Shot by Dave

Margins drive NGS

I am a member of the Natural Gas Services Group (New York Stock Exchange:Next-generation seedsYou can read past articles and the latest articles of herepublished on July 6, 2023. Over the past year, we have shifted our strategy to maximize the utilization of our rental vehicles. Operating margins. Our focus on crude oil-dominated shale plays has paid off, despite reducing rental units and horsepower as natural gas prices have fallen. We will see more contracts for higher horsepower units with long-term contracts that will stabilize cash flows in the mid- to long-term. We are reviewing our unused fleet and estimate that we can upgrade many of these assets to smart systems.

However, investments in new assets resulted in lower cash flows in the first quarter of 2024. Inflationary pressures in labor and lubricants could also weigh on operating margins in the near term. A healthy balance sheet ensures that adverse energy price fluctuations will not throw the company’s finances off balance. The stock is reasonably valued relative to its peers. We recommend investors “hold” this stock.

Why not change your rating?

In our previous article, published on July 6, 2023, we discussed how NGS has maintained stable compressor unit and horsepower prices despite a challenging industry environment. We also discussed the rising costs of new natural gas compression equipment. I have written:

In the first quarter, the company accelerated its construction schedule and won contracts worth $20 million to $25 million. The company’s services are “sold out” through 2023. But new natural gas compression equipment is getting expensive. The sudden drop in natural gas prices is unlikely to rebound sharply anytime soon, although it may improve over time.

About a year after our last article, NGS transitioned its operations into oil-dominated shale formations and upgraded its fleet, which improved utilization rates in its rental fleet. It also increased pricing in certain categories to mitigate the impact of inflation. However, in 1Q24, the company saw a reduction in natural gas compressor and pump capacity in its rental fleet. The installation of several new units depleted working capital and led to negative free cash flow. The relative valuation is quite reasonable, so we maintain our rating as “Hold.”

Oil prices and their impact

First Quarter Earnings phoneNGS management expressed optimism about the outlook, mainly due to relatively stable oil prices, which have increased 10% over the past year. Given the current momentum, the company expects energy production to increase in the short to medium term. This stability has kept demand for the company’s rental equipment strong, as 75% of the active fracking fleet is in oil-dominated shale basins.

Key Strategies

One of NGS’s primary strategies is to optimize its existing utilized fleet. Rental fleet utilization has increased from 62% in fiscal 2021 to 66.5% in fiscal 2023. It will remain stable at that level in the first quarter of 2024. Therefore, we believe that stabilizing utilization is beneficial in terms of maintaining stable operating margins. We also plan to monetize short-term assets. As short-term assets decrease, the company’s working capital will increase. Through this process, we aim to generate $12 million in cash by fiscal 2024. We are also increasing prices in certain categories to strengthen margins, which will also mitigate the impact of inflation.

The company has begun the process of reviewing its unused vehicle fleet. The company estimates that 650 of these assets can be upgraded to smart systems such as electric drives and high-pressure gas lift equipment, which could reduce operational hours in the coming quarters. The company has increased automation to provide more interfaces and more precise customer service.

Additionally, the company will expand its rental fleet. As the energy environment improves with rising oil prices, the company will be able to contract higher horsepower units on long-term contracts. However, it will be cautious with capital expenditures in this regard. Contract terms will improve and NGS will continue to explore M&A opportunities to strengthen its growth trajectory.

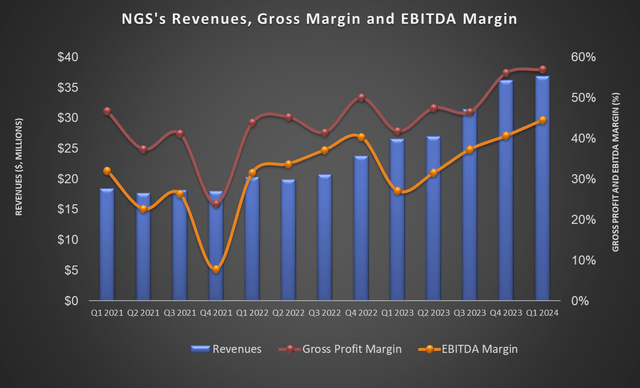

Operating profit margin remains strong

As of March 31, 2024, NGS had 1,245 rental units with over 444,220 horsepower. This means that the rental fleet of natural gas compressors decreased compared to the previous quarter. However, total HHP remained relatively strong due to the start-up of new large horsepower units. Not only did rental unit utilization rates improve in the first quarter, but gross profit and adjusted EBITDA also increased.

