Svetik

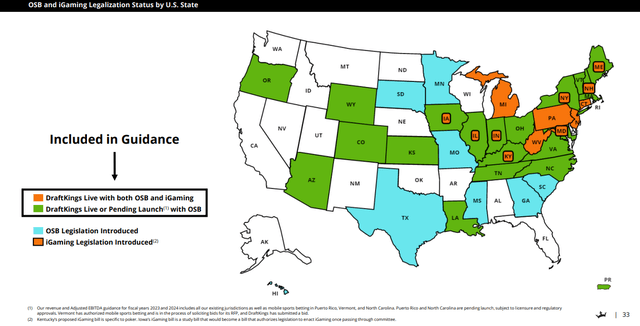

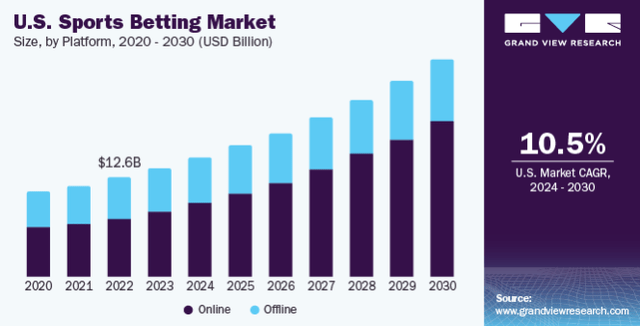

of Gambling Industry The scale is huge, as it generated over $54.9 billion in revenue in the 2022 calendar year.Vichi) and now real estate income (oh), but I want to get in touch with the industry first-hand. In 2023, Sports Betting Market It is estimated to generate $13.76 billion and is expected to grow at a compound annual growth rate (CAGR) of 10.5% through 2030. Sports betting Thirty-eight states and territories in the United States have legalized sports betting, with California likely to join in the future. Although only a few states have casinos, and the largest states, such as California and Texas, have yet to jump on board with sports betting, there’s no denying that gambling is big business and has room to grow. DraftKingsNasdaq:DKNG) is a name I’m keeping an eye on, especially with its strong recovery back into the $40 range. DKNG has great brand recognition and is a pioneer in the ever-growing mobile gambling space. User BaseThe issue is valuation. I believe sales will continue to grow, but I’m not convinced the actual operations will be able to generate the EPS that some analysts are predicting. If DKNG were to reverse or improve its valuation, I’d be more interested in initiating a position, but right now DKNG is trading at too high a premium for its growth potential, so I can’t place a buy order.

Find Alpha

Risks of investing in DraftKings

There are many risks associated with investing in DKNG, and investors should consider them before initiating a position. Gambling is legal in many states, and sports betting is on the rise, but there is no way to predict how future legislation will affect the industry. If it becomes widespread that people lose their life savings to gambling, restrictions may be imposed or states may repeal their gambling laws, despite the impact on tax revenues. DKNG also faces stiff competition, and while some may disagree, it is a strong player in the industry, with Caesars Entertainment (CZR), Pen Entertainment (pen), Las Vegas Sands (LVS) and Churchill Downs (ChineseDKNG is also unprofitable, and cutting bonuses and incentives for using its platform could lower usage and impact revenues. It could also lead to more people turning away from gambling in the coming years as American consumer debt grows and disposable income becomes tighter.

Why am I interested in DraftKings?

