Vertigo3d

Introduction

Everyone is talking about NVIDIA (NVDA), which is on its way to the title of largest market cap company in the world.

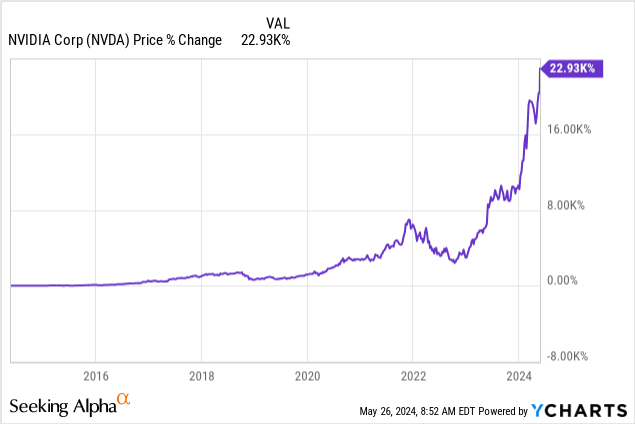

Over the past ten years, the company’s stock price has risen by more than 22,900%, beating the market by a margin that can be seen from space. I don’t even have to include the S&P 500 in the chart below, as everyone knows it’s nowhere close to 22,900%.

The company is in the right place at the right time with the right products, as it benefits from the massive AI revolution, which may be the biggest disruptor since the invention of the Internet.

The company’s recent earnings confirm its strength.

As reported by The Wall Street Journal (emphasis added):

Nvidia’s sales turned sharply upward about a year ago, after OpenAI’s ChatGPT wowed users with its ability to generate humanlike text. OpenAI used thousands of Nvidia’s AI chips to create ChatGPT, analysts say, and there are few alternatives for the computation-intensive job of creating and deploying such systems. (Wall Street Journal owner News Corp has a content-licensing partnership with OpenAI.)

Big tech companies and AI startups have since been scrambling to buy as many of Nvidia’s chips as possible, leading to a shortage that company executives expect to persist through this year and into next year. – The Wall Street Journal

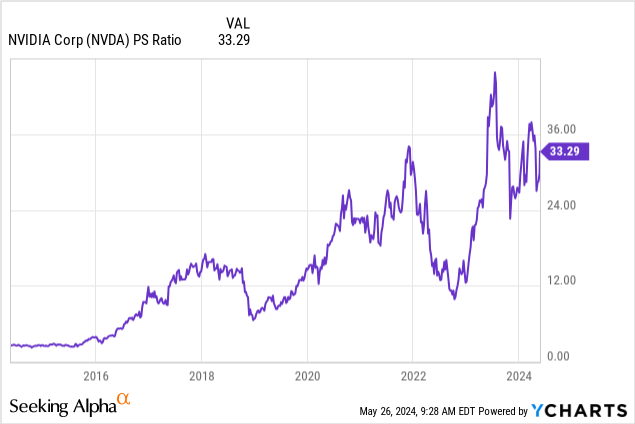

With that said, one could make the case that NVDA shares are lofty valued.

At 33x sales, the risk/reward is not great, with major risks being slower cyclical demand and pressure on margins as the initial wave of “panic buying” from hyper scalers slows.

However, this is by no means an article about NVDA or an attempt to get NVDA investors to sell.

My point is that this AI trend is likely moving beyond semiconductors, benefiting companies that may not seem like the most obvious winners of this new technology revolution.

That’s where the headline below comes in.

Bloomberg

According to Bloomberg, we’re dealing with an increasing focus on companies benefitting from rapidly rising energy demand.

Makers of electrical components such as Amphenol Corp. have rallied, while real estate investment trusts that focus on data centers are expected to see increasing demand as AI usage grows and more workloads shift to the cloud. Notably, the energy required to run AI is expected to result in upside for utilities and other companies connected to the power grid.

“I never believed that it would affect electricity prices this much, but people are talking multi-gigawatt expansions here,” said Brian Frank, president of Frank Capital Partners. “It’s bleeding into my energy and utility stocks.” – Bloomberg (emphasis added)

Obviously, there are many ways to benefit from this, and we’ll discuss a lot of them in the coming weeks, months, and probably years.