My quote

Reflecting recovery, NGS expect Adjusted EBITDA growth for fiscal 2024 is in the range of 34% to 47%. Such strong growth could significantly improve the company’s financial position (and valuation) given that the majority of its revenues are recurring in nature, which would likely position it above its competitors with stable, growing revenues tied to long-term contracts.

Over the past 12 quarters, NGS’s EBITDA has grown at an average of 32%. The company is focused on maintaining stability, but near-term pressures from inflationary costs will negatively impact the company’s outlook. As such, I believe management’s growth forecasts are a bit more optimistic than is reasonable. It would be reasonable to see EBITDA growing at 15%-25% over the next four quarters.

Challenges and risk factors

U.S. Natural Gas Production Increased Production has declined over the past year through February 2024. But the EIA expects natural gas production to decline 2% from the first to second quarters due to lower natural gas prices. Production is on track to increase 2% in 2025, the EIA said. Environmental Impact AssessmentI believe the natural gas market will remain volatile and negative in the near term due to oversupply and low prices.

While the drilling environment is generally favorable, natural gas production lacks a solid growth story, especially due to uncertainty over LNG exports. Similarly, a sharp drop in crude oil prices could have a more severe impact on its performance. Investors should keep in mind that commodity markets tend to fall sharply when adversely affected.

Inflation has had a negative impact on the U.S. economy in 2022. Although inflation has been contained following rising interest rates, I believe inflation could strike again in 2024. This could increase NGS’s cost structure, including labor costs, parts costs, lubricants, and other items it uses in its business. The company has occasionally passed on higher costs to consumers through higher prices. But it has also eroded its advantage in a competitive marketplace.

First Quarter Performance Analysis

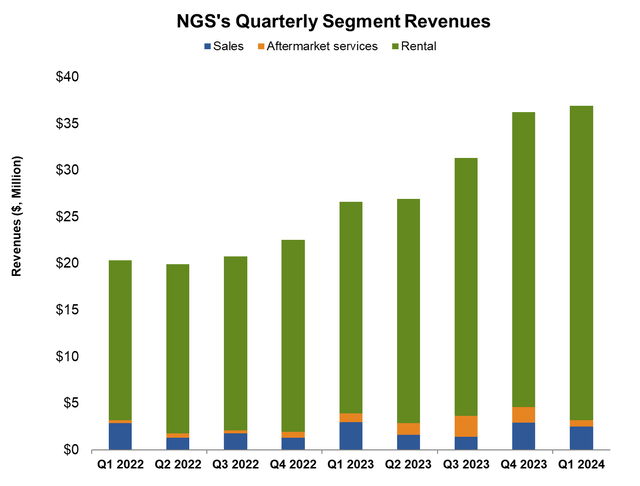

In the press release announcing the financial results Announced The company revealed on May 15 that sales increased slightly in the first quarter of 2024 compared to the fourth quarter of 2023. Despite a significant decline in rental units, sales remained stable due to higher horsepower packages and improved pricing.

The company’s adjusted gross margin expanded 40 basis points (q-q) in the first quarter. Repair and maintenance expenses declined as the company introduced a relatively new vehicle. However, investors should keep in mind that as the company expands in scale, labor and overhead costs are expected to increase. As a result, recent margin expansion momentum may not continue, and gross margins and EBITDA margins may come under pressure in the near term.

Liabilities and cash flow

In Q1 2024, despite revenue growth, NGS’s operating cash flow (CFO) declined significantly (69%) compared to the prior year. Working capital issues are primarily related to increased accounts receivable as the company installed several new units. The company is working to resolve these issues and expects to see progress in Q2 or Q3 2024. Capital expenditures also declined. As such, free cash flow (FCF) remained negative in Q1 2024, but improved from a year ago.

