DMP/E+ via Getty Images

Gilead Sciences (Nasdaq:guild) is one of the world’s largest pharmaceutical companies with leading positions in the global liver disease and HIV treatment markets, and also has an extensive portfolio of experimental drugs aimed at fighting various types of cancer.

Investment Thesis

The company’s shares have fallen about 20% over the past five months, reflecting growing skepticism among institutional and retail investors following dismal results from clinical trials evaluating the company’s efficacy. Sacituzumab govitecan and Magrolimab.

On the other hand, taking into account technical analysis, the situation looks optimistic for several reasons. Firstly, Gilead shares have reached a strong support zone in the $64-65 price range, and financial market participants have begun to open long positions again. Moreover, on the weekly basis, the gap marked in the chart below remains and continues to fluctuate around 30 together with the RSI, which could be a sign of a potential trend reversal. The beginning of the upward movement.

Source: TradingView

In my assessment, I will focus on several well-known brand-name products that will continue to play a key role in improving the company’s financial position in the long term and minimizing the damage caused by the launch of generic versions of Truvada, in addition to the experimental drugs that will be discussed in more detail later in this article. These innovative drugs are Biktarvy, Vemlidy, Tecartus, Yescarta, and Trodelvy.

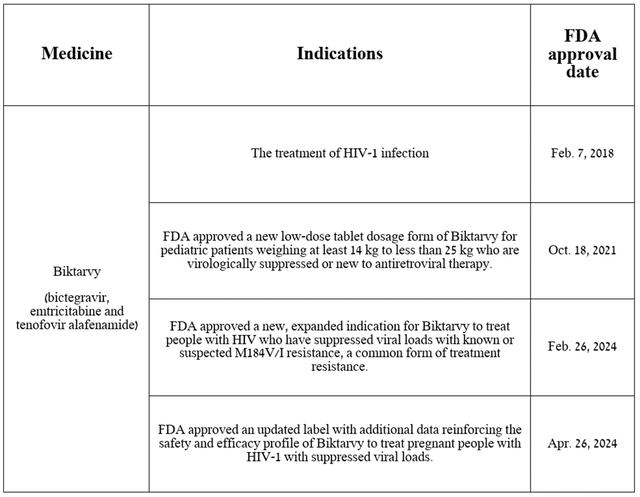

So Biktarvy is a medicine used to treat certain patients with human immunodeficiency virus type 1.

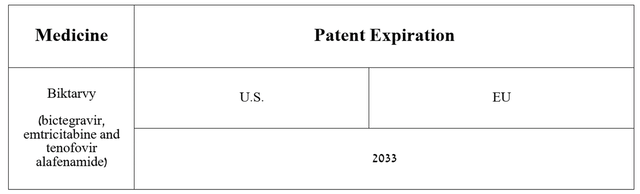

Source: Table compiled by authors based on Gilead Sciences press release.

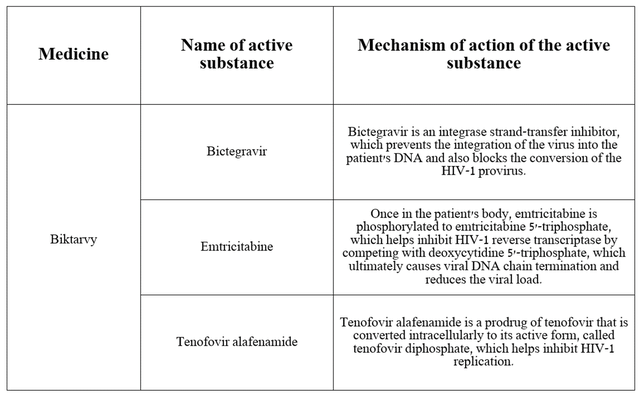

Biktarvi is 3 Active IngredientsI believe we need to discuss their respective mechanisms of action and their role in fighting the virus.

Source: Table compiled by the authors based on DrugBank

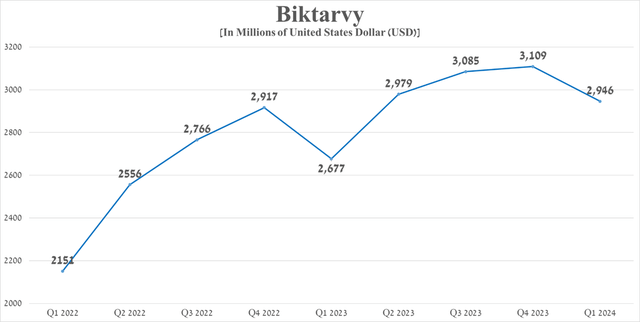

Biktarvy’s total sales were approximately $2.95 billion in the first quarter of 2024, up 10% year-over-year, due to an increase in patients switching from the company’s other HIV medications and the release of additional data in early March 2024. 31st Congress on Retroviruses and Opportunistic Infections Its extremely high effectiveness in HIV treatment has been confirmed, leading to an expansion of its indications.

soon February 26, 2024The FDA approved Biktarvy for the treatment of HIV patients with known or suspected resistance to the M184V/I mutation and who have suppressed viral loads.