However, in this article, I’ll focus on a very specific area, which is natural gas.

While I believe utility companies will benefit tremendously from the expected surge in electricity demand from AI applications, I prefer to buy the sources of energy, which usually have more pricing power than regulated utilities that are also subject to multi-billion investments in the energy transition and prone to the impact of elevated rates on their balance sheets.

Hence, in this article, I’ll present three fantastic natural gas companies that I consider to be among the best natural gas stocks in the world.

So, let’s get to it!

Natural Gas Is Where It’s At

I have a love/hate relationship with natural gas.

On the one hand, it’s one of the world’s most important commodities, with rapidly rising demand from nations switching from coal to natural gas, general population growth, and AI applications.

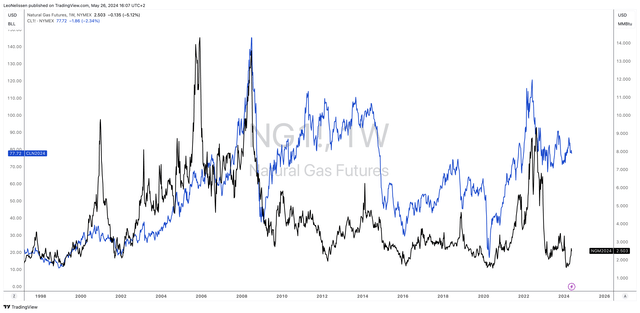

On the other hand, it’s such an incredibly volatile commodity that it’s very tough to trade, exposing its producers to severe revenue volatility. It also does not help that natural gas is much more abundant than oil, which is why oil prices have done much better than natural gas since the pandemic.

TradingView (NYMEX Henry Hub, NYMEX Crude Oil)

So, regardless of what I’m about to say in this article, please be aware that natural gas stocks may not be right for you if you’re a conservative investor who usually avoids elevated volatility.

That said, natural gas is seeing an upswing, fueled by market participants who are starting to figure out what AI means for this commodity.

US natural gas is expected to reach the $3 mark as soon as next year as electricity-hungry data centers drive demand for the power-plant fuel, according to law firm Haynes and Boone LLP. – Bloomberg (emphasis added)

To add some more color, Reuters showed how big the longer-term impact could be.

As much as 8.5 billion cubic feet per day of natural gas could be required additionally to match the rise in demand, the report added.

(…) The report estimates current power demand from data centers at 11 gigawatts (GW), which, in the base case, is expected to grow to 42 GW by 2030.

The report added that, at its base case, around 2.7 bcfd of incremental natural gas would be required by 2030. – Reuters (emphasis added)

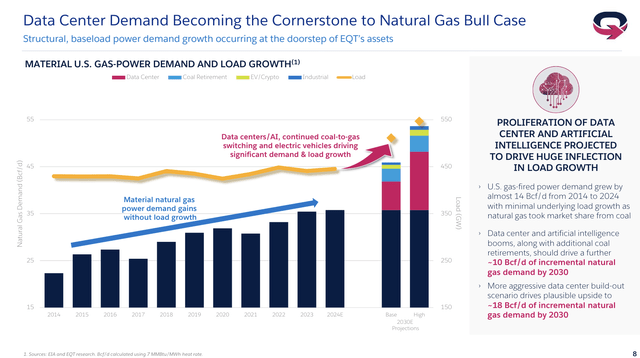

EQT Corp. (EQT), one of America’s largest natural gas producers, visualized the bull case for demand in its latest presentation.

- Between 2014 and 2024, gas-fired power demand rose by almost 14 billion cubic feet per day (Bcf/d), with almost no underlying load growth, as it was mainly based on the transition from coal to natural gas.

- AI alone could drive another 10 Bcf/d in incremental demand by 2030!

- Even more bullish estimates could see 18 Bcf/d growth by 2030 – from AI alone…

EQT Corp.

