Sun Nomachi

One company I’ve been bullish on for a long time is Boise Cascade Company (New York Stock Exchange:BCCFor those unfamiliar with the company, it focuses on manufacturing and selling wood-related products such as laminated veneer and laminated lumber. Beams, I-joints, plywood, strand board, and similar products. With high interest rates and their impact on housing and other construction activities, one would think that companies like these would take a hit in the market, but the reality is quite different.

Despite the weakness we saw in 2023, the company is beginning to see improving fundamentals, which is bullish for the stock. For context, consider how much the stock has risen since my last comment: Repeated My rating for this stock is “Buy”. As of February 2023, the stock price has risen 117.1%, far outpacing the 33.7% rise recorded by the S&P 500 over the same period. And I First evaluation Since rating the company a Buy in September 2021, the stock has risen 205.8%, compared to a 21.5% increase in the broader market. With such a large increase, one might think that now might be the time to look elsewhere. However, the stock remains attractive in absolute terms and is undervalued relative to peers, so there is no reason to be anything but bullish on the company.

Solid company at a great price

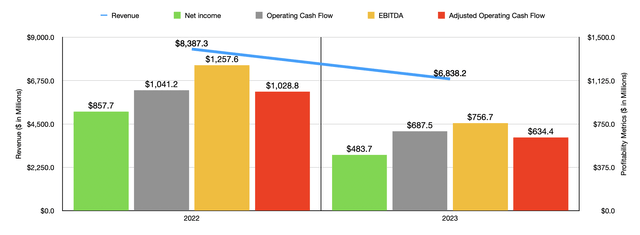

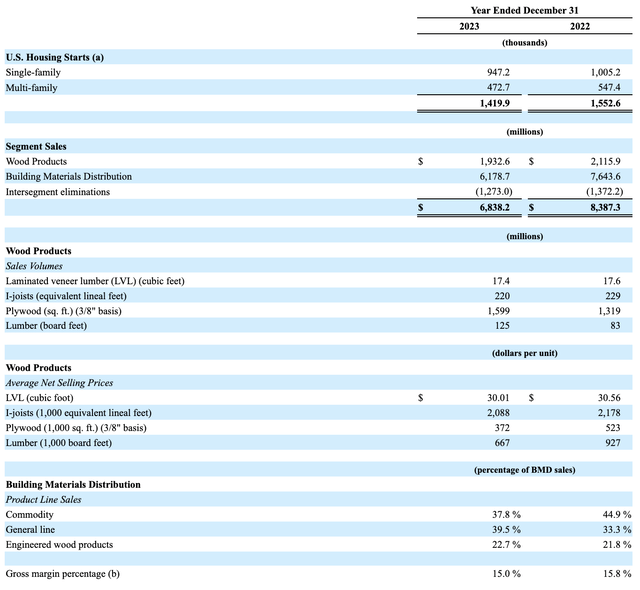

Given the stock’s rise since the beginning of last year, you might think Boise Cascades’ fundamental performance is excellent, but that’s not necessarily the case. 2023In 2019, the company’s revenue was $6.84 billion, down 18.5% from $8.39 billion just a year ago. There are multiple factors that contributed to this. For example, within the Wood Products division, sales volumes of laminated veneer and I-joints declined 1.1% and 3.9%, respectively. Prices for these also fell 1.8% and 4.1%, respectively. Plywood volume actually increased 21.2%. However, this came at the expense of prices plummeting 28.9%, from $523 to $372 per 1,000 square feet. Lumber volume also increased 50.6%, but prices fell 28%, from $927 to $667 per 1,000 square feet.

That’s not the only business the company has. It also has a building materials distribution business, whose revenues fell 19.2%, from $7.64 billion to $6.18 billion. Management attributed the decline to an overall decline in both sales prices and volumes. Prices fell an average of 16%, while sales volumes fell 3%. Merchandise sales were hit the hardest, plummeting 32% year over year. Even the company’s focus on EWP products fell 16%.

