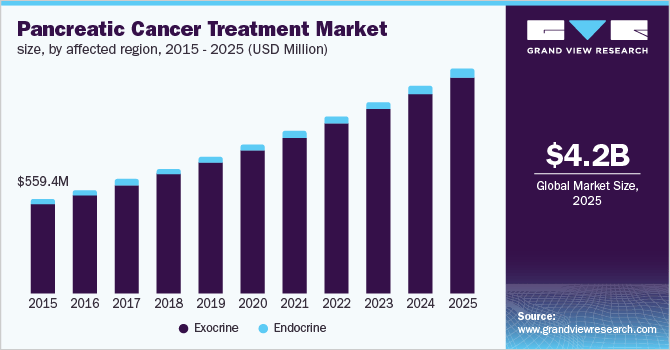

In 2019 Market Research Reports According to Grand View Research, the global market for pancreatic cancer treatments was estimated at $560 million in 2015 and is projected to reach $4.2 billion by 2025.

This indicates a projected CAGR (compound annual growth rate) of 23% from 2016-2025.

The key factors driving this expected growth are the growing elderly population worldwide, which is resulting in weakened immune function and rising incidence of cancer, as well as the increasing prevalence of alcohol consumption and obesity.

Also, the graph below depicts the historical and projected future growth of the global pancreatic cancer treatment market through 2025.

Grand View Research

Major competing vendors that have developed or are in the process of developing similar treatments include:

Eli Lilly and Company

Celgene

F. Hoffmann-La Roche AG

Amgen

Novartis

Pharmasite Biotech

Clovis Oncology

Teva Pharmaceuticals

Merck

Pfizer

others.