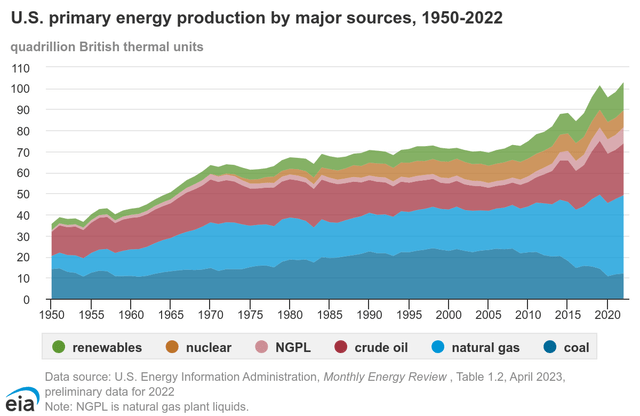

Using the chart below, we see a visualization of natural gas taking away market share from coal while benefitting from increasing load growth, which is now in its early growth stages – thanks to AI.

Energy Information Administration

On top of that, natural gas benefits from rising global demand, which makes North America a major source of liquified natural gas to satisfy overseas energy demand.

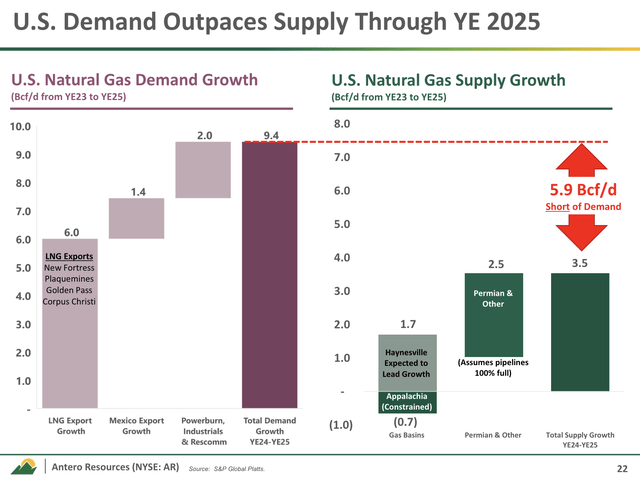

Antero Resources (AR) makes the case that export demand will rise so fast that total demand growth will outpace supply growth, which is highly beneficial for prices.

Antero Resources

Essentially, the bull case is a convergence between cheap natural gas prices in North America and “expensive” international prices, as the U.S. focuses more on exports with higher internal demand from data centers.

Our modeling suggests dry gas production will not be able to meet the new demand. As a result, we expect the US natural gas market will slip from surplus to deficit sometime later this year. With international gas trading for $12 per mmbtu (four times the domestic price), traders will aggressively bid US prices higher to take advantage of the arbitrage. – G&R

While it’s very hard to estimate where natural gas prices may end up, I believe we are looking at a future of Henry Hub prices consistently above $5, which is roughly twice where prices are currently.

This brings me to three of my all-time favorite natural gas stocks, which I expect to do extremely well in the years ahead (albeit with elevated volatility).

ARC Resources (ARX:CA) – A Producer That Has It All

The first pick is a Canadian company.

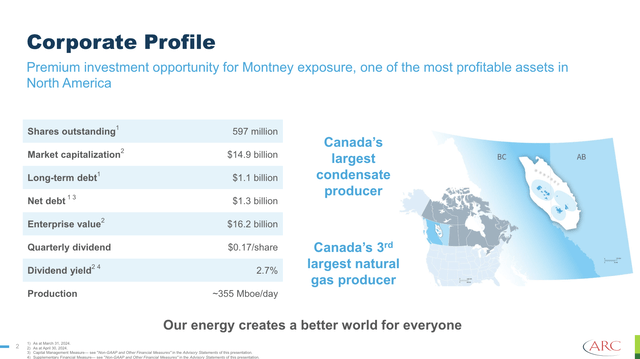

In this case, ARC Resources is Canada’s largest condensate producer and the third-largest natural gas producer.

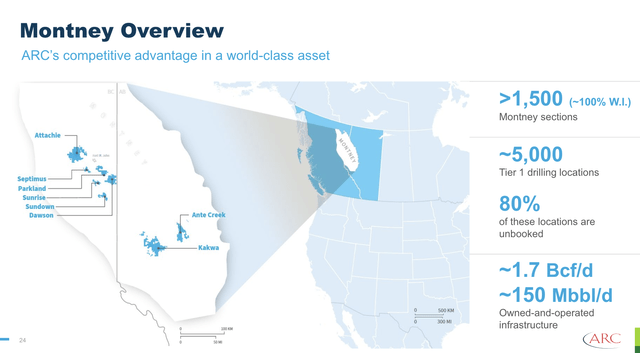

It produces roughly 355 thousand barrels of oil equivalent (“BOE”) per day, with major operations in the Montney, one of North America’s most favorable Basins.