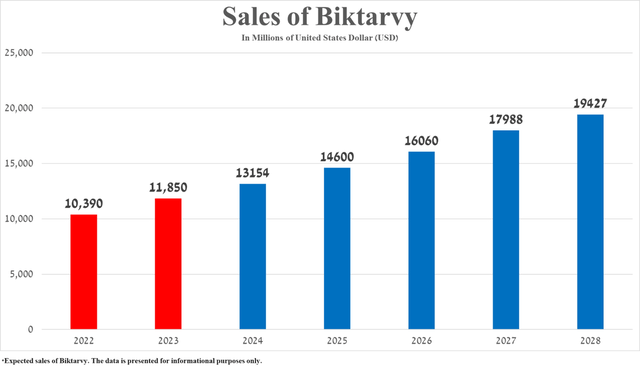

Source: Graph created by author based on 10-Q and 10-K

In addition, of the numerous patents issued in the United States and the European Union, Doesn’t expire until 2033 And if Gilead can prevent Biktarvy from being introduced to the market as a generic version, I believe sales growth for Gilead’s blockbuster drug could continue in the long term.

Source: Graph compiled by author based on Gilead Sciences’ 10-K.

In my assessment, based on Biktarvy’s past sales growth, FDA approval is likely. Label updated on April 26, 2024Data confirming a favorable safety profile and efficacy in treating pregnant women infected with Human Immunodeficiency Virus Type 1 with suppressed viral loads, as well as the publication of results from numerous clinical trials over the past 12 months, confirms its competitive advantage over the “gold standard” in the fight against this sexually transmitted disease, and is expected to reach total sales of $19.43 billion in 2028.

Source: Graph created by author based on 10-K

As a result, I am beginning to cover Gilead Sciences with a “Buy” rating.

Gilead Sciences’ business outlook for 2024

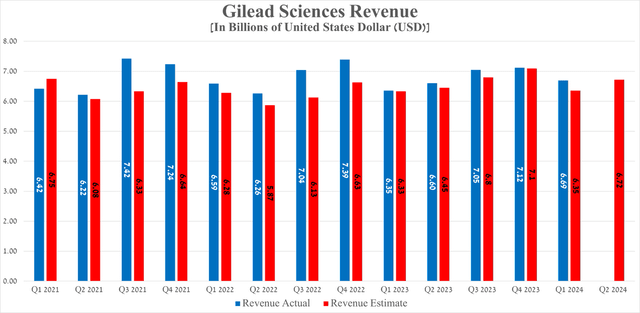

Gilead Sciences Q1 2024 Revenue Revenue reached $6.69 billion, up 5.4% from a year ago and beating analyst expectations by $340 million.

Source: Seeking Alpha

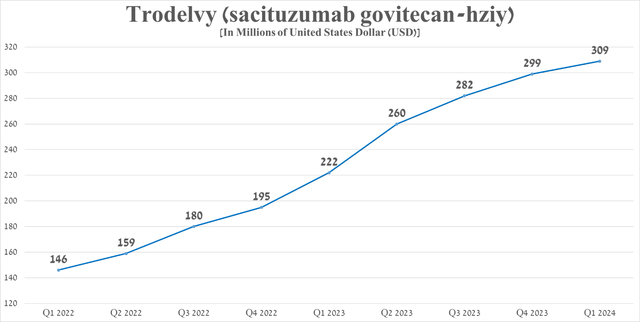

In addition to Biktarvy, Trodelvy is beginning to play a key role in the company’s revenue growth following the COVID-19 pandemic, contributing to extremely strong Veklury sales in 2021-2023.

Trodelvy was developed by Immunomedics, which was subsequently acquired by Gilead. $21 billion in 2020it is Antibody-drug conjugates It binds to trophoblast surface antigen 2 (TROP2), which is expressed on the surface of various cancer cells. After that, SN-38 is released into the cell, which is an antitumor drug that acts as a topoisomerase I inhibitor, ultimately helping to prevent cancer cells from replicating and dividing.