The company expects capital expenditures to remain at $40-50 million in 2024, 16% lower than in 2023. The company’s liquidity (cash and cash equivalents plus borrowing capacity under its credit facilities) was approximately $46 million as of March 31, 2024. The company’s leverage (debt-to-equity ratio) is lower than its peers (NOA, CCLP, AROC). As such, lower capital expenditures with stable liquidity would likely not strain the balance sheet in the near term.

Target price and relative valuation

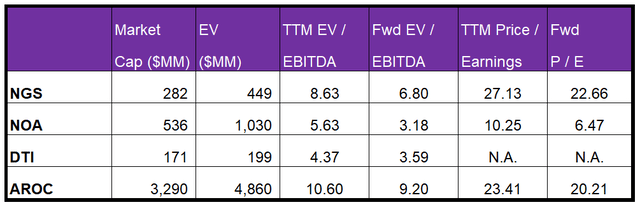

NGS’s current EV/EBITDA multiple (8.6x) is higher than its 5-year average (6.4x). It therefore appears overvalued relative to the past. If the stock were to trade at its 5-year average, a 40% drop would be expected. The stock has more than doubled since my last article was published on July 6, 2023, and any upside potential is gone.

NGS’s future EV/EBITDA multiple contraction is less steep than its peers relative to current EV/EBITDA. Therefore, adjusted EBITDA is not expected to grow as sharply as its peers over the next four quarters. This typically results in a lower EV/EBITDA multiple. The current EV/EBITDA multiple (8.6x) is lower than its peers (NINE, OIS, PTEN). Therefore, at this level, the company’s stock is reasonably valued relative to its peers.

As I mentioned at the beginning of the article, I expect adjusted EBITDA to grow 15%-20% over the next four quarters. If we input these values into the EV calculation and assume the EV/EBITDA multiple holds, the stock could trade between $19.2 and $22.1, with some near-term downside expected. However, with an expected recovery in natural gas prices, I believe investors could also expect upside in the medium term.

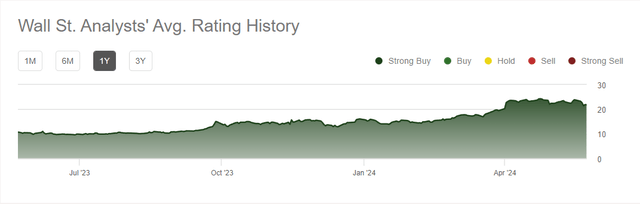

Analysts’ comments

according to data According to a survey provided by Seeking Alpha, three sell-side analysts have rated NGS a “buy” (including a “strong buy”), while none have rated it a “hold” or “sell.” The consensus price target is $31, implying a 42% upside at current prices.

What do you think about NGS?

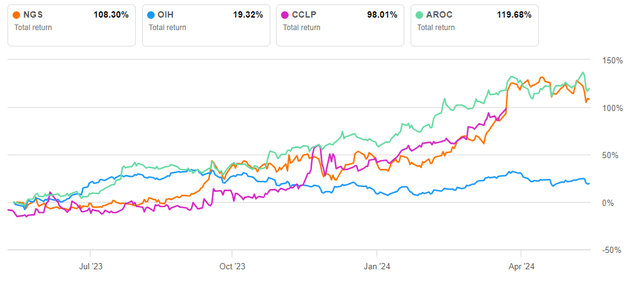

NGS is focusing on improving the utilization of its rental fleet to improve its operating margins. The company reduced its rental fleet size in the first quarter compared to the previous quarter as it converted short-term assets into cash to improve its working capital. With the improving energy environment, the company will contract higher horsepower units on long-term contracts. Given the recurring nature of the revenue, the long-term contracts will increase the stability of sales and cash flow in the coming quarters. Therefore, the company’s stock price is expected to be a strong contributor to the VanEck Vectors Oil Services ETF (OIH) in the past year.

However, continued weakness in natural gas prices has forced NGS to restructure its operations, increasing working capital requirements. There are also concerns about inflation in the cost structure related to labor, parts, lubricants, etc. The company’s debt levels are low. Given the reasonable relative valuation, my expectations for operating margin growth and how that will impact valuation, I believe investors will want to “hold” at these levels.