Roughly 38% of its production consists of crude oil and natural gas liquids, which adds higher-margin exposure to its attractive natural gas operations.

ARC Resources Ltd.

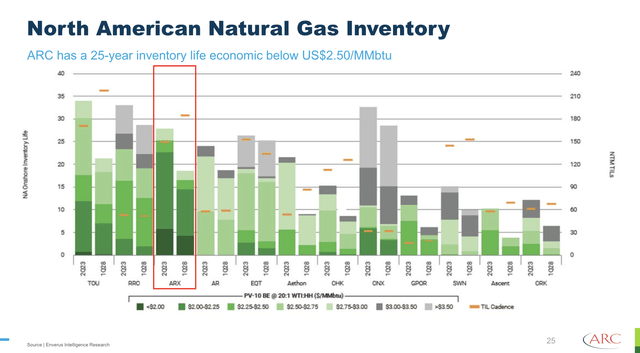

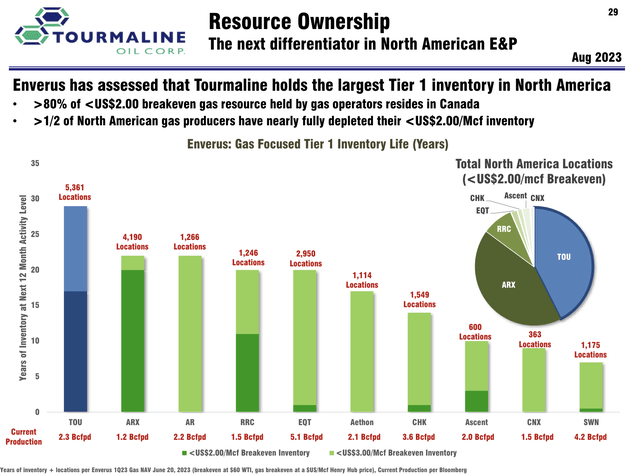

The company also benefits from a 25-year inventory life with breakevens below $2.50/MMbtu, which is very low.

In fact, it has one of the most favorable inventory and breakeven profiles in the entire industry, as we can see below.

ARC Resources Ltd.

Even better, the company won’t be without production after 25 years, as it has replaced more than 140% of its production for 16 consecutive years!

Roughly 80% of the company’s Tier 1 drilling locations are unbooked.

ARC Resources Ltd.

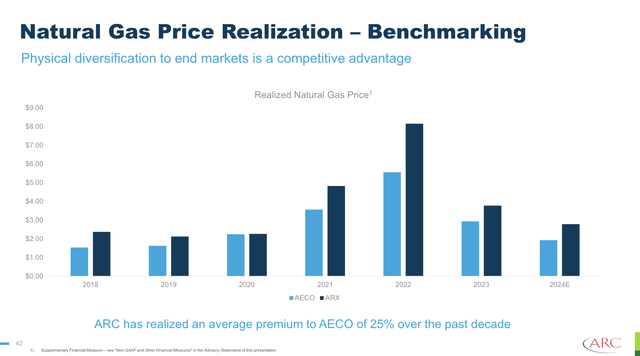

It also benefits from a good marketing strategy, as it has long-term agreements with major LNG producers and a sales mix that has allowed the company to consistently outperform the local AECO gas price, as the chart below shows.

ARC Resources Ltd.

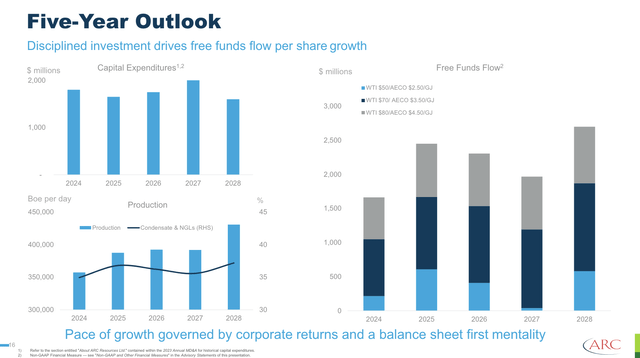

In addition to benefitting from a potential long-term rise in natural gas prices, the company expects to grow its production to roughly 550 thousand BOE per day in the next two decades, with Montney assets capable of sustaining production of 500 thousand BOE per day.

