Semler Scientific Co., Ltd. Bitcoin (Nasdaq: SMLR), known for its healthcare solutions to combat chronic diseases, has announced a major shift in its financial strategy: the company’s board of directors has adopted Bitcoin as its primary treasury reserve asset, making a bulk purchase of 581 Bitcoin for a total purchase of $40 million, including fees and expenses.

Latest Update: Healthcare Products Manufacturer Semler Scientific Acquires 581 Companies #Bitcoin For $40 million 👀 pic.twitter.com/zYsVgN19gL

— Bitcoin Magazine (@BitcoinMagazine) May 28, 2024

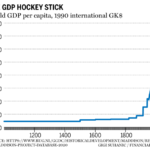

“Our Bitcoin Treasury strategy and Bitcoin purchases underscore our belief that Bitcoin is a reliable store of value and an attractive investment,” said Eric Semler, Chairman of Semler Scientific. “Bitcoin is currently a leading asset class with a market capitalization exceeding $1 trillion. We believe that Bitcoin’s unique characteristics as a scarce and finite asset allow it to act as a reasonable inflation hedge and safe haven amid global volatility. We also believe that its digital and structural resilience makes it superior to gold, which has a market value roughly 10 times that of Bitcoin. Given the value differential between gold and Bitcoin, we believe that Bitcoin has the potential to generate significant gains as it gains increasing acceptance as digital gold.”

in spite of this Despite this strategic financial move, Semler Scientific said it remains committed to its core mission in healthcare: delivering innovative technologies as solutions that transform the medical management of chronic diseases and provide healthcare providers with opportunities to reduce costs and improve long-term patient outcomes. The company also will continue to focus on its flagship product, QuantaFlo®, a point-of-care test for peripheral artery disease, as well as expand FDA approval for other cardiovascular diseases.

“Furthermore, we are encouraged by the growing global acceptance and ‘institutionalization’ of Bitcoin, reflected most recently by the Securities and Exchange Commission’s approval of 11 Bitcoin exchange-traded funds in January 2024,” Semler continued. “These funds have reported net inflows of more than $13 billion, with investments from approximately 1,000 institutions, including global banks, pensions, endowments, and registered investment advisors. It is estimated that more than 10% of all Bitcoin is currently held by institutions.”

After carefully considering various uses for the company’s excess cash, Semler Scientific’s Board of Directors and senior management have concluded that holding Bitcoin represents the best strategy. For more information about Semler Scientific, please visit the company’s website. here.