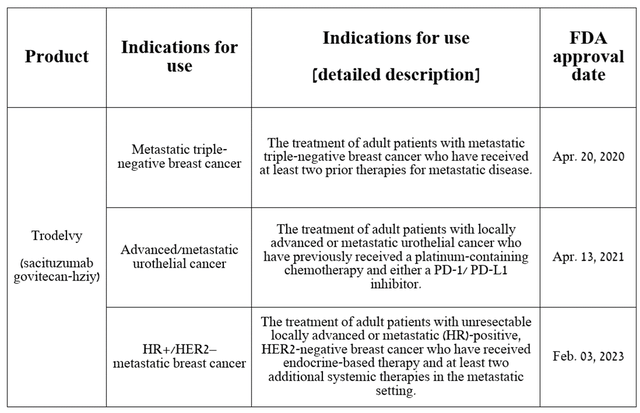

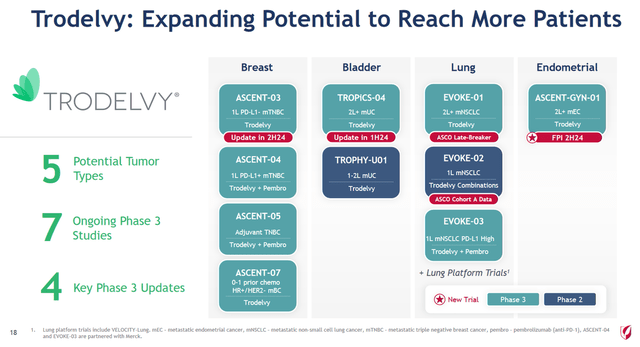

Trodelvy is currently approved by the FDA to treat certain patients with breast and urothelial cancer.

Source: Table compiled by authors based on Gilead Sciences press release.

Sales in the first quarter of 2024 were $309 million, up 39.2% year over year, driven by approval by the EMA in late July 2023 for the treatment of certain patient populations with breast cancer and continued strong demand for the drug in the United States.

Source: Graph created by author based on 10-Q and 10-K

Looking at the bigger picture, despite the dismal results of the Phase 3 EVOKE-01 trial, I believe Trodelvy will be a commercial success as Gilead continues to move forward with studies evaluating its efficacy and safety profile. Monotherapy and combination therapy with other drugs It is used to treat blood, breast, and endometrial cancers.

Picture from Gilead Sciences

Additionally, the Seeking Alpha platform also provides financial data and Wall Street analyst forecasts for Gilead Sciences’ revenue and earnings per share through 2033.

In other words, Q2 2024 Revenues are expected to be in the range of $6.31 billion to $7.01 billion, an increase of $120 million from last year.

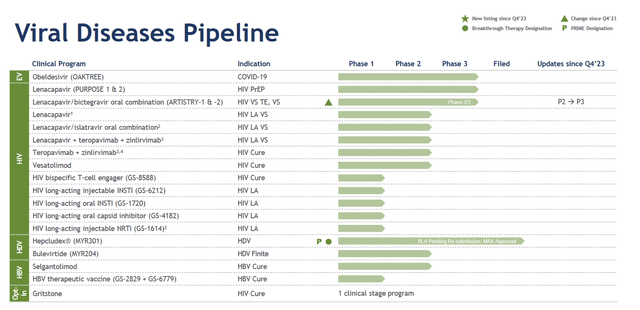

Meanwhile, in the long term, in addition to the strong sales of the key FDA-approved drugs mentioned at the beginning of this article, I believe another factor that will boost Gilead Sciences’ revenue and EBIT growth is the company’s aggressive research and development policy, with the goal of developing and subsequently commercializing next-generation product candidates that could become the “gold standard” in the treatment of HIV, inflammatory diseases, and cancer.

In my opinion, one of the most promising drugs is lenacapavir. Mechanism of action The drug is based on its ability to bind to the HIV-1 capsid and subsequently inhibit its interaction with host proteins such as CPSF6 and Nup153, ultimately inhibiting HIV-1 replication as well as the synthesis of viral DNA.

Lenacapavir (brand name Sanrenka) is the first FDA approval expected in late December 2022 For treating patients with multidrug-resistant HIV-1.

Gilead Sciences is currently evaluating its effectiveness compared with other FDA-approved drugs and its ability to reduce the risk of sexually acquired HIV infection in adults and adolescents. CAPELLA Clinical TrialAnd unlike its main competitor GSK, Gilead Sciences’ product is the first and only drug taken every six months to fight HIV infection.GSK) and Pfizer’s Cabenuva (Personal consumption tax) and Johnson & Johnson’s Symtuza (J.N.J.), we believe Sunlenca will be the “gold standard” in treating this virus.