This is great news for shareholders, as the mix of rising production low and breakeven prices allows the company to produce between C$2.0 and C$2.7 billion (depending on capital expenses) in free cash flow in an $80 WTI and C$4.50 AECO environment.

The midpoint of that (C$2.4 billion) translates to a free cash flow yield of 16%!

ARC Resources Ltd.

Bear in mind that the company can cover its capital expenditures and base dividend below $50 WTI/C$2.50 AECO.

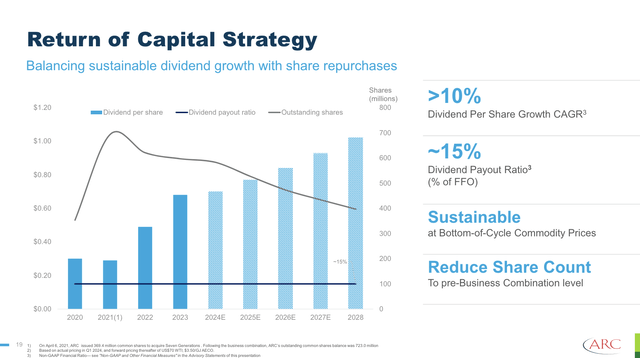

Its base dividend is 2.7%.

As the company has a sub-1x net debt-to-funds from operations leverage ratio, it can use almost all of its cash for shareholder distributions.

The company aims to grow its dividend by more than 10% per year, along with its business. It does NOT base dividend growth on the price of natural gas but underlying business growth, which is unique in its industry.

ARC Resources Ltd.

Moreover, a huge amount of free cash flow will be used to buy back stock as long as the company believes the “real value” of its business is above the current market cap.

By 2028, the company aims to reduce the number of shares to pre-merger levels. In 2021, ARX merged with Seven Generations Energy in an all-stock deal worth C$8.1 billion.

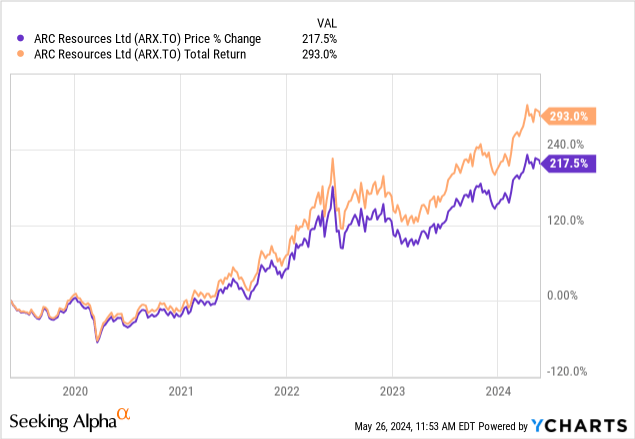

Over the past five years, ARX has returned 293%, including dividends.

Although I usually prefer natural gas players that pay special dividends, I consider this company to be a superior player in its industry with deep reserves, very low breakevens, a healthy balance sheet, and a clear plan to let shareholders benefit from what could be a very favorable period of higher volumes and better pricing.

Range Resources (RRC) – An American Upstream Gem

Some people cannot invest in Canadian stocks (I’ve been told by some readers). Others have no interest in investing in non-U.S. nations – and that’s fine!

After all, the U.S. is also home to some of the finest players in the industry, which I expect to benefit from higher natural gas demand and better prices as well.

Range Resources comes to mind.