The woes facing Boise Cascade are largely due to a weak housing market. Housing starts for 2023 are forecast at 1.42 million, down from 1.55 million in 2022. Multifamily housing was hit especially hard, dropping 13.6% from 547,400 to just 472,700. Meanwhile, single-family homes are down just 5.8% from 1.01 million to 947,200. This is due to inflationary pressures and high interest rates meant to combat inflation.

Not surprisingly, the company’s profitability plummeted. Net income fell by nearly half, from $857.7 million to $483.7 million. Other profitability measures followed a similar trend. For example, operating cash flow fell from $1.04 billion to $687.5 million. Taking into account changes in working capital, it fell from $1.03 billion to $634.4 million. And finally, the company’s EBITDA fell from $1.26 billion to $756.7 million.

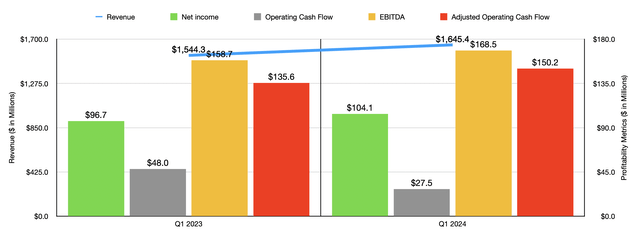

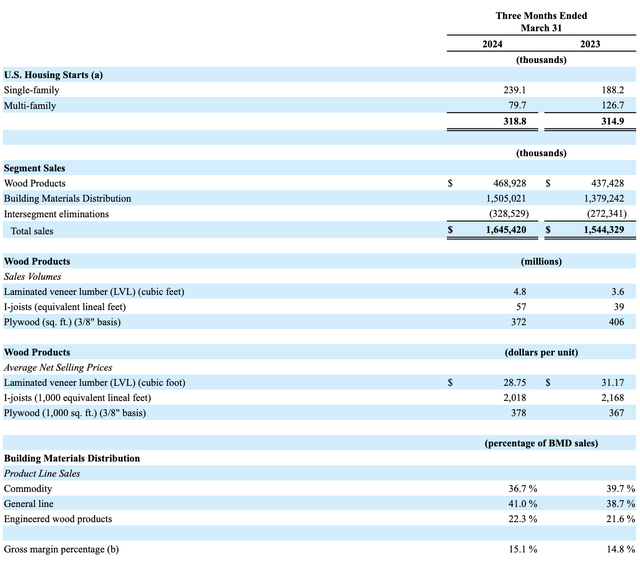

While these results were heartbreaking, there are bright spots ahead for 2024. prediction Housing starts should be on par with what the industry experienced last year. However, revenues increased from $1.65 billion to $1.54 billion. This is a 6.5% increase year over year. The company benefited from an increase in housing starts from 314,900 to 318,800. Correspondingly, laminate veneer lumber volume increased 33.3% year over year, while I-Joyce volume surged 46.2%. The only weak spot was plywood, where volume declined 8.4%. As the image below shows, both laminate veneer and I-Joyce prices remained weak year over year. However, plywood prices managed to increase by 3%. However, the company’s biggest increase in terms of revenue came from its building materials distribution division, where sales increased 9.1% from $1.38 billion to $1.51 billion. The increase was driven by an overall 12% increase in sales volumes, partially offset by a 3% decrease in prices.

With revenues trending upwards again, it’s not surprising to see the company’s profitability improve. Net income was $104.1 million, up from $96.7 million a year ago. It’s true that operating cash flow fell from $48 million to $27.5 million. But taking into account changes in working capital, it increases from $135.6 million to $150.2 million. And finally, EBITDA for the business increased from $158.7 million to $168.5 million.