Picture from Gilead Sciences

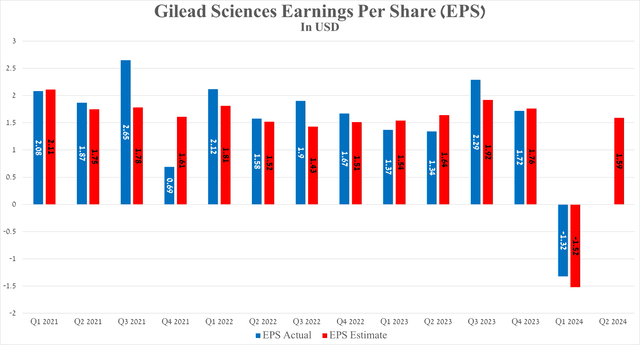

Gilead Sciences’ earnings per share Q1 2024 The negative EPS was unrelated to a drop in drug sales; the only reason for the sharp decline in this financial metric was the acquisition of CymaBay Therapeutics.

Meanwhile, second-quarter EPS is expected to be in the range of $1.41 to $1.70, up about 18.7% from the same period last year.

Source: Seeking Alpha

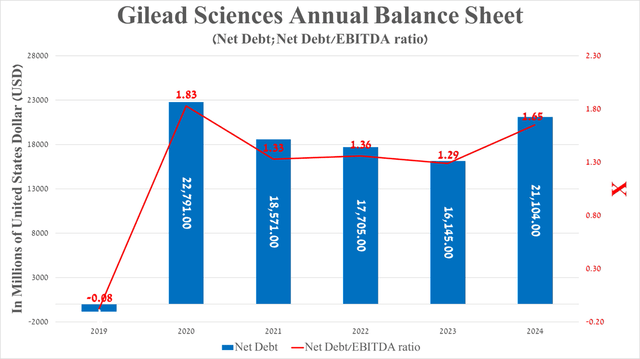

Before moving on to the risks section, I would like to touch on Gilead Sciences’ debt, which in my assessment does not pose a significant risk to the company’s financial position. The company’s net debt is expected to be approximately $21.1 billion as of the end of March 2024, up $4.96 billion from December 31, 2023. Acquisition of CymaBay Therapeutics Mid-February of this year.

The transaction allowed Gilead Sciences to acquire Seradelpal, which is Pivotal Clinical Trials But more importantly, Genfit’s Elafibranor (GNFT) and Intercept Pharmaceuticals’ Ocaliva are used to treat patients with primary biliary cholangitis. Approximately 58 out of 100,000 women are affected In the United States.

Source: Seeking Alpha

risk

Before jumping to conclusions, let’s highlight some of the key financial risks that could impact Gilead’s stock price in the short and medium term. These risks include a continued decline in Veklury sales due to a decline in COVID-19 hospitalizations; President Biden’s Inflation Control Act The impact on the pharmaceutical industry and increased competition in the global non-Hodgkin’s lymphoma treatment market may ultimately have a negative impact on the revenue growth rates of Yescarta and Zydelig.

remove

In recent quarters, Gilead Sciences has continued to shift its business development approach to reduce its reliance on sales of its HIV and HCV drugs by accelerating the pace of development of next-generation product candidates to treat patients with liver disease, and lung, breast and colorectal cancer.

soon May 18, 2024The company announced additional results from the Phase 3 ASSURE trial, which confirmed that seradelpal demonstrated competitive advantages over elafibranor and ocaliva, significantly reducing pruritus and improving markers of cholestasis in patients with primary biliary cholangitis.

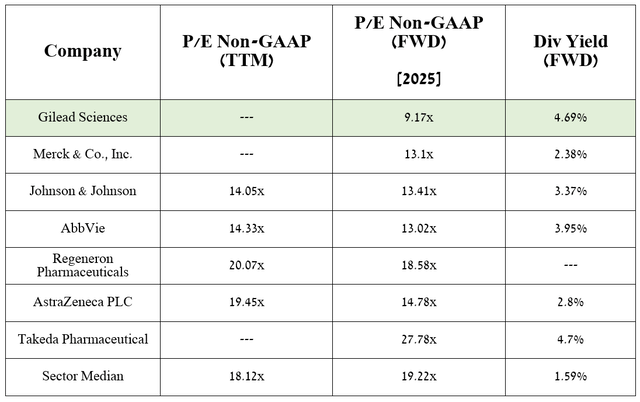

Moreover, based on my valuation and analyst estimates, the company’s anticipated expansion of indications for its already-on-the-market drugs domvanalimab, lenacapavir, and Trodelvy would bring its EPS to 9.17 times in 2025.

Source: Seeking Alpha

Therefore, this suggests the company is trading at a discount to many of its peers, and given its 4.69% dividend yield, Gilead Sciences represents an attractive asset for conservative investors looking for distressed stocks in the healthcare sector.