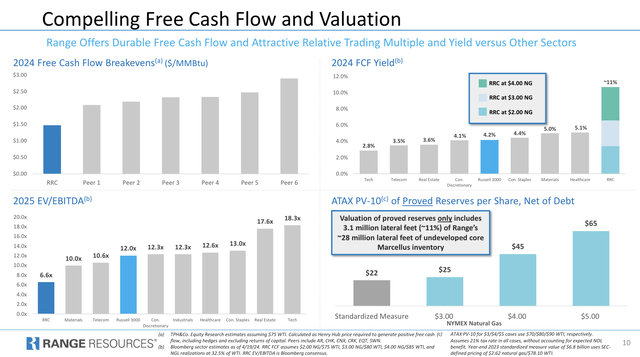

- The company is one of the largest producers of natural gas in the United States.

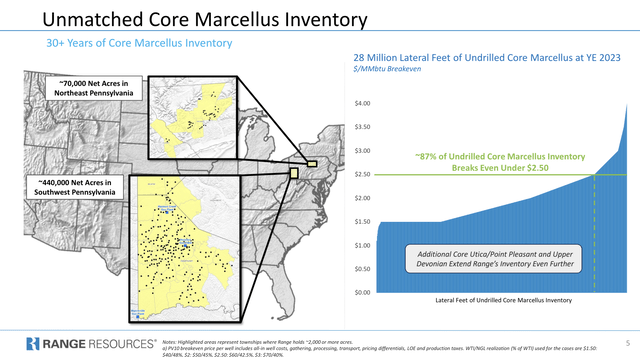

- The company has more than 30 years of low-cost reserves in the Marcellus Basin (part of the Appalachia).

87% of undrilled core Marcellus inventory is breakeven below $2.50 Henry Hub, giving the company an almost unmatched inventory benefit.

Range Resources Corp.

This comes with major benefits.

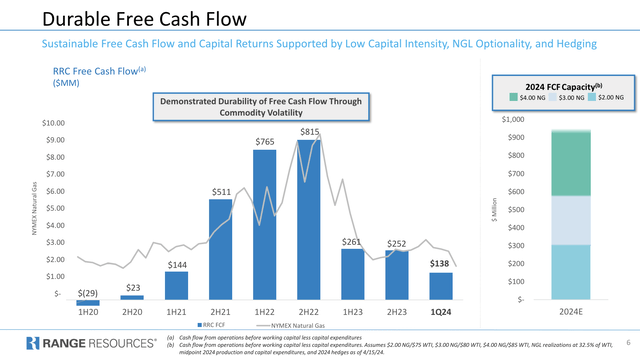

Based on 2024 production numbers, the company has the capability to generate more than $900 million in free cash flow at $4.00 Henry Hub – that’s 10.3% of its $8.7 billion market cap!

Range Resources Corp.

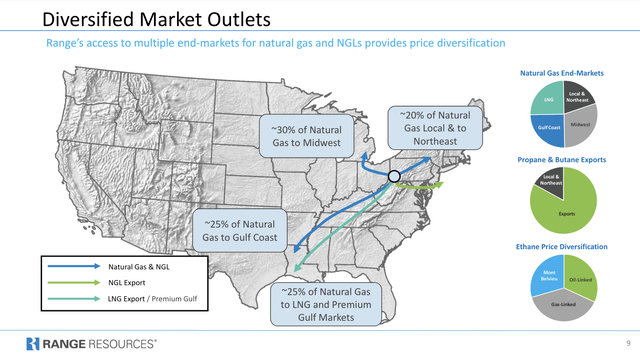

Another major benefit of the company is its diversified customer base. It sells roughly half of its natural gas to the Gulf Coast, which includes LNG customers (a quarter of its production).

Range Resources Corp.

It also helps that the company has a hedging program.

Currently, it has hedged 55% of 2024 production with a floor of $3.70. This allows it to have a peer-beating breakeven price, with free cash flow breakeven at roughly $1.50 Henry Hub – an absolutely spectacular number.

Range Resources Corp.

While its dividend yield is just 0.9%, the company has a focus on buybacks.

It currently has $1 billion outstanding under its buyback authorization and aims to buy back stock more aggressively on stock price weakness.