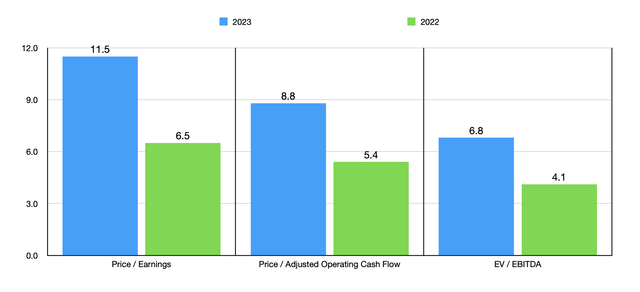

With 2024 still early and management not providing any guidance for this year, I don’t think it would be prudent to project financial performance at this point. However, even if we were to value the company using fiscal 2023 results, the stock still looks attractive. Look at the chart above and you’ll see what I mean. This same chart also shows trading multiples using 2022 data. Admittedly, the stock looks more expensive on a forward-looking basis than if we were using prior year results. But it’s still encouraging to see a company trading at a mid-to-high single-digit cash flow multiple. It’s also worth mentioning that the company is cheap relative to other companies. In the table below, we compare it to five similar companies. In each of the three valuation scenarios, Boise Cascade ended up being the cheapest of the group.

| company | Price / Earnings | Price / Operating Cash Flow | EV/EBITDA |

| Boise Cascade Company | 11.5 | 8.8 | 6.8 |

| Martin Marietta Materials (Multi-Level Marketing) | 18.2 | 24.7 | 11.4 |

| Summit materials (sum) | 18.8 | 13.9 | 12.2 |

| Top Build (Building de) | 21.7 | 15.9 | 13.0 |

| Installed building products (International Business Plan) | 26.4 | 18.8 | 13.9 |

| Eagle Material (Experience point) | 19.3 | 17.3 | 12.4 |

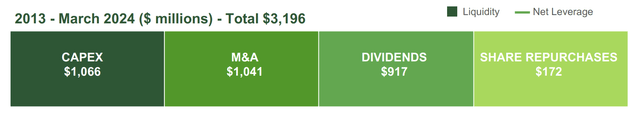

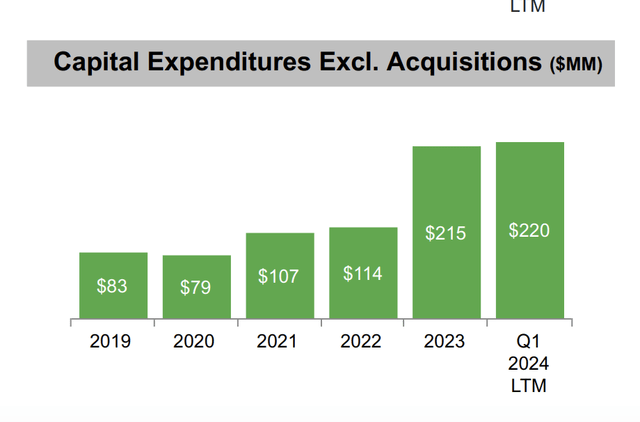

Valuation aside, it’s worth mentioning that management is planning for the future. The goal is to grow by all means in the long term, which includes both organic growth and acquisitions. From 2013 through the end of the first quarter of this year, the company had Assigned It allocated $1.4 billion to merger and acquisition activities, including $220 million spent in the most recent quarter alone and $215 million allocated throughout 2023. This doesn’t mean management isn’t focused on rewarding shareholders in other ways. From 2013 to the end of the first quarter of this year, the company allocated $172 million to share buybacks. But this is only a part of the rewards, as the company also spent $917 million on dividends. Given the low stock price, I wish these two figures were reversed. In the long run, it would make much more sense to buy back cheap shares than to pay cash to investors now. But at the end of the day, the important thing is that shareholders are being rewarded.

Boise Cascade Company Boise Cascade Company

remove

It’s been a rollercoaster ride for Boise Cascade, fundamentally speaking. But during this time, the market has noticed just how cheap the company’s stock is. Since I first rated the company a Buy in late 2021, the stock has more than doubled. And given how cheap the stock is, both in absolute terms and relative to peers, I’d argue there should be room for further upside. This is especially true considering interest rate cuts are likely on the horizon, which would increase demand for the types of products the company offers.