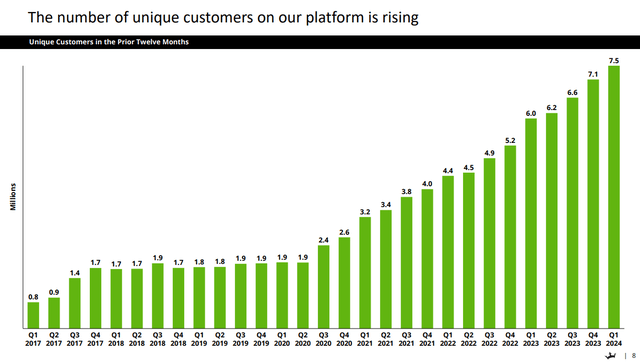

DKNG is a pioneer in the field of online sports betting. Today, DKNG DKNG has generated $4.07 billion in trailing twelve months (TTM) revenue, and Q1 2024 marked the first quarter DKNG has generated more than $1 billion in revenue for two consecutive quarters. DKNG achieved this without the participation of California or Texas amid stiff competition. DKNG’s Investor Day 2023 In November, the company projected revenue would grow at a 14% compound annual growth rate through fiscal 2028. This would put DKNG on track to generate $7.1 billion in revenue and $2.1 billion in adjusted EBITDA. Now, the reverse trend is playing out in DKNG’s favor, with customer acquisition costs declining 21% in 2022 and another 20% in 2023, while user numbers have grown at a 40% compound annual growth rate since 2021. As more states approve online sports betting and iGaming legislation, DKNG The company estimates that additional states, including California, Texas and Florida, could approve the bill, which could add another $6.2 billion to its adjusted EBITDA.

DraftKings

My opinion doesn’t matter. Ask 10 people which sports betting app they use and you’ll get multiple answers on why they chose it. To see the relevance of a platform, we want to see hard data. When we look at DKNG’s engagement, we are blown away by the magnitude of its growth. Since Q2 2020, DKNG has delivered 15 consecutive quarters of unique customer growth. In the past 15 quarters, DKNG has grown its unique customer base by 294.74%, adding 5.6 million unique users. In the past three months, DKNG has grown 5.63% quarter-over-quarter as 400,000 unique users were added to the platform. Overall TTM, DKNG added 1.5 million unique users, for an average quarter-over-quarter growth of 5.75%. If DKNG can achieve 5% quarter-over-quarter growth, it would finish 2024 with 6.68 million unique users, with an additional 1.18 million added to the platform throughout the rest of the year.

DraftKings

Sports betting The sports betting market continues to grow in the United States, accounting for 15% of the global sports betting market in 2023. The fact that sports betting alone is expected to grow from $13.76 billion in 2023 to $27.5 billion in 2030 is attractive enough, but when you also include iGaming, DKNG’s overall target market becomes even more attractive. As more legislation is approved, DKNG has seen its annual revenue grow 1,158.72% since the end of fiscal 2019. DKNG closed 2019 with $323.4 million in revenue and generated $4.07 billion in revenue on a TTM basis. Given the user growth DKNG is experiencing and the fact that it has generated over $1 billion in revenue for two consecutive quarters, I believe we can expect even more top-line growth from DKNG, especially as more states get involved in online gambling. From a tax revenue perspective, it’s unlikely that states like California, Texas and Florida will sit on the sidelines forever, and the rise of these markets could provide a big boost to DKNG’s sales and profits.

Grand View Research

I want to start a position on DraftKings but the financials and valuations are holding me back