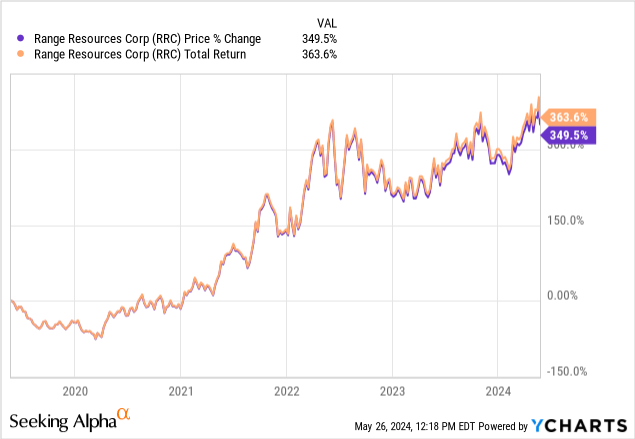

Over the past five years, RRC shares have returned 364%, beating even ARC Resources by a considerable margin.

While other stocks may have a more favorable dividend profile, I consider RRC to be one of the best-run natural gas companies on the planet and a great play for investors looking for upstream exposure in the United States.

Tourmaline Oil Corp. (TOU:CA): This Giant Has It All

So far, I have given you one company with consistent dividend growth and aggressive buybacks and one company with a focus on buybacks.

Now, I’ll give you a company that comes with massive benefits for investors looking for dividends!

We’re also going back to Canada.

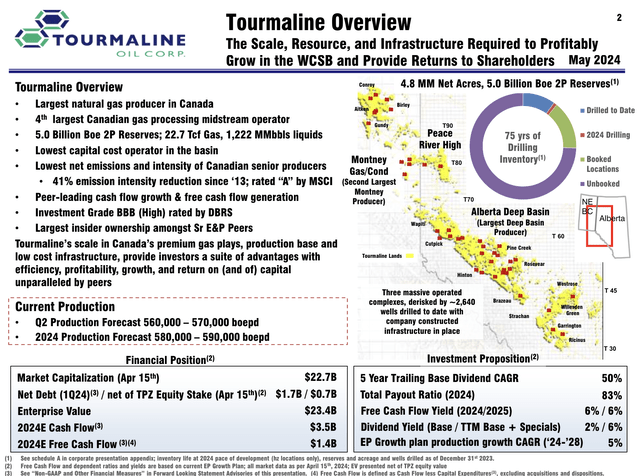

If I had to invest all of my money into a single natural gas producer, it would be Tourmaline.

- Tourmaline is the largest natural gas producer in Canada.

- It’s also the 4th-largest Canadian gas processing midstream operator.

- It has 75 years of drilling inventory, which is unmatched in its industry.

- It’s the lowest-capital producer in the basins where it operates.

Tourmaline Oil Corp.

This year, the company is expected to produce 585 thousand BOE per day.

That number is expected to rise to 715 thousand BOE per day in 2028 (5.1% CAGR).

76% of its current production is natural gas.

Interestingly enough, Tourmaline and ARC Resources dominate low-breakeven Tier 1 natural gas inventories in North America. The only company coming close is Range Resources, which is also included in this article.

Tourmaline Oil Corp.

In addition to its massive size, the company has a very favorable cost structure.

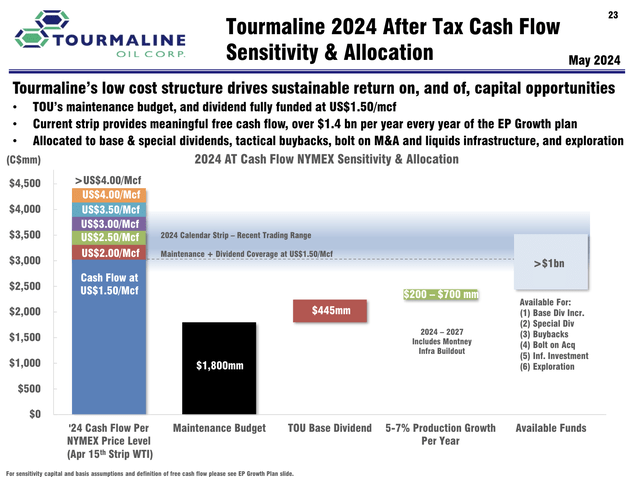

Both its maintenance and 1.9%-yielding base dividend are covered at $1.50/Mcf, which paves the road for tremendous shareholder distributions.

Tourmaline Oil Corp.