Actuate Therapeutics Financial Situation

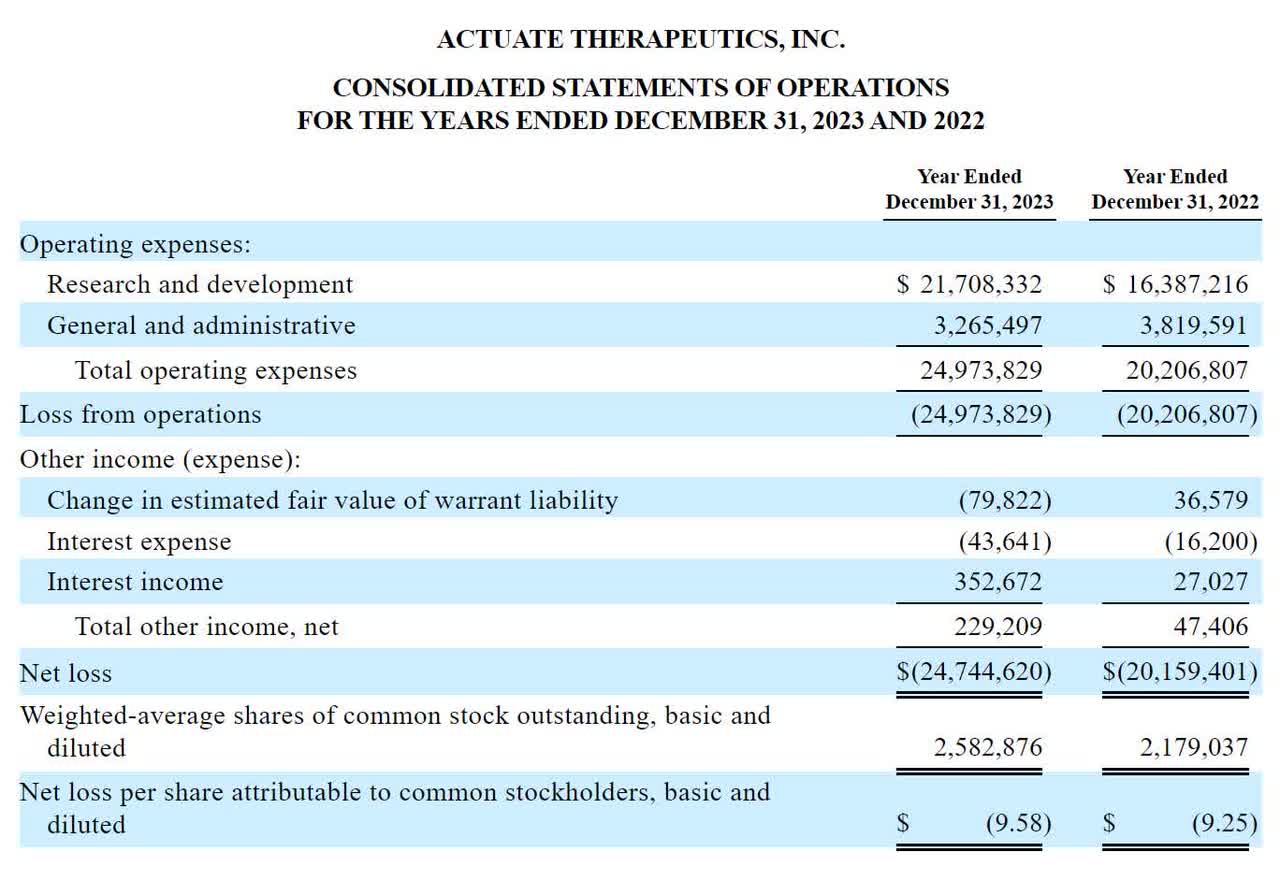

The company’s recent financial results have been typical of a clinical-stage biopharmaceutical company in that it has had no revenues and incurred significant research and development and general and administrative expenses from its various development programs.

According to the company’s recent IPO filing, its latest financial performance for the past two calendar years is as follows:

SEC

As of March 31, 2024, the company had cash of $2.1 million and total debt of $16.3 million.

Actuate Therapeutics IPO Details

Actuate expects to raise gross proceeds of $50 million through its common stock IPO, although the final amount may be higher.

Neither existing nor potential new shareholders have expressed interest in acquiring shares at the IPO price.

The company has elected to be an “emerging growth company” and a “smaller reporting company” pursuant to the JOBS Act of 2012.

These classifications allow management to provide significantly less information to shareholders, at their option.

Given the development stage of the company’s pipeline, Actuate’s market capitalization at IPO is expected to be around $200 million.

Management stated that it intends to use the net proceeds of the IPO as follows:

Ongoing Phase 2 mPDAC study of injectable erraglusib (Actuate-1801 Part 3B)

Fund an existing Phase 1 dose escalation study in pediatric refractory cancers to continue exploring development opportunities and potentially initiate the Phase 2 portion of this study in patients with refractory Ewing’s sarcoma (Actuate-1902)

The transaction will satisfy the company’s funding obligations for an IIT study of erraglusib injection in combination with other chemotherapy agents to treat advanced oropharyngeal cancer (mPDAC) and another trial aimed at treating recurrent salivary gland cancer.

As long as revenue remains, it will fund the initial planning steps of the study and additional general and administrative tasks described below.

(Source: SEC)

Leadership’s Online Corporate Roadshow presentation is not yet available.

With respect to litigation, management has stated that it has not been party to legal claims that, taken in the aggregate, if brought against the Company, would have a material adverse effect on its financial condition or operations.

Listing bookrunners for the IPO are Titan Partners Group and Newbridge Securities.

Actuate IPO Commentary

ACTU is seeking investment from the US public capital markets to advance erlaglisib drug treatment for a range of cancer conditions.

The company’s pancreatic cancer program is the most advanced, having completed a Phase 1/2 trial, and management is also advancing a treatment trial for Ewing’s sarcoma as part of the Actuate-1902 Phase 1/2 trial in pediatric intractable malignancies.

The market opportunity for pancreatic cancer treatment is moderately large, but developing effective treatments has proven challenging as the disease is difficult to detect and treat successfully at its early stages.

Actuate is developing lead drug candidates for other cancer diseases, which have relatively large markets that are growing due to an aging population and a weakening immune system’s ability to respond.

Management has not disclosed any collaboration agreements or relationships with major pharmaceutical companies.

The company’s investor syndicate includes investors from venture capital firms specializing in biotechnology.

Actuate has demonstrated early Phase 2 efficacy results in its lead program. Management stated:

Based on this interim data, a preliminary Kaplan-Meier analysis showed that the median mOS (overall survival) in the erraglusib combination therapy group was 12.2 months compared to 7.3 months in the GnP control group (HR=0.60, log-rank p=0.012).

Thus, ACTU appears to have very promising Phase 2 trial activity for a cancer condition that is proving difficult to treat.

We will provide an update once we know management’s assumptions regarding IPO pricing and valuation.

IPO Pricing Date: To be announced.