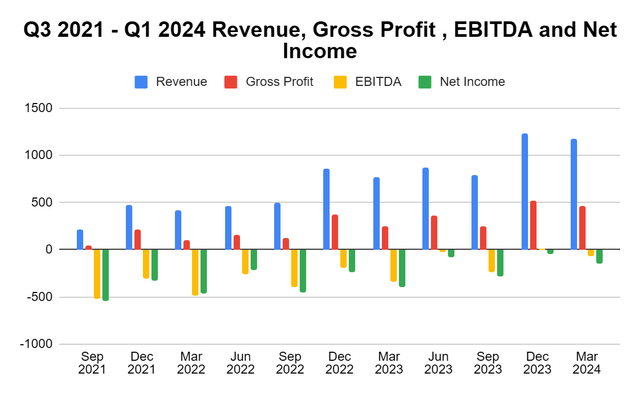

While I believe DKNG has the potential for revenue and earnings growth, the current financials are a red flag to me and I would not go over the valuation. Even if DKNG doesn’t sell and I miss the upside, I would still like to see the financials improve before initiating a position. On the positive side, revenues are booming and the trends in revenue and gross margins over the past two years have been very strong. The issue I have with the financials is that DKNG is valued based on future projections, with no guarantee that those projections will play out the way they think they will. DKNG DKNG has never been profitable. Since Q3 2021, DKNG has never been profitable, even though the trends are moving in the right direction, with $7.77 billion in revenue per quarter. To make revenue, DKNG spent $4.91 billion, leaving $2.86 billion in gross profit for the remaining expenses. Combined with R&D and general and administrative expenses, DKNG has spent $6.15 billion on operating its business since Q3 2021. DKNG has only had one quarter of positive EBITDA and has never been profitable at the bottom line. The numbers are getting better, but the fact is that DKNG has generated -$2.81 billion in EBITDA and -$3.19 billion in net income over the past 11 quarters.

Stephen Fiorillo, Seeking Alpha

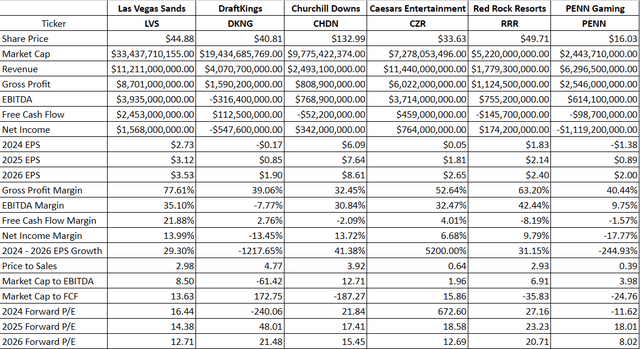

I would like to thank DKNG for being a Las Vegas SandsLVS), Churchill Downs (Chinese), Caesars Entertainment (CZR), Red Rock Resort (RRRR is), PENN Entertainment (pen) to see how the market is valuing these companies, and I was surprised to see that DKNG came in second among these companies.and DKNG has the largest market capitalization. It is the only one of these companies with a negative EBITDA, so it seems like the market is pretty much pricing in DKNG’s future. DKNG also has the highest price-to-sales ratio and the second-highest stock price.and It has the lowest gross margin. It’s hard to justify DKNG’s valuation at $19.43 billion when CHDN is valued at $9.78 billion and generated EBITDA of $768.9 million and net income of $342 million over the last 12 months. CZR has a market cap of $7.28 billion and generated EBITDA of $3.71 billion and net income of $764 million over the last 12 months on revenue of $11.44 billion. CZR’s gross margin is 52.64%, with 32.47% of every dollar reflected in EBITDA and 6.68% in net income after all expenses.

To DKNG’s credit, the market is looking ahead and predicting DKNG DKNG will have EPS of -$0.17 in 2024, but will grow to EPS of $1.90 in 2026. This puts DKNG’s forward P/E ratio at 21.48 based on projected 2026 EPS. While this is still the highest multiple in the group, I don’t think it’s at all unreasonable to pay 21.48 times 2026 earnings. In fact, it may be cheap based on the projected growth. The issue I have is that DKNG is not profitable and I would like to see a track record of profitability to have confidence in these projections. There are a lot of unknowns and DKNG has large competitors in the market. There are catalysts on the horizon, but governments move slowly and it will be a few more quarters before I think I can justify paying this kind of premium.

Stephen Fiorillo, Seeking Alpha

Conclusion

DKNG is at the top of my watch list, but I will wait for a better entry point. I believe DKNG will continue to be a dominant player in the mobile gambling industry, so I expect to become a shareholder at some point. As more catalysts emerge and more states pass laws allowing sports gambling and iGaming, DKNG will benefit greatly as one of the most recognized brands in the space. DKNG’s numbers are moving in the right direction, and as unique users grow, EBITDA and net income are getting closer and closer to sustainable profitability. I am confident that DKNG will continue to establish itself as a market leader, and my decision to stay on the sidelines may come back to haunt me later, but the current valuation is not attractive enough to allocate capital to this investment. The stock would need to fall significantly or the valuation would be cheaper to establish a position in DKNG. I will be watching DKNG closely while looking for a more optimal price to initiate a position.