At $4.00/Mcf Henry Hub, the company expects to generate roughly C$4.4 billion in cash flow. After C$1.8 billion in maintenance capital and up to C$700 million in costs to expand its Montney operations, we’re left with C$4.1 billion in free cash flow.

That’s 17% of its market cap!

That’s where special dividends come in.

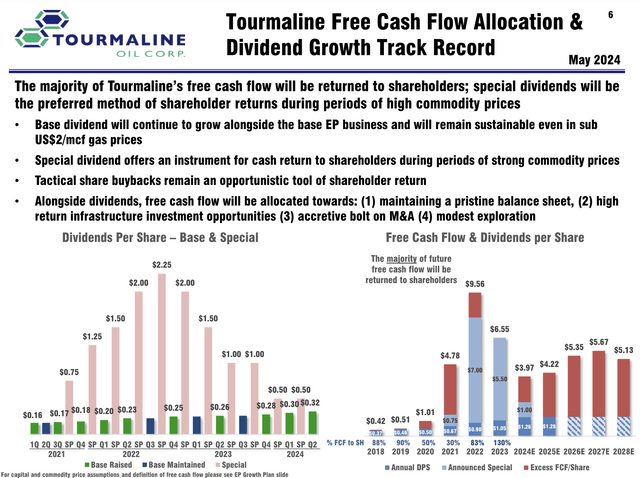

As we can see in the overview below, the company has raised its regular quarterly dividend almost every quarter since 2021 and used very juicy special dividends to reward investors.

As someone who likes special dividends, I’m a huge fan of Tourmaline – not that this may come as a surprise at this point.

Tourmaline Oil Corp.

Last year, the company paid four regular quarterly dividends and four special dividends.

The dividend total was C$6.55 – 10% of its current stock price.

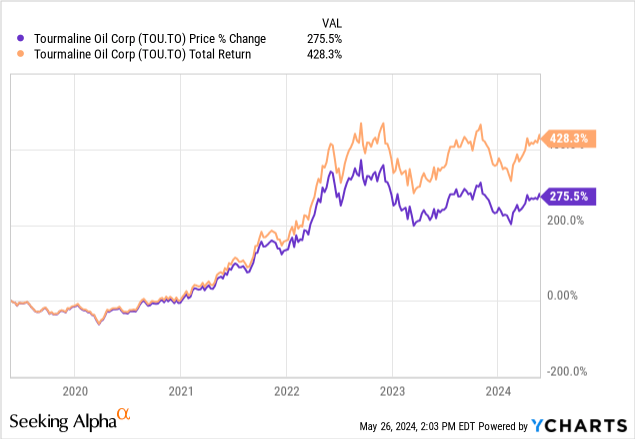

Thanks to this dividend, the total return of this stock was 428% over the past five years.

While I’m currently figuring out how to structure my energy portfolio (as I discussed in this article), there’s a high likelihood I’ll soon buy Canadian TOU:CA shares, as I believe it’s one of the smartest energy plays for the next decade – and likely beyond.

Please note that I sold RRC and AR stock. That is purely based on the fact that they were in my trading account. I decided to close the account and fully focus on long-term investing.

Hence, you’ll soon see some changes to my dividend portfolio. I’ll keep readers up to date!

Takeaway

AI is reshaping the energy industry, driving a significant surge in natural gas demand.

As AI applications, like data centers, require massive power, the need for natural gas is expected to rise sharply. This trend promises a bright future for the natural gas sector, with potentially significant price increases on the horizon.

Three standout companies poised to benefit from this shift are ARC Resources, Range Resources, and Tourmaline Oil.

They share several key characteristics: massive low-cost reserves, strong free cash flow generation, and strategic positioning in prolific basins.

- ARC Resources shines with its low breakevens and consistent production growth.

- Range Resources boasts an unmatched inventory profile in the United States and a safe hedging strategy.

- Meanwhile, Tourmaline stands out with its massive reserves, low operating costs, and generous dividend payouts, including special dividends.

These companies are well-positioned to capitalize on the AI-driven demand surge, offering investors attractive opportunities in the evolving energy market.

Needless to say, going forward, I’ll continue to cover this AI trend, as there are many more attractive investment opportunities on the market.

Editor’s Note: This article discusses one or more securities that do not trade on a major U.S. exchange. Please be aware of the risks associated